8 Charts Sending a Warning Sign to Mega Cap Tech Stocks

2025.02.10 03:26

This week: tech turbulence, flows, volume, rotation, , mega-cap, risk premium, Buffett Indicator 2.0, investor expectations, mood shifts, and market regime swings.

Learnings and conclusions from this week’s charts:

-

Sentiment seems to be shifting (bull/bear trend change).

-

US Tech stock warnings are sounding (volumes, dollar, flows).

-

Chinese Tech stocks are turning up from prior bear market.

-

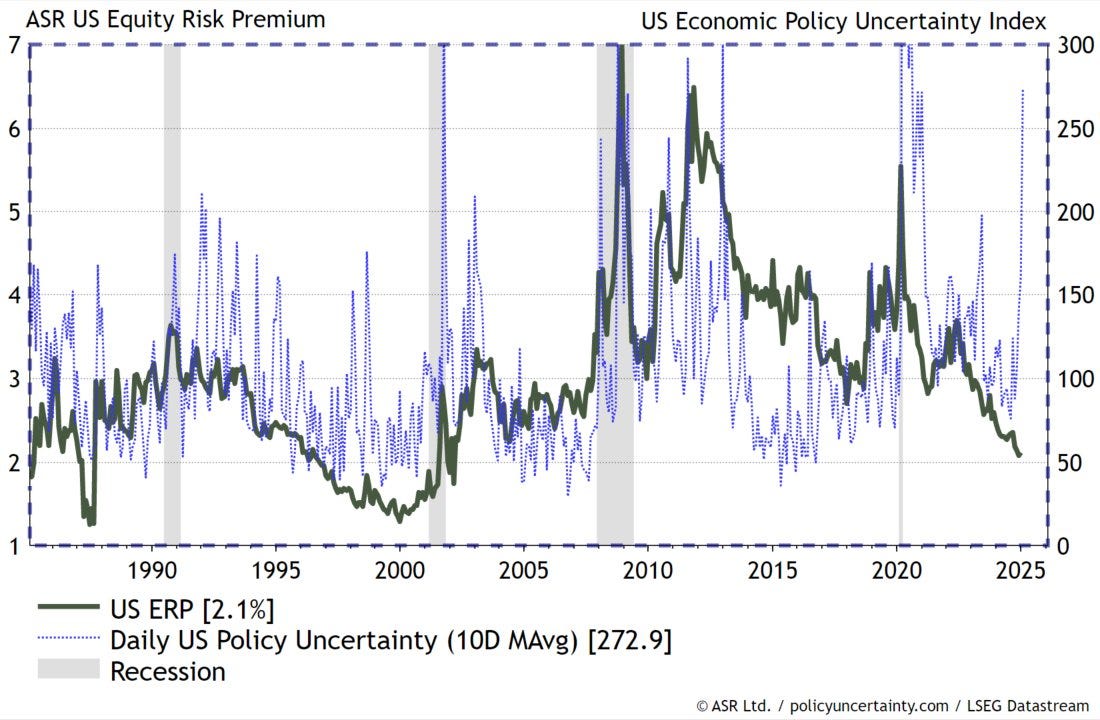

The US equity risk premium is at multi-decade lows.

-

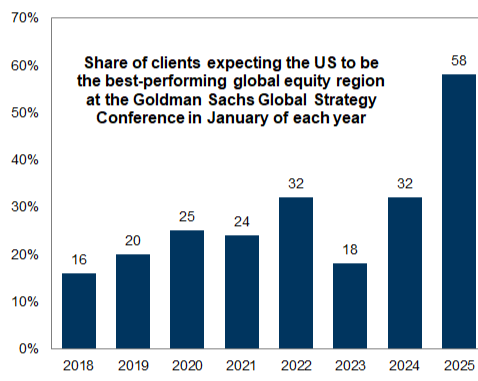

Record high consensus expects US equities to outperform vs global.

Overall, this week’s charts take a distinct cautionary hue as an aging bull contends with multiple hurdles, and topping risk flags begin to wave. But take a look for yourself and let me know what you think in the comments. Too bearish? Not bearish enough? Too early to say?

