Biden should sanction Huawei Cloud, other Chinese firms -senators

2023.04.25 14:22

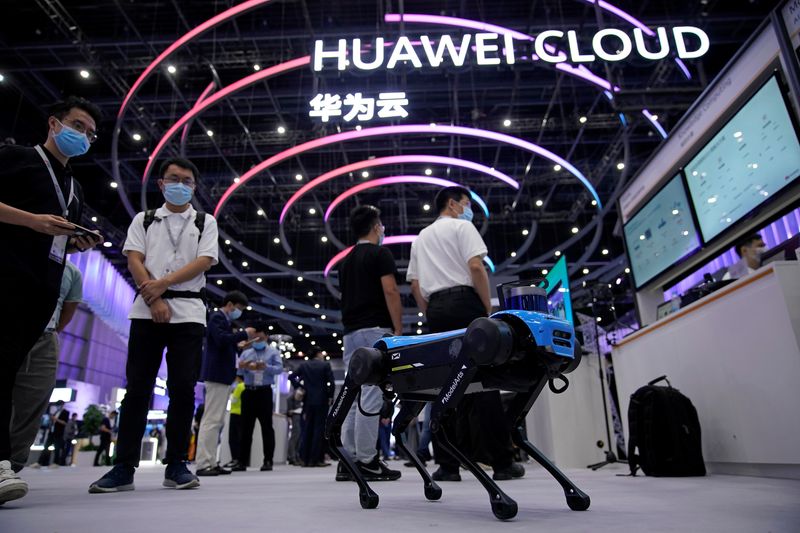

© Reuters. FILE PHOTO: A robotic dog powered by Huawei Cloud is seen at a booth during Huawei Connect in Shanghai, China, September 23, 2020. REUTERS/Aly Song

By David Shepardson

WASHINGTON (Reuters) – A group of nine Republican senators on Tuesday urged the Biden administration to impose sanctions on Huawei Cloud and other Chinese cloud service providers, citing national security concerns, according to a letter seen by Reuters.

The previously unreported letter led by Senator Bill Hagerty to the Commerce, State and Treasury departments said Chinese cloud computing companies “are increasingly engaging with foreign entities – in some cases sanctioned foreign entities – that are directly challenging the national security and economic security interests of the United States and our allies and partners.”

Huawei Technologies and the agencies did not immediately respond to a request for comment.

The senators said Huawei Cloud launched its “Sky Computing Constellation” in co-sponsorship with Changsha Tianyi Space Science and Technology Research Institute also known as “Spacety China” in 2021. They noted Spacety was “recently sanctioned by the Treasury Department for providing significant satellite imagery assistance to entities in the Russian Federation.”

In May 2019, the Commerce Department added Huawei to a trade blacklist over U.S. security concerns. The company denies that it poses a security risk.

“We urge you to use all available tools to engage in decisive action against these firms, through sanctions, export restrictions, and investment bans, and to further investigate PRC cloud computing service companies,” said the letter which was also signed by senators Thom Tillis, Marco Rubio, Steve Daines, Ted Cruz, Joni Ernst, Katie Britt, Kevin Cramer and Dan Sullivan.

The letter also asked the Biden administration officials to add Alibaba (NYSE:) Cloud to the Commerce Department’s export control list, arguing its close ties to the Chinese military “renders it a clear ongoing national security threat” and that Treasury should add Alibaba Cloud to a list of companies involved in the Chinese military-industrial complex.

Alibaba Cloud, a subsidiary of Alibaba Group Holding Ltd, did not immediately comment. The letter said Alibaba opened two cloud data centers in Santa Clara, California, in 2015.

Reuters reported in January 2022 that the Biden administration was reviewing the cloud business of e-commerce giant Alibaba to determine whether it poses a risk to U.S. national security. The review focuses on how the company stores U.S. clients’ data, including personal information and intellectual property, and whether the Chinese government could gain access to it.

The letter said the Biden administration should consider further investigation or actions against China’s other cloud service providers including Baidu (NASDAQ:) Cloud and Tencent Cloud which may impact U.S. national security.

The Trump administration issued a warning in August 2020 against Chinese cloud providers including Alibaba, “to prevent U.S. citizens’ most sensitive personal information and our businesses’ most valuable intellectual property … from being stored and processed on cloud-based systems accessible to our foreign adversaries.”