A Bullish Recession: 5 Reasons to Buy Stocks Despite the Anticipated Market Drop

2024.07.30 16:25

When we think about investing or trading, the stock market often comes to mind. It has remained the most popular financial market globally for more than a century. This should not be surprising, given the huge number of businesses of varying sizes under the SEC. Also, it has become more accessible to individual traders amid the digital revolution in recent years.

However, risks remain evident in the market as the global economy remains shaky. It has started to recover in the past three quarters, but macroeconomic indicators have yet to stabilize. That is why the Fed postponed its plan to implement three rate cuts. With that, many people are anticipating an economic slowdown, if not a recession.

Despite this, the capital market, particularly the stock market, remains attractive due to potential earnings in the long run. It may appear counterintuitive, but well-thought-out strategies can turn pullbacks into opportunities for gains. So, understanding patterns in a bearish market can help make prudent financial decisions. Also, keeping adequate liquidity levels can help during these times.

In this article, we will provide insights into why investing in the stock market today is a wise move. We will list why the stock market remains sturdy despite a potential market slowdown. In addition, we will give tips to optimize your strategies for lowering risks and maximizing returns. These include potential industries for investments and risk-reward management techniques.

An Overview of the US Economy

Price corrections in the stock market happen occasionally, and that’s normal. If not, investors may not find reasonable entry and exit points. Also, price corrections provide room for stocks to adjust to macroeconomic changes. We have seen this in different crises the stock market has experienced—the dot-com bubble and the Great Recession, to name a few. After all, stocks have a notable correlation with inflation, which varies depending on their industries.

It happened again during the height of the pandemic in 2020. Health protocols, border closures, and restrictions affected business operations. The massive drop in sales and even net losses led to business shutdowns, layoffs, and lower income. Production, consumption, and investment suffered, leading to a recession.

Similarly, the stock market took a nosedive, with the and dropping by 20% and 14%, respectively. Yet, many investors considered this an opportunity to buy stocks at a discount. This was most evident in hard-hit industries like hotels, consumer staples, property builders, and technologies. The stock market regained momentum in a few months amid easing restrictions and business openings.

In 2022, the US economy was tested once again. It began in the real estate market when median home prices dropped to $317,100 in 2Q20. This was complemented by interest and mortgage rate cuts to near-zero levels, which enticed millions of homebuyers.

The problem arose when prices soared by 40% to nearly $440,000, leading to the 2022 inflation, amplified by the Russo-Ukrainian War and OPEC oil cuts. With additional supply chain disruptions, the US inflation accelerated to an all-time high of 9.1%. In response, the Fed implemented interest rate hikes from 0.5% to 5.5% in less than a year. While it proved effective in tempering inflation, it led to a banking crisis led by the Silicon Valley Bank collapse.

Since 2023, US macroeconomic indicators have shown some signs of hope. Inflation, for instance, dropped within the 3.0%- 4.0% range. Meanwhile, the nominal Gross Domestic Product (GDP) rose by about 4.0% to $27T. Both led to a lower unemployment rate amid increased labor force and business openings.

Right now, inflation is more stable despite some upticks earlier this year. At 3.3%, the Fed does not reach its 2.0%-2.5% target range, but its current trajectory is affirmative. The only problem is that rate cuts may be postponed, affecting investor expectations and business growth outlook. Although interest rate pauses will stay to prevent a recession, a potential economic slowdown must be considered to make wise investment choices.

Top Reasons for Investing in the Stock Market

Investing in the stock market today may seem daunting as the recession specter continues to loom. The substantial influence of a recession can affect the performance of stocks. Even so, investors can find new opportunities to buy and sell stocks for gains. These are some reasons you should still invest in the stock market.

1. It has stood the test of time

The stock market has existed for more than a century. During that time, it experienced numerous massive crises, such as the Great Depression, the US Stagflation, the dot-com bubble, and the Pandemic Recession. These are just a few notable examples of disruptions in the market. Despite all these, the stock market continues to exist. It has indeed survived all these crises and stood the test of time.

