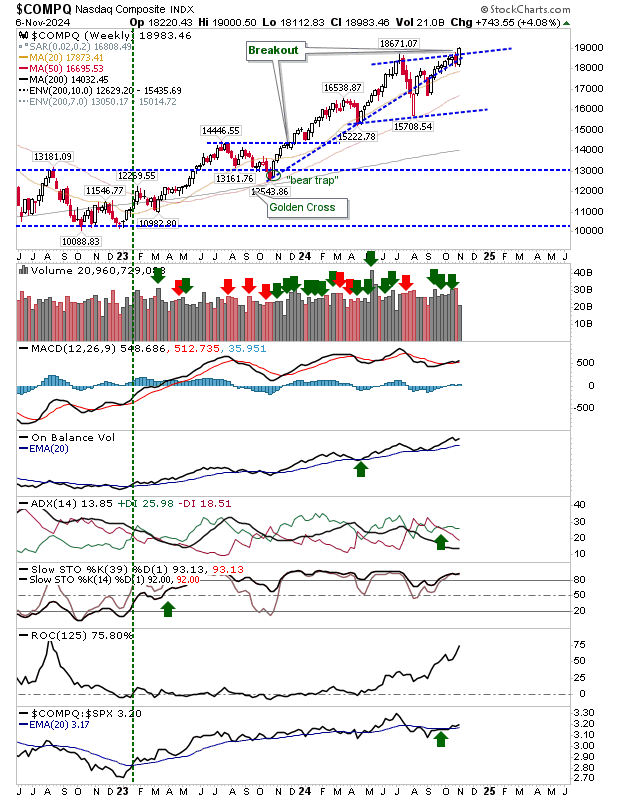

Nasdaq: Does This Surge Spell the End of Bearish Whispers?

2024.11.07 07:49

After indices ailed at resistance for so long traders made the decisive move, buying stocks with glee on Trump’s victory. Most of the gains were achieved pre-market on the opening gap, but this gap offers substantial wiggle room should profit-taking kick in.

Wednesday’s action should mark a clear breakout gap – and breakout gaps can’t close – so even if we see a move inside the gap, the risk:reward should be easy to establish for long trades. What I will also want to see is an improvement in breadth metrics, particularly the Nasdaq Summation Index ($NASI).

It was pointing towards a larger loss for the and could yet still forecast one. What doesn’t happen now could happen in the New Year once the seasonal “good will” factor wears off.

However, while the week is not yet out, it’s looking good for the Nasdaq as it clears a convergence of support and resistance that had the look for a potential move back to the low end of the 2024 range around 16,000. This is the off the menu if Friday’s action can hold the marked breakout.

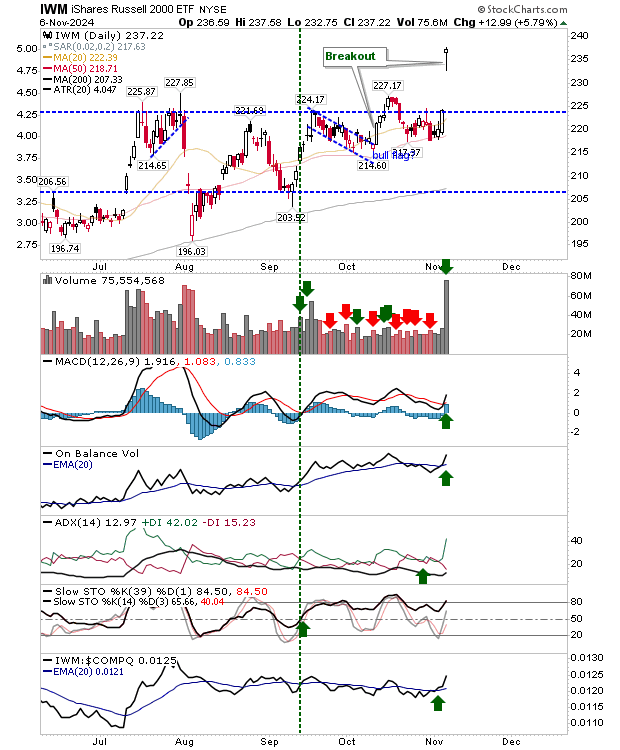

The big winner from Trump’s presidential victory was the (). A near 6% surge is incredible and sets up $225 as great support for the index ETF. Not surprisingly, there was clear accumulation to go with the move, and technicals are once again net bullish.

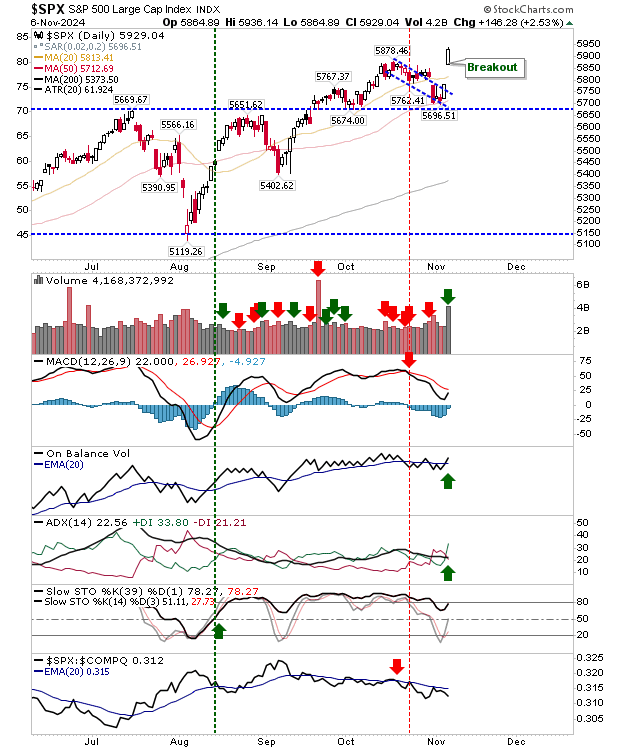

The already banked the advantage of its breakout, and prior to the election was toying with breakout support. This game has ceased as it moved to new highs. The only flies in the ointment are a weak MACD ‘sell’ (a signal well above the bullish zero line), and continued relative underperformance against the once-struggling Nasdaq.