1. Mag-7 Volume Warning: Starting off with an intriguing eye-catcher, this chart shows the 1-year rolling average trading volume in Mag 7 Stocks. The concern is it seems to be doing a similar thing to what it did late-2021 into the pandemic stimulus frenzy peak. Taken by itself you might dismiss it, but there are a few other points to ponder on this…

Source: @i3_invest via @dailychartbook

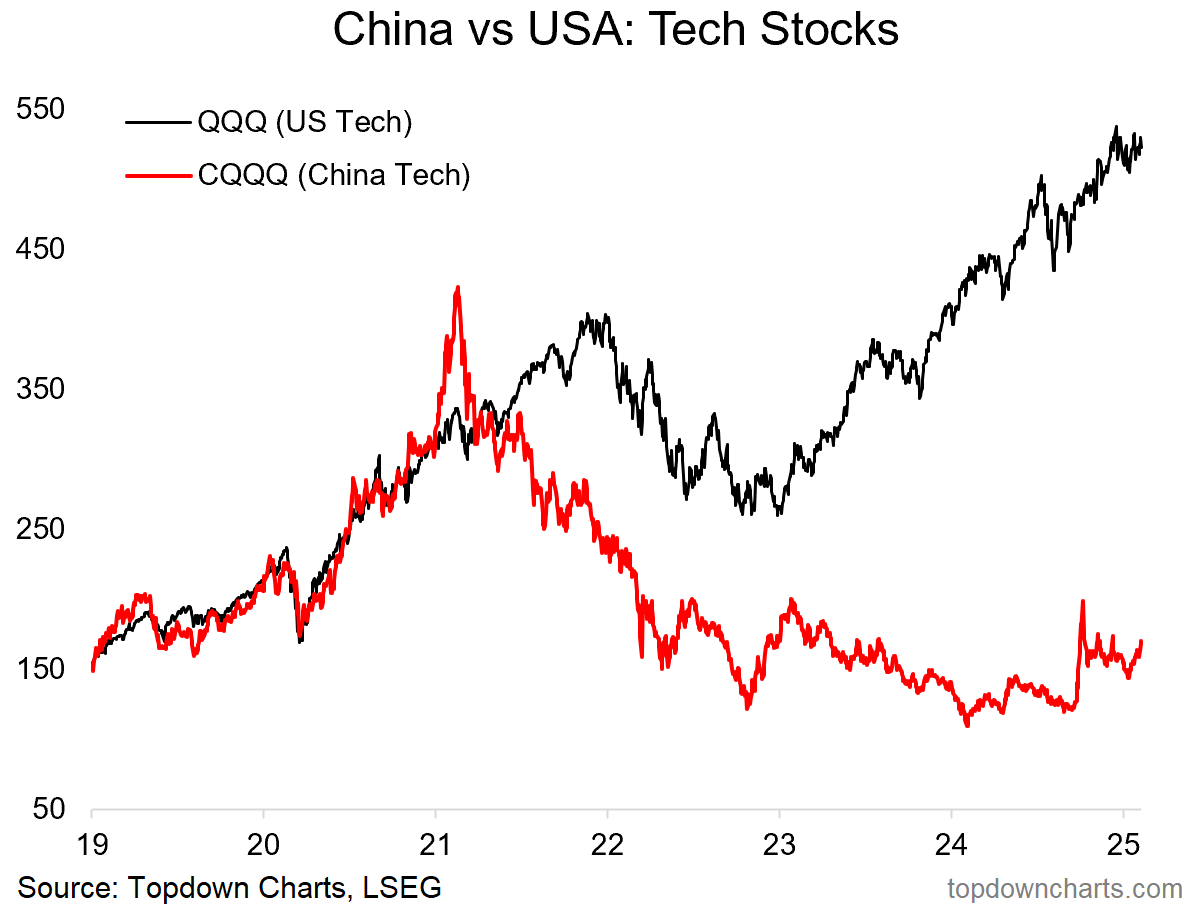

2. China vs USA — Tech Rotation? I highlighted the other day the point that Chinese tech stocks are cheap (valuations trading at the bottom end of the range and big discount to US), and more interestingly more recently the DeepSeek breakthrough is effectively a paradigm shock to the notion of China being the supreme imitator and USA being the supreme innovator. It throws those narratives into question and even begins to raise some doubts around US tech supremacy. With Chinese tech stocks cheap and US tech stocks expensive, maybe a rotation trade is not entirely out of the question.