Even better, the stock market has always bounced back after every crisis. Prices of stock indices have always exceeded pre-crisis levels, which shows their resilience. It also shows the impact of macroeconomic changes on the market, proving its flexibility to booms and bursts. This should not be surprising at all since many companies have been trading here for a long time. They survived and rebounded, and so did the whole market.

Newer and more advanced companies entered, so the market had to adjust to cater to more companies and investors. Even better, technologies opened many opportunities for the market to become more accessible and efficient, allowing it to operate regardless of market conditions. Given this, stock trading or investing has remained a viable financial move for individuals and businesses.

To illustrate this better, we can check how the S&P 500 (SPX) and NASDAQ (IXIC) changed before, during, and after the 2007-2008 financial crisis.

|

S&P 500 (SPX) |

NASDAQ Composite (IXIC) |

|

|

Pre-Crisis Price |

$1,456.81 |

$2,524.74 |

|

Peak-Crisis Price |

$676.53 |

$1,292.80 |

|

Change (Pre-to-Peak Crisis) |

-53.56% |

-48.78% |

|

Post-Crisis Price |

$1,257.60 |

$2,605.15 |

|

Change (Pre-to-Post Crisis) |

-13.67% |

3.19% |

|

Change (Peak-to-Post Crisis) |

85.89% |

101.51% |

The table above shows that the average price of SPX and IXIC dropped by 54% and 49%, respectively, amid the Global Financial Crisis (GFC). As the Fed tried to stabilize inflation through policy tightening, businesses and households with high borrowing levels suffered. Banks and capital-intensive companies like property builders suffered and became insolvent, leading to layoffs.

The wave of bankruptcies didn’t just stop with businesses and individuals—it rippled out, hitting other companies with revenue drops and losses and, ultimately, weakening stock performance.

But after two years, the economy started to regain its footing. Fiscal stimulus helped many households and businesses and bolstered the market. Stock prices rebounded as companies started to recover. Post-crisis prices showed the resilience of the stock market.

Although the SPX price was still 14% lower than the pre-crisis price, the 86% increase during the GFC offset the 54% decrease.

Meanwhile, stocks in the IXIC index showed a stronger performance. The stock was more resilient as it doubled its value from $1,292 to $2,605, exceeding the pre-crisis price. Given this, the stock market remained durable.

It happened again in the past five years amid the pandemic and 2020 inflation. They both led to price corrections but provided opportunities to buy stocks at a much lower price. To assess it better, we will use the Sharpe Ratio:

|

S&P 500 (SPX) |

NASDAQ Composite (IXIC) |

|

|

2019 Starting Price |

$2,510.05 |

$6,665.92 |

|

Current Price |

$5,537.02 |

$18,188.30 |

|

Five-Year Returns |

120.60% |

172.83% |

|

Average Annual Returns |

17.15% |

22.24% |

|

Risk-Free Rate |

4.30% |

4.30% |

|

Standard Deviation |

20.56% |

24.41% |

|

Sharpe Ratio |

0.63 |

0.73 |

Once again, the stock market showed its resilience after the two economic disruptions it experienced. It even exceeded pre-pandemic levels, so one may wonder whether the stock market will drop again or not. The S&P 500 gave 120% returns, while NASDAQ Composite stocks had 172%.

Meanwhile, the standard deviation shows that S&P 500 and NASDAQ Composite stocks changed by about 20% annually. Even so, the risk was negligible as they gave annual returns of 17.15% and 22.24%, respectively.

This showed that SPX and IXIC rose by $426 and $1,464 annually. They were more than four times the yield of the US 10-year treasury. Lastly, the positive Sharpe Ratio proved that the stock market is more viable than bonds, and returns can outweigh risks.

More interestingly, the two indices have more than doubled since the GFC. The current price of SPX is 280% higher than its pre-GFC peak. IXIC, on the other hand, has risen by 619% in the past 17 years.

2. Many stocks stay undervalued

You may be daunted by the fact that stocks have risen substantially in recent months. You may also wonder how much losses you could incur if another crisis occurs.

