Lions Gate Stock Can Triple

2022.11.30 17:18

[ad_1]

Legacy media and entertainment companies have been struggling lately. Comcast (NASDAQ:), Disney (NYSE:), and Warner Bros Discovery (NASDAQ:) have been badly underperforming the averages this year. Even Netflix (NASDAQ:) is down by 60% from its all-time record. Another movie-making business whose valuation hasn’t been spared is Lions Gate Entertainment (NYSE:).

Fundamentally speaking, there are much better deals than Lions Gate out there. Revenues have actually dropped by 12.8% since 2018. The company managed to remain free cash flow positive for three more years, but even that stopped being the case in fiscal 2022. Investors willing to give the Elliott Wave setup below a chance must keep this gloomy business picture in mind.

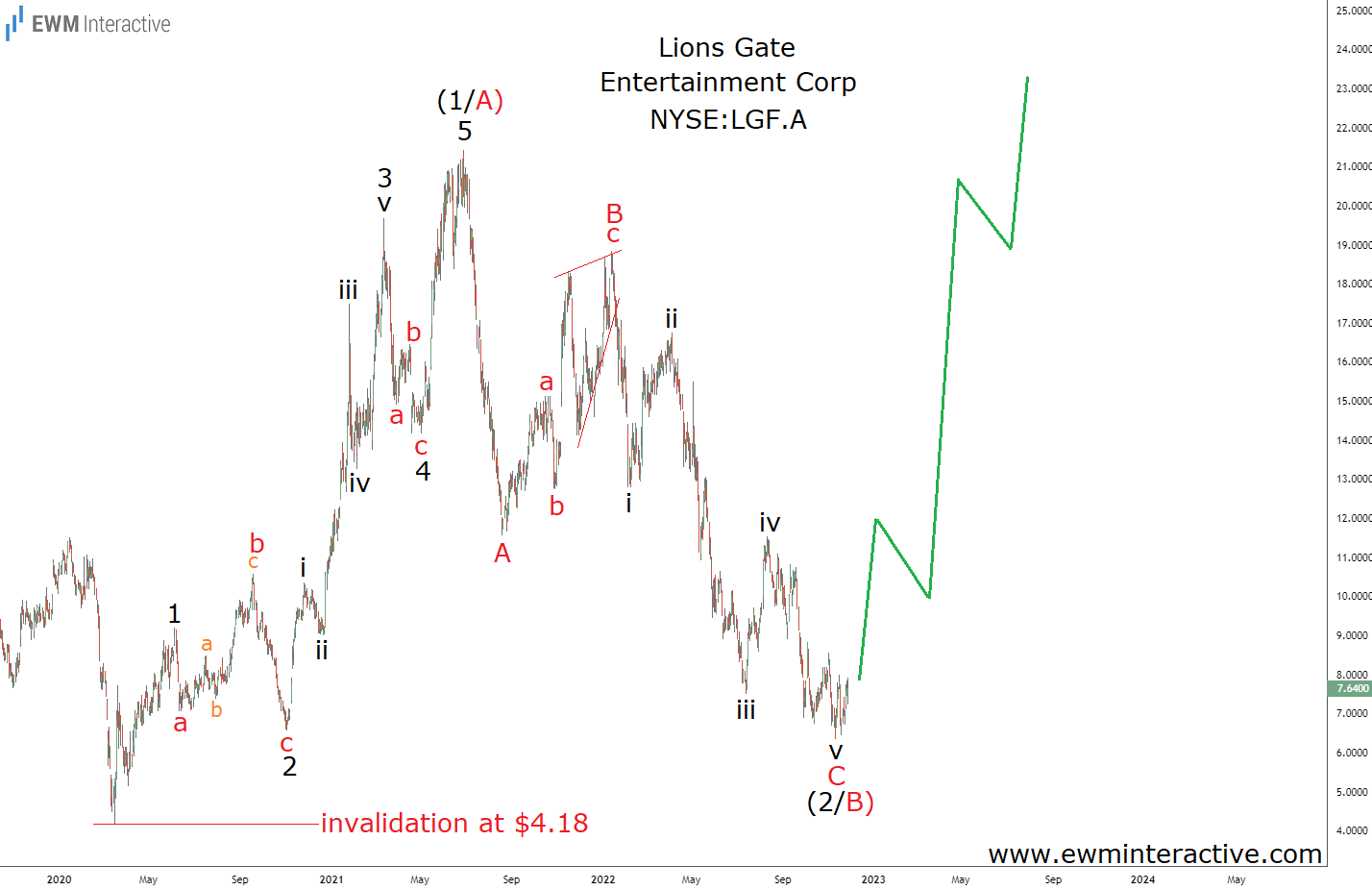

The setup, however, is very clear. It consists of a five-wave impulse to the upside, labeled 1-2-3-4-5, and a simple A-B-C zigzag correction. Wave 2 is an expanding flat correction, while wave 4 is an a-b-c zigzag. Wave 3 is the extended one and its sub-waves are marked i-ii-iii-iv-v. Within the corrective phase of the cycle we can recognize a simple a-b-c zigzag in wave B, where wave ‘c’ is an ending diagonal. Also, wave C is another very clear impulse pattern, labeled i-ii-iii-iv-v.

If this count is correct, the 5-3 wave cycle is complete. According to the theory, we can now expect the price to head in the direction of the five-wave sequence. Wave (3/C) should be able to exceed the top of wave (1/A). This puts targets above $22 a share within the bulls’ reach. Given how close the invalidation level at $4.18 is, the risk/reward ratio of this setup is almost irresistible.

Original Post

[ad_2]

Source link