Source: Chart of the Week – China Tech Surprise

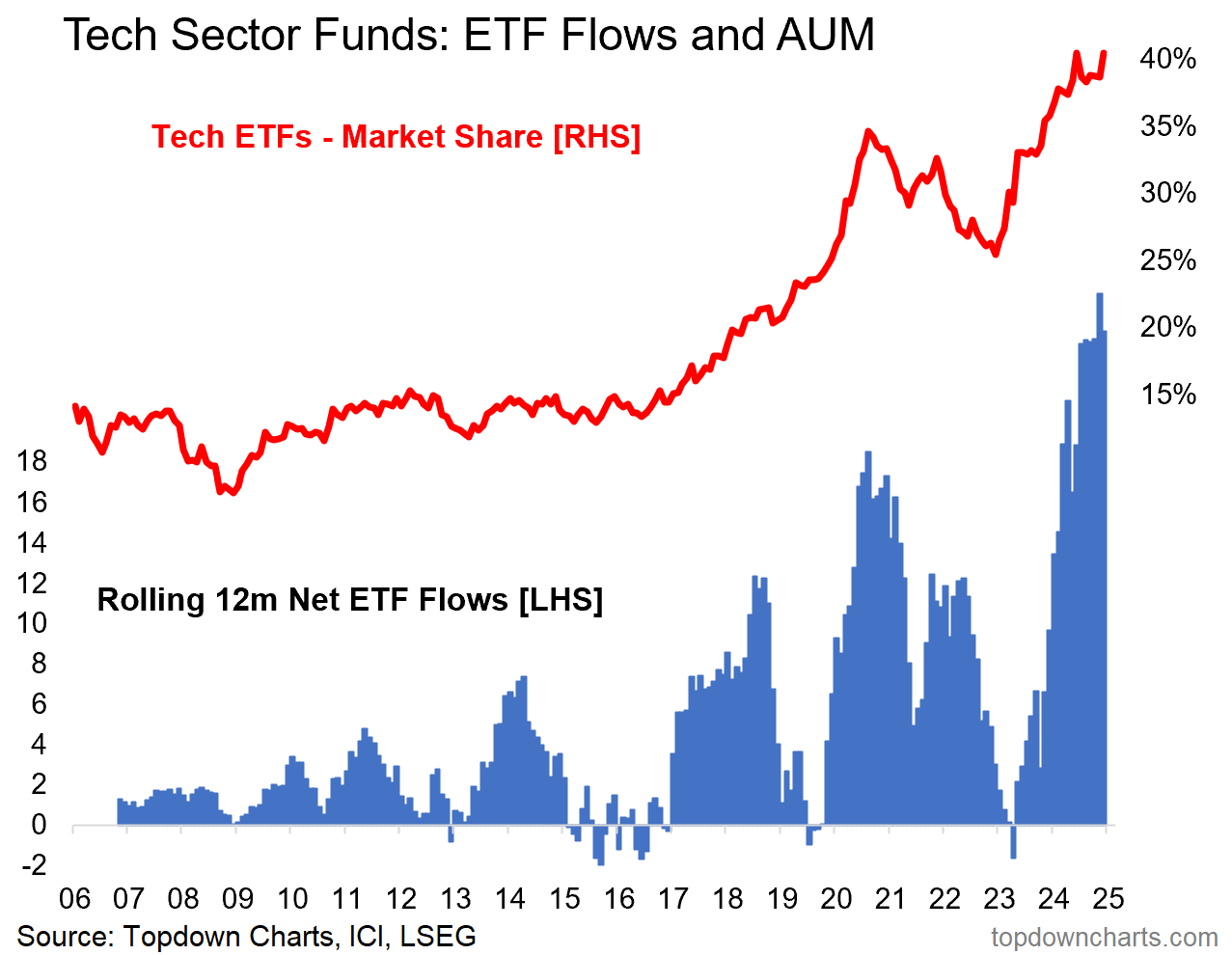

3. Tech Top Fund Froth: And this all comes at a time where sentiment on US tech stocks is frothy to say the least. Record inflows and allocations to US tech funds, consensus expectations of eternal exponential earnings growth, and hefty helpings of AI Hype. Even if this isn’t a top or turning point, it’s the type of setup that makes a market vulnerable to any change of mind in the masses.

Source: Weekly Macro Themes Report (Tech Turbulence topic no. 2 & 3)

