US Inflation and the US Dollar Index: A Pre-CPI Analysis

2024.12.11 06:06

- The upcoming US CPI data release on December 11th is a key event for markets, as it could influence the Fed’s decision on interest rates at its December 18th meeting.

- While a rate cut is widely expected, a higher-than-forecast CPI print could raise questions about the Fed’s path forward.

- The US Dollar has strengthened recently, partly due to positive economic data and a risk-off sentiment in markets. Can the Dollar continue its rise?

The upcoming release of the US data on December 11, 2024, is set to draw the attention of market participants. Scheduled for release at 8:30 a.m. EST, Inflation may be starting to play on the minds of the once more following an uptick in average hourly earnings as well.

Another factor raising inflation concerns are comments by President-Elect Trump who stated that he is not sure he will be available to control the potential inflationary impact of his tariff proposals. However, as many have pointed out, tariffs may just be a negotiating tactic.

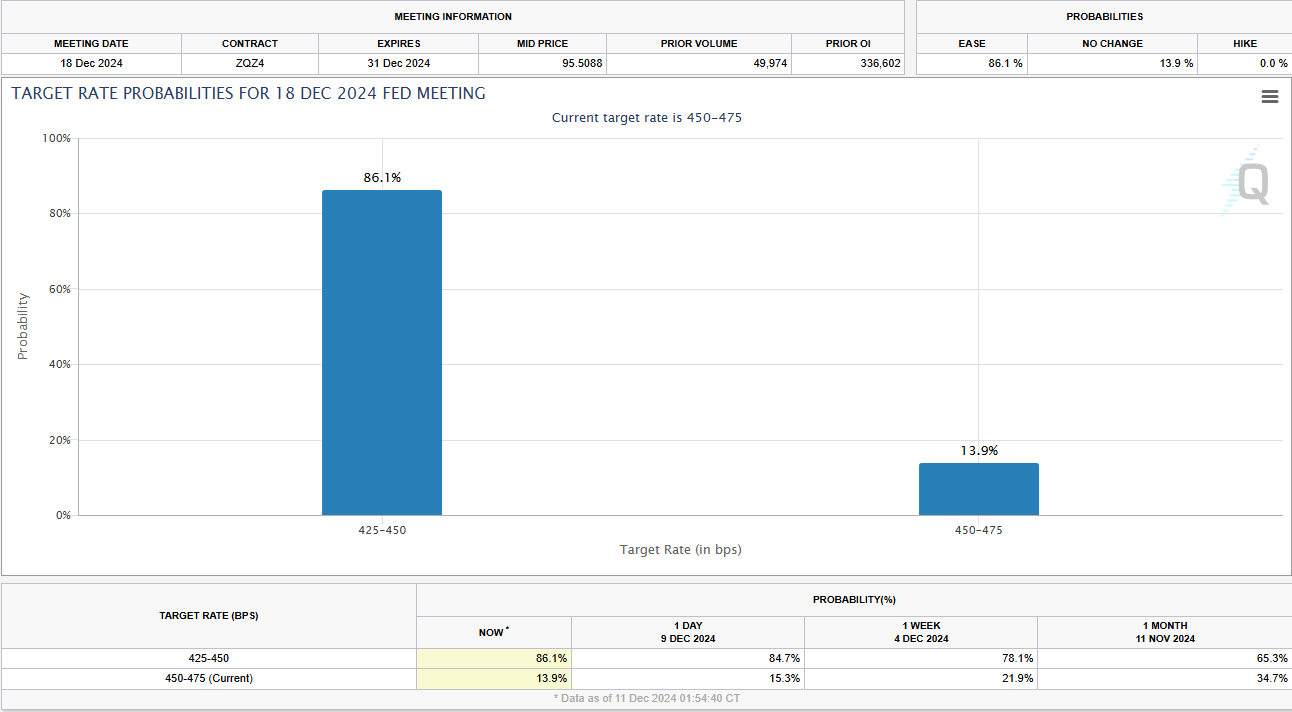

Heading toward the Fed meeting on December 18, market participants are pricing in around an 86% probability of a 25 bps rate cut.

Inflation in my opinion is unlikely to change that narrative with any change to policy likely to come at the Feds January meeting.

Source: CME FedWatch Tool

What is the Expected CPI Print?

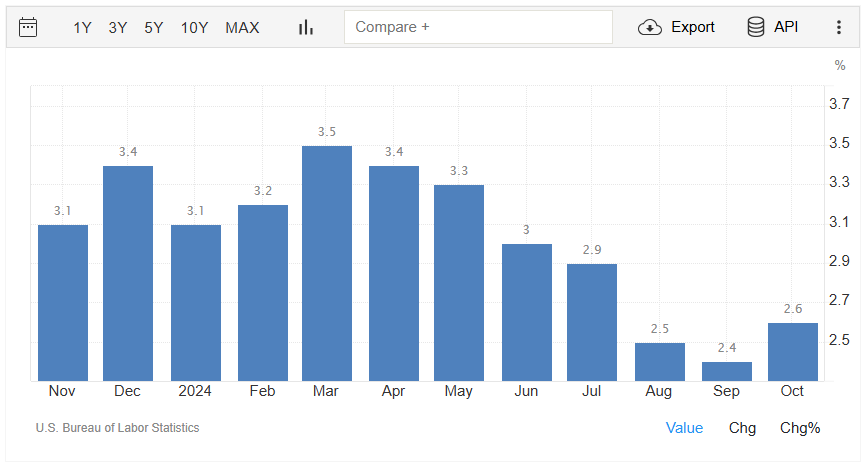

Analysts predict that overall inflation (headline CPI) will go up slightly to 2.7% from 2.6% over the last year. Core inflation, which ignores food and energy price changes, is expected to stay the same at 3.3%. On a monthly basis, both measures are likely to rise by 0.3%.

This shows that inflation is steady but still a concern. Factors like stable housing costs and lower energy prices are expected to play a role in these changes.

Source: TradingEconomics

The big question is whether this will be enough to result in any change to the Fed decision this month? Most Fed members have recently said they plan to cut interest rates by 0.25% at the December meeting. The Fed are also in their ‘blackout period’ at present, which means we have nothing else but the CPI data to go on ahead of the Fed meeting.

It’s easy to think the Fed is done worrying about inflation, but if core inflation goes above the expected 0.3% for the month, this could lead to a change in the probability of a rate cut even if it might not delay it. A high core CPI reading could make it more of a 50/50 proposition although i would still lean toward a rate cut.

An increase in the CPI prints, particularly the core reading could then in theory be responsible for another leg higher in the (DXY).

Technical Analysis – US Dollar Index (DXY)

From a technical standpoint, the has strengthened this week, partly because of the very positive small business optimism report released yesterday. It’s not surprising that US business owners are excited about possible tax cuts and fewer regulations next year.

This coupled with a risk of tone at the start of the week which helped boost the US Dollars safe haven appeal have left the US Dollar Index eyeing acceptance above the 107.00 handle.

There is a trendline break which has come to fruition and hints at further US Dollar upside. Based on the rules of a trendline break the overall target of the breakout is around the 107.50 which could come into play on a higher US CPI reading.

The implications of this on other assets could be broad ranging with it likely to effect US equities, currencies and bond markets.

US Dollar Index (DXY) Daily Chart, December 11, 2024

Source: TradingView.com

Support

Resistance

Most Read:

Original Post