Is the S&P 500 Still on Track for the 4270s?

2023.09.25 15:59

Two weeks ago, see , we found for the , using the Elliott Wave Principle (EWP),

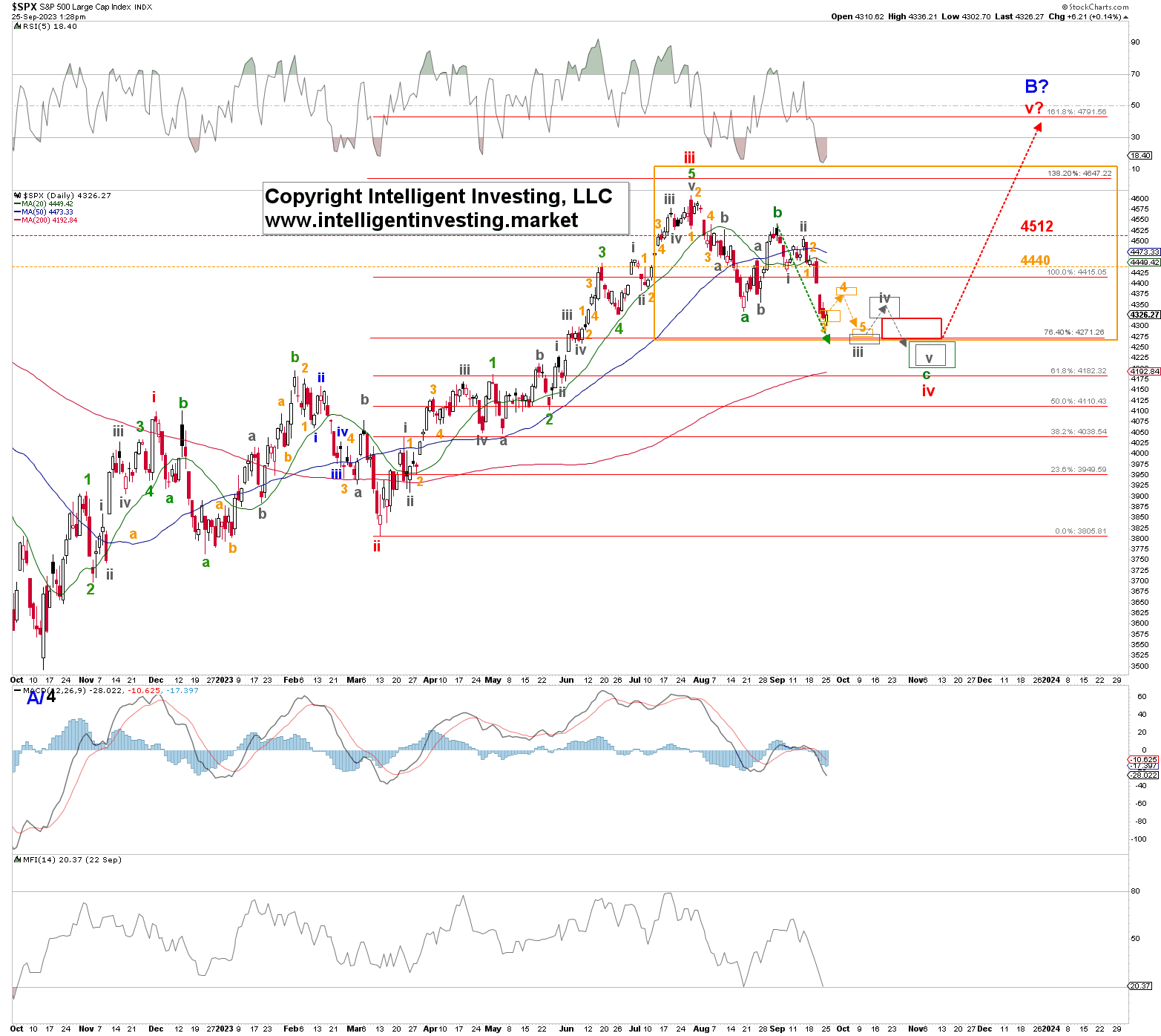

“Our preferred scenario is for [a] rally to around $4490+/-10, which it achieved today, and then drop to ultimately and ideally ~$4270+/-10 in five (grey) waves. … A drop below the grey W-i low ($4430 on September 7), will then trigger the grey W-iii, iv, and v sequence to ideally $4330+/-15, $4400+/-10, and $4270+/-10, respectively. The latter target zone is also where green W-c equals the length of green W-a, measured from the green W-b (September 1) high. A typical c=a relationship. Moreover, it is also where the (red) 76.40% extension of red W-i resides (see Figure 1 below).”

Figure 1. Daily SPX chart with detailed EWP count and technical indicators.

Fast forward, and the index’s countertrend (grey W-ii) rally decided to subdivide and lasted through September 14 to $4505, but still only 5p above our ideal target zone. On September 16, the index broke below $4430 by trading to as low as $4416, signaling the grey W-iii to ideally $4330 was most likely underway. Although the decline was a bit less than ideal, and a Triangular corrective pattern to around $4370+/-10 was possible, our primary-preferred path remained the Flat correction to ideally the $4270s.

