6 Undervalued Gems That Stand to Benefit as Fed Kicks Off New Easing Cycle

2024.09.18 11:39

- Rate cuts are on the horizon—discover which sectors are poised to benefit.

- Defensive stocks could thrive as lower interest rates boost profitability.

- Explore top picks for a lower-rate environment using InvestingPro’s stock screener.

- Not yet a subscriber? Unlock access to InvestingPro now for under $9 a month!

The ‘s first rate cut of the coming policy easing cycle is imminent. However, the big question persists: will it be 25 or 50 bps?

With easing and the labor market slowing, attention has started to shift from combating inflation to stimulating economic growth.

Whether the Fed opts for a 25 or 50 basis point cut, lower rates are on the horizon. For investors, this prompts a crucial question: is it time to rebalance your portfolio?

In light of that, let’s look at some sectors and stocks that might do well in a lower interest rate environment, especially those that analysts believe are undervalued.

Which Sectors Stand to Benefit the Most?

Historically, defensive sectors – such as utilities The Utilities (NYSE:), healthcare (NYSE:), and industrials – tend to thrive when rates fall. Lower borrowing costs can reduce debt burdens and enhance profitability, especially for companies that outperform market expectations.

This boost in profits often translates into higher stock prices, rewarding investors. Additionally, as interest rates decline, bond yields drop, making dividend-paying companies more attractive, particularly those with yields higher than government bonds.

Rate cuts can also provide relief for heavily indebted mid- and small-cap companies. However, given the heightened volatility and ongoing economic uncertainty, focusing on well-established companies with market caps above $5 billion may offer more stability in this phase.

Finding the Top Stocks

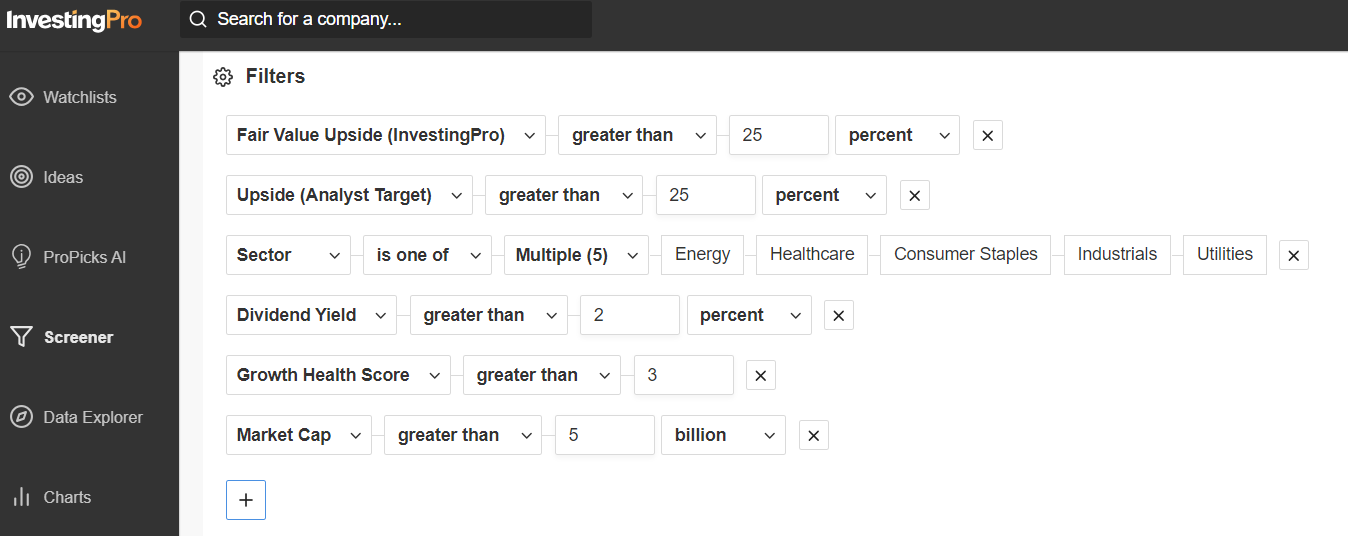

Now that we’ve identified the key sectors, we can leverage InvestingPro’s stock screener to pinpoint stocks likely to benefit from these rate cuts.

