5 Undervalued Stocks Positioned for a Breakout Year in 2025

2024.12.30 12:21

- These undervalued stocks could deliver significant growth in 2025.

- Analyst forecasts suggest big upside potential for these top picks.

- Solid fundamentals and growth opportunities make these stocks stand out.

- Kick off the new year with a portfolio built for volatility and undervalued gems – subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

As we head into 2025, some undervalued stocks are catching the attention of analysts who believe they have huge upside potential.

While traditional Buy, Sell, or Hold recommendations offer general guidance, forecasts based on in-depth analysis provide a clearer picture of which stocks could be poised for significant growth.

By examining factors like solid financial performance, growth opportunities, and competitive advantages, these five companies stand out as prime candidates for potential breakthroughs in the year ahead.

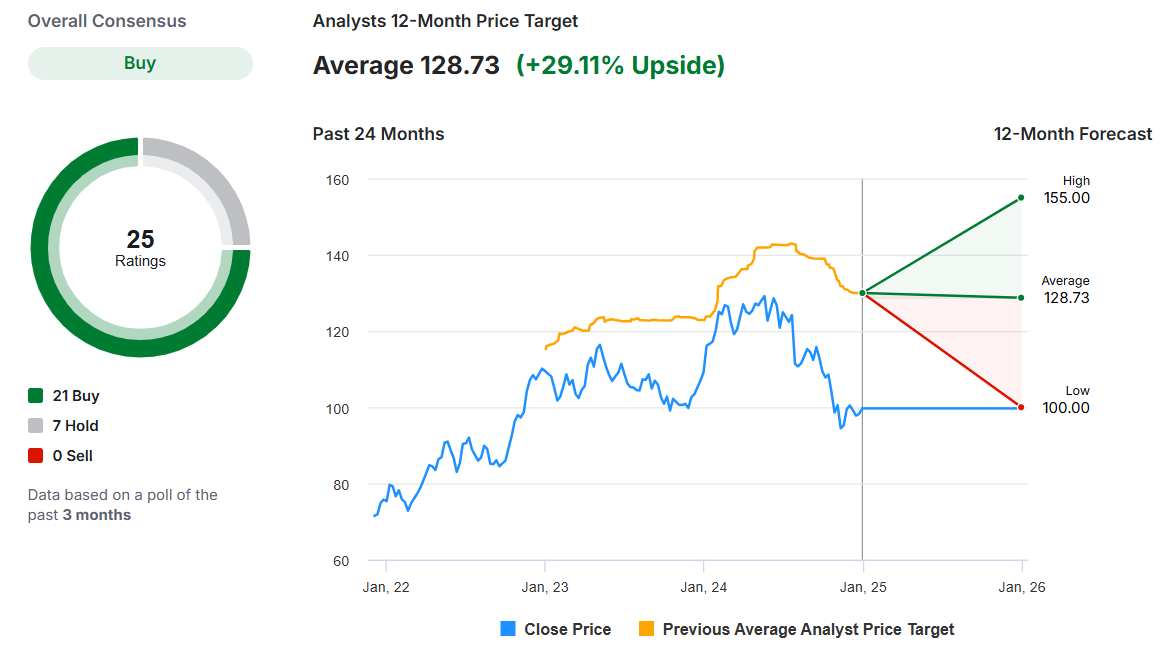

1. Merck & Co

- 12-Month Analyst Forecast: +29.11%

Merck & Company (NYSE:) is positioned as a leader in the pharmaceutical and vaccine markets, backed by its powerhouse oncology drug, Keytruda.

However, its future growth could hinge on expanding into new areas like immunology and cardiovascular treatments.

Despite risks from heavy dependence on Keytruda and competition in key sectors, Merck’s solid pipeline and long-standing history of dividends make it a solid bet.

Strengths:

- Market leader in oncology with Keytruda

- Expanding vaccine portfolio with new products like CAPVAXIVE

- Robust pipeline and high gross margins

Challenges:

- Heavy reliance on Keytruda for revenue

- Rising competition and regulatory pressures

Opportunities:

