No Bounce, Markets Set For More Losses

2022.09.28 20:51

[ad_1]

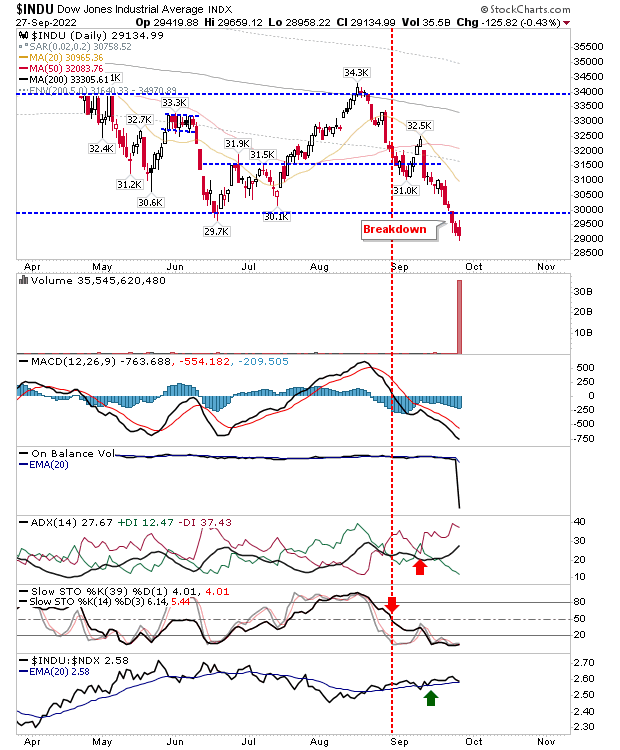

After Friday’s close I would have expected some form of bounce – either yesterday or Monday – but this didn’t happen. On the (somewhat) plus side, there was no undercut of support of June lows for our monitored indices, although the did undercut such support last Friday and it didn’t get much better day with another standard bearish candlestick yesterday.

DJIA Daily Chart

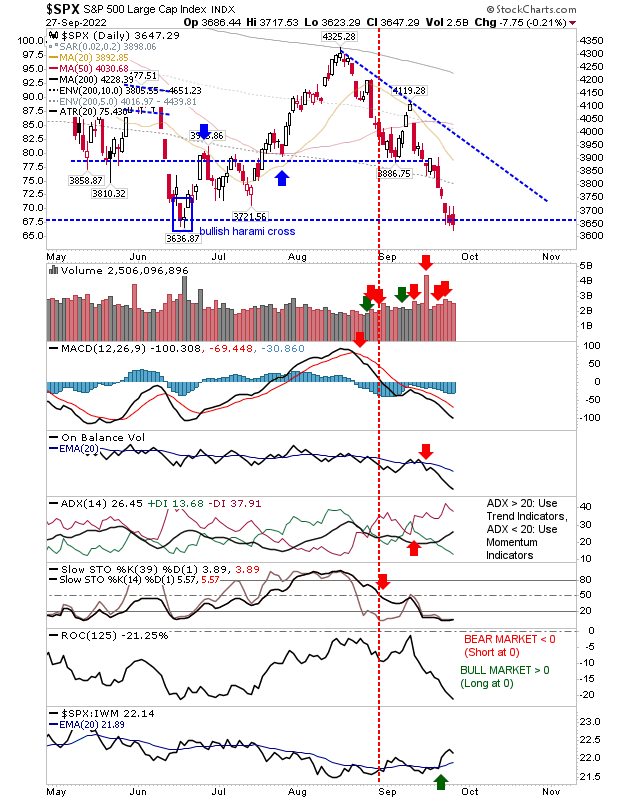

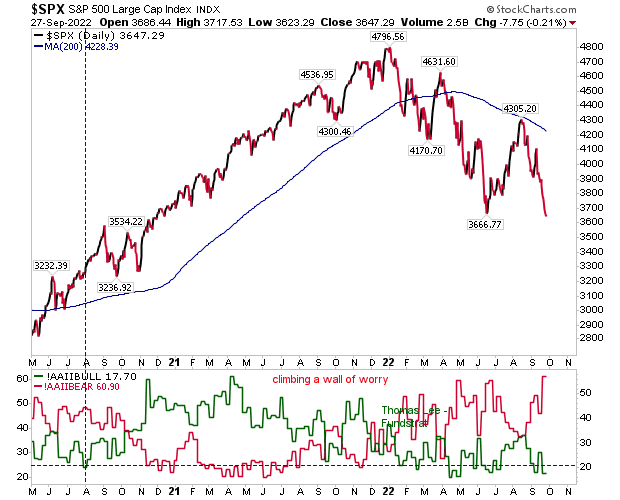

The is next on the loser list and it’s only hanging on to June support. Given action in the Dow Jones Industrial Average and bearish technicals it’s hardly looking likely that we will get a bounce here, but bulls can live in hope.

