India’s RBI relaxing borrowing limit in interbank call market no ‘game changer’ – traders

2023.06.08 05:37

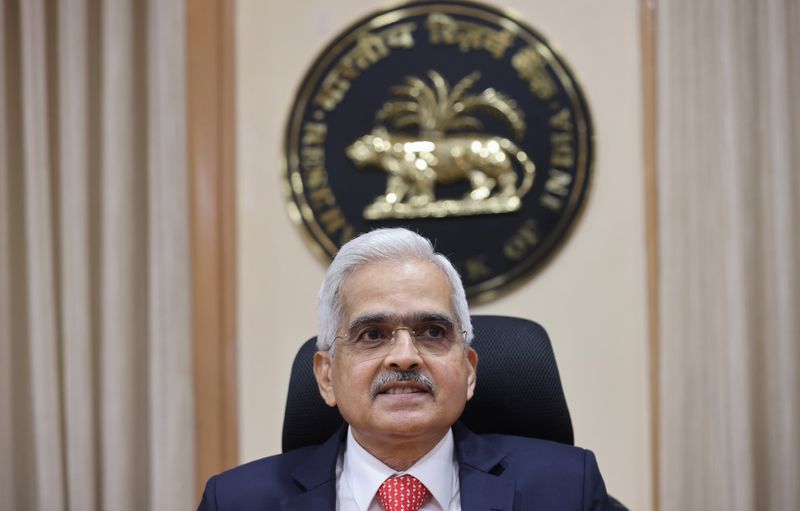

© Reuters. FILE PHOTO: The Reserve Bank of India (RBI) Governor Shaktikanta Das attends a news conference after a monetary policy review in Mumbai, India, April 8, 2022. REUTERS/Francis Mascarenhas

MUMBAI (Reuters) – The Reserve Bank of India on Thursday allowed banks to set their own limits to borrow from the interbank call money market in a bid to better manage liquidity, though at least four traders said it would not move the needle much as lenders might not be willing, or able to participate.

“With a view to providing greater flexibility” the RBI decided that banks can set their own limits for borrowing in call and notice money markets within the prudential limits for inter-bank liabilities prescribed, the central bank said earlier in the day as it announced its monetary policy.

Banks can currently borrow all of their capital funds on a daily average basis in a reporting fortnight, and 125% of capital funds on any given day.

“Smaller banks can borrow more via this window, but ultimately lenders should be willing, and they should have the interbank limits to provide more funds, so we do not think there may be any major change in liquidity operations after this move, and this may not be game changer,” a senior treasury official who did not want to be named because he is not authorised to speak to media, said.

Call rates had jumped above the RBI’s marginal standing facility rate in the first half of May amid skewed liquidity distribution, with the weighted average call rate remaining above 6.75%.

“The prevalence of surplus liquidity amidst higher recourse to the marginal standing facility (MSF) by some banks suggests skewed liquidity distribution within the banking system,” RBI governor Shaktikanta Das said.

He also said the central bank’s intention was to maintain the call rate around the repo rate, which is at 6.50%.

Weighted average interbank call money rate jumped to 6.59% on Thursday, up by over 25 basis points since last week, after central bank withdrew over 1.5 trillion rupees ($18.17 billion) via reverse repos.

($1 = 82.5525 Indian rupees)