5 Powerhouse Stocks to Fuel Your 2024 Portfolio

2024.01.04 08:45

- The new year has kicked off and it is time for investors to create a new investment portfolio or make changes to an existing one.

- Today we are going to create a portfolio and we will look at 5 stocks you can consider for 2024.

- on Wednesday, January 10, the second part of this article will some more stocks you can look to include.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The has demonstrated a robust rally in 2023 and the true champions emerged in the form of Apple (NASDAQ:), Amazon (NASDAQ:), Alphabet (NASDAQ:) (NASDAQ:), Meta (NASDAQ:), Microsoft (NASDAQ:), Nvidia (NASDAQ:) and Tesla (NASDAQ:), propelling the index to new heights through their significant surges.

The anticipation on Wall Street is that the winners of 2024 will closely resemble this year’s winners. However, in our pursuit of constructing an optimal portfolio for 2024, this post will delve into five stocks and examine the reasons behind their inclusion.

Stay tuned for the analysis of the remaining stocks, which will be covered next week on Wednesday, January 10. I will use the professional tool InvestingPro to access intriguing data and insights.

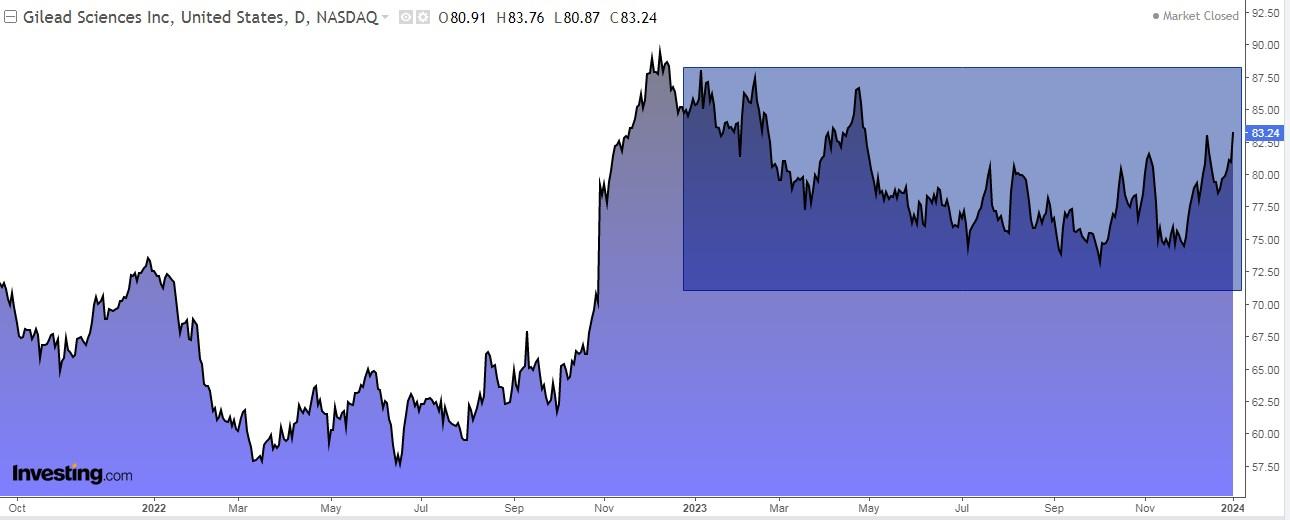

1. Gilead

Gilead Sciences (NASDAQ:) portfolio is based on oncology drugs whose data will be delivered later this year.

At the time it was the most popular biotech company curing hepatitis C. It has a robust balance sheet and can easily cover its $10 billion in net debt with its expected earnings.

It is now testing the use of Trodelvy in the treatment of lung cancer, and the results will be published later this year.

At 11 times expected earnings per share, the stock is cheaper than the S&P 500 index.

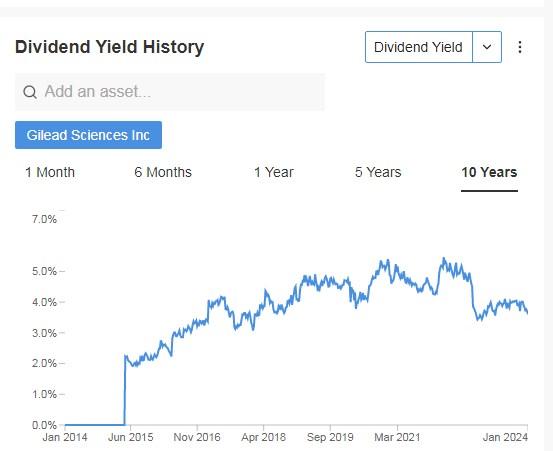

Its dividend yield is +3.59%.

