USD/JPY: Uptrend Intact as Bulls Eye 138.00

2023.05.17 04:18

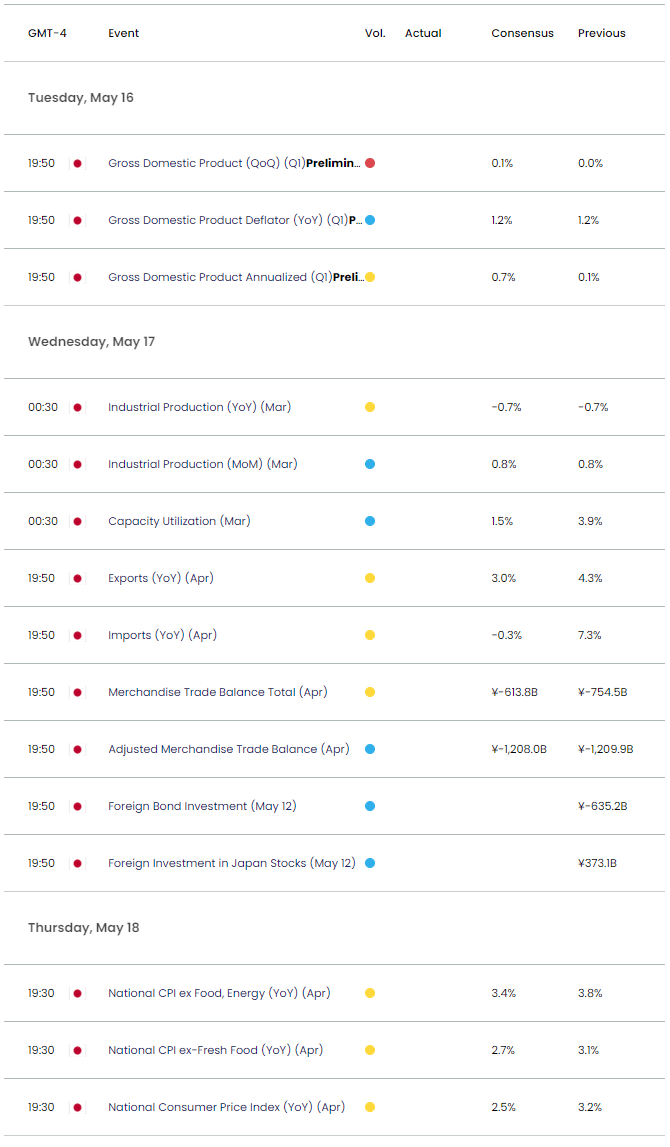

- Traders will get the latest updates on Q1 GDP, Industrial Production, Trade Balance, and National CPI data out of Japan over the next 48 hours.