By applying filters such as Fair Value, target price growth, and solid financial health, we narrow down the most promising opportunities.

Here are the screening parameters:

- Fair Value increase greater than 25%

- Analysts’ target price increase greater than 25%

- Sectors: energy, healthcare, basic consumer goods, industrials, and utilities

- Financial health score of 3 out of 5 or higher

- Market capitalization exceeding $5 billion

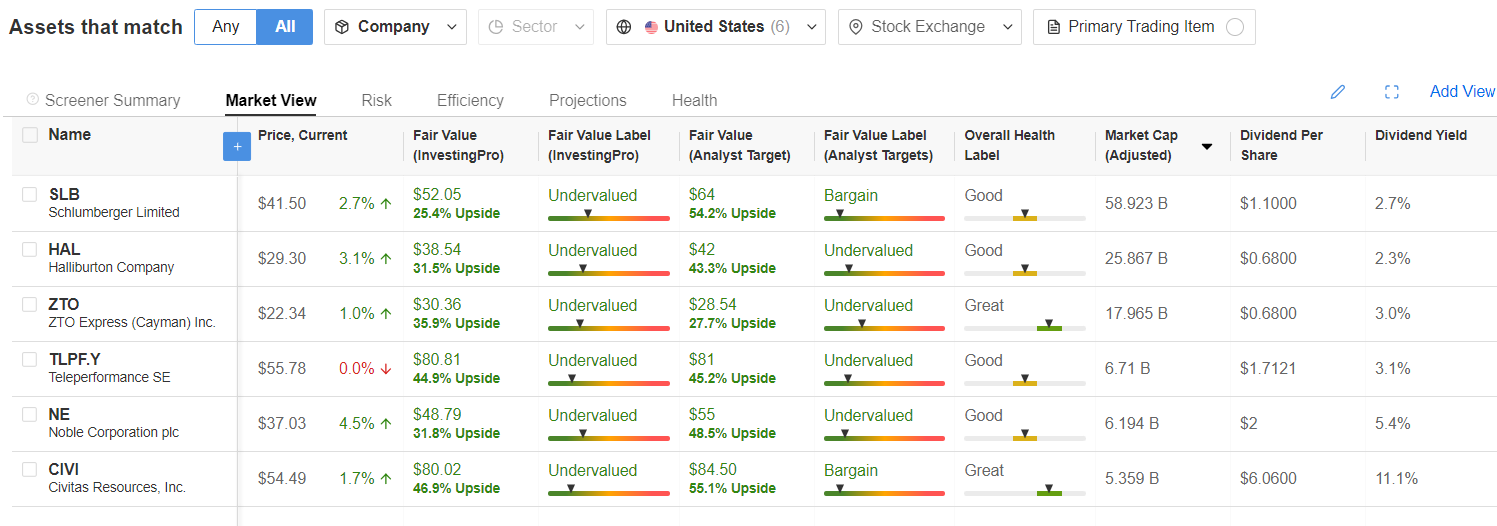

After running the screen, six stocks emerged as strong candidates, based on their growth potential and analysts’ targets over the next 12 months:

- Schlumberger NV (NYSE:): Current price $41.50, Fair Value upside 25.4%, analysts’ target up 54.2%

- Halliburton Company (NYSE:): Current price $29.30, Fair Value upside 31.5%, analysts’ target up 43.3%

- ZTO Express (Cayman) Inc (NYSE:): Current price $22.34, Fair Value upside 35.9%, analysts’ target up 27.7%

- Teleperformance SE (EPA:): Current price $55.78, Fair Value upside 44.9%, analysts’ target up 45.2%

- Noble Corp (CSE:): Current price $37.03, Fair Value upside 31.8%, analysts’ target up 48.5%

- Civitas Resources Inc (NYSE:): Current price $54.49, Fair Value upside 46.9%, analysts’ target up 55.1%

InvestingPro subscribers can recreate this screen using the parameters above, or customize their own to match specific investment goals.

You can get access to InvestingPro today. Subscribe now with an exclusive discount and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.