Gilead Dividend Yield History

Source: InvestingPro

On February 6, we will know its results for the quarter and revenue is expected to increase by +5.21% and EPS by +3.60%.

For 2024, the increase is +2.1% and +7% respectively. Annual sales growth is also expected to reach $28 billion by 2025. Not least interestingly, margins are expected to increase.

Gilead Upcoming Earnings Report

Source: InvestingPro

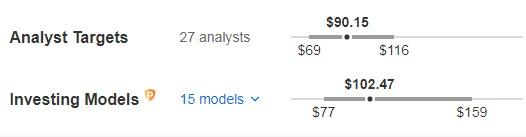

Its shares are up +9% in the last 3 months. The market sees potential at $90.15 after a year from now and InvestingPro models put it at $102.47.

Gilead Analyst Targets

Source: InvestingPro

2. Alphabet

Alphabet Stock Price Chart

Alphabet Stock Price Chart

Alphabet is expected to grow as fast as Microsoft, and earnings are forecast to rise +15% by 2024, three times faster than Apple’s +5% growth.

However, its shares trade at only 20 times earnings, a discount to Microsoft and Apple’s 30 times, despite rising strongly in 2023.

It has over $100 billion in net cash, plenty of money to buy back shares, and maybe even start paying dividends.

On February 1 it presents its results and is expected to increase earnings per share (EPS) by +8.76%. Looking ahead to 2024 the increase could be +16.1% and revenue +11.3%.

Alphabet Earnings

Source: InvestingPro

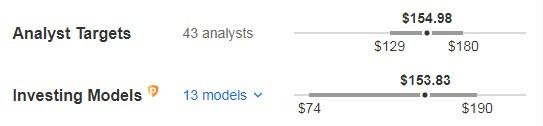

Its shares are up +57% in the last year. The market sees potential at $154.98, while InvestingPro’s models pretty much come to the same conclusion giving it potential at $153.83.

Alphabet Targets

Source: InvestingPro

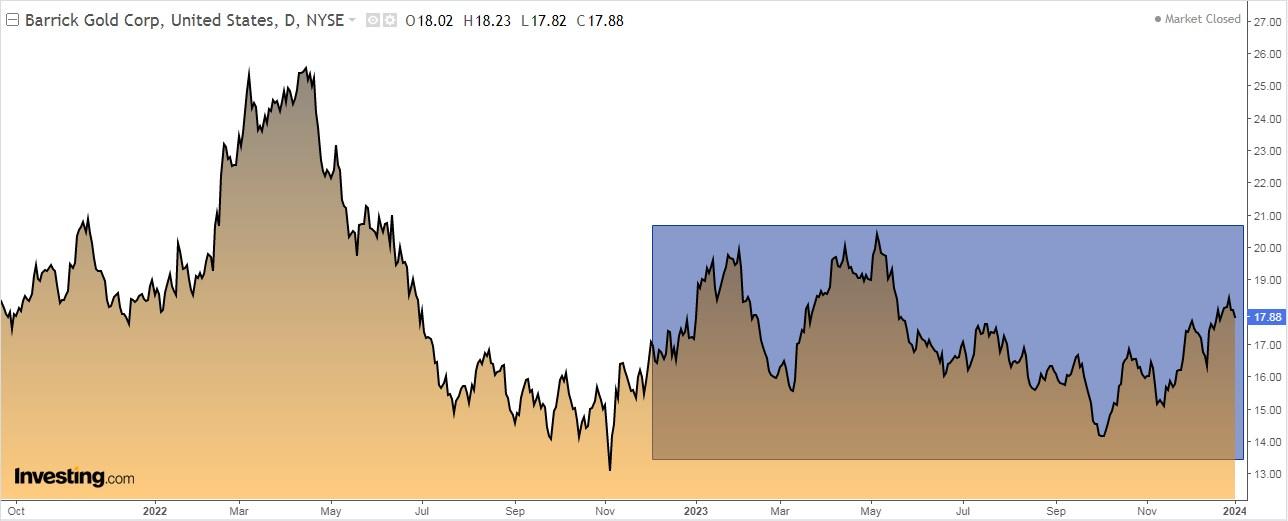

3. Barrick Gold

Barrick Gold’s (NYSE:) stock has been unable to keep pace with prices on , due to higher costs and lower gold production.

