Gold Prices Hit Highest Level Since May, Oil Settles Higher

2023.11.29 03:26

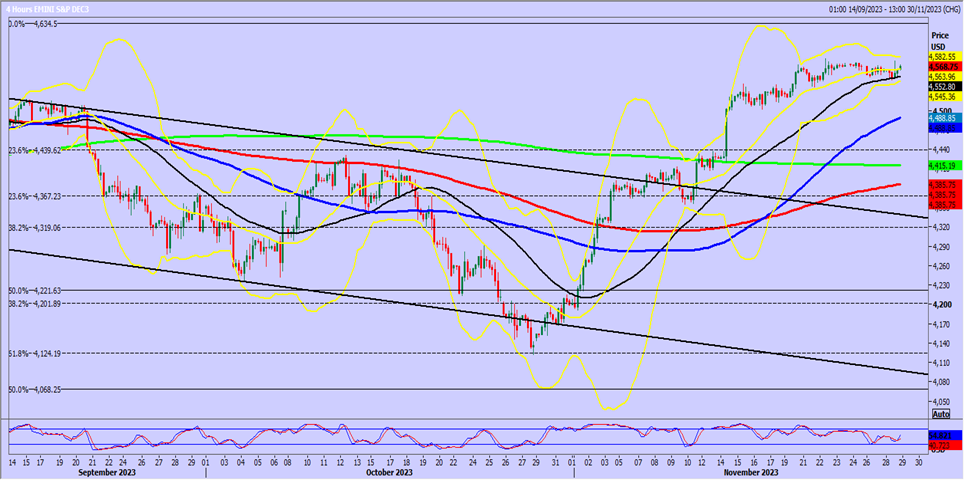

December futures still just drifting aimlessly after the long holiday weekend. We are still holding just above minor support at 4542/38 to keep bulls in control & perhaps on the next leg higher we can reach my next target of 4591/94, perhaps as far as 4615/19 eventually.

Strong support again at 4542/38. Longs need stops below 4533.

A break lower risks a slide to 4505/00 & even 4480/75 is possible.

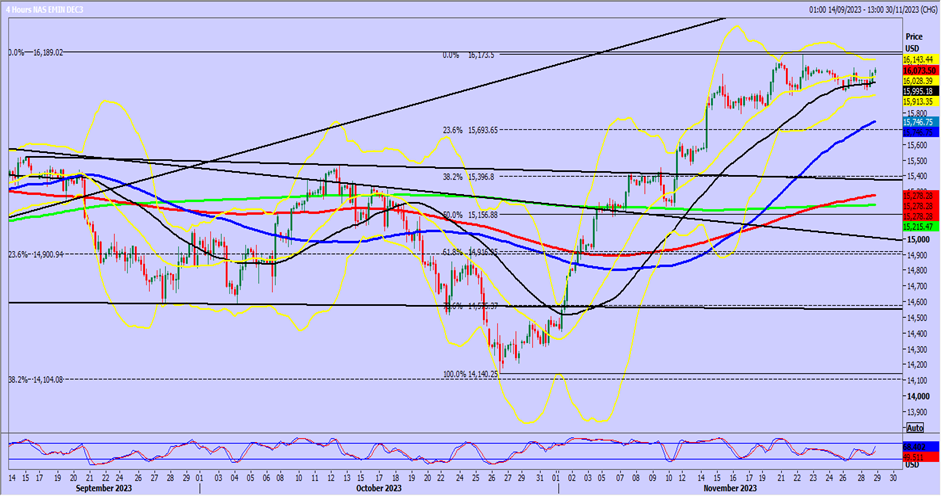

December futures edged higher to 16173 last week as we look for 16300 next target. Further gains can target 16390/410.

We have held a very tight range from around 15940/920 up to 16090/16120 for a week.

The best buying opportunity should be at 15850/830 and longs need stops below 15770. We should also have strong support at 15700/660.

