US drops digital trade demands at WTO to allow room for stronger tech regulation

2023.10.25 19:34

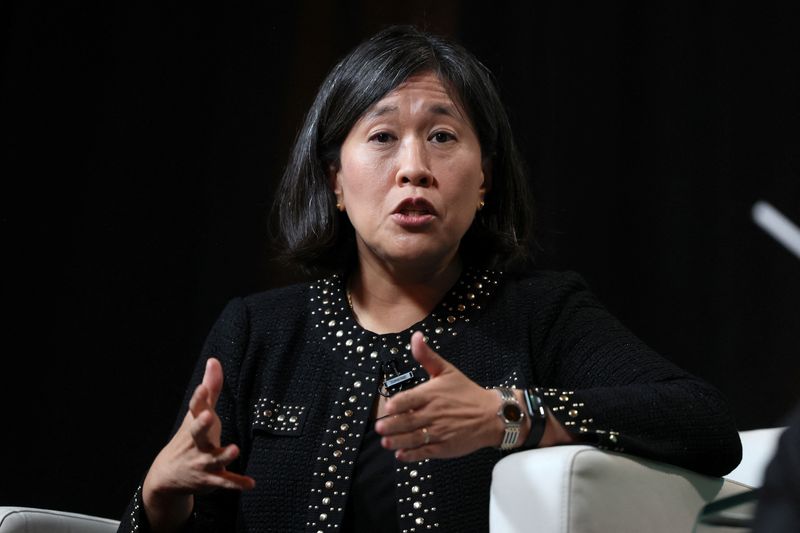

© Reuters. U.S. Trade Representative Katherine Tai speaks during the Axios BFD event in New York City, U.S., October 12, 2023. REUTERS/Brendan McDermid/File Photo

By David Lawder

WASHINGTON (Reuters) – U.S. Trade Representative Katherine Tai has dropped longstanding U.S. digital trade demands in World Trade Organization talks in order to give Congress room to regulate big tech firms, her office said on Wednesday.

The U.S. is withdrawing proposals made in 2019 by the Trump administration insisting that WTO e-commerce rules allow free cross-border data flows and prohibit national requirements for data localization and reviews of software source code.

The decision angered some lawmakers and business groups, who said it would put U.S. firms at a disadvantage.

The withdrawals were made in Geneva during a meeting of the WTO’s Joint Statement Initiative on E-Commerce, with a U.S. official saying that the U.S. was reviewing its approach to trade rules in sensitive areas such as data and source code.

The official said U.S. policy must take into account regulatory objectives, “balancing the right to regulate in the public interest and the need to address anticompetitive behavior in the digital economy,” according to a transcript seen by Reuters.

The USTR move aligns with the Biden administration’s desire to strengthen regulation of large technology firms and the direction of digital trade negotiations in the U.S.-led Indo-Pacific Economic Framework for Prosperity (IPEF) group of Asian countries.

‘WIN FOR CHINA’

But Senator Ron Wyden, the Oregon Democrat who leads the Senate Finance Committee, called the move “a win for China, plain and simple,” saying it would strengthen the Chinese model of internet censorship and government surveillance.

“USTR’s unilateral decision to abandon any leverage against China’s digital expansionism, and to oppose policies championed by allies like Australia, Japan, the U.K. and Korea, directly contradicts its mission as delegated by Congress,” said Wyden, who has long championed big U.S. tech firms, including Intel (NASDAQ:), the largest for-profit employer in Oregon.

USTR spokesman Sam Michel said many countries were examining their approaches to data and source code, and how trade rules can affect them.

“In order to provide enough policy space for those debates to unfold, the United States has removed its support for proposals that might prejudice or hinder those domestic policy considerations,” Michel said in a statement to Reuters, adding that the U.S. would remain “an active participant” in the WTO e-commerce talks.

The move was applauded by some lawmakers who want to rein in large tech firms, including Democratic Senator Elizabeth Warren of Massachusetts, who said Tai was rejecting efforts by Big Tech lobbyists to use trade deals to thwart regulation.

“We need to make clear that digital rules favoring Big Tech monopolies are a non-starter for the U.S. in any trade agreement, including IPEF,” she said.

U.S. Chamber of Commerce said the digital trade principles being dropped by USTR won overwhelming congressional support as part of the 2020 U.S.-Mexico-Canada Agreement on trade and have helped to make U.S. tech firms “the envy of the world.” The top business lobby group urged a reversal by USTR.

“These digital trade rules prevent countries around the world from using regulation to lock out American companies and their workers from their markets,” said John Murphy, the Chamber’s senior vice president for international policy.