The market is heating up amid decreasing inflation and interest rate hike pauses. Market sentiments are also primarily optimistic. These drive more demand, which puts an upward force on stock prices. As such, you may be worrying about buying an undervalued stock. It is logical as recent S&P 500 statistics show that the stock market is overvalued by 98%-163% versus last month at 92%-154%.

But fret not. The observation remains inconclusive due to the limited metrics used to assess the market. They only employed the PE Ratio and Q Ratio versus price patterns using regression. While the PE Ratio is a vital price indicator, it does not always reveal a stock’s intrinsic value. It may not apply to capital-intensive industries like hotels, property builders, shipping, and logistics. These industries must use other valuation methods like the PB Ratio and the Price/FCF Ratio.

For instance, an SPX stock named JB Hunt Transport Services Inc (NASDAQ:) has a PE Ratio of 25.19x, higher than the SPX average of 24.08x. Relative to the market, Old Dominion Freight Line Inc (NASDAQ:) is already overvalued. But that doesn’t automatically mean the stock itself is overvalued. Using the PB Ratio, we will derive 3.93x versus the SPX average of 5.01x.

Another helpful valuation method is the DCF Model. It is a more accurate tool for fundamental analysis as it involves all financial statements to assess the company’s future performance. For this example, let’s use used Marriott International, Inc. (NASDAQ:) with a PE Ratio of 24.80x.

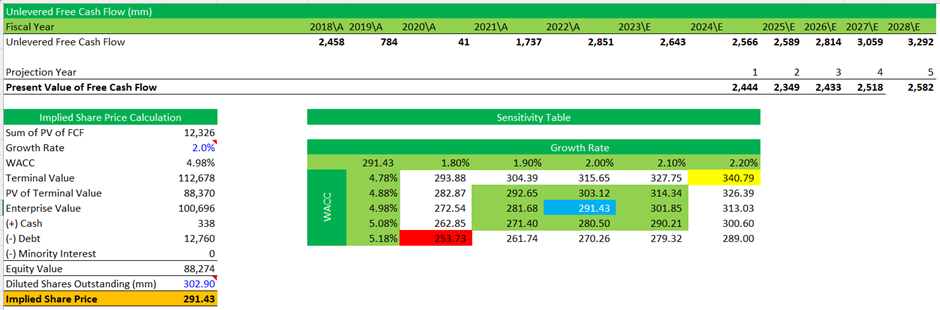

Image Source: Author’s Computation

Using this, we derived $291.43 as its target price. It shows that the stock is undervalued and may increase by 20%. We derived WACC using the Capital Asset Pricing Model (CAPM).

Meanwhile, we set its growth rate at 2.0%, which is conservative if we pattern it with the Fed’s target inflation. If we adjust its WACC and growth rate, the lowest target price is $253.73, while the highest is $340.79. Either way, the stock appears undervalued.

This is only one of the many stocks available for your buying choices. Instead of focusing on the PE Ratio alone, you should consider various metrics.

3. Some industries have solid growth prospects

Investors and analysts alike are wary of the looming recession. Although we don’t think another one will take place soon, it is wise to prepare for it. After all, the economy has yet to recover completely. Buying the right stock or industry can still be challenging. Even so, some industries have solid growth prospects to support their expansion in the long run.

Hotels

Travel and economic rebound will be some primary growth drivers of many hotels globally. This may be more evident this summer and fall. After years of restricted travel amid restrictions and higher energy prices, travel is here to rebound.

In a recent TripAdvisor (NASDAQ:) survey, 51% and 44% of Americans plan to travel more than and as much as they did last summer. More interestingly, 26% plan to spend more than $5,000 solely for summer vacations this FY24. This is about thrice the average spending of $1,500 in the previous years.

The stabilizing economy may support this exciting trend. Inflation, for instance, has started to stabilize at 3.3% after its upticks in March and April. It was also much lower last year at 4.1% in the same month. The Fed will keep rate hike pauses to stabilize inflation, borrowing, and spending. Expenses may decrease with the increasing oil outputs, allowing hotels to realize higher revenues and margins.