But this may be the year that changes that fact. It has several issues on its side, such as the company has some of the best mines in the world, is Africa’s leading gold producer, and aims to increase its mine production.

It also has a balance sheet with no net debt. The stock trades at around 16 times next year’s projected earnings.

Its dividend yield is +2.31%.

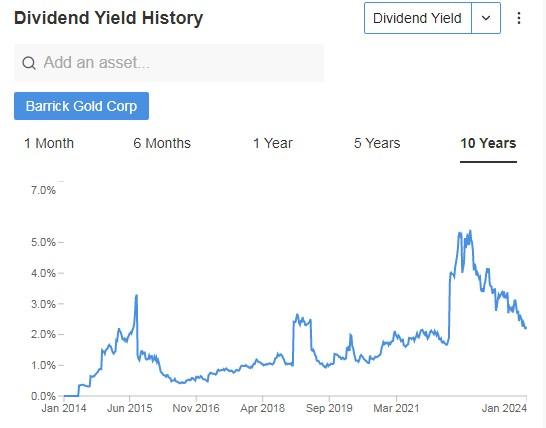

Barrick Gold Dividend Yield History

Source: InvestingPro

On February 14 it presents its accounts for the quarter and earnings per share are expected to increase by +42.89% and revenue by +14.41%. For 2024 the expected increase is +30.8% and +10.3% respectively.

Barrick Gold Earnings

Source: InvestingPro

It has 23 ratings, of which 17 are buy and 6 are hold. The market gives it a potential at $21.65.

Barrick Gold Targets

Source: InvestingPro

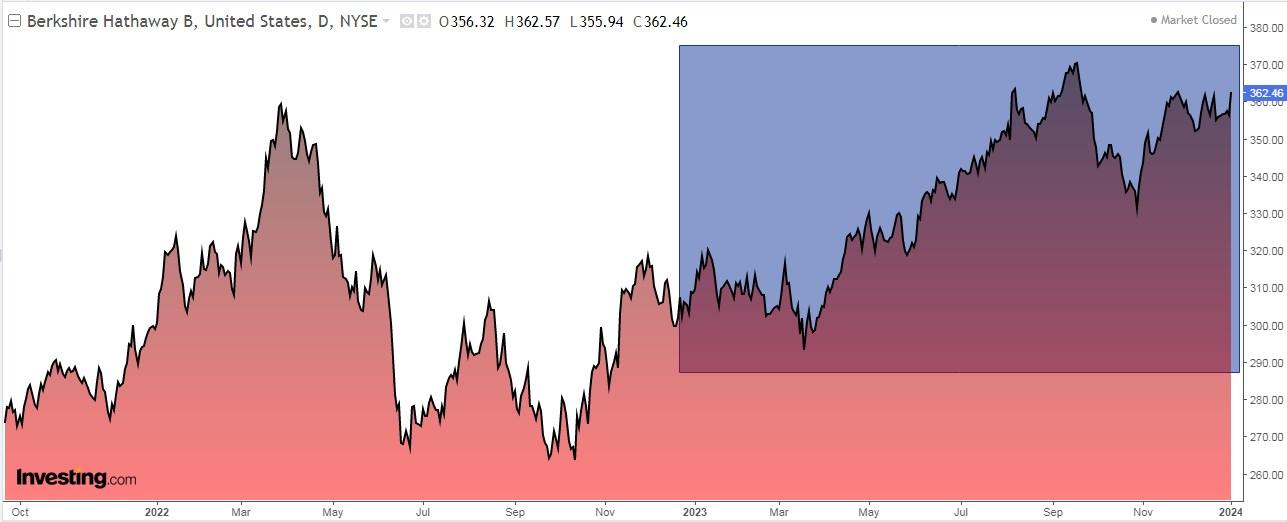

4. Berkshire Hathaway (NYSE:)

Berkshire Hathaway Stock Price Chart

Berkshire Hathaway Stock Price Chart

Berkshire Hathaway’s (NYSE:) Earnings are growing, with the after-tax operating earnings up nearly +20% in 2023. They could reach $40 billion this year, driven by higher interest income on cash.

