Nasdaq, S&P 500 Face Further Pressure as Yesterday’s Late Selloff Hurts Technicals

2024.10.31 03:55

Markets started brightly yesterday but that was it. Heading into the final hour of trading it turned into a bit of a free-fall.

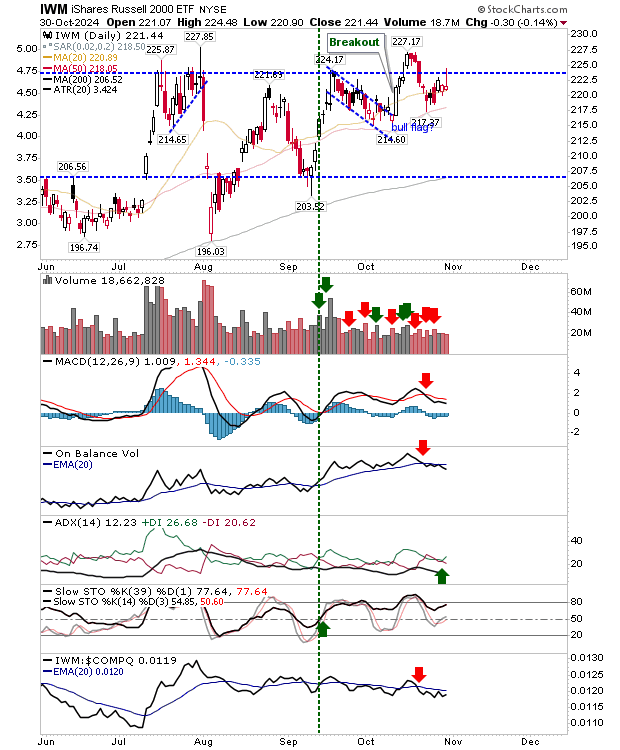

The () took the worst of the pain, leaving behind a very bearish looking inverse “hammer”. There are prior ‘sell’ triggers in the MACD and On-Balance-Volume, along with an underperformance against the .

It’s hard to see things opening brightly today, but if bulls can make a stand into Friday’s close it might alleviate some of the selling pressure building in this index.

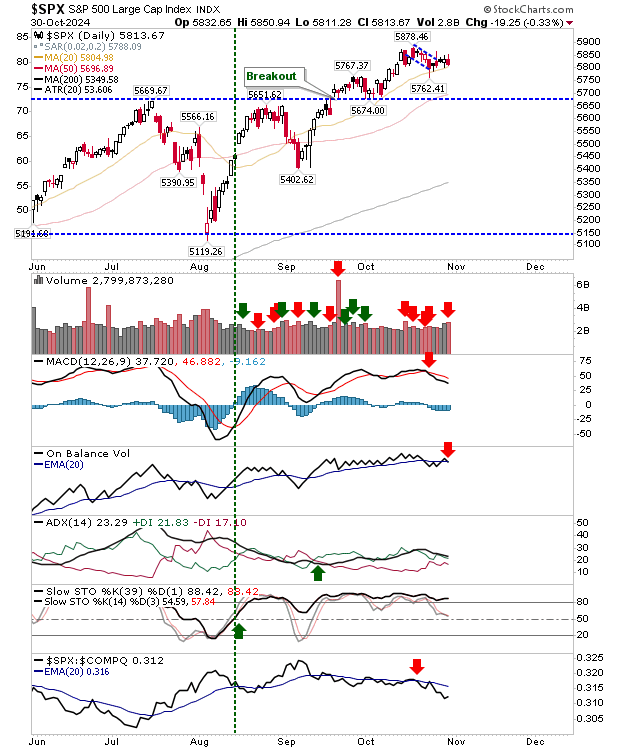

The is holding on to 20-day MA support, but the pressure is building to the downside with a series of small, upper spikes marking points of attack by bears. There was a new ‘sell’ trigger in On-Balance-Volume to add the earlier ‘sell’ trigger in the MACD. The best aspect oof this is the strong bullish momentum; momentum that hasn’t waivered during the development of the ‘bull flag’.