Today, the index bottomed, so far, at $4302, which is only 13p below the ideal grey W-iii target zone set forth two weeks ago based on standard Fibonacci-based extension patterns. Thus, the market’s waves decided to extend. That can always happen but cannot be foreseen.

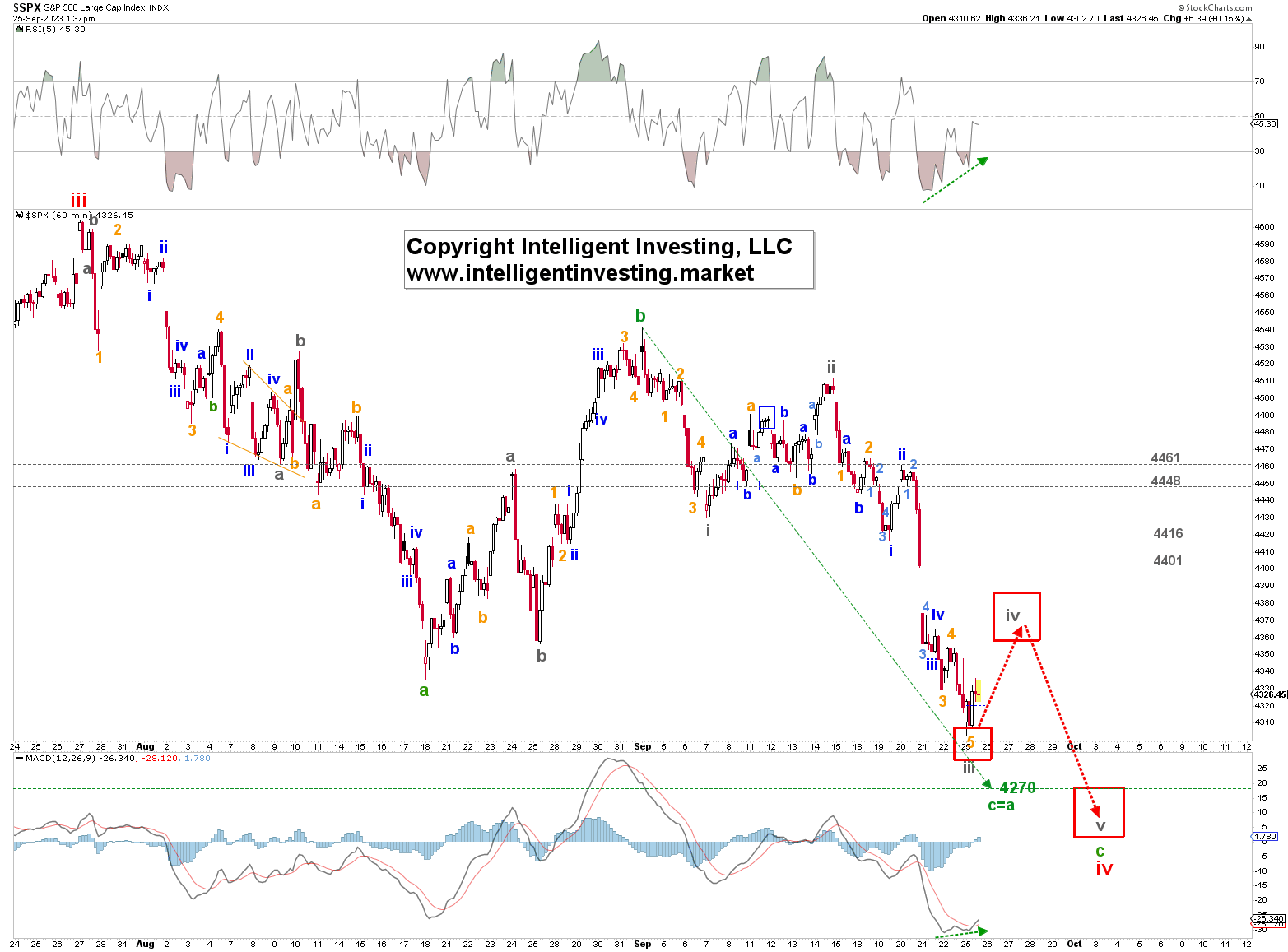

Due to this extension, the index should now be in orange W-4 to around $4370+/10, followed by an orange W-5 down to ideally $4280+/-10, etc. See Figure 1 above. Alternatively, the index already completed the grey W-iii at today’s low and is now in grey W-iv, followed by only one last 5th wave lower to $4270-4230. See Figure 2 below.

Figure 2. Hourly SPX chart with detailed EWP count and technical indicators.

Please note the positive divergence on the hourly RSI5 and MACD (dotted green arrows). Although only a condition and not a trigger because divergence is only divergence until it is not, this is the first buy cross on the MACD since last week to suggest a more significant bounce is underway.

Please note the positive divergence on the hourly RSI5 and MACD (dotted green arrows). Although only a condition and not a trigger because divergence is only divergence until it is not, this is the first buy cross on the MACD since last week to suggest a more significant bounce is underway.

Thus, based on the EWP, our primary expectations for lower prices came to fruition, and we are now tracking the completion of this impulse lower that started on September 4. The index must move above at least $4401 to suggest the low is already in place. That would be unorthodox but not impossible. For now, we prefer to look for a local high at around $4370+/-10 followed by at least one lower low at about $4270-4230 before the decline from the September 4 high can be considered complete.