- New cardiovascular treatments and immunology pipeline

- Potential growth in emerging markets

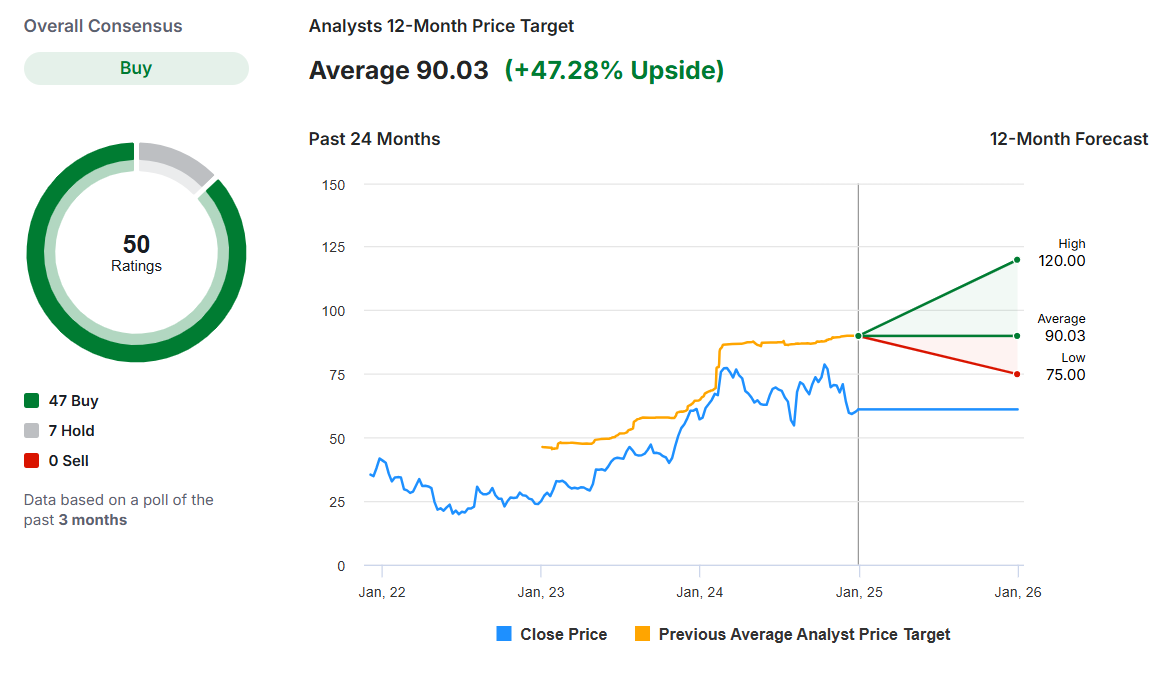

2. Uber Technologies

- 12-Month Analyst Forecast: +47.28%

Uber’s (NYSE:) dominance in ridesharing continues, and its expansion into delivery services and autonomous vehicle tech positions it as a top growth stock.

While challenges remain—like its reliance on gig economy workers and increasing competition—Uber’s ability to expand into new markets and reduce operational costs through technology could fuel strong returns.

Strengths:

- Leader in the ridesharing industry

- Diversified business model in mobility and delivery

- Growing profitability and operational efficiency

Challenges:

- Regulatory risk in multiple markets

- Pressure from competition and customer acquisition costs

Opportunities:

- Expansion of loyalty programs like Uber One

- Growth in advertising revenue

- Integration of autonomous vehicle technology

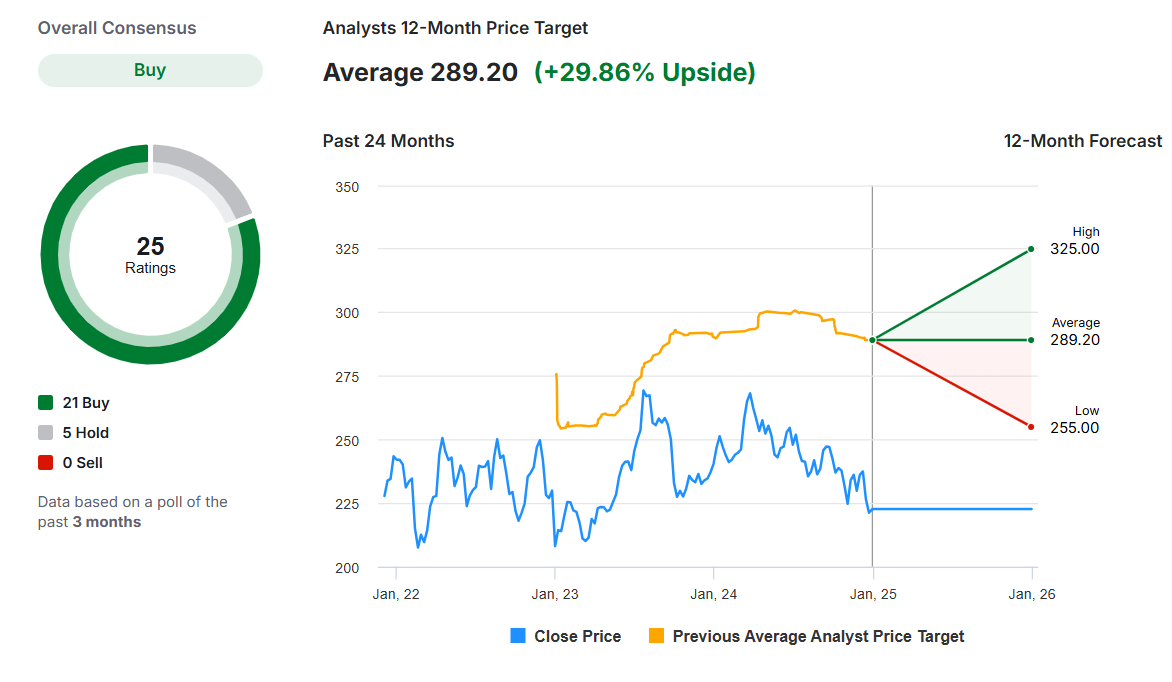

3. Constellation Brands

- 12-Month Analyst Forecast: +29.86%

Constellation Brands (NYSE:) has long been a dominant player in the beer market with top brands like Modelo Especial and Pacifico.

Despite challenges in its wine and spirits segment, Constellation’s strong profitability and market share in beer give it a bright outlook. With strategic investments in premium products and international markets, this stock could outperform.

Strengths:

- Leading beer brands and strong market share

- High profitability and effective marketing

- Solid growth prospects in premium beer

Challenges:

- Dependence on beer sales for growth

- Struggles in the wine and spirits division

Opportunities:

- Expansion in the premium beer sector

- Portfolio optimization and international growth

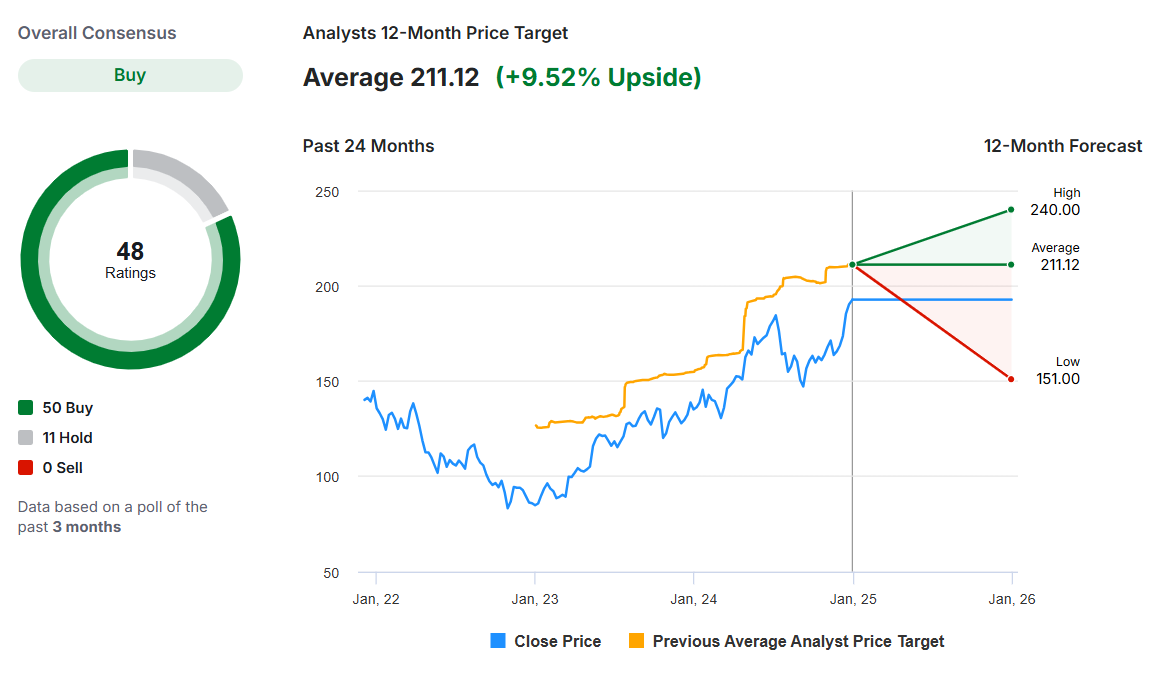

4. Alphabet

- 12-Month Analyst Forecast: +9.52%

Alphabet (NASDAQ:) (NASDAQ:) continues to lead in AI integration and digital advertising. The company’s diversified ecosystem, from Google Search to cloud computing, positions it well for steady growth.