SPX Daily Chart

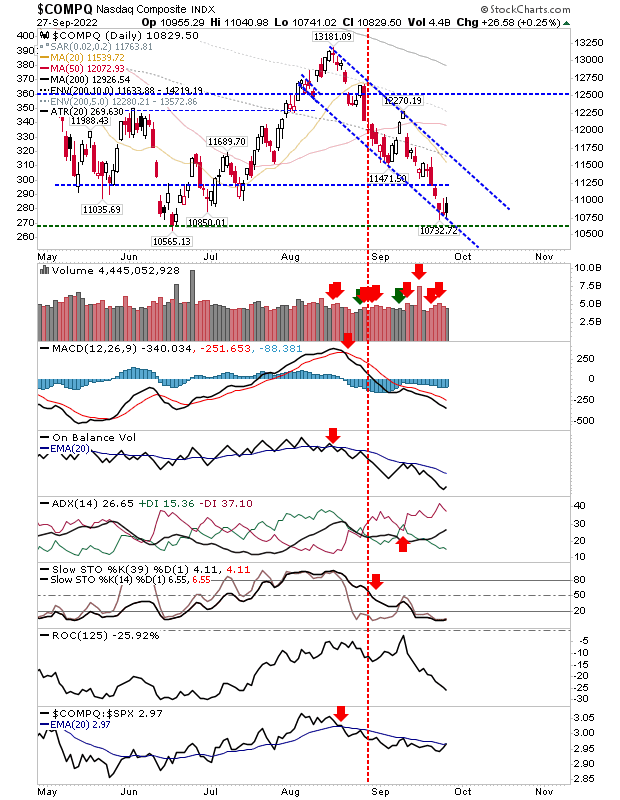

The continues to make inroads in relative performance against its peers, but overall technicals remain problematic (and bearish). It still has room-to-runt to support but little else is positive.

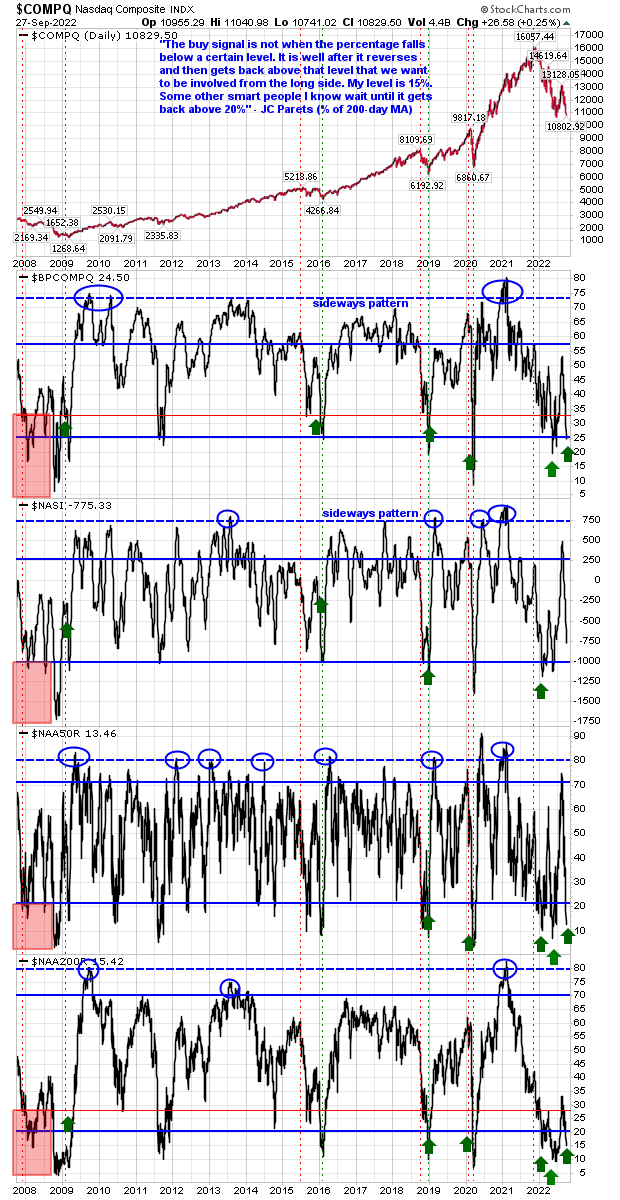

COMPQ Daily Chart

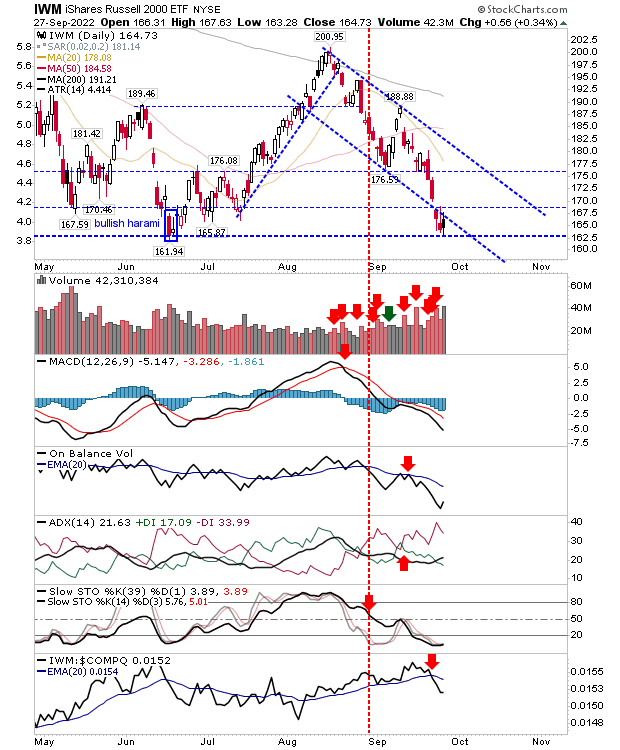

The accelerated its losses, falling outside of its downward channel as it maps its retest of the June low. It posted significantly higher volume for a day which would measure as accumulation, but it’s thin pickings for bulls. Relative performance to its peers took another big knock.

IWM Daily Chart

For today, bulls really need to see something soon. Monday’s candlesticks offered an aggressive long trade which could be managed with a relatively tight stop, but there was no follow through for any of the aforementioned indices. The risk now is that markets will limp below June lows as the Dow Industrials Average has done, then take another acceleration lower. All of this is good news for investors looking to add to their positions as we hit another extreme in investor bearish sentiment and breadth lows.

SPX Daily Chart

COMPQ Daily Chart

[ad_2]

Source link