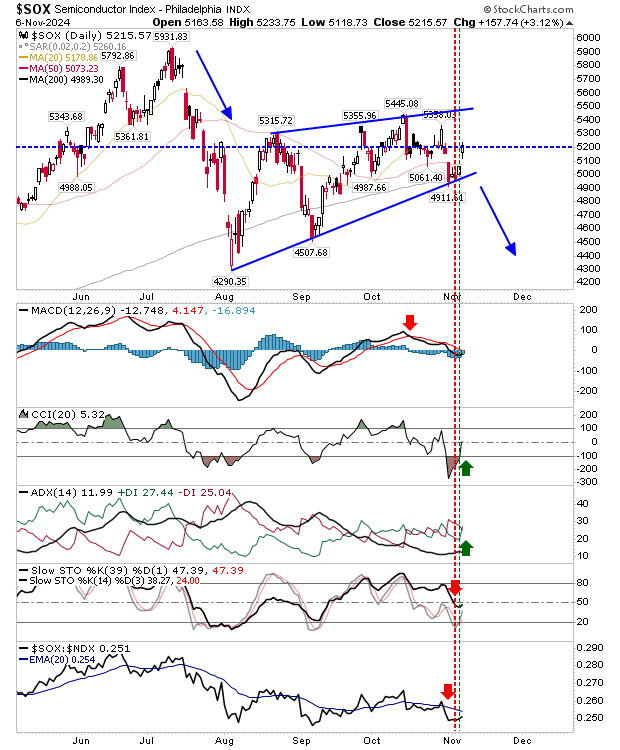

If there is still trouble brewing it’s in the ($SOX). This economic bellwether didn’t really knock itself out of the park yesterday and still looks under pressure. Technicals have started to improve, but they are looking at little scratchy.

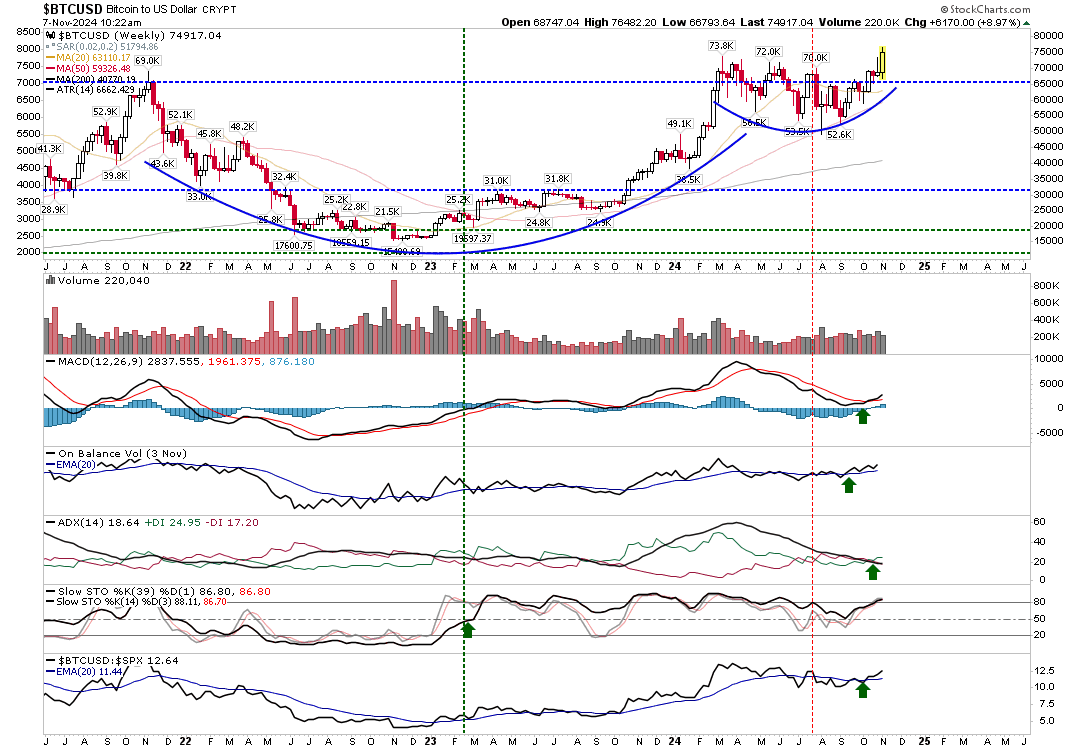

As a final note, () is emerging from a 2-year cup-and-handle pattern. While I have very little interest in it as I don’t really understand it’s true value, from a technical perspective, it’s going gang busters. The measured move target for this is up around $120K – quite incredible really.

So, there was no “Sell the news” event on the election result; quite the opposite in fact. We are also heading out of the bearish September/October period into the more bullish end-of-year. If you want to play “glass-half-full”, then February will probably be the time sellers will try to attack whatever gains are posted by then. But until then, happy hunting.