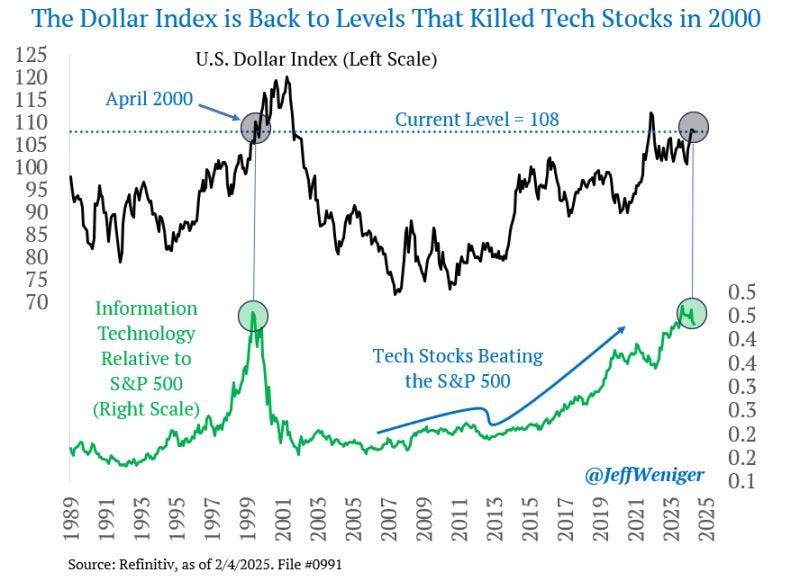

4. US Dollar Doomer: Call it a coincidence or a cautionary, the US dollar index is back toward levels where it got to at the peak of the dot com bubble back in 2000. To think it through, the way this could work logically would be if a strong dollar reflected excess optimism and foreign flows into US assets (which there is definitely evidence of), but also the valuation aspect (expensive dollar, expensive stocks = high hurdle, cheap foreign currencies, cheap foreign stocks = low hurdle for future outperformance). There’s also the financial conditions aspect; if the dollar surges stronger for longer enough then it can present headwinds to the economy.

Source: Jeff Weniger

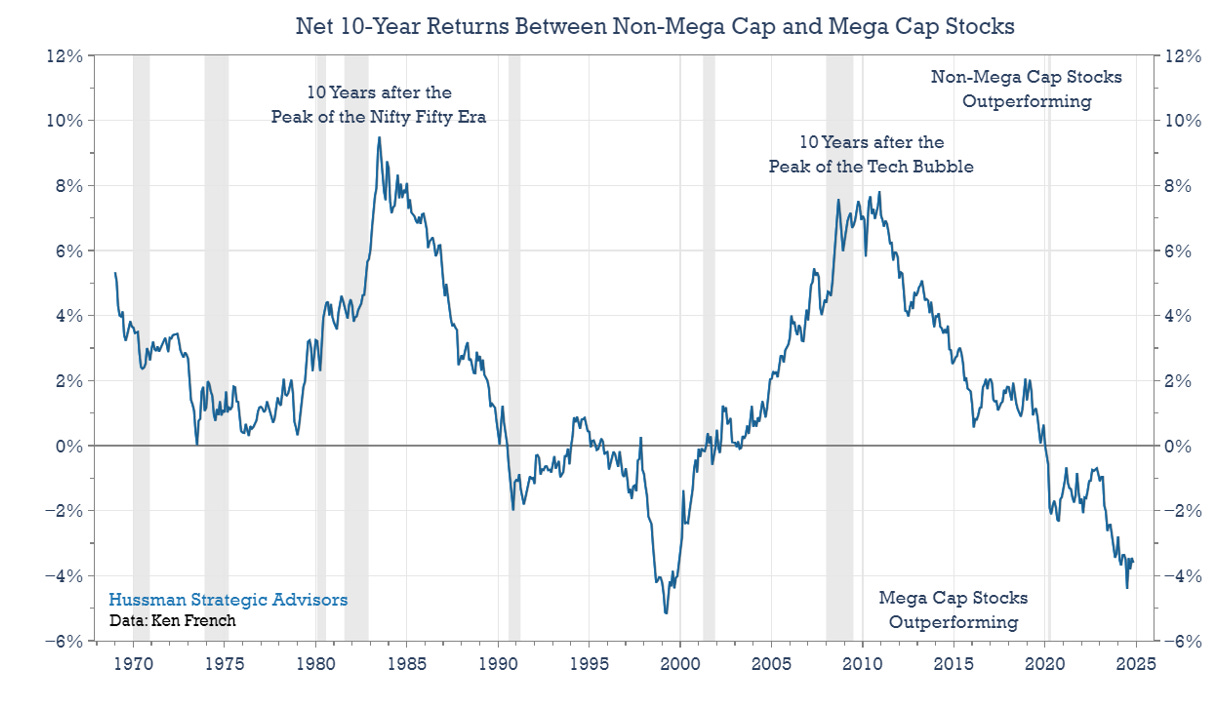

5. The Mega Cap Pendulum Swings: Meanwhile another parallel with the dot com peak is the rolling 10-year performance spread between non-mega vs mega cap stocks. Currently mega cap stocks’ relative performance is a stretched levels. And there sure seems to be a cycle there.

