5 Key Charts for the Week Ahead in Financial Markets

2024.12.16 01:44

This week: euphoria, flows, expectations gaps, foreign flows, rate cut trading, bull markets, deleveraging, NVIDIA (NASDAQ:), Moore’s law, long-term equity risk premium.

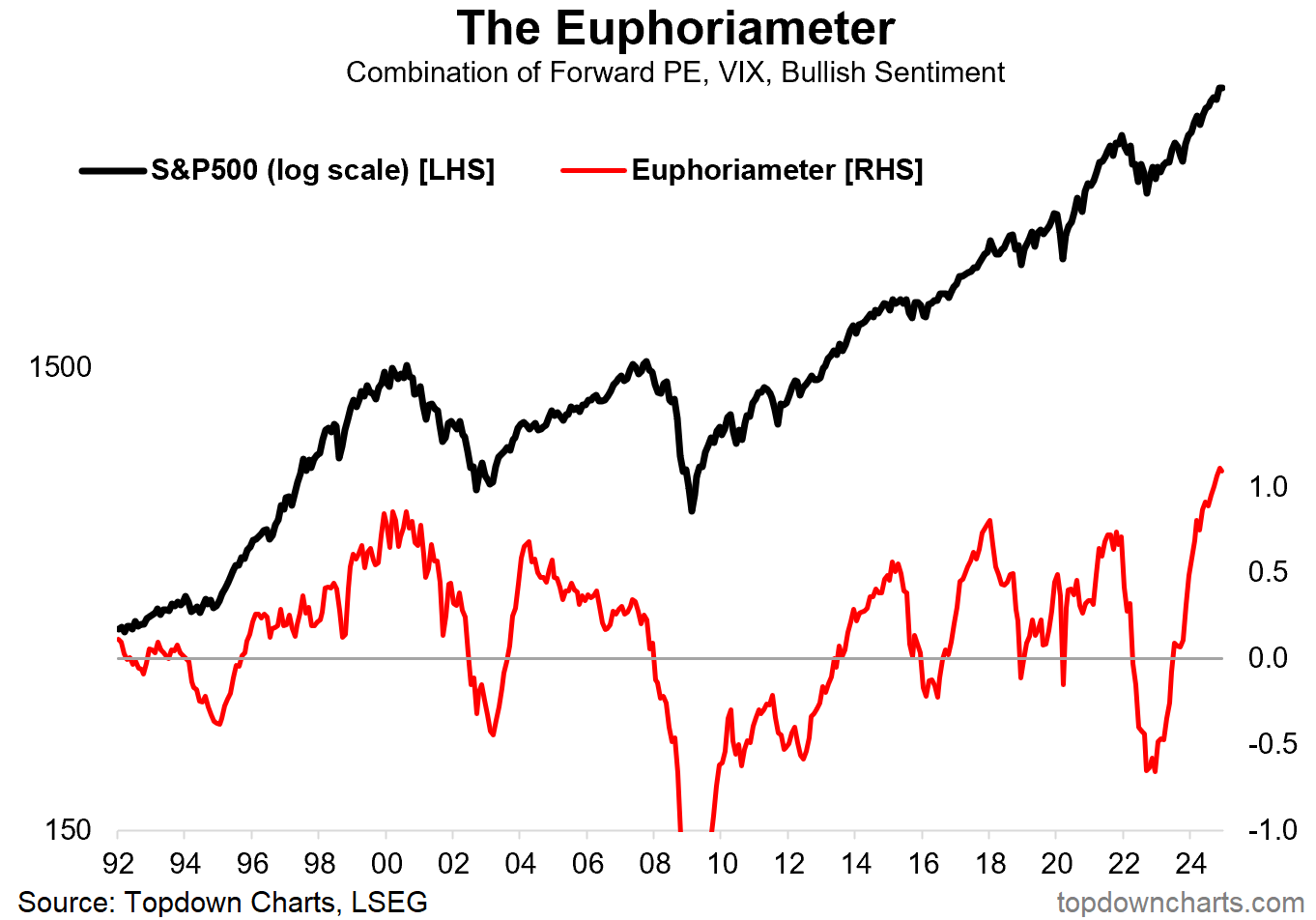

1. Peak Euphoria: Starting off with everyone’s favorite weird indicator —but a key difference this time after a string of back-to-back new all-time highs in this indicator, the flash December reading has come in ever so slightly lower than the November reading. One thing to note with indicators like this is that they send the most powerful signals when they reach an extreme and then turnaround — was November a climax in stock market euphoria?

Source: “What is the Euphoriameter?”

