Is Microsoft a Buy After Crushing Q1 Estimates?

2023.10.26 04:04

After the market closed yesterday, Microsoft (NASDAQ:) released its Q1 earnings report for fiscal year 2024. The company blew past analysts’ estimates, beating both revenue and earnings by a good margin. The stock is up nearly 5% to over $346 a share in pre-market trading today. This stellar report is likely to add more fuel to MSFT’s spectacular uptrend since its 2009 bottom.

For over fourteen years now, investors in the Redmond-WA-based software behemoth have been enjoying high, steady, and predictable gains. The stock has been following the business on its upward trajectory to a valuation of ~$2.5 trillion. However, we should not forget that this phenomenal success largely coincided with the era of easy money and the longest economic expansion in US history.

Of course, Microsoft is one of the greatest companies ever created. Given its competent management and the numerous competitive advantages working in its favor, its hegemony is very likely to continue for years to come. Does this make MSFT a good investment at current prices, though? After all, the company didn’t stop growing its revenue and earnings between the 2000 Dot-com bubble peak and the 2009 bottom. Yet, from investors’ perspective, it was a lost decade as the stock fell 75% over those nine years.

There always comes a point when the fundamentals of even the best business can no longer justify its high valuation. Simply extrapolating yesterday’s gains into the future works until it doesn’t. At 30 times earnings, Microsoft is obviously far from cheap. Such a multiple implies that the company is going to keep growing at a 30% clip for years to come. This is next to impossible for a business, whose revenue is already measured in the hundreds of billions and whose valuation is in the trillions.

And if common sense is not enough to talk some caution into the bulls, there is also a big warning sign on Microsoft‘s price charts for those who care to look.

