9 Charts Showing Stocks Poised for Deeper Pullback as Key Indexes Break Trendlines

2024.10.23 05:41

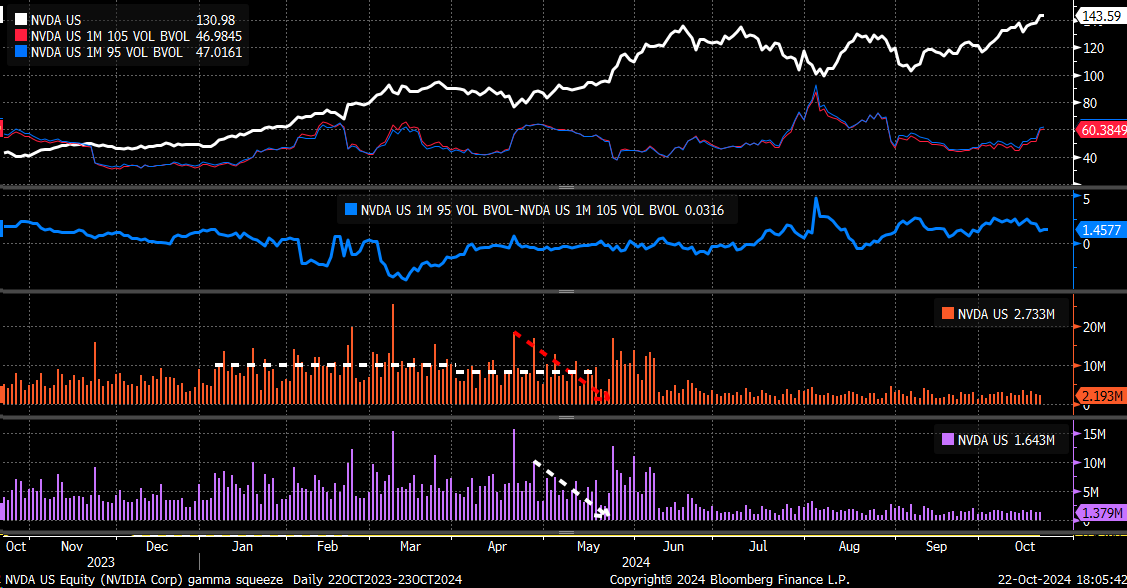

Stocks ended the day mostly lower, and perhaps more notably, Nvidia (NASDAQ:) finished flat.

For once, it had little to no influence on the broader market, a positive development. Even better, call volume was significantly lower, with just 1.7 million contracts traded. We’ll see how this plays out moving forward.

Historically, Nvidia’s stock price struggles when 1-month implied volatility (IV) exceeds 60%. So, keep an eye on the 1-month IV—if it continues rising, it could signal a short-term top forming in the stock price.

Without support from the chipmaker, key stock indexes could experience a deeper correction. Here are 9 charts supporting this thesis:

1. S&P 500 Continues to Form Rising Wedges

Anyway, the continues to form a rising wedge pattern. The futures look clearer to me, as I can simply wait to see when, or if, the pattern breaks.

2. at Key Juncture

The are right at the crucial point, having hovered along the lower trend line over the past couple of days.

It’s at a tipping point now—either it breaks or it doesn’t. The setup’s appearance suggests it’s ready and positioned for a break lower.

3. Equal Weight Stocks Correct

The (RSP) already broke the pattern yesterday.

4. Dow Jones Breaks Rising Wedge

The also appear to have broken the rising wedge pattern.

5. Housing Index Vulnerable

The (HGX) has broken the trendline, which was part of the bump-and-run pattern.

6. Nikkei, Dollar Break Lower

The also had a rising wedge, and it has broken lower.

7. DAX Snaps Uptrend

Even the is close to breaking its uptrend.

8. GE Stock Drops Hard

GE Aerospace (NYSE:) was hit hard, dropping 9% after reporting results. It broke its bump-and-run pattern and found temporary support around $177.

The results didn’t live up to expectations, with revenue missing estimates. Given that the stock has more than doubled over the past year, it’s no surprise expectations were high.

9. Gold Looking Overextended

The last time traded with an RSI above 80 and above its upper Bollinger Band on the monthly chart, it peaked and then returned to its lower Bollinger Band two years later. Gold is starting to look very overextended here.

Once again, the market appears primed for a drop, with multiple indexes already breaking down.

Nvidia’s options activity seems to be running out of steam, so maybe, at last, we can see a break from this stagnation—which has been absolutely exhausting to endure.

Original Post