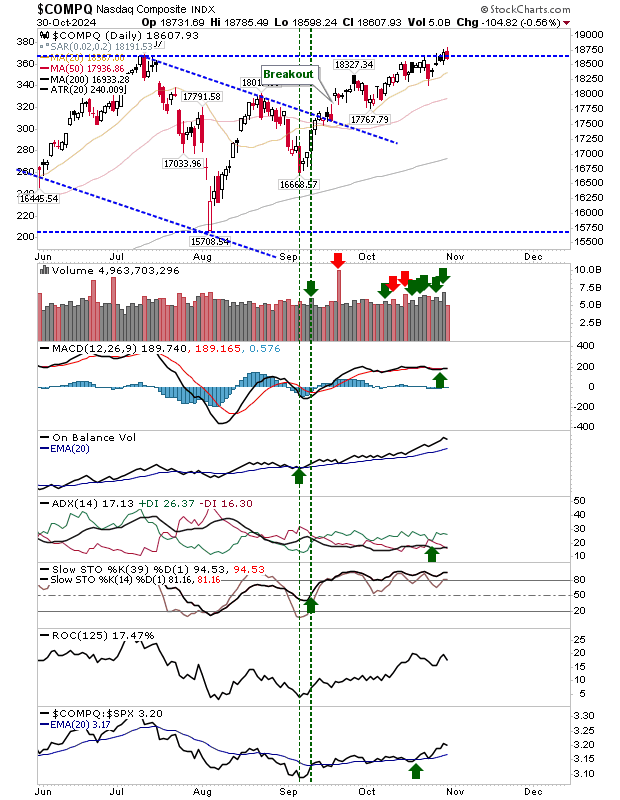

The Nasdaq edged a breakout yesterday, but found itself drifting back inside resistance yesterday – not enough for a ‘bull trap’ – but enough to put the move higher on pause. The MACD is flip-flopping between ‘buy’ and ‘sell’ triggers, but other technicals are positive. The one thing I like is that buying volume days far outweigh selling ones.

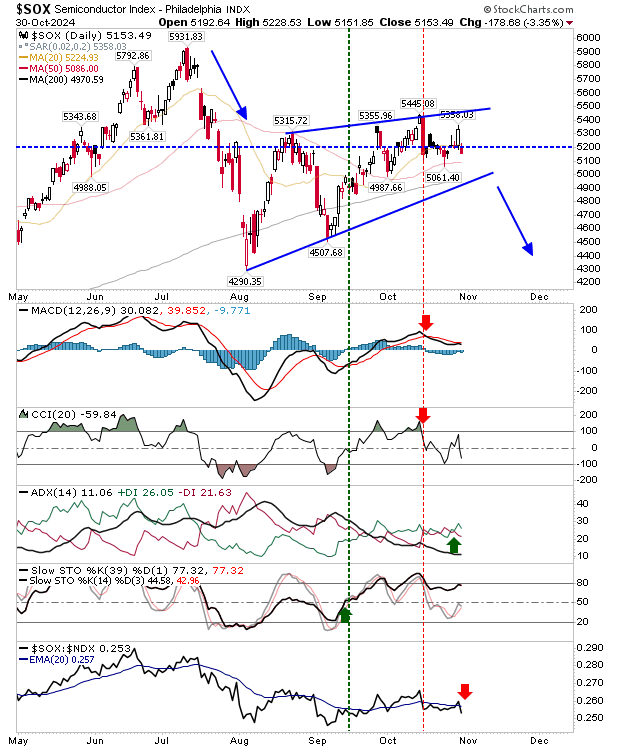

I’m also watching the . Tuesday was a solid day of upside, but yesterday was the opposite. Key moving average support is still there, but it now finds itself fast approaching rising wedge support. Technicals are a mixed bag, but the performance relative to the is the one of potential greatest concern.

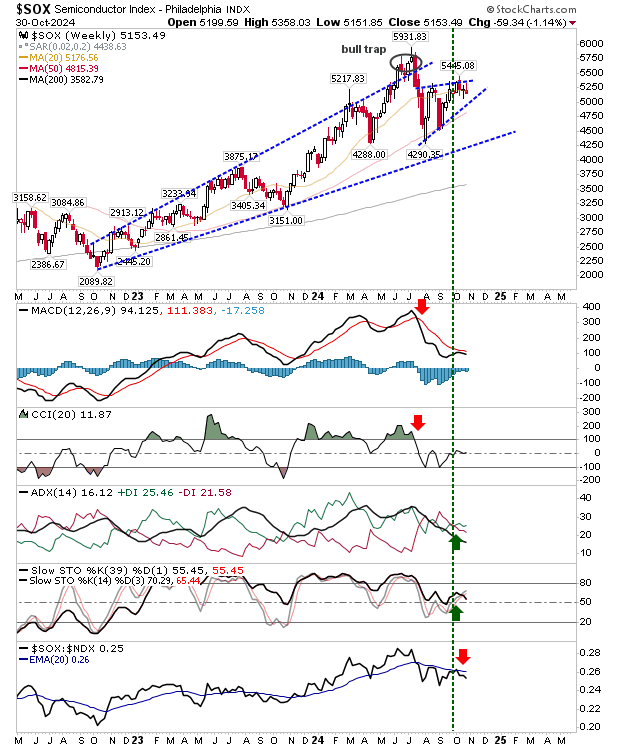

Also, track the weekly chart picture for Semiconductors. Here, things look more bearish on the technical front. There is a ‘bull trap’ in play, and ‘bull traps’ typically retrace back to consolidation support; support defined by the October 2022 and November 2023 swing lows.

The weak finish is setting up for a weak start tomorrow. Assuming a slow first half-hour, watch for buyers to step in and move the needle. If nothing happens around 10 am, then it could be a scrappy day with the potential to sell off into the last hour.