7 Rules For Banking Dividends (And Significant Gains) In Closed-End Funds

2022.09.27 19:19

[ad_1]

Don’t be drawn in by this spiking 2-year Treasury yield. Even at just north of 4%, we’re still not retiring off of it!

Think about it for a second: for a ho-hum 4.2%, you’re locking up your cash for two years. Sure, you’ll get your principal back, but you’re still way behind inflation. And it’s almost certain that stocks will be higher two years out, so you’ll miss out on that gain, too.

I say that because the average bear market lasts about 10 months. This is month nine. We don’t get a free pizza if it ends at the 10-month mark. But even if we get a 2008-style 18-month grind, the recession will still be well in the rear view by the time your 2-year Treasury note matures!

CEFs Double Treasury Yields and Set Us Up for Strong Gains

That’s why we’re going to skip Treasuries and go with closed-end funds (CEFs), which regularly pay 8% or better, instead. That’s the difference between a paltry income of $40,000 on a million-buck nest egg or a terrific $80,000 annually.

And if you’re smart about your CEF purchases, you can even buy these funds at discounts—especially after the drop we’ve seen this year—and snare some nice price upside to boot!

With the markets in flux (to say the least), now is a good time to review the principles of successful CEF investing. They are more nuanced than classic stock picking because we’re analyzing managers, strategies and holdings versus simple business models.

It’s easier, for example, to count on dividends via the number of cellular subscriptions Verizon Communications (NYSE:) has than it is to determine how much interest income theDoubleLine Income Solutions Fund (NYSE:) generates.

1. Be Careful With Price-Only Charts

The PIMCO Dynamic Income Fund (NYSE:) has been a strong performer since its 2012 inception. Its sister fund, the Perpetual Credit Income Trust (ASX:), which was recently absorbed into PDI, was equally great to my Contrarian Income Report subscribers.

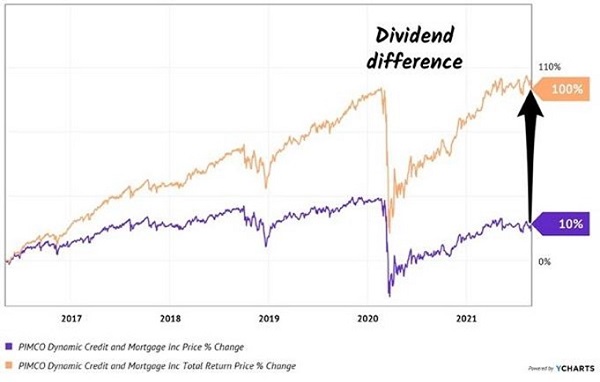

Traditional analysts missed the beauty of PCI because they missed the payouts. And with CEFs, the dividends always make the difference.

PCI: A Dividend Double

PCI-Total-Returns

A non-payout chart of PCI—purple line—would miss this dividend double—orange line. Be careful about price-only charts when evaluating CEFs. Brokerage statements typically report price-only returns, too.

2. Collect Your Cash Quickly

In less than six years, we collected 70% of our original purchase price in dividends from PCI. Plus, the fund gained value while it was paying us! It was like an annuity, but better. It paid more and our capital kept growing. (We earned 100% total returns from this purchase in our CIR portfolio!)

CEF-Paying-Us-Back

3. Demand Alpha

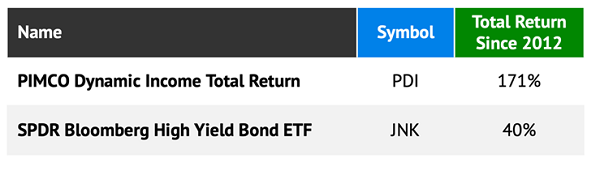

Past performance can be an indicator about the quality of the management team and its strategy. PCI and PDI have had the benefit of the brightest bond minds on the planet calling the shots, from retired “Bond King” Bill Gross to current superstar Dan Ivascyn.

They have consistently beaten the bond benchmark SPDR Bloomberg Barclays High-Yield Bond ETF (NYSE:). Since inception, PDI has pummeled JNK, delivering total returns of 171% versus 40%!

CEF-Outperforms-ETF

4. A closed-end fund can pay you from some combination of:

- Investment income,

- Capital gains, and/or

- Return of capital.

Of the three, investment income is preferable because it’s usually the most reliable. Many CEFs pay monthly distributions, so it’s best if they match up their payouts with steady income streams.

Capital gains from rising bond or stock prices can further boost distributions. But they are at risk of disappearing if the markets drop.

Finally, everyone assumes that return of capital is bad because it’s simply shipping your money back to you. But if the fund trades at a significant discount, this can actually be a savvy way to kick-start the closing of a discount window. More on this shortly.

5. Don’t Be Cheap About Fees

Most investors are conditioned to a fault by their experience with mutual funds and ETFs to search out the lowest fees. This makes sense for investment vehicles that are roughly going to perform in line with the broader market. Lowering your costs minimizes drag.

Usually, but not always. Closed-end funds are a different investment animal. On the whole, there are more dogs than gems. It’s a necessity to find a great manager with a solid track record. Great managers tend to be expensive, of course—but they’re well worth it.

The stated yields you see quoted, by the way, are always net of fees. Your account will never be debited for the fees from any fund you own. They are simply paid by the fund from its NAV. You receive the yield you see—a rare and happy case of truth in packaging!

6. Demand a Discount

One aspect of the CEF structure lends itself perfectly to contrary-minded investing: a fixed pool of shares.

Mutual funds issue more shares whenever they want, fixed each day at NAV. But closed ends have a fixed share count, with their funds trading like stocks. As a result, from time to time a fund will fall out of favor and find its shares trading at a discount to its NAV.

This is basically “free money” because these underlying assets are constantly marked to market (unlike mutual funds). If a fund trades at a 10% discount, management could theoretically liquidate the fund and pay everyone $1.10 on the dollar. Or it can buy back its own shares to close the discount window (and boost the share price).

A discount is a great start, but do make sure that management has a plan to close that window! Sometimes, the discount exists for a reason, so we dig deeper.

7. When Possible, Buy Along Insiders

It’s rare to see any fixed-income manager put his or her own money on the line at all, unfortunately. Barron’s research showed that, out of 558 closed-end funds at the time of its study, nearly half (269) had no insider ownership whatsoever. And only 70 had insider ownership above $500,000.

I’ve seen no evidence that insider ownership is any higher today, which raises the question: why would we want to own any of them, if the managers have no skin in the game?

What we want is a Bradford Stone, one of the managers at the Flaherty and Crumrine Dynamic Preferred and Income Closed Fund (NYSE:),whose 26,667 shares of DFP are worth around $549,340 today.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link