S&P 500 Still On Track For 3300s, But Bears Should Take Note

2022.09.22 17:57

[ad_1]

Last week, I using the Elliott Wave Principle (EWP):

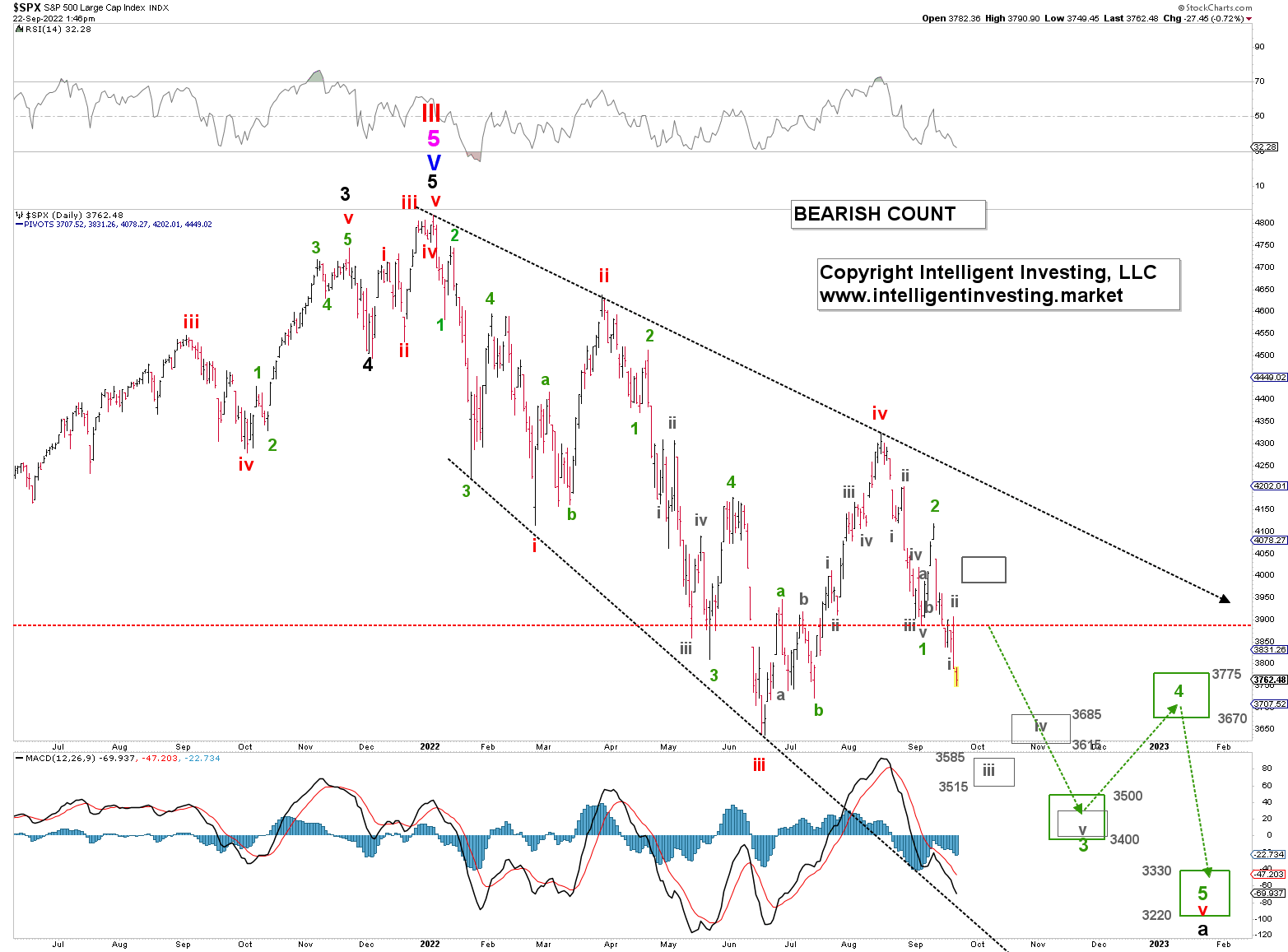

“A break below the early September low of SPX 3886 opens the door for [an] impulse pattern with an ideal target zone of SPX 3515-3400 for (red) W-iii/c, then a potential W-iv rally back to ideally SPX 3675-3785 followed by the last drop to ideally SPX 3230-3330 to complete W-v of W-c of W-A.”

Thus, the door was opened. The bears are still in control until proven otherwise. But what can that “otherwise” be?

Figure 1. S&P 500 daily chart with detailed EWP count and several technical indicators:

Although the preferred view remains that of an impulse lower, with the ideal third-, fourth- and fifth-wave target zones shown in Figure 1 above, the bears do not want to see the index move back above SPX 3900 (horizontal dashed red line) as that would start to suggest only three waves lower. See Figure 2 below.

