A Sign of Things to Come as EM Stocks Begin to Outperform US Counterparts

2024.09.24 12:11

You might think that war in the Middle East, heightened geopolitical risk elsewhere, and the potential for turmoil in the upcoming US election would spell trouble for world stock markets.

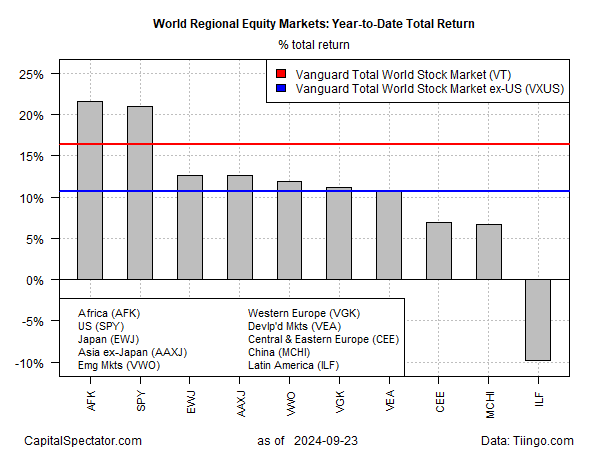

But a review of year-to-date results through Monday’s close (Sep. 23), based on a set of ETFs, suggests otherwise.

Most of the major categories of equities around the world are posting gains this year. Stocks in Africa () and the US () are essentially tied for first place with roughly 21% year-to-date increases.

The rallies mark solid premiums over world equities overall (), which are posting a solid 16.4% advance so far in 2024.

The downside outlier: stocks in Latin America (), which have lost nearly 10% year to date.

So-called emerging markets stocks () are now slightly outperforming shares in developed markets ex-US () this year. Recent headlines have boosted expectations that the rally in EM shares will continue.

Following last week’s decision to start cutting US interest rates, the news brightened the outlook for emerging markets.

“Central banks in emerging markets have more room to respond to their local inflation profile and ease more than they otherwise would have,” says Christian Keller, head of economics research at Barclays.

Today’s news that China is becoming more aggressive in reviving its slowing economy is another factor that’s helping boost the outlook for emerging markets.

China’s central bank actions “suggest that the government is finally coming to terms with the grim situation the economy is in,” says Eswar Prasad, a professor of trade policy at Cornell University and a former head of the International Monetary Fund’s China division.

Emerging markets stocks have underperformed US and developed markets in recent years, putting a dent in previous forecasts that expected returns were higher in these countries. Optimists hope that a turnaround is unfolding.

One glimmer of hope: EM (VWO) is slightly outperforming US shares (SPY) over the past month. It’s too early to say if this is noise, but for long-beleaguered EM bulls it’s a hopeful sign that the performance drought for these stocks may finally be ending.