Factbox-What are global companies saying about China’s economy?

2023.07.27 07:43

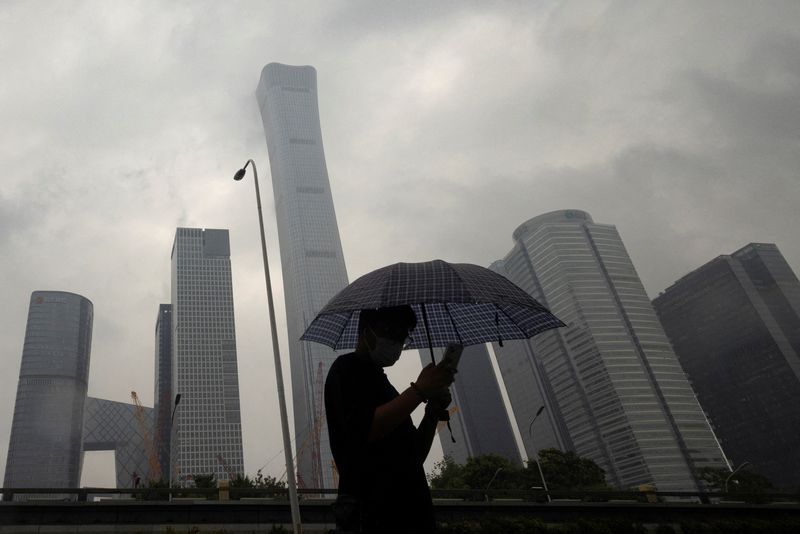

© Reuters. FILE PHOTO: A man walks in the Central Business District on a rainy day, in Beijing, China, July 12, 2023. REUTERS/Thomas Peter/File Photo

(Reuters) -Major global firms ranging from banks to chipmakers are taking a largely cautious stance on their China business amid a frail recovery at the world’s second-largest economy from a pandemic slowdown.

Following are comments from firms on their China business during the latest reporting season:

Company China recovery comments

Citigroup (NYSE:) The lender called it the “biggest disappointment” as growth

decelerated after an initial post-reopening pop.

Dow Inc The chemical maker said the anticipated rebound following

the end of pandemic curbs has yet to fully materialize.

NXP (NASDAQ:) The chipmaker said China’s export curbs on certain gallium

Semiconductors and germanium products did not impact the company.

3M Co The industrial conglomerate flagged continued weak appetite

for consumer electronics demand in China.

GE Healthcare The company saw improved demand for medical equipment in the

region in the recent quarter and that is expected to

continue as China prioritizes improved healthcare access

following the end of the pandemic.

ABB The engineering firm witnessed fewer new orders from China

in the quarter and said some customers were shifting

investments to other parts of Asia due to geopolitical

tensions.

LVMH The French luxury giant logged a strong rebound in China

during the second quarter.

EssilorLuxottica The luxury eyewear maker continued to benefit from a

recovery in China during the second quarter.

Seagate The computer hardware maker

Technology said that the fourth-quarter performance was

impacted due to the uneven pace of the Chinese economic

recovery.