Black Candlesticks Are Bearish, But Buyers Are Building An Advantage

2022.10.20 02:49

[ad_1]

Yesterday was a day when markets closed below their open, but above the close; this set-up is typically bearish and shows as a black candlestick in a chart. The problem is that buyers have been building a nice edge since the big bullish engulfing patterns from last week. The expectation for today is a day of selling – so if this doesn’t happen then bulls can look to the rest of the week with optimism.

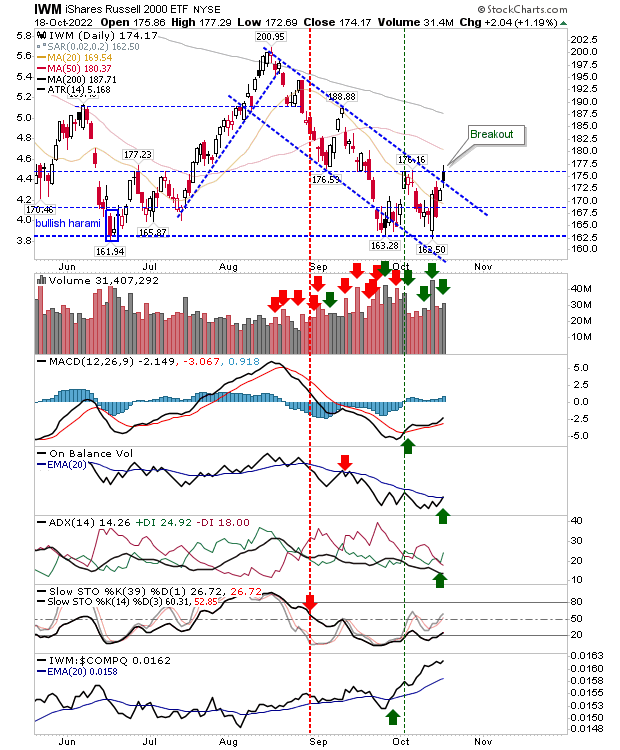

The is the index to watch. In addition to yesterday’s gain it also managed a break from the declining channel on higher volume accumulation. Technicals have shifted more in favor of bulls with ‘buy’ signals in the MACD, On-Balance-Volume and the ADX with sharp gains in relative performance to peer indices.

IWM Daily Chart

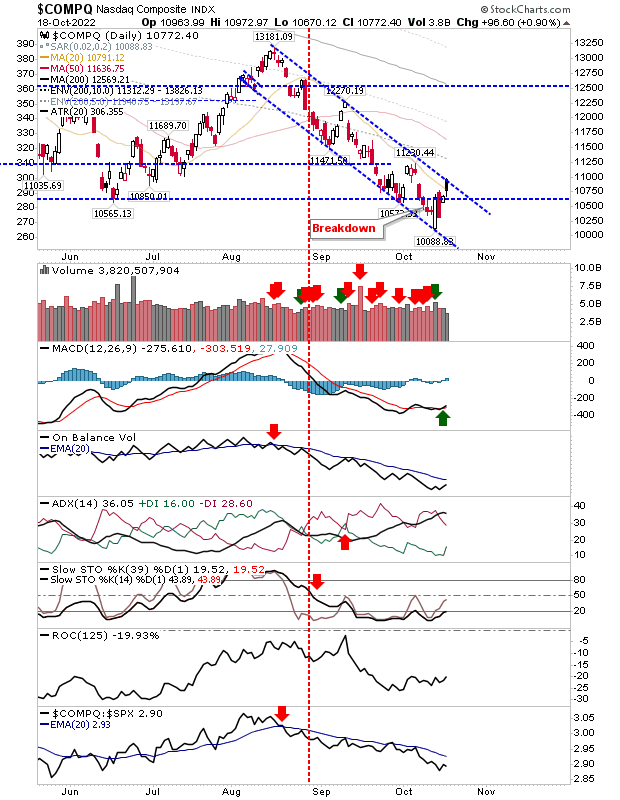

The was contained by channel resistance but it did manage a close above the 20-day MA. There was no confirmed accumulation as in the Russell 2000, but there was at least a close above June swing low support.

COMPQ Daily Chart

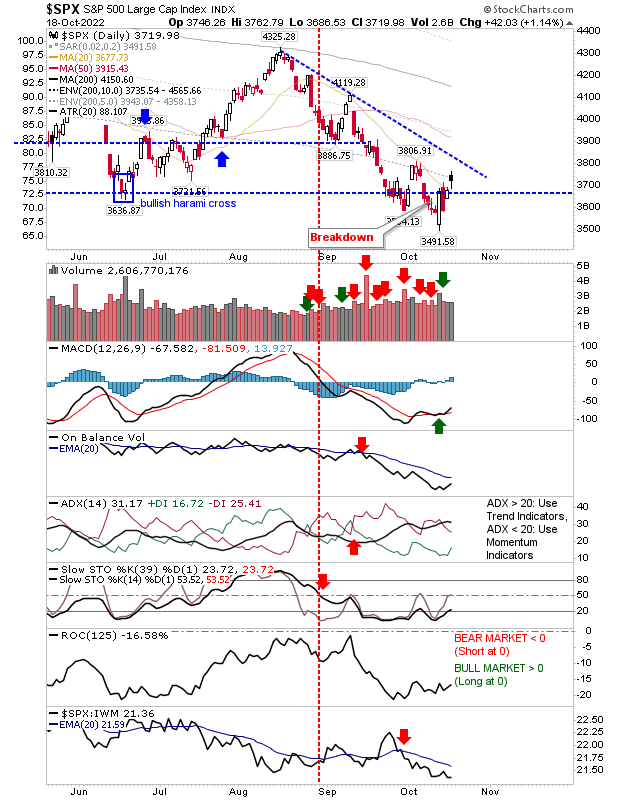

The managed to recover June swing lows and a return above its 20-day MA, but it hasn’t managed to make it too declining resistance. Technicals haven’t changed from yesterday with only the MACD on a ‘buy’ trigger.

SPX Daily Chart

Today is an important day. Set ups like yesterday at the end of a rally – even a small rally – point to potential weakness, but if markets can defy this weakness despite the larger trend lower, then it could be the start of a much larger rallies towards 200-day MAs, and likely more.

[ad_2]

Source link