5 Undervalued Stocks to Snap Up Before Black Friday

2023.11.21 04:46

- The stock market has been rallying

- But there are still some stocks you can bag at a discount

- In this piece, we will take a look at five such stocks you can consider buying

- Secure your Black Friday gains with InvestingPro’s up to 55% discount!

Despite the recent rally in the stock market, there are still some stocks trading at a discount due to the downturn in October. These stocks represent bargains with significant upside potential.

The market’s current sentiment, discounting the expectation that the Federal Reserve will cease raising interest rates and may lower them in 2024, serves as an additional incentive to explore these opportunities.

As Black Friday approaches, let’s delve into the best bargains available on the stock market using InvestingPro’s models to glean valuable data and information.

1. PayPal

On January 30, PayPal Holdings Inc (NASDAQ:) will present earnings. The forecast for the full year in terms of revenue is +7.6% and for 2024 +8.7%.

PayPal Forecasts

Source: InvestingPro

PayPal’s new CEO makes a strong impression with his strategic clarity and plans for profitable growth. That’s a plus for the company.

The stock is down -5% in the last 3 months.

80% of its ratings are buy, 18% hold, and 2% sell.

The market gives it potential at $77.58, and InvestingPro models at $79.89.

PayPal Targets

Source: InvestingPro

2. Chevron

On February 2, Chevron Corp (NYSE:) will present results. For 2024’s first earnings, an increase in earnings per share of +5.2% is expected.

Its dividend yield is +4.18%. It has not cut its dividend since 2014, demonstrating a continued commitment to profitability throughout the cycle.

Chevron Dividends

Source: InvestingPro

The punishment suffered by the oil stock following its deal with Hess (NYSE:) has been excessive.

The stock is down -8.5% over the past three months.

67% of the ratings are Buy, 33% are Hold and it has no Sell rating.

The market sees potential at $181.19.

Chevron Targets

Source: InvestingPro

3. Boeing

Boeing (NYSE:) will report quarterly results on January 31. It is expected to post revenue growth of +15% in 2023 and +18.2% in 2024.

Boeing Forecasts

Source: InvestingPro

It has in its favor the delivery of orders in December, a peak season month, in addition to demand outstripping supply.

The stock is down -8.44% in the last 3 months.

It has 77% buy, 33% hold, and no sell ratings.

The market gives it a potential at $241.04.

Boeing Targets

Source: InvestingPro

4. Honeywell

Honeywell (NASDAQ:) offers a wide variety of consumer products and security services for all types of customers, from individual buyers to large corporations and governments. It is headquartered in Morristown, New Jersey.

Its dividend yield is +2.26%.

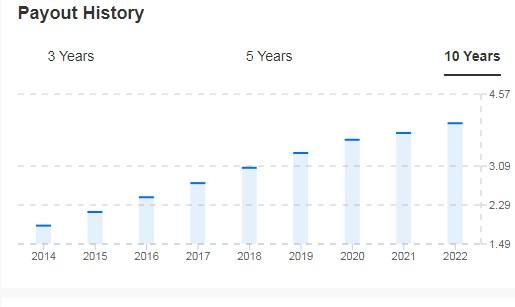

Honeywell Payout History

Source: InvestingPro

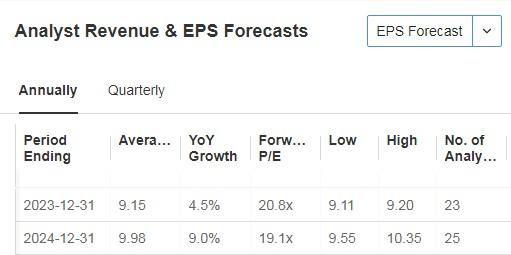

The company is set to report earnings on February 2. Earnings per share (EPS) are expected to increase by +4.5% in 2023 and +9% in 2024.

Honeywell Forecasts

Source: InvestingPro

The stock is up +2.90% in the last 3 months.

60% of its ratings are buy, 37% are hold and 3% are sell.

Both the market and InvestingPro’s models agree on its potential. The former at $213.16 and the latter at $213.98.

Honeywell Targets

Source: InvestingPro

5. Nike

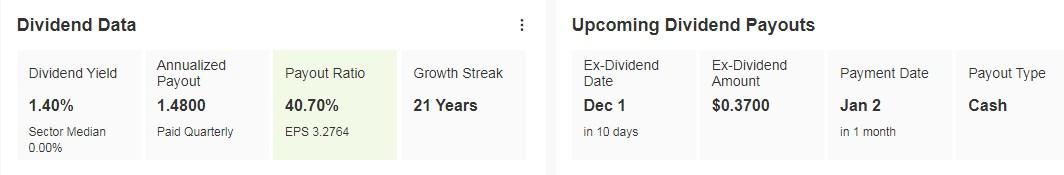

Nike (NYSE:) will distribute a dividend on January 2, namely 0.37 euros per share. To receive it, shares must be held before December 1. The annual dividend yield is +1.40%.

Source: InvestingPro

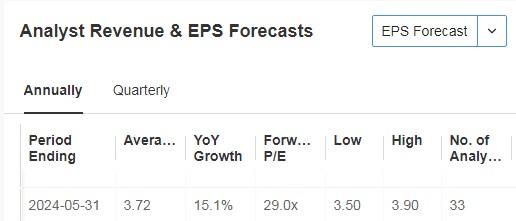

On December 21, the company will present its quarterly accounts. Earnings per share (EPS) for 2024 are expected to increase by +15.1%.

Nike Forecasts

Source: InvestingPro

The stock is up +3.36% in the last 3 months.

It has 60% buy, 36% hold, and 4% sell ratings.

The market believes it has potential at $121.40.

Nike Targets

Source: InvestingPro

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you’re a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Black Friday Sale – Claim Your Discount Now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.