Will the Rally in AUD/USD Falter?

2023.06.15 06:07

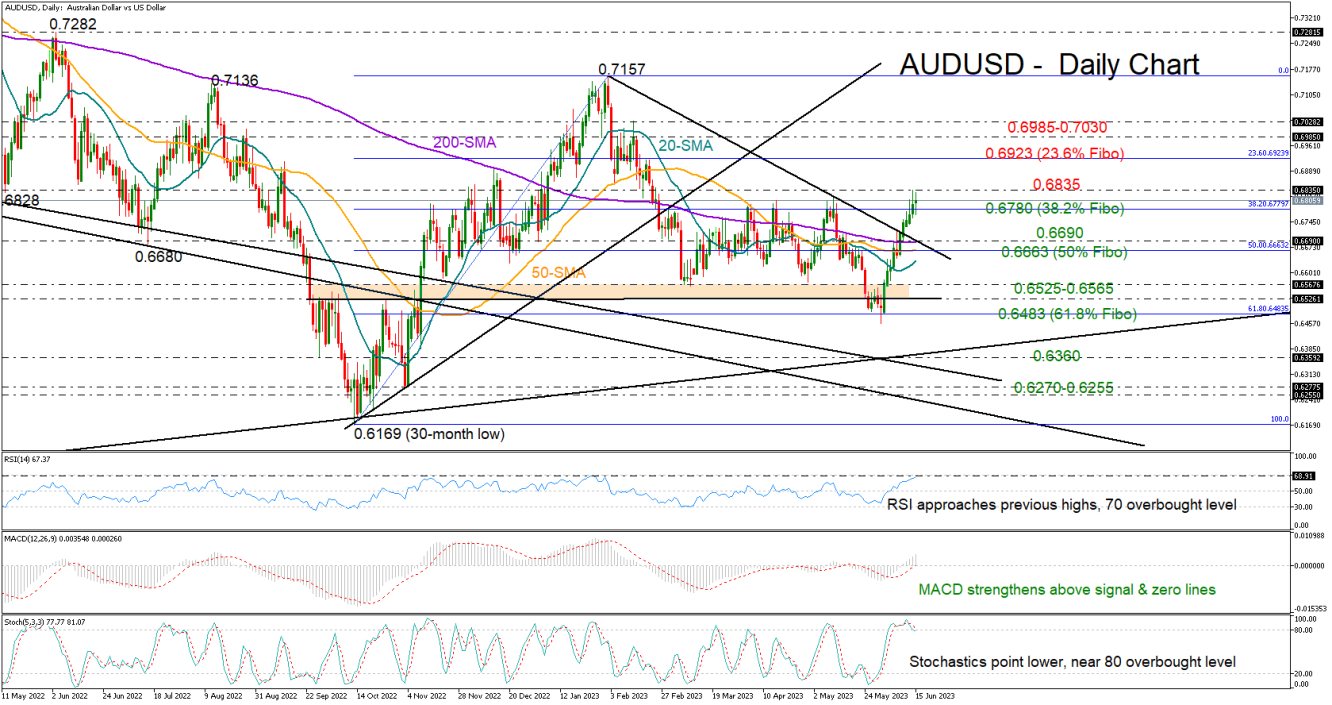

has been enjoying an almost three-week nonstop rally, gaining around 5.0% since the bounce on the 0.6500 level at the end of May.

On Wednesday, the pair reached its highest level since February and closed slightly above the 0.6780 ceiling, which has been capping bullish actions over spring. The impressive ascend could motivate some profit-taking as the RSI and the stochastic oscillator are hovering near overbought territory. Yet, the indicators have yet to show a clear downside reversal, suggesting some extra recovery before the next pivot takes place.

A clear step above yesterday’s high of 0.6835 could push the price up to the 23.6% Fibonacci retracement level of the previous uptrend at 0.6923. Additional increases from here could immediately lose pace somewhere between 0.6985 and 0.7030. If buying interest grows further, the door will open for the February and August highs at 0.7157 and 0.7136 respectively.

In the event the price pulls below 0.6800, the spotlight will fall on the broken 2023 resistance trendline and the 200-day simple moving average (SMA) at 0.6690. The 50% Fibonacci mark and the 50-day SMA are marginally lower, with the 20-day SMA approaching that territory as well. Should the bears breach those lines, selling forces could intensify towards the 0.6565-0.6525 floor. An extension below the 61.8% Fibonacci mark would put the pair back in a downtrend in the medium-term picture.

All in all, AUDUSD is expected to haunt extra gains in the short-term if it stays afloat above 0.6800-0.6780.