A Dividend Catalyst Offering A Safe 15% Yearly Returns

2022.09.15 00:35

[ad_1]

Why chase the market when we can let 15% per year—every year—come to us?

This is the perfect time to buy what I call “hidden yield” investments. These are stocks that dish out dividends today. But, more notably, they have an important catalyst coming in the year ahead that will help boost their stock prices.

This trigger is so powerful that it sends these stocks sailing by 15% or more per year, every year. Which is truly great when other equities and even bonds are getting buried around us.

We’ll talk about these stocks and their “dividend spark” in a moment. First, let’s get back to why now.

This bear market started in January. We identified the train wreck quickly with a “Look out, ahead!” With the Federal Reserve finally tightening, the bear’s arrival was all but inevitable.

But let’s remember that bear markets are much shorter than bull markets. On average they only last ten months or so. Our current bear is in month nine.

(Of course, ten is an average, not a promise or a guarantee. We don’t get a free pizza if it lasts longer. The 2000-02 bear market dragged on over multiple years. The Financial Crisis gave us an 18-month downdraft.)

My point, cue the Stones, is that time is on our side. And while turbulence ahead is likely, we can use that to our advantage and accumulate the 15%-per-year stocks for cheap.

L3Harris Technologies (NYSE:) is one such opportunity. Its headline yield is one we would usually yawn at—LHX pays 1.9% today and it’s rare for this current dividend to pop above two.

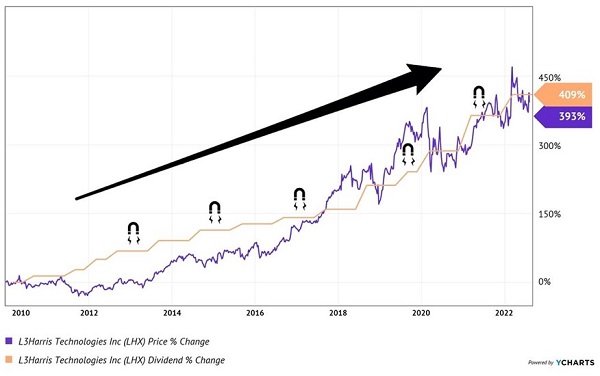

But LHX, over time, is the type of safe dividend stock that makes us rich. Since the start of 2010, the stock has returned 393% to investors.

Most of that has come from price gains, but we can thank the dividend for it!

You see, LHX’s payout acted like a “dividend magnet” that pulled its price higher. (Yes, sometimes investing is this simple.) The payout increased by 409%. This is no coincidence.

Every time the rate of the payout increase leaps ahead of the dividend, the stock price catches up. That’s the dividend magnet at work, baby!

The Key to 393% Gains: LHX’s Dividend Magnet

LHX-Dividend Magnet Chart

Of course this is past performance. But the future is looking bullish too.

Not for warm and fuzzy reasons, I’ll admit. LHX makes what the US needs to compete with China militarily, especially on the seas. It’s a leader in anti-air warfare for US navy ships and aircraft.

The company is due for its next dividend increase in March. Mark this catalyst on the calendar.

Let’s apply this magnet hunt to utility stocks. Utilities have done well this year because investor “refugees” have swarmed from bad ideas like profitless tech and crypto. “Utes,” the old school dividend stocks, are back in vogue.

That’s nice from a price standpoint, but it’s challenging to put new money to work. After all, when stocks are popular it means their yields are lower. Not good for us purists who are in it for the dividends.

So, let’s grab a magnet.

Again, a simple yet successful formula. We buy the dividends that are growing the fastest.

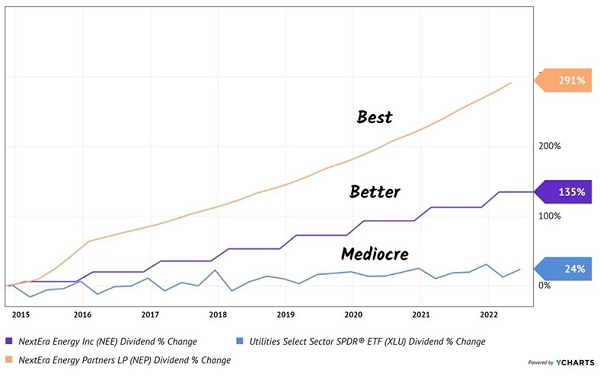

NextEra Energy (NYSE:) has been a favorite of ours for this reason for years. NEE is the largest developer of renewable energy in North America. It’s one of the fastest dividend growers in the utility space.

NEE is one of those great dividend stocks that is rarely cheap because everyone knows it’s awesome. In fact, Chief Financial Officer (CFO) Kirk Crews recently said ten percent payout hikes are likely for the next couple of years.

Double-digit yearly dividend raises from a safe utility—does it get any better than that? Yes, it does when we consider Kirk’s spinoff firm.

Check out its payout growth since inception. Kirk’s baby has made a mockery of utility ETF and it’s even run a lap around parent NextEra:

Mediocre, Better, Best

Good Better Best Dividend Growth

How’s the future look for this dividend? Now we’re asking the right question. Let’s find dividends that are growing the fastest, and their stock prices will follow.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link