5 Stocks to Avoid While Riding the Fed Pivot

2023.12.21 07:25

- Some stocks are backed by Wall Street to rally in 2024.

- On the flip side, some stocks repel investors because of poor prospects.

- In this piece, we will discuss 5 stocks that are primed for a poor 2024.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn more here

As we near the conclusion of 2023, it’s worth noting that December 21 has historically been a bullish day for the past 35 years, showcasing the highest daily gains across all major US indexes. The average rise on this day is as follows:

- : +0.18%

- : +0.15%

- : +0.34%

This suggests that the rally can resume today after the recent pullback.

However, let’s shift our focus to 2024. While it’s uncommon on Wall Street to dwell on underperforming stocks, tracking them can provide valuable insights.

In this spirit, let’s explore some stocks that the market anticipates to perform poorly in 2024 and delve into the reasons behind these expectations.

1. Seagate Technology

Seagate Technology (NASDAQ:) offers data storage technology and solutions in Singapore, the United States and the Netherlands.

It sells its products primarily to equipment manufacturers, distributors, and retailers. It was founded in 1978 and is headquartered in Dublin, Ireland.

It paid a dividend of $0.70 on January 9 and its dividend yield is +3.32%.

Results for the quarter will be presented on January 24 and are expected to be poor with earnings per share (EPS) down -106.69% and revenue down -36.07%. For 2024 the forecast is for a fall in real revenues of -13.1%.

Its shares are up +55% in the last year and +25% in the last 3 months.

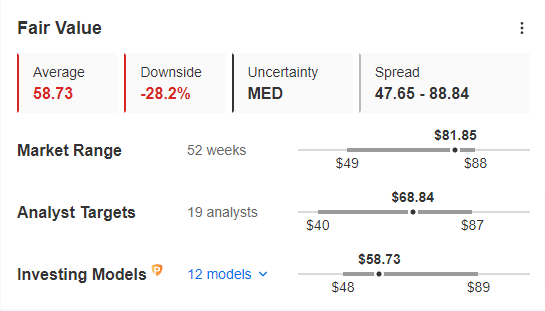

STX Fair Value

Source: InvestingPro

The market does not bode well for 2024, giving it a potential downside of -18% to $68.84. InvestingPro Fair Value sees the stock falling even further, with a 28.2% downside risk over the next 12 months.

2. Robert Half (RHI)

Robert Half (NYSE:) provides business consulting solutions and services in North America, South America, Europe, Asia and Australia.

The company’s dividend yield is +2.2%.

On January 30 it will release its accounts for the quarter and earnings per share are expected to fall by -39.96% and revenue by -13.36%. Looking ahead to 2024, revenues are expected to fall -1.7%.

Its shares are up +24.90% in the last year and +18.21% in the last 3 months.

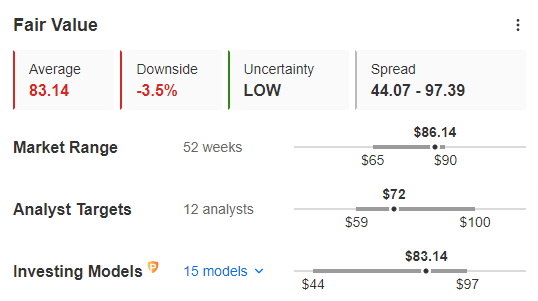

Fair Value

Source: InvestingPro

The market gives it a potential downside of -17.50% at $72, while InvestingPro sets its Fair Value at $83, implying a 3.5% downside from current levels.

3. Intel

Intel (NASDAQ:) was incorporated in 1968 and is headquartered in Santa Clara, California.

Its dividend yield is +1.08%.

Results for the quarter will be released on June 25 and it expects earnings per share to fall -31.50% and actual revenue to fall -8.40%.

Its shares are up +80.59% in the last year and +34.95% in the last 3 months.

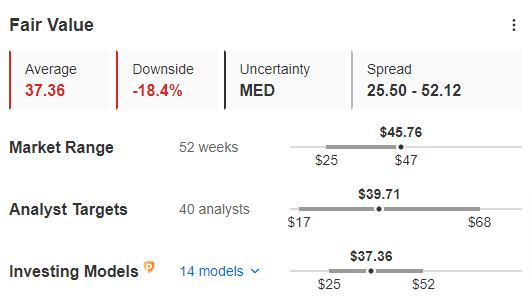

Fair Value

Source: InvestingPro

The market sees a downside potential of -19% at $37.34. Accordingly, InvestingPro sees the stock falling by 18.4% over the next 12 months.

4. Southwest Airlines

Southwest Airlines Company (NYSE:) was incorporated in 1967 and is headquartered in Dallas, Texas.

It pays a dividend on January 11 of $0.18 and the yield is +2.48%.

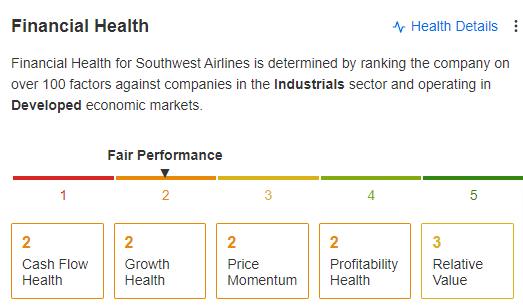

On January 25 we will know its numbers for the quarter and earnings per share are expected to fall by -83.19% and actual revenue by -3.27%. That’s perhaps why InvestingPro gives is a meager “Fair” financial health score.

src=

Source: InvestingPro

Its shares are down -17.14% in the last year.

The market believes it could fall by -9.8% in 2024.

5. Expedia Group

Expedia (NASDAQ:) is an online travel company that operates primarily in the United States but also in other countries.

The company was formerly known as Expedia and changed its name to Expedia Group in March 2018. It was founded in 1996 and is headquartered in Seattle, Washington.

We will learn about its quarterly accounts on February 8, with earnings per share expected to fall by 18% and actual revenue by -0.80%, according to InvestingPro.

Upcoming Earnings

Source: InvestingPro

Its shares are up +76.99% in the last year and +45.29% in the last 3 months.

The market sees a downside potential of -8.3% by 2024.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users.

Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Join now and never miss another bull market by not knowing which stocks to buy!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.