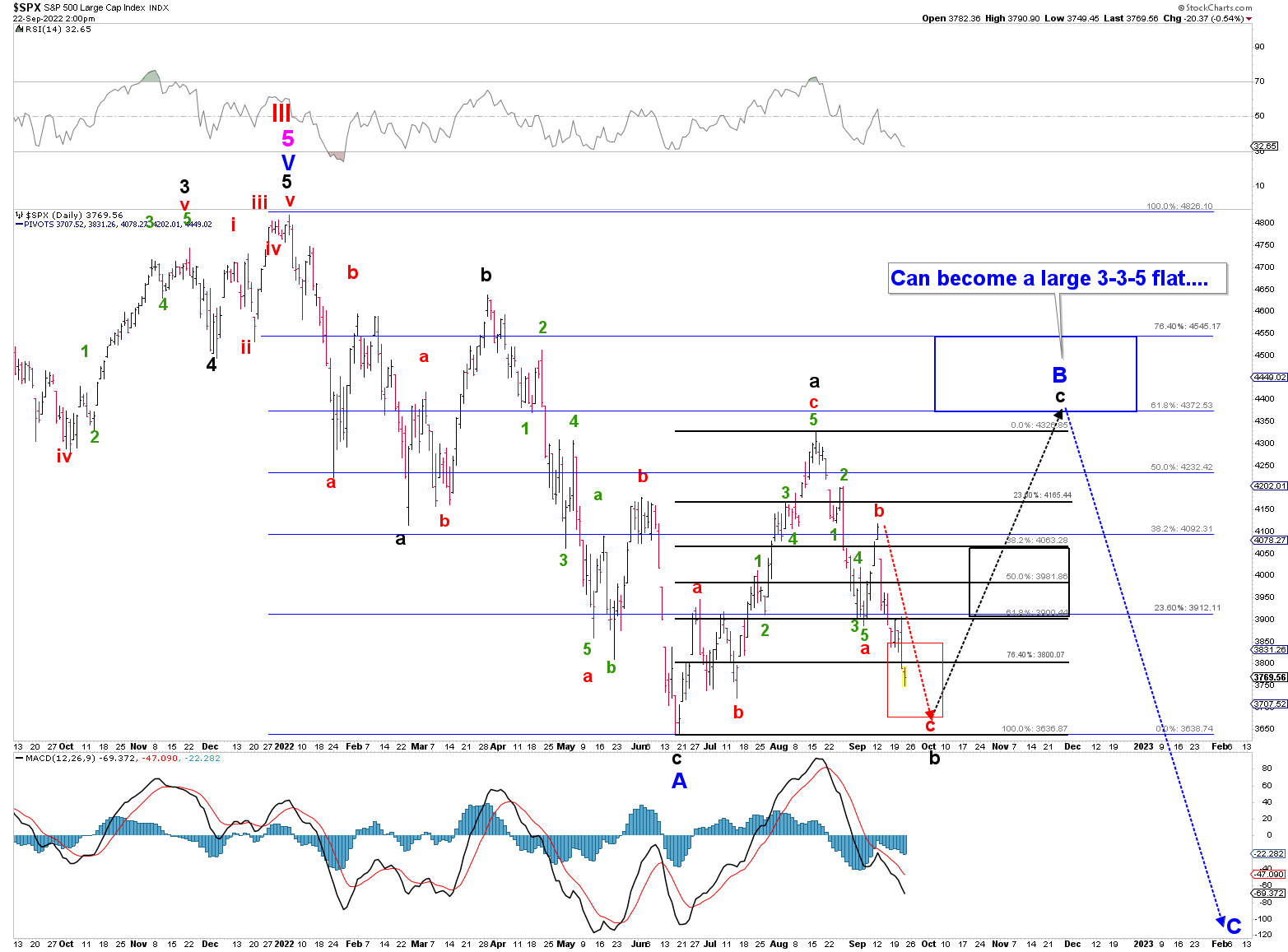

Figure 2. S&P 500 daily chart with detailed EWP count and several technical indicators:

In that case, the index is most likely working on a large 3-3-5 corrective pattern, black W-a, -b and-c, called a flat (Blue W-B). What would argue for a counter-trend rally?

- Investor sentiment is bearish, see here, which is often a contrarian signal.

- The index is relatively oversold, see here, leaving less room for the downside.

- Average seasonality for a mid-term election year, see here, has a low in late September and then could rally into the end of the year.

Ultimately, the bulls will have to push the index back above the red W-b high made in mid-September to confirm this path, but it pays to be aware of it.

Even this more complex pattern can still allow for SPX 3680+/-20, where W-c = w-a (red dotted arrow) before the black dotted arrow kicks in. Thus, short-term pressure remains to the downside regardless of an impulse lower to ~SPX 3300 (Figure 1) or if we’re dealing with this larger flat. However, the market can have a few tricks up its sleeve. I am simply conveying these options. Don’t kill the messenger. Being forewarned is forearmed.

[ad_2]

Source link