GBP/USD pulls back from 15-month peak; bullish structure holds

2023.07.18 05:46

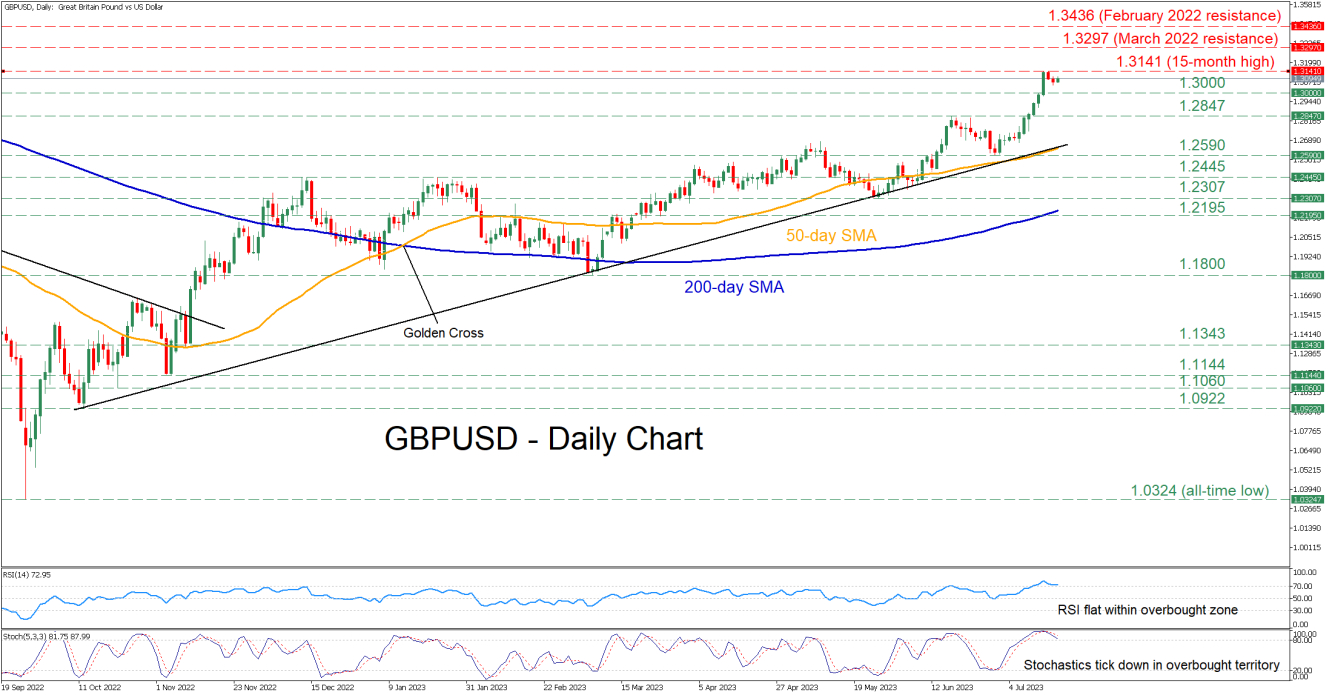

GBPUSD has been in a prolonged uptrend since October 2022 supported by its long-term ascending trendline. Last Friday, the pair stormed to a fresh 15-month high of 1.3141 before paring some gains, but it is still too early to call this a downside correction.

However, the momentum indicators are holding well within their overbought territories, hinting that the recent pullback could extend. Specifically, the stochastic oscillator is negatively charged within its 80-overbought territory, while the RSI remains directionless in overbought conditions.

If the bears manage to push the price lower, the crucial 1.3000 psychological mark could act as the first line of defense. Sliding beneath that floor, the pair may face the previous resistance zone of 1.2847. Should that barricade fail also, the congested region that includes the ascending trendline taken from October 2022 and the 50-day simple moving average (SMA) could cap the pair’s downside before the June support of 1.2590 gets tested.

On the flipside, if the long-term bullish structure extends, the 15-month peak of 1.3141 might be the first hurdle for buyers to clear. Jumping to a fresh higher high, the pair could ascend towards the March 2022 resistance of 1.3297. A violation of the latter may open the door for the February 2022 resistance of 1.3436.

Overall, GBPUSD appears to be ready to experience a healthy correction due to reaching overbought conditions. Nevertheless, it is likely that the pair extends its bullish long-term structure as long as it holds above the ascending trendline.