Source: Slimming Down a Top-Heavy Market

6. No Risk Premium, No Problem? Looking at US equities as a whole, the equity risk premium is squeezing down to multi-decade lows… at a time when policy uncertainty is high and rising and likely to stay higher for longer as the new Trump administration and friends push through what is basically a reform agenda; of the type that can be short-term pain for long-term gain). The question we need to ask is if we are happy with the anticipated compensation for taking on equity risk? (over and above lower-risk/risk-free alternatives such as bonds and cash).

Source: @IanRHarnett

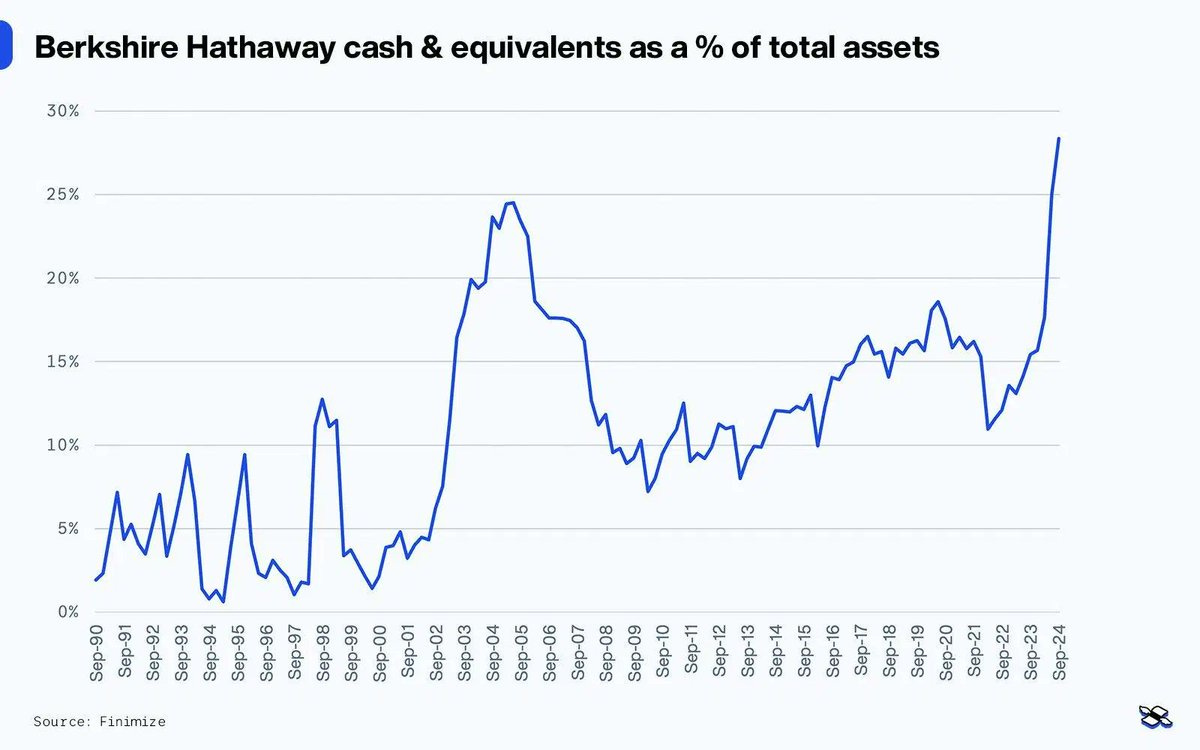

7. The new Buffet Indicator: If you ask Warren Buffet he might tell you no — Berkshire Hathaway (NYSE:) cash levels are at record highs (maybe this is the new or the real “Buffett Indicator”). And while actually if you look at the path of the line in that chart it doesn’t seem to be a precise timing indicator it does give pause to ponder on investing philosophy: “He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price. Once an investor looks at cash as an option, it is less bothersome that it earns almost nothing.”

Source: @TidefallCapital

8. What to Expect when Everyone’s Expecting: And if it wasn’t all enough already, check this one out — the crowd consensus at Goldman Sachs’ investment conference reckons the US will be the best-performing equity region this year. And that’s after a prolonged, substantial, and stretched run of relative outperformance by the US vs global —and at a time where relative valuations are at a record deep discount for global vs US. I mean, talk about hindsight/recency bias and top-ticking sentiment-checks

Source: Goldman Sachs via @MikeZaccardi

9. Mind the Mood Swing: Meanwhile, if you peer below the surface it looks like the mood is already shifting. The combined surveyed sentiment signal has rolled over from extreme optimism to now murmuring pessimism, and even portfolio allocations are starting to quietly turn the corner too. Is that it? (is that the turning point?)

Original Post