Gold Prices Consolidate – What’s Next?

2024.05.07 05:59

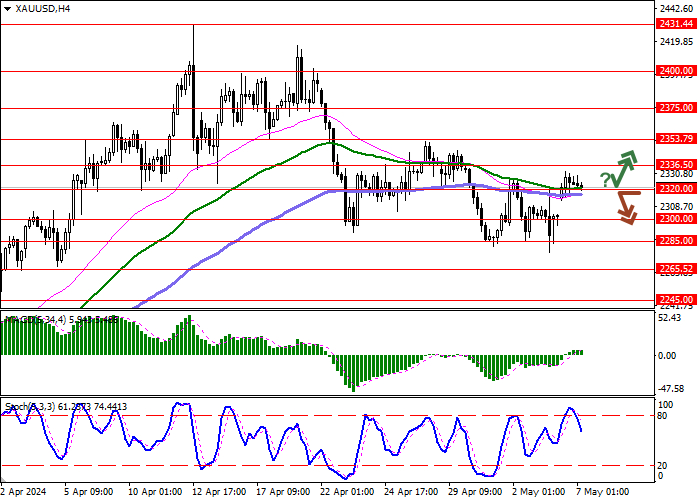

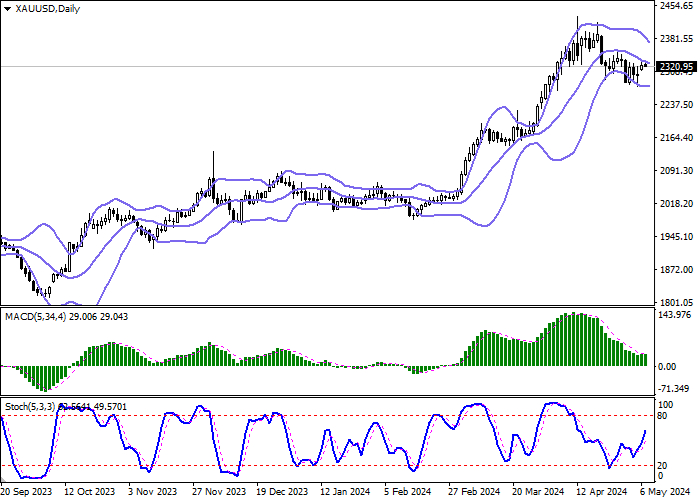

The pair is maintaining mixed dynamics, oscillating near the 2320.00 level. The market is searching for new drivers while the pair undergoes a slight technical correction after reaching local lows since April 5.

Recent data on the U.S. labor market weakened the dollar’s position. Non-farm payrolls fell from 315,000 to 175,000, below the expectation of 243,000. The average wage slowed to 3.9% per year, indicating a reduction in inflation risks. The ISM services business activity index also pressured the dollar, dropping from 51.4 to 49.4 points.

Gold finds support in geopolitical risks in the Middle East, as negotiations between Israel and Hamas did not result in a ceasefire, leading to intense attacks. Additionally, the European Central Bank may implement changes in monetary policy, boosting interest in precious metals.

Gold contracts also show signs of growth. According to the CFTC report, speculative net positions rose to 204,200, and investors expect a clearer trend to initiate new trades.

Support and Resistance Levels:

- Resistance: 2336.50, 2353.79, 2375.00, 2400.00

- Support: 2320.00, 2300.00, 2285.00, 2265.52

Technical Indicators

Bollinger Bands: Showing a moderate decline, narrowing with possible mixed short-term dynamics.

MACD: Attempting to reverse upwards, suggesting a possible buy signal.Stochastic: Indicates active growth, suggesting a potential short-term correction for the “bulls.”

Trading Scenarios:

Primary Scenario (SELL):

- Entry Point: 2319.05

- Take Profit: 2285.00

- Stop Loss: 2336.50

Time Frame: 2-3 days

Alternative Scenario (BUY STOP):

- Entry Point: 2336.55

- Take Profit: 2375.00

- Stop Loss: 2320.00

These strategies seek to capitalize on current market dynamics and protect against unforeseen fluctuations.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link