Nasdaq Futures-4-Hr Chart

Nasdaq Futures-4-Hr Chart

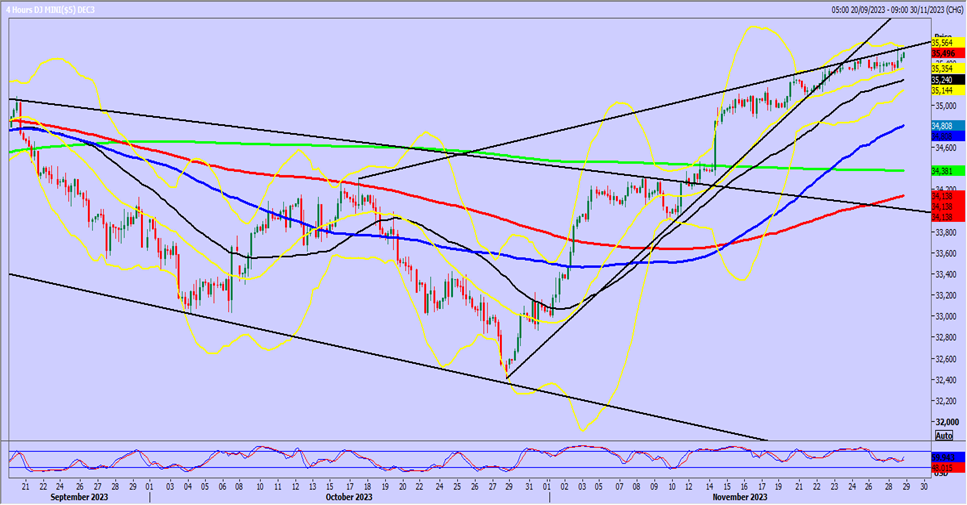

December continues higher through 35080/35100 to my next targets of 35170/190 and 35230 & now we are edging above 35400/450, so we look for 35570/590. Further gains this week can target 35650/670.

Support again at 35390/360. Longs need stops below 35250.

Global stock index and Dollar movement

-

Global stock indexes advanced on Tuesday.

-

The US dollar fell to a 3-1/2 month low, marking its biggest monthly drop in a year.

-

Federal Reserve official signals that the central bank may consider rate cuts if inflation continues to ease.

Fed Governor Christopher Waller’s Comments

-

Waller suggested the possibility of lowering the Fed policy rate in the coming months if inflation continues to decrease.

-

He expressed increasing confidence that the current interest rate setting would be sufficient to lower inflation to the Fed’s 2% target.

Fed Governor Michelle Bowman’s Remarks

Market Response and Rate Cut Expectations

-

Traders increased bets for the first rate cut, with March being a possibility.

-

Probability for a 25 basis-point cut rose to nearly 33% from 21.5% on Monday, according to CME Group’s (NASDAQ:) Fedwatch tool.

-

Majority expected a cut, at least one notch, in May.

Wall Street Indexes Performance

-

Wall Street indexes closed higher.

-

Dow Jones rose 0.24%, gained 0.10%, and added 0.29%.

US Consumer Confidence Survey

-

A survey showed U.S. consumer confidence rose in November after three months of declines.

-

However, households still anticipated a recession over the next year.

Upcoming Economic Data

-

The spotlight will be on the U.S. October personal consumption expenditures report (PCE), including core PCE (Fed’s preferred inflation measure).

-

Eurozone consumer inflation figures are expected to provide clarity on price and monetary policy directions.

US treasury yields and Dollar Index

-

After the Fed commentary, U.S. Treasury yields dipped, with benchmark notes down 6 basis points.

-

fell 0.368%, with the up 0.32% to $1.0988.

Currency movements

-

strengthened 0.82% against the greenback.

-

was last trading at $1.2694, up 0.55% on the day.

Gold prices

Oil prices

-

Oil prices settled higher on the possibility of OPEC+ extending or deepening supply cuts, a storm-related drop in Kazakh oil output, and the weaker .

-

settled up 2.07% at $76.41 per barrel, and settled at $81.68, up 2.13% on the day.

Australian and New Zealand Dollars

-

held near a four-month peak.

-

scaled a roughly four-month top of $0.61495.

-

Australian inflation data and a rate decision from the Reserve Bank of New Zealand are awaited.