5 Small-Cap Stocks to Buy as Russell 2000 Catches Up to Broader Market Rally

2023.11.28 04:15

- Large-cap stocks have dominated all the headlines in 2023

- But 2024 could belong to small-cap stocks, as the market gives them great upside potential

- In this piece, we’ll take a look at a few stocks set to outperform next year

- Missed out on Black Friday? Secure your up to 55% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Throughout the year, the media has predominantly focused on and highlighted large-cap stocks, especially those in the technology and artificial intelligence sectors, given their excellent YTD returns.

While this emphasis is logical due to their noteworthy performance, it’s important not to overlook intriguing opportunities within small-cap stocks.

Small caps are defined by market capitalizations ranging from $300 million to $2 billion. Those exceeding $2 billion transition into mid-caps, and the largest among them become large caps.

Two prominent indexes in the small-cap space are:

- : This index holds significance as small companies within it offer a more accurate reflection of the country’s economic health, given their focus on domestic operations. Updated annually during May and June.

- : This index comprises 600 small-cap companies. Notably, it has outperformed the Russell 2000 over the last 25 years, partly due to its stringent entry filter, requiring companies to possess a robust earnings history.

Interestingly, the market is anticipating that S&P 600 index stocks will deliver superior results in 2024 compared to their counterparts, with a projected increase of +18% versus +11%.

So, let’s explore 5 small-cap stocks that the market believes will experience substantial growth in 2024. To do so, we’ll leverage the InvestingPro tool for relevant information and data.

InvestingPro is an exceptionally practical tool for identifying stocks with the most promising upside potential based on specific criteria.

The Cyber Monday sale has been extended, with up to 60% off on subscription plans.

Claim Your Discount Now!

1. Avid Bioservices

Avid Bioservices (NASDAQ:) was formerly known as Peregrine Pharmaceuticals and changed its name to Avid Bioservices in January 2018.

It was established in 1981 and is headquartered in Tustin, California. It offers services such as drug substance manufacturing, packaging, analytical method development, etc.

On December 11, it will present its results.

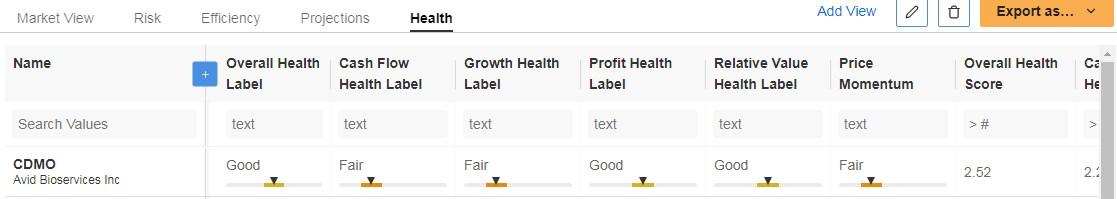

The following chart shows key data about the company’s financial health.

Source: InvestingPro

Its shares fall more than -50% this fiscal year and in the last month -11% because its earnings are expected to plunge -60%. But by 2024 earnings forecasts are up +250% and the market gives the stock a +236% potential to $18.50.

Avid Bioservices Analyst Targets

Source: InvestingPro

2. Vir Biotechnology

Vir Biotechnology (NASDAQ:) is a company focused on boosting the immune system to address the needs of patients with infectious diseases. The company was formed in 2016 and is based in San Francisco, California.

It will present its results on February 22.

Here we can see some of its metrics.

Vir Biotechnology Financial Metrics

Source: InvestingPro

Its shares fell in the year by -60% due to the expected poor results. But by 2024 the market gives it a potential of +204% at $29.75. It has 9 ratings, of which 7 are buy, 2 are hold and none are sell.

Vir Biotechnology Targets

Source: InvestingPro

3. Arcus Biosciences

Arcus Biosciences (NYSE:) is a biopharmaceutical company that develops and commercializes cancer therapies in the United States. It was incorporated in 2015 and is headquartered in Hayward, California.

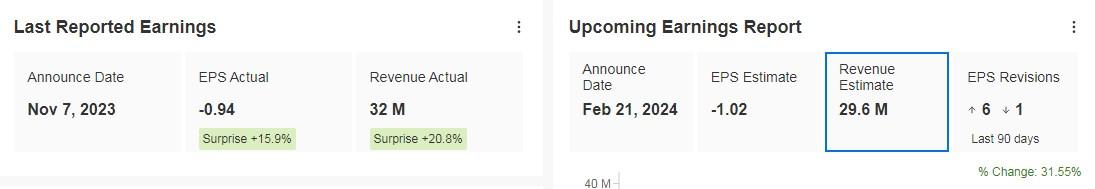

It reports its results on February 21 and is expected to report earnings per share (EPS) up +20.61% and revenue up +31.55%.