While it faces regulatory hurdles and growing competition, Alphabet’s investments in AI and cloud services could drive significant revenue increases.

Strengths:

- Dominant in search and digital advertising

- Strong AI and cloud computing growth

- Diversified product ecosystem

Challenges:

- High reliance on advertising revenue

- Regulatory and legal pressures

Opportunities:

- Expansion in AI and cloud computing

- Increased ad revenue through YouTube and connected TV

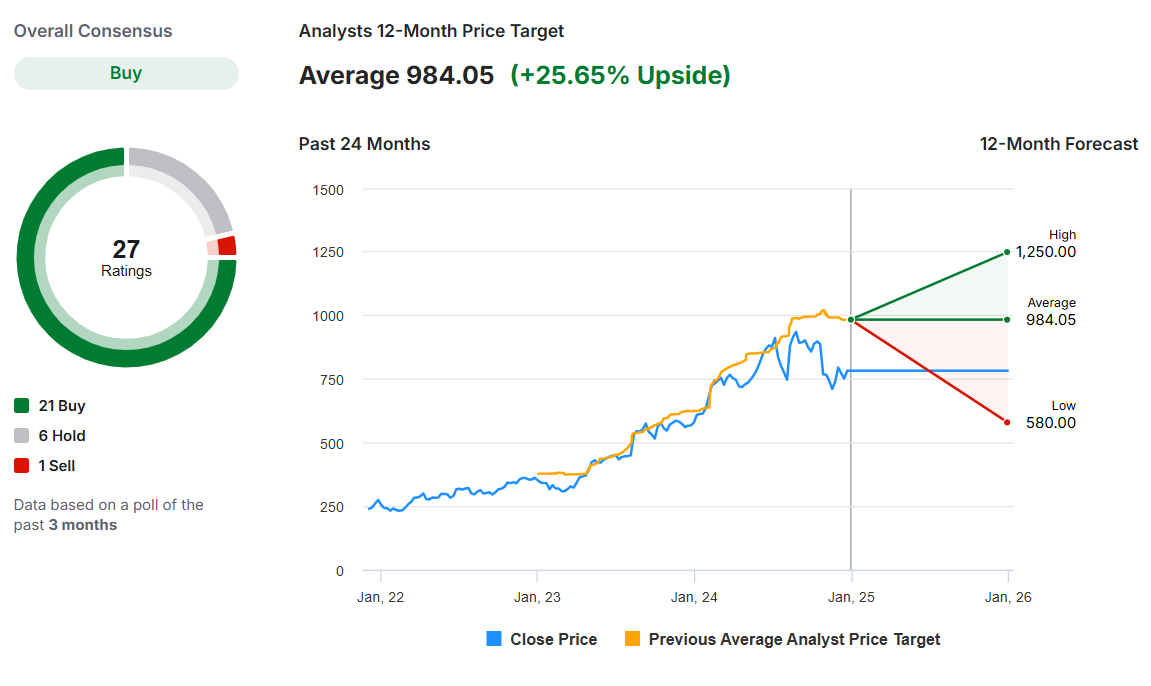

5. Eli Lilly

- 12-Month Analyst Forecast: +25.65%

Eli Lilly’s (NYSE:) success with GLP-1 drugs, particularly for obesity and diabetes, has driven strong sales growth. With a promising pipeline and major investments in manufacturing, Eli Lilly is positioned to continue its growth trajectory.

However, the company faces competition in the GLP-1 market and potential supply constraints, which could limit its upside.

Strengths:

- Success in GLP-1 drugs, especially Mounjaro and Zepbound

- Strong pipeline with promising treatments

- Impressive sales growth and manufacturing investments

Challenges:

- Supply chain constraints

- Potential competition in the GLP-1 market

Opportunities:

- Expanding market for obesity and diabetes treatments

- International growth potential and new drug applications

Conclusion

As we look ahead to 2025, these five undervalued stocks stand out for their strong growth potential, backed by solid fundamentals and strategic opportunities.

While challenges remain, their ability to adapt and innovate positions them well for substantial upside. Keep an eye on these companies as they navigate market dynamics and work to capitalize on emerging trends.

For investors seeking high-reward opportunities, these stocks could be worth considering in your portfolio.

Curious how the world’s top investors are positioning their portfolios for next year?

Don’t miss out on the New Year’s offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Ready to take your portfolio to the next level? Click the banner below to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.