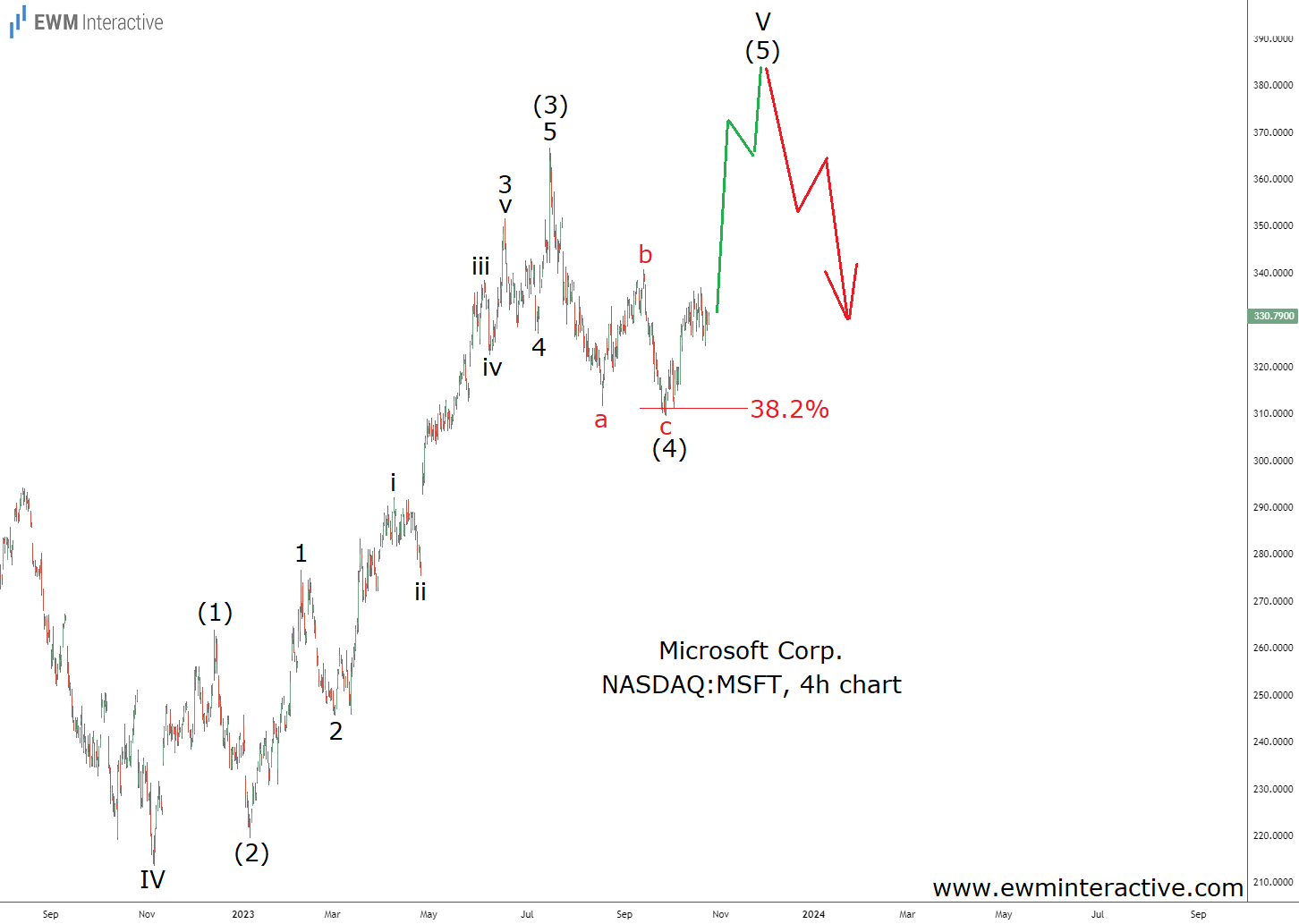

The 4-hour chart above reveals the stock’s rally over the past twelve months. Starting from the bottom at $213 in early November, 2022, its structure reminds us of an impulse pattern, whose fifth and final wave is still missing. Waves (1), (2), (3), and (4) are already in place and two lower degrees of the trend can also be seen within wave (3). Wave (4) seems to have ended shortly after touching the 38.2% Fibonacci support level.

If this count is correct, we can expect more upside in wave (5) towards a new all-time high approaching the $400 mark. Contrary to current sentiments, however, we think this would be an opportunity to take profits off the table rather then joining the bulls. In addition to the lofty valuation, the Elliott Wave theory states that every impulse is followed by a correction. And in this case, it might be a bigger one than the 4h chart above suggests.