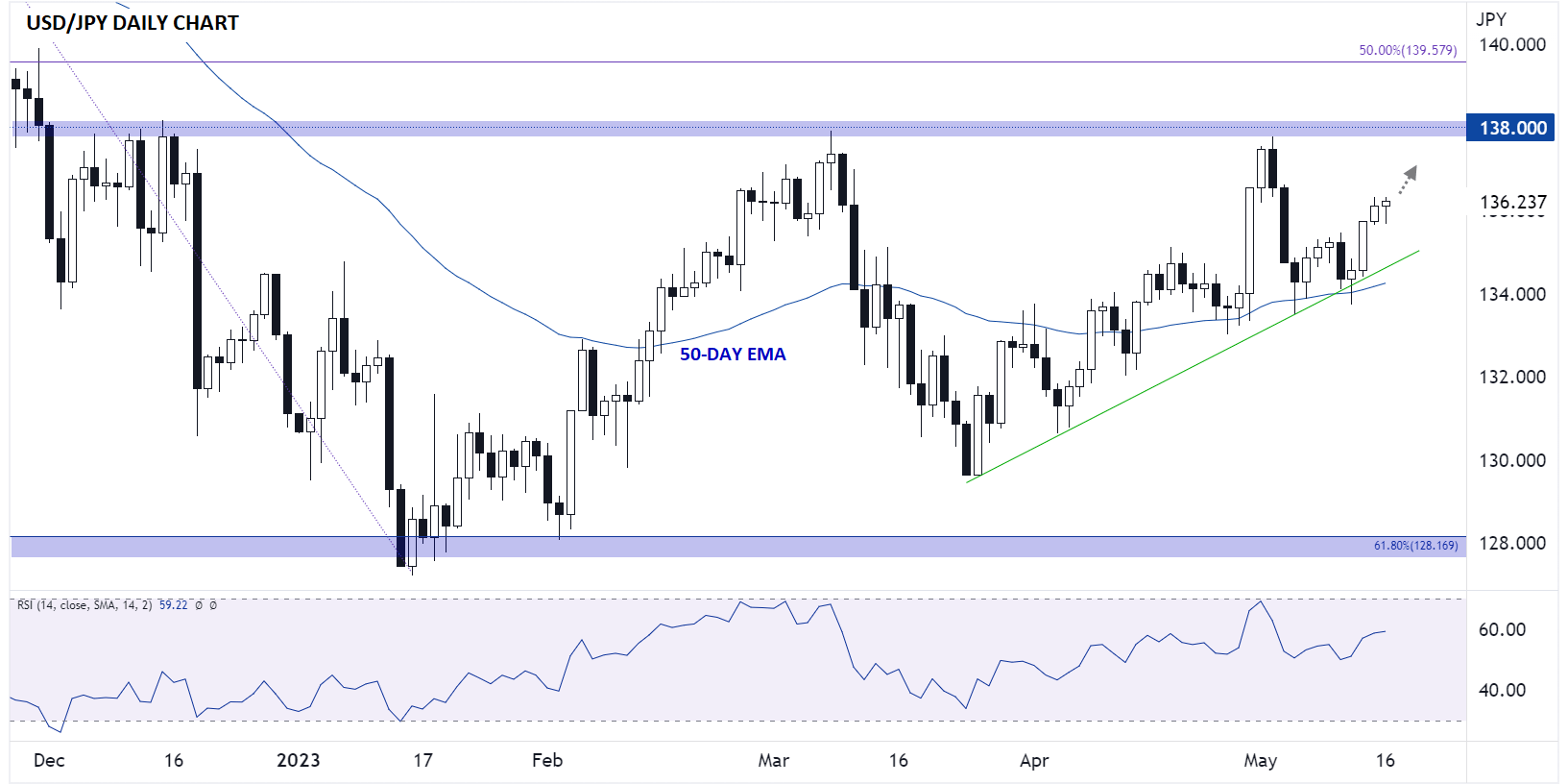

- USD/JPY found support at its rising trend line and 50-day EMA last week, keeping the near-term bullish bias intact.

- The next resistance level to watch will be the year-to-date high near 138.00.

Japanese yen fundamental analysis

Ahead of this weekend’s G7 summit in Hiroshima, it’s a big week for Japanese economic data. Over the next 48 hours, traders will be treated to the latest updates on Q1 , , , and data.

Outside of traditional economic data, it’s also notable that Prime Minister Kishida has called for the BOJ to examine the sustainability of recent wage increases, a possible precursor to an eventual hawkish shift in monetary and/or fiscal policy, though like everything in Japan, that may take longer than many traders would hope to bear fruit.

Source: StoneX

Japanese yen technical analysis – USD/JPY daily chart

Turning our attention to the daily chart of , rates remain in an uptrend after testing rising trend line support and the 50-day EMA midway through last week. Today’s rally is particularly impressive given this morning’s lackluster US data, with retail sales rising by just 0.4% month-over-month, half of the projected 0.8% gain:

Source: Tradingview, StoneX

Moving forward, USD/JPY has little in the way of nearby resistance, and bulls may therefore look to drive the pair back toward its year-to-date high near 138.00, especially if Japanese economic data comes in worse than expected. At this point, only a bearish reversal back down below the confluence of the rising trend line and 50-day EMA near 134.50 would erase the current bullish bias and open the door for additional losses.

Original Post