Another driver of revenge travel is the prevalence of remote and hybrid work setups. These allow employees and business owners to work and travel simultaneously, so hotels can expect an influx of new guests this summer and fall.

Marriott (MAR) and Hilton Worldwide Holdings Inc (NYSE:) are our top picks. Their solid business models give them a competitive advantage over their close peers, particularly Hyatt (H). MAR and HLT use a fee-based model instead of a lease-based model by H. Given the current tourism trend, a fee-based model is more flexible and advantageous.

MAR and HLT can easily impose higher fees or adjust their percentage fees on their franchisees, generating higher revenues. If the economy slows down, they can lower prices to maintain demand.

Banks

Banks face some challenges related to elevated interest rates. They incur expenses due to higher deposit yields. Also, loan defaults and delinquencies must be considered.

Thankfully, many banks maintain prudent portfolio allocation to optimize their risk-reward management. For example, they lower real estate and personal loan exposure. Instead, they focus on commercial loans, which are more interest-sensitive and secure.

Now, all eyes are on online or digital banks as they become more appealing to the market. They are consistent with the digital and fintech revolution, making them more accessible, user-friendly, and suitable for the evolution driven by the crypto market.

Another potential driver is the increasing number of SMBs, particularly online businesses. These have no brick-and-mortar stores, so they heavily rely on digital banking for their transactions. Some even have a vast ATM network, allowing them to compete with traditional banks. Even better, many offer favorable APYs and sign-up bonuses of $300 when you open an online checking account.

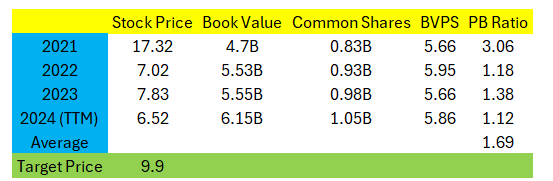

SoFi Technologies (NASDAQ:) is our top pick. It may take advantage of its technology platform segment amid the digital revolution. It also has increasing liquidity, given its decreasing Loan-to-Deposit Ratio from 1.60x in 1Q23 to 1.08x in 1Q24. It shows improved loan and deposit management. If we assess it using the PB Ratio, the stock is undervalued by 52%.

Image Source: Author’s Computation

AI

AI is now at the forefront of the digital revolution. They are now taking over many industries, particularly banking and finance. They are starting to adopt AI to help users in their transactions. Also, AI is applied to online investing platforms to help investors make data-driven and well-informed decisions. In addition, more companies are also eyeing AI to aid in customer support and cut labor costs. Given all these, the AI industry may keep expanding as it caters to more clients. Statistics show that the AI industry will grow to $2.5T by 2032 with a CAGR of 19%.

NVIDIA (NASDAQ:) remains our top pick. But new alternatives like Advanced Micro Devices, Inc. (NASDAQ:) and Arista Networks, Inc. (NYSE:) can be considered.

4. Lower prices mean higher gains in the long run

A recession has always led to a massive price drop in the stock market, which has happened many times before. This may happen again if policymakers continue to postpone interest rate cuts. Household spending, particularly in the real estate market, is softening, which may affect the economy.

This can be an opportunity for investors to buy stocks at a discount. And once prices rebound, they can enjoy higher gains in the long run. Good timing and valuation for buying and selling stocks will help you find good entry and exit points.

5. The economy will rebound

We must note that the economy is relatively stable compared to 2020-2022. The current trend is more manageable and cyclical. So, eventually, things will normalize, although we are unsure if they will return to their pre-pandemic conditions. Eventually, inflation deceleration will become stable, allowing the Fed to implement interest rate cuts. In turn, stock prices across many industries will keep increasing and give massive returns.

Takeaways

The stock market has always been a great place to build and multiply wealth. It has already stood the test of time and helped many individuals and businesses achieve financial freedom. There may be some worries about a recession that may affect prices. But there are many opportunities ahead that can outweigh the risks.