Approximately Right About Solana‘s Crash

2022.11.10 09:56

[ad_1]

Rather Than Being Precisely Wrong

Warren Buffett, arguably the best investor to have ever lived, once said that in order to achieve long-term success, investors should focus on being “approximately right rather than precisely wrong.” He mostly invests in stocks and buys entire businesses, but his maxim rings true regardless of the specific investment asset. In other words, it is far better to buy things with promising long-term potential, instead of pursuing short-term gains from a questionable asset. That is why we decided not to join the bulls back in August, 2021.

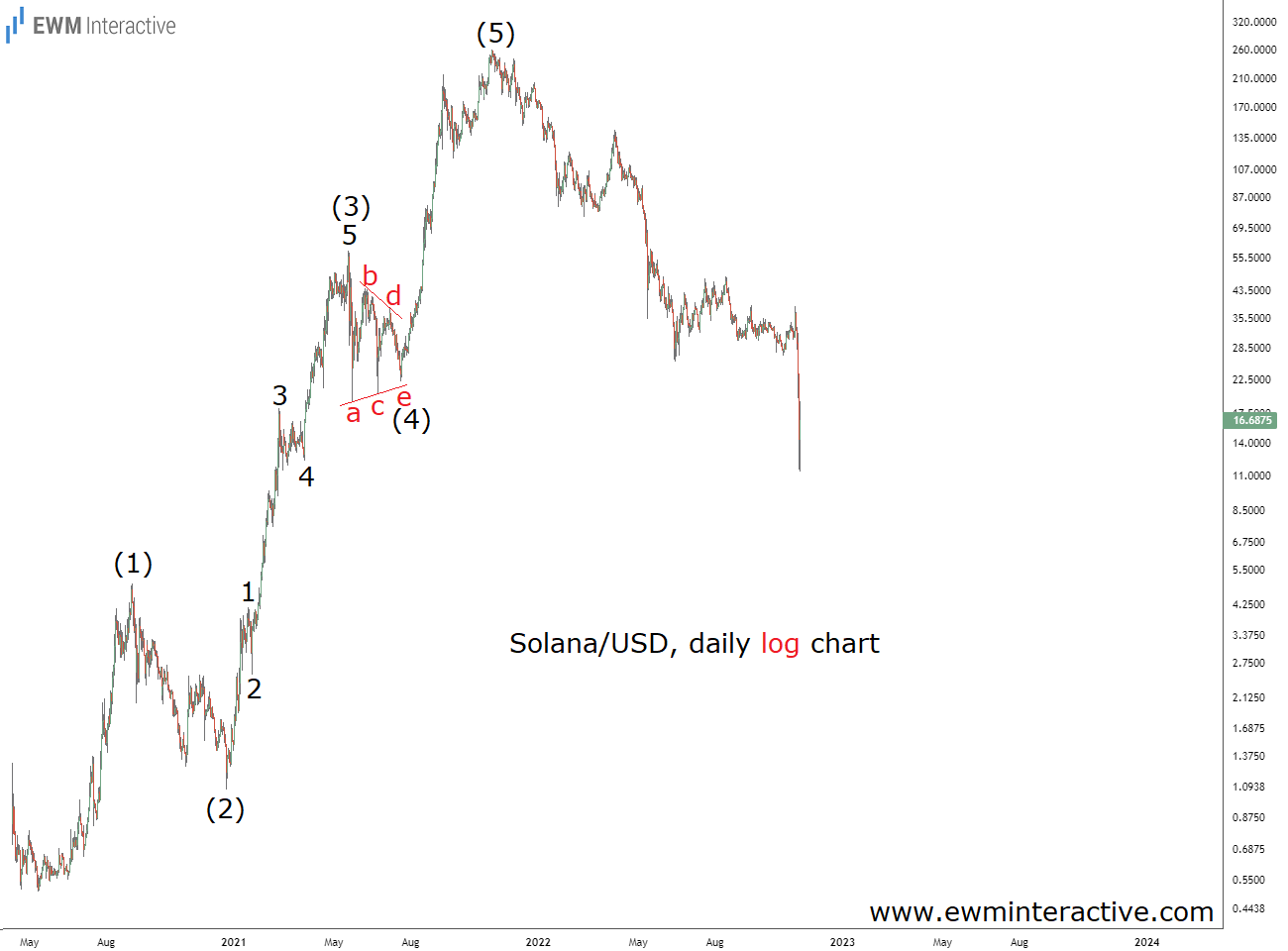

Solana/USD Daily Log Chart

Solana/USD Daily Log Chart

We published the chart above over a year ago, in the summer of 2021. Solana was hovering near $73 after a relentless rally from under a dollar in May, 2020. Crypto was all the rage back then and a high tide lifts all boats. The problem was that the logarithmic chart revealed an almost complete five-wave impulse. We labeled it (1)-(2)-(3)-(4)-(5), where the five sub-waves of wave (3) were also visible and wave (4) was a clear triangle correction.

According to the Elliott Wave theory, a correction follows every impulse. Usually, it erases all the gains achieved by the fifth wave. So, we thought that a major bearish reversal can be expected as soon as wave (5) is over. We anticipated a top somewhere near the $100 mark to be followed by a crash to under $20.

Solana and the Case for Recognizing and Avoiding Bubbles Altogether

Turns out we were only approximately right about the first part, since Solana’s bubble kept inflating until it reached $260 in November, 2021. On the other hand, most crypto investors thought Solana was going “to the moon”. For them, no price was too high. Unfortunately, to quote Buffett again, “it’s only when the tide goes out that you discover who’s been swimming naked.” In the end, Solana investors were precisely wrong.

Solana/USD Daily Log Chart

Solana/USD Daily Log Chart

Solana currently trades under $17, which means everyone who bought after March, 2021, and still holds is now under water. That’s the trouble with bubbles. They feel great and unstoppable while they last, but eventually almost everyone losses all their money when they burst. And no-one knows how far a bubble can go, nor when it is going to burst. Therefore we think it is much better to learn how to recognize a bubble and then resist the temptation and simply avoid it. Something everyone now wished they did with Solana.

Original Post

[ad_2]

Source link