The stock trades at about 18 times the projected earnings for the year. Class B shares, at $362, trade at a discount to Class A shares.

On February 26, their numbers and earnings per share are expected to increase by +8.62% and revenue by +2.86%. By 2024 the expected increase is +3.7% EPS.

Berkshire Hathaway Earnings

Source: InvestingPro

Its shares are up +16.98% in the last year and +5.68% in the last 3 months. The 12-month forward potential given by Investing’s model stands at $462.99.

Berkshire Hathaway Targets

Source: InvestingPro

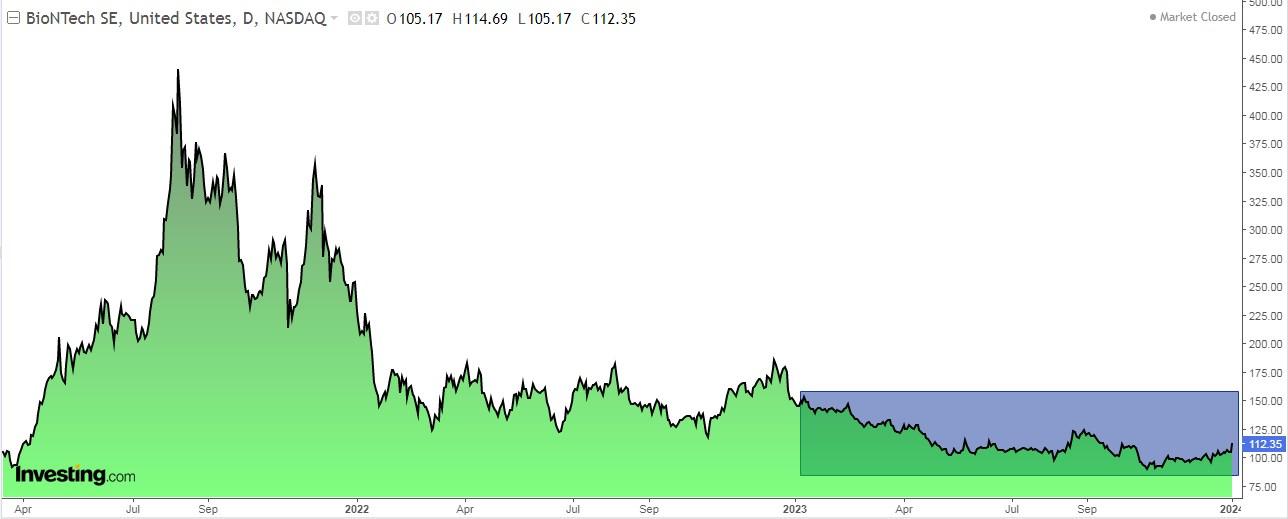

5. BioNTech

BioNTech Stock Price Chart

BioNTech Stock Price Chart

BioNTech (NASDAQ:), like all Covid vaccine makers, has been hit in 2023.

Covid vaccine suppliers, including BioNTech, its partner Pfizer (NYSE:), and competitor Moderna (NASDAQ:), have slumped amid growing doubts about demand for the shots.

However it is still expected to be profitable in 2024, and the company’s oncology-focused pipeline could prove more promising than some believe. Plus, it has plenty of cash, more than $18 billion.

On March 20, we will have its financial results. The ones it presented in November were tremendous with EPS up +200.5% and revenue up +15.5%.

BioNTech Earnings

Source: InvestingPro

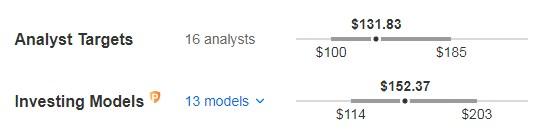

Market potential stands at $131.893, while InvestingPro models are more optimistic and see it at $152.37.

BioNTech Targets

Source: InvestingPro

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Join now for up to 50% off on our Pro and Pro+ subscription plans and never miss another bull market by not knowing which stocks to buy!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.