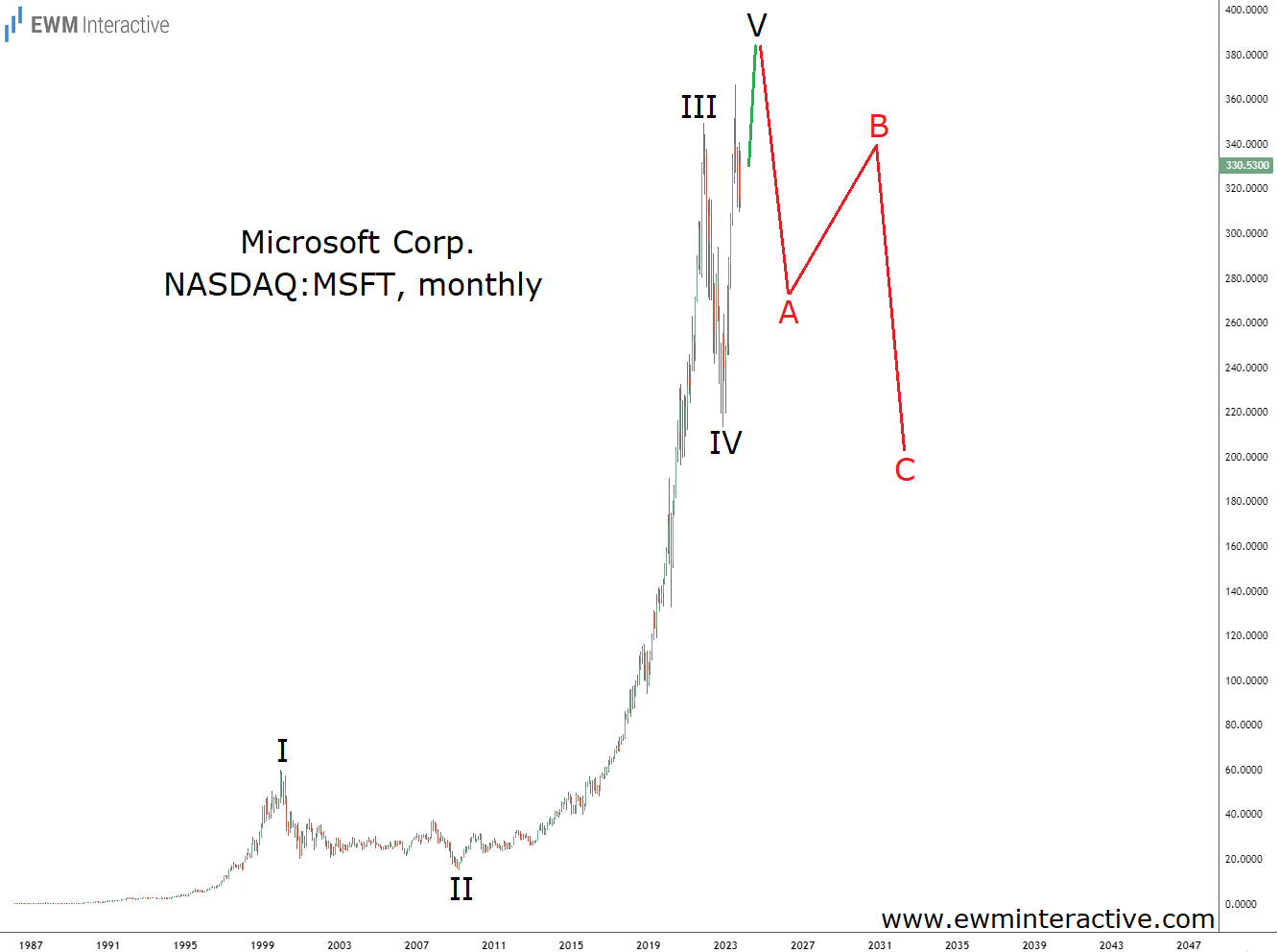

Moving on to the monthly chart of Microsoft, we see that the recent recovery from $213 is actually wave V of the impulse, that’s been in progress since the company’s IPO in 1986. It is marked I-II-III-IV-V, where the top of wave I stands for the peak of the Dot-com bubble in 2000. The last decade we mentioned earlier was wave II. Wave III was a wonder to behold before the Fed-induced bear market of 2022 dragged the stock down in wave IV. It follows that the 2023 recovery is wave V.

Once it is complete, a major three-wave correction can be expected to begin. Corrections usually erase the entire fifth wave. Assuming a bearish reversal near $400 a share, that’ll be a ~50% decline back to the support of wave IV near $200.

“Impossible!”, many would say. Not really, especially when you consider that it didn’t take Armageddon for MSFT to drop 39% between November 2021, and November 2022. Just a slight change in the market’s mood. There was also nothing wrong with the company, business-wise, during the 75% crash in 2000-2009. Just a sharp change in investors’ perception of it.

Bull markets feel best right before they end. This was true about The Roaring 1920s and all the other great bull markets before and since. It was true about the Dot-com mania and the following housing bubble. The market turns long before there is even the slightest sign of trouble on the horizon. By the time the trouble arrives, it is already too late. Elliott Wave analysis tells us that Microsoft’s bull market is about to end soon. Just when it feels like it is going to last forever.

So, is Microsoft a buy? Yes, but only in the short term. We doubt that wave (5) of V would take more than a couple of months. That’s how much time we think the bulls have left to evacuate.

Original Post