Credit Suisse ups S&P 500 year-end forecast to 4,700

2023.07.18 13:54

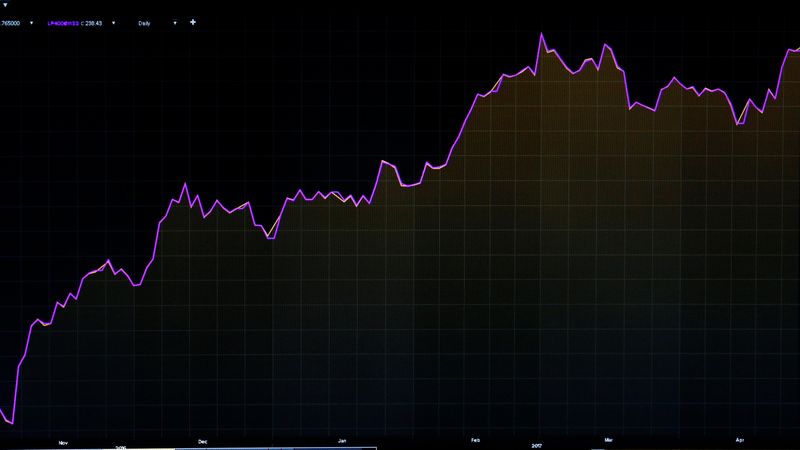

© Reuters. A screen that charts the S&P 500 is seen on the floor of the New York Stock Exchange (NYSE) in New York, U.S., April 27, 2017. REUTERS/Brendan McDermid

NEW YORK (Reuters) – Credit Suisse increased its year-end target on the to 4,700 from 4,050, citing a decline in the near-term U.S. recession risk and a stronger earnings outlook for the largest technology-related companies, according to a research note on Tuesday from Jonathan Golub, chief U.S. equity strategist & head of quantitative research at Credit Suisse Securities USA.

The S&P 500 is currently at 4,545 and up about 18% for the year so far.

The company also said it raised its 2023 earnings per share estimates to $220 from $215 and its 2024 EPS forecast to $237 from $220, noting additional 2024 growth tied in part to a rebound in technology-focused company earnings and to buybacks.

“Our base case is that a recession will be averted, inflation will remain sticky near current levels, and monetary policy will tighten incrementally,” Golub and other Credit Suisse strategists wrote.