Stock Markets Analysis and Opinion

Netflix Earnings: Options Signal Bearish Tilt, But a Beat Could Flip the Script

2025.01.21 06:41

Key Highlights:

- Netflix (NASDAQ:) is set to report its Q4 2024 earnings on Tuesday, January 21, 2025, at 4 PM ET.

- Key focus areas for the report include subscriber growth, revenue changes, content performance (especially following the return of popular series like “Squid Game”), and any updates on future content strategies.

- Investors will assess how the NFL games, a successful Jake Paul vs. Mike Tyson” boxing match and the halftime show by Beyoncé impacted viewership and subscriber numbers.

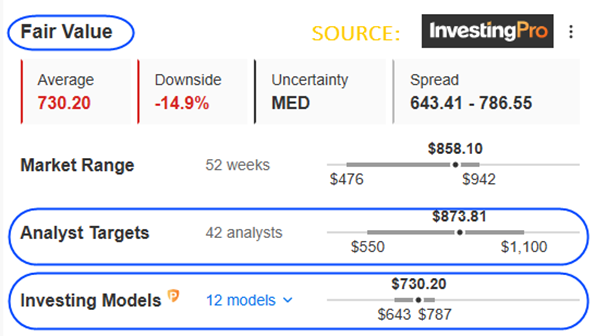

- The fair value average is at $730.20 based on “Investing Pro 12 Models”.

- Analyst targets (42 analysts) = $873.81.

- 52 Weeks Market Range = 47

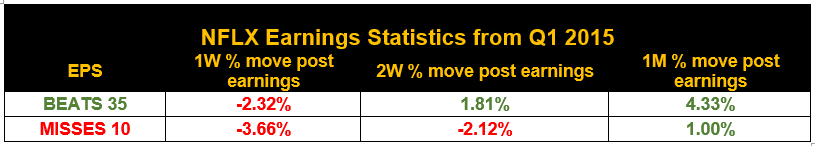

Notably, the company has achieved 35 earnings beats since Q2 2012, with just 10 misses since Q3 2015.

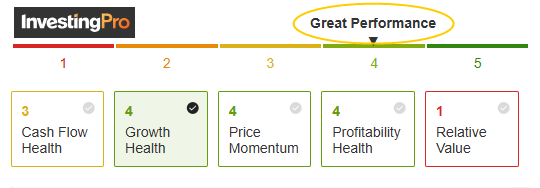

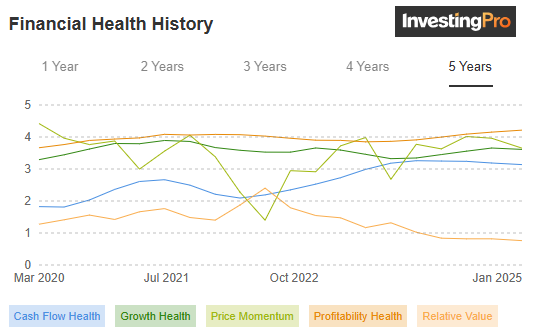

Financial Health History

Financial Health for Netflix is determined by ranking the company on over 100 factors against companies in the Communication Services sector and operating in Developed economic markets.

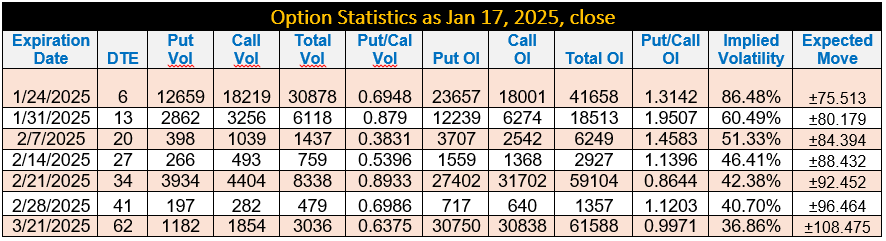

Option Statistics Show Bearish Tilt

The put/Call ratio for the Jan 24 expiry is 1.3142% more puts than calls which suggests the following three scenarios:

- With a Put/Call ratio between 1.9507 to 1.1396 for the next four upcoming expiries suggests that the traders are extremely bearish.

- Earning miss or lower guidance could trigger a sell-off as anticipated by the option market.

- Earning and guidance in line with or better than estimates would trigger a sharp rally.

Technical Analysis Perspective:

- NFLX weekly and monthly charts have two significant technical patterns.

- Prices formed a large rounding formation pattern between Nov 2012 to Sept. 2024 and penetrated 700/701 (all-time high during the period) to record 941.75 in the week of Dec 09, 2024.

- Most of the time prices come back to retest the breakout of the previous high after rising for a while, which could still be on the cards.

- The stock has been hovering inside a large bullish channel since June 2022. The mid-point of the formation is at 881.50 this week, rising about 14 to 15 dollars a week.

- There is a likelihood that NFLX may hit between 890 – 925 pre or post-earnings and reject this level to initiate a retest of 700/701 (previous high) at some point in the coming months.

Netflix Rounding and Rising Channel Pattern:

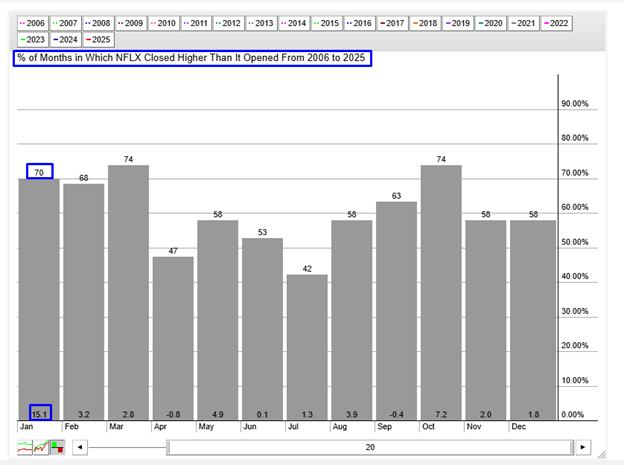

NFLX Seasonality Chart:

- NFLX closes 15.10% lower higher in January 70% of the time since 2006.

Conclusion

Netflix has the upside room to hit 890 to 925 to retest Dec 2024 highs before heading lower.