5 Stocks to Buy as Stock Market Gears Up for December Rally

2023.12.05 03:48

- December is the third-best month of the year for the stock market historically

- There are a number of stocks that consistently beat the market by a wide margin during this month

- We will take a look at five such stocks in this article

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

December has historically been a bullish month for stock markets, marked by a notable track record of positive returns since 1950, sharing the top spot with November and April.

It used to be the best month historically in terms of returns, but a sharp drop in December 2018, with the plummeting by -9.18%, moved it to third place in the annual ranking. On average, December boasts a return of +1.51%, with positive performance observed nearly 75% of the time.

Despite December’s overall positive trend for the S&P 500, we can identify specific stocks that consistently outperform the market over the past 5 years. Using the InvestingPro tool, we’ll explore five of such noteworthy performers in this article.

1. Skyworks Solutions

Skyworks Solutions (NASDAQ:) semiconductor chips are used in the aerospace market, defense, entertainment, industry, medicine, military, smartphones, tablets, and portable devices.

It reports its results on February 1. The previous ones it in November improved revenue and earnings per share (EPS) forecasts.

Skyworks Solutions Forecasts Vs. Actual Earnings

Source: InvestingPro

The shares rose an average of +8.3% during December over the last five years, highlighting the +23% upside in 2019.

Over the past year, its shares are up +7.45%. InvestingPro models give it a potential of $114.36.

Skyworks Solutions Investing Models

Source: InvestingPro

2. Eli Lilly

Headquartered in Indianapolis, Indiana, Eli Lilly and Company (NYSE:) was created in 1876 by Colonel Eli Lilly, a pharmacist and veteran of the American Civil War.

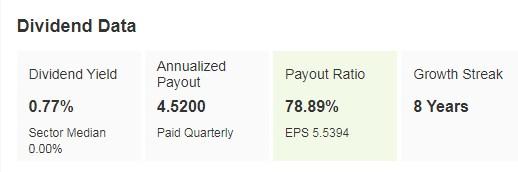

Its dividend yield is +0.77%.

Eli Lilly Dividend Data

Source: InvestingPro

On February 6, it will present its accounts, and earnings per share (EPS) are expected to increase by +5.84% and actual revenue by +10.97%.

Eli Lilly Earnings Report

Source: InvestingPro

Its shares are up on average +7.2% in December over the last 5 years.

In the last year, its shares are up +59.66%, and in the last 3 months +4.79%. The market gives it a potential at $619.14.

Eli Lilly Analyst Targets

Source: InvestingPro

3. Baker Hughes

Baker Hughes (NASDAQ:) is one of the world’s largest oilfield services companies operating in more than 120 countries across the globe. It was incorporated in 2016 and is headquartered in Houston, Texas.

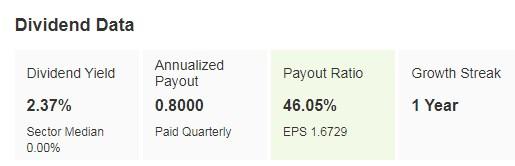

Its dividend yield is +2.37%.

Baker Hughes Dividend Data

Source: InvestingPro

It reports its numbers on January 18 and is expected to report +5.04% actual revenue growth.

It raised its full-year revenue forecast, mainly due to strong demand for its liquefied equipment. The project pipeline remains strong, both in the U.S. and internationally.

Baker Hughes Dividend Data

Source: InvestingPro

Its shares are up on average +7.2% in December over the last 5 years.

Over the last year, its shares are up +20.53%. It has 29 ratings, of which 21 are buy, 6 are hold and 2 are sell. The market gives it a potential of $619.14.

4. Las Vegas Sands

Las Vegas Sands (NYSE:) is a casino and resort company based in Las Vegas, Nevada. The company’s integrated resorts feature lodging, gaming, entertainment, and shopping. It was founded in 1988.

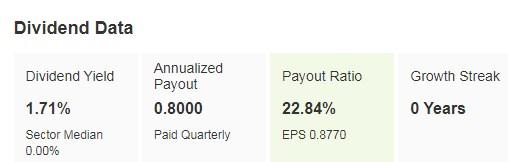

Its dividend yield is +1.71%.

Las Vegas Sands Dividends

Source: InvestingPro

It presents its accounts on January 24 and earnings per share (EPS) are expected to increase by +50.06% and actual revenue by +29.83%.

Las Vegas Sands Earnings

Source: InvestingPro

Its shares are up on average +5% in December over the last 5 years.

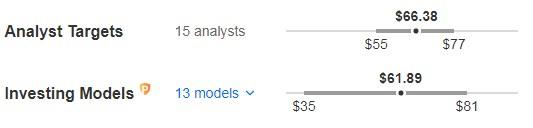

In the last year, its shares have fallen by -1.18% %. The market gives it a potential at $66.38, while InvestingPro models put it at $61.89.

Las Vegas Sands Targets

Source: InvestingPro

5. Teleflex

Teleflex (NYSE:) designs, develops, manufactures, and supplies single-use medical devices for therapeutic and diagnostic procedures in surgical applications.

The company was incorporated in 1943 and is headquartered in Wayne, Pennsylvania.

Its dividend yield is +0.60%.

Teleflex Dividend

Source: InvestingPro

On February 22 it presents its results. The previous ones it in November improved revenue and earnings per share (EPS) forecasts.

Teleflex Stock Price Reaction to Earnings

Source: InvestingPro

Its shares are up +4.2% on average in December over the last 5 years.

In the last year, its shares fell -2.86% and in the last 3 months they rose +9.46%. It has 16 ratings, of which 6 are buy, 10 are hold and none are sell. InvestingPro models gives it a potential at $276.27.

Teleflex Targets

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.