USD/CNH: China Fires Back with Tariffs as Markets Brace for Fallout

2025.02.04 09:17

- China hits US energy, autos with fresh tariffs.

- USD/CNH pushes higher, but key resistance in focus.

- Hang Seng pares gains after trade war flare-up.

Summary

China announced fresh tariffs on select US imports just moments after a US deadline to do the same expired, escalating trade tensions and sparking a fresh rout in riskier asset classes. But with China’s tariff deadline not arriving until February 10, there’s still time for both sides to strike a deal, keeping moves in and relatively contained.

Trade War 2.0

China has fired back at the latest round of US tariffs, announcing countermeasures that hit key American exports, including , liquified (LNG), , and farm equipment. Beijing’s finance ministry confirmed a 15% tariff on US energy commodities such as LNG and coal, while crude oil, autos, and agricultural machinery will see an additional 10% levy starting February 10. The move follows Washington’s decision to impose additional 10% tariffs on Chinese goods, further escalating tensions between the world’s two largest economies.

Alongside the tariff announcement, China’s anti-monopoly regulator launched an investigation into Google (NASDAQ:). While details remain scarce, the move signals a willingness to target major US tech firms, adding another layer of complexity to negotiations amid broader economic friction.

USD/CNH Holds Below Key Level

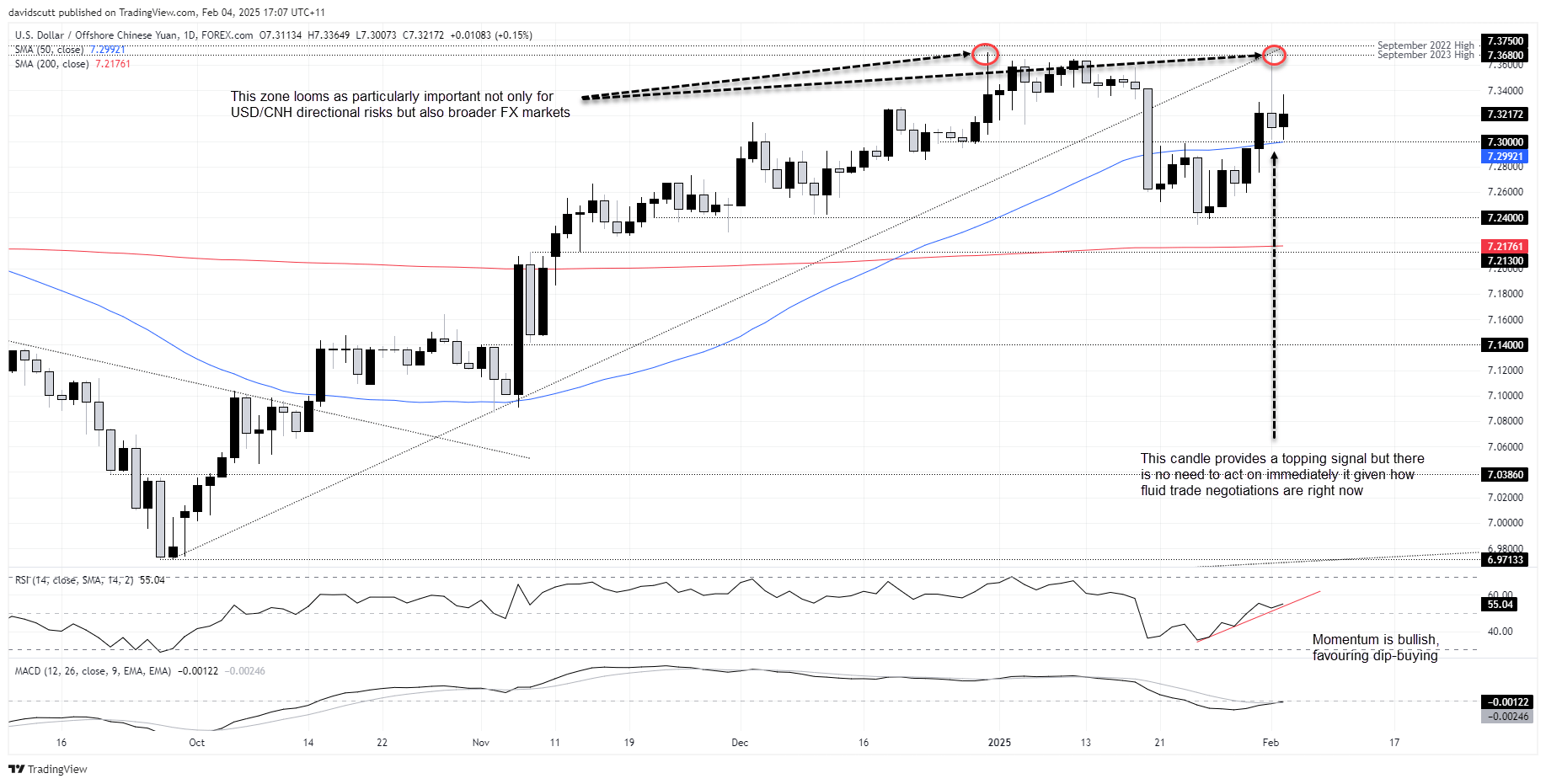

Source: TradingView

USD/CNH pushed higher on the news, reversing earlier declines driven by hopes that a last-minute deal could be struck—similar to those negotiated with the Trump administration by Mexico and Canada on Monday. That may explain the limited reaction in USD/CNH so far, but it could also reflect intervention from China to limit yuan losses while negotiations continue.

For now, the swing highs from September 2022 and 2023 remain key levels for traders. A sustained break above could open the door for an extended run higher, given the price signal it would send. These levels held firm on Monday, but will that remain the case when the People’s Bank of China announces its fixing on Wednesday following the Lunar New Year holidays?

Resistance sits at 7.3680 and 7.3750, while support is seen at 7.3000, 7.2400, and the 200-day moving average. MACD and RSI (14) are flashing bullish momentum signals, keeping the near-term bias tilted toward buying dips and bullish breakouts.

Hang Seng Breakouts Fizzle

Source: TradingView

Hang Seng futures had been up 3% earlier in the session on hopes of a last-minute trade deal. However, the latest headlines have erased roughly half those gains. It’s been a volatile start to the week, with a false bearish break of a rising wedge on Monday and a potential false bullish break on Tuesday, depending on the session close.

For now, momentum indicators are trending higher, supporting a near-term bullish bias. Initial topside levels to watch include Monday’s high at 20,960 and the double-top at 21,377. Bids may emerge at the 50-day moving average and 19,430.

Original Post