Arcus Biosciences Earnings

Arcus Biosciences Earnings

Source: InvestingPro

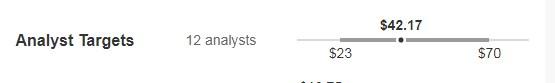

Its shares are down -50% for the year and -1.95% in the last month. It has 12 ratings, of which 10 are buy, 2 are hold and none are sell. The market sees a potential of +200% at $42.17.

Arcus Biosciences Targets

Source: InvestingPro

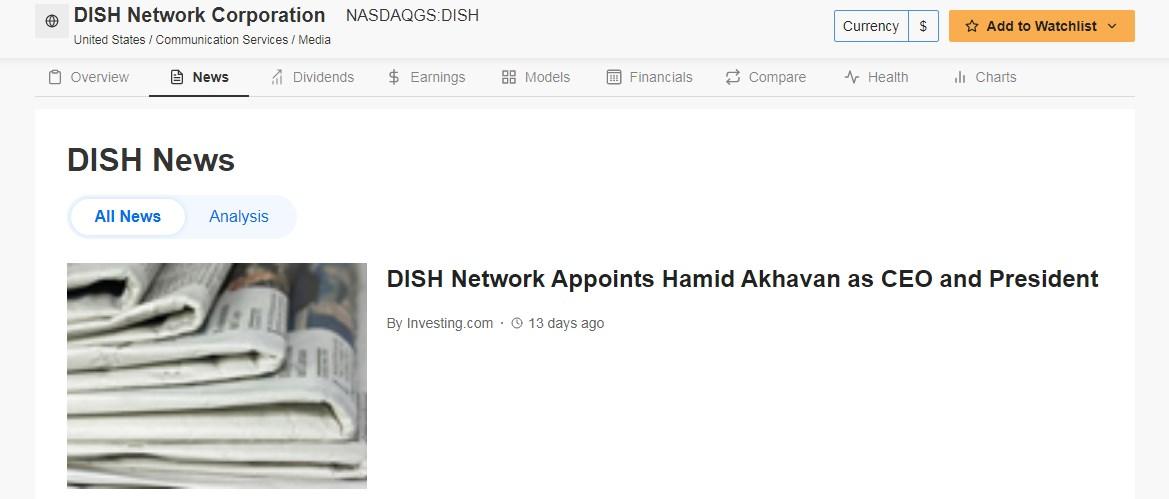

4. DISH Network

DISH Network Corporation (NASDAQ:) is the largest pay-TV provider in the United States and offers satellite TV, audio programming, and interactive TV services. It was founded in 1980 and is based in Englewood, Colorado.

It will report its results on February 22.

It recently announced today the person who would be joining DISH as president and chief executive officer (CEO).

Source: InvestingPro

Its shares are down -39.40% over the past three months. It presents 17 ratings, of which 6 are buy, 10 are hold and 1 is sell. The market gives it +138% potential at $8.74.

DISH Network Targets

Source: InvestingPro

5. Enviri

Enviri Corp (NYSE:) was formerly known as Harsco (NYSE:) Corporation and changed its name to Enviri Corporation in June 2023.

The company was founded in 1853 and is headquartered in Philadelphia, Pennsylvania. It provides solutions for complex environmental problems and serves major industries, including railroads and energy.

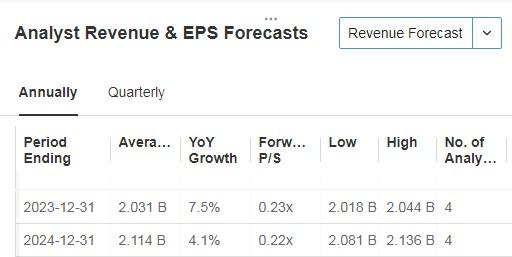

It reports its results on February 22. For 2023 it expects revenue growth of +7.5% and for 2024 of 4.1%.

Enviri Revenue and EPS

Source: InvestingPro

Its shares are down -9% for the year. It has 4 ratings, of which 2 are buy, 2 are hold and none are sell. The market sees it potential of +135% at $13.63.

Enviri Targets

Source: InvestingPro

You can easily determine whether these companies are suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 55%), by taking advantage of our extended Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.