A Fund That Profits From The Resilient U.S. Consumer

2022.09.26 08:15

[ad_1]

The US consumer just got a $162-billion “pay raise,” and I’m betting you haven’t heard a word about it. Today, we’re going to tap that “extra” cash through a 6.6%-yielding fund that trades at 87 cents on the dollar.

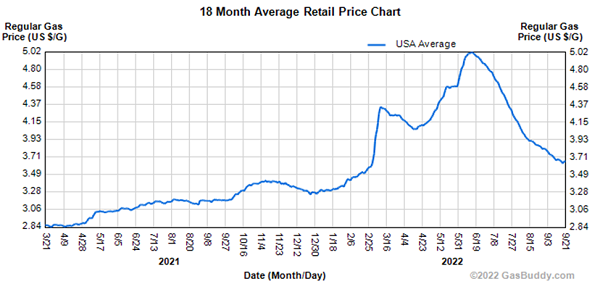

What I’m getting at is the good news story we’ve heard little about in the media: the extra cash consumers are pocketing thanks to the recent plunge in gasoline prices.

It’s no small amount, either: according to Mark Zandi, chief economist at Moody’s Analytics, US households save about $125 billion in total for every dollar the price at the pump drops. And with average pump prices now around $3.70 a gallon, down from north of $5 in June, we’re looking at about $162 billion being thrown back into the economy, or around $13 billion a month.

US Gas Prices Ease

To be sure, not all of this is “extra” money to most folks. With inflation running hot in other goods in services, higher prices are sucking a good portion of it back out the door.

But bear in mind that corporate profit margins are soaring (no matter how any of us may feel about companies boosting their bottom lines at a time of high inflation), so this money is still a net plus for stocks. Moreover, some of this cash will go into fresh spending on consumer staples, like higher-quality foods, as well as discretionary purchases.

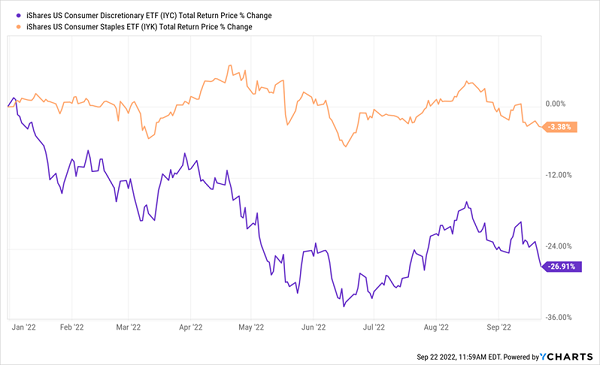

Even so, two of the main ETFs benchmarking these sectors, the iShares US Consumer Discretionary ETF () and iShares US Consumer Staples ETF (), are down for the year, with IYK holding up better as staples attract defensive-minded investors as recession worries rise.

$162-Billion “Pay Raise” Bodes Well for Bargain Staple and Discretionary Stocks

Consumer Focused ETFs

Owning a healthy mix of these sectors always makes sense, and especially so these days, as staples help fortify our investments in a downturn, while discretionary firms’ low valuations aren’t accounting for the billions of extra cash consumers have, thanks to lower gas prices, recent wage gains and leftover pandemic savings.

You could get exposure to both sectors by picking up IYK and IYC. Problem is, you’ll be counting on price gains alone for your return, as IYC yields a mere 0.6%, and IYK isn’t much better, at 1.8%.

An “ETF-Beating”—and Cheap—CEF Yielding 6.6%

Luckily there’s a better option that gives us “all in one” exposure to the US economy and pays us a rich 6.6% dividend. That’s 11 times the payout on IYC and nearly four times IYK’s 1.8% dividend. It also means we’re getting a large slice of our yearly return in cash.

That would be a well-established closed-end fund (CEF) called the Gabelli Dividend Income Trust (NYSE:{{959934|GDV})). A look at its top-10 holdings reveals a host of companies that profit from higher spending on discretionary goods and staples, such as online-advertising play Alphabet (NASDAQ:), Mastercard (NYSE:), Microsoft (NASDAQ:), Sony (NYSE:) and American Express (NYSE:), as well as food maker Mondelez International (NASDAQ:):

GDV Top Holdings

Source: Gabelli Dividend & Income Trust fact sheet

In addition, we get the management expertise of Mario Gabelli, a value-investing guru who has more than doubled his investors’ money in the last decade, with a 124% return. He’s also boosted the fund’s dividend by 37.5%, with the odd special payout along the way. Best of all, this CEF pays dividends every month, in line with our bills.

This kind of active management is crucial for spotting bargains (and avoiding weak businesses and sectors) in the panicked market we’re in—and algorithm-driven ETFs can’t match it.

Now let’s talk about the discount.

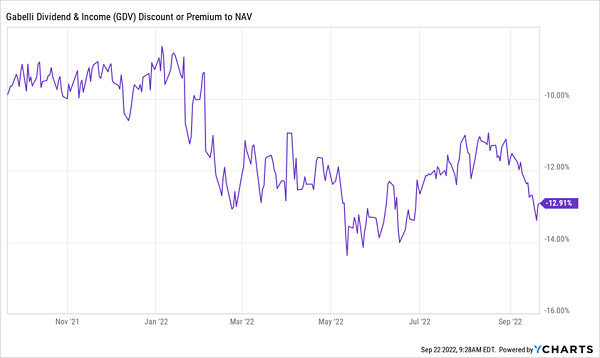

A 13%-Off Deal Appears

GDV Discount NAV

Thanks to the recent selloff, GDV’s discount to net asset value (NAV, or the difference between its portfolio value and the fund’s price on the open market) is 13% as I write this, not far off its 2022 lows. This means we’re essentially buying this reliable fund for just 87 cents on the dollar.

So if you’re considering adding consumer staple, discretionary or just plain exposure to your portfolio, GDV is definitely worth a look. Its deep discount, stable monthly dividend and active management are all advantages you’ll never get in an ETF.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link