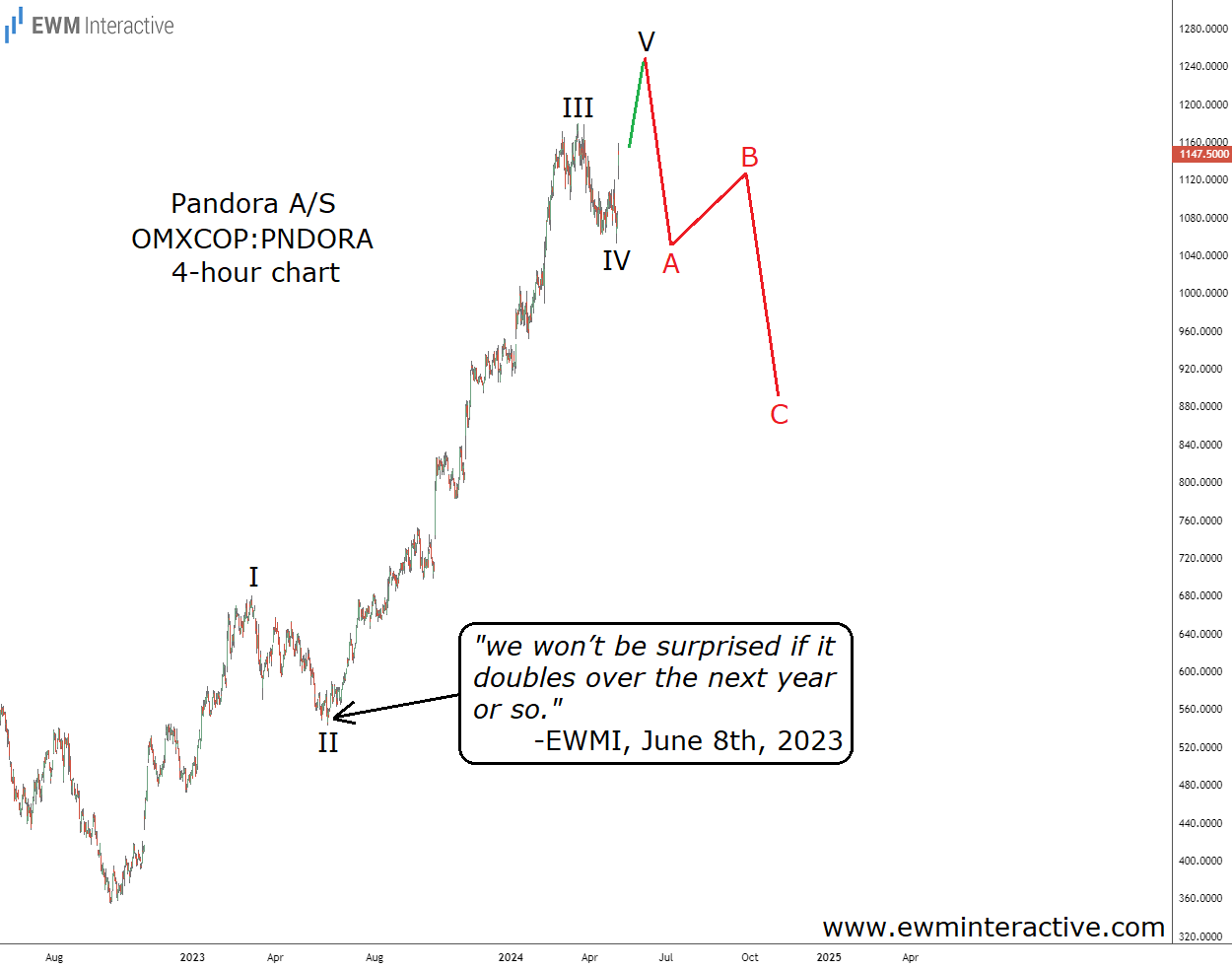

Pandora Doubled in Less Than a Year: Now What?

2024.05.02 13:51

When we wrote about Danish jewelry-maker Pandora A/S , we said that,

“We won’t be surprised if it doubles over the next year or so.”

Fast forward to today, the stock is trading near DKK 1150, up 109% from its price of DKK 550 at the time of writing. Today alone, shares are up 6% after the company posted another stellar quarterly earnings report.

With its strong sales growth, Pandora bucks the recent trend of consumer discretionary companies issuing disappointing revenue guidance and profit warnings. From Ulta Beauty (NASDAQ:), Lululemon (NASDAQ:) and Nike (NYSE:) to Starbucks (NASDAQ:), Yum! (NYSE:)! and even Dollar General (NYSE:), companies have been sharing their concerns about the health of the US consumer while downgrading their expectations for the year ahead.

Not Pandora. The company, whose largest market is also the United States, raised its organic growth guidance from 6-9% to 8-10% earlier today. Alas, as legendary investor Howard Marks says, most forecasts are just extrapolations. Pandora’s management has been doing an incredible job for years. However, given the pessimism expressed by other consumer-dependent companies, their rosy extrapolations of the recent past into the future might not come to fruition.

We think that what was a low-risk high-potential investment at DKK 550 is no longer so at DKK 1150. Besides, the stock’s recent surge seems to be on the verge of producing a familiar Elliott Wave pattern.

Similarly to the general US stock market, Pandora‘s recent uptrend began in late September, 2022. It’s been far more rewarding, though, with the stock up 225% from its respective bottom at DKK 354. The problem for the bulls is that this surge can be seen as an almost complete five-wave impulse pattern, marked I-II-III-IV-V.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

According to the theory, a three-wave correction follows every impulse. Instead of joining the bulls as wave V makes a new all-time high near DKK 1200, investors would do well to take some profits. The depth of the anticipated pullback is impossible to predict, but a decline back to DKK 800 would make sense. Considering Pandora‘s history of very deep retracements, we might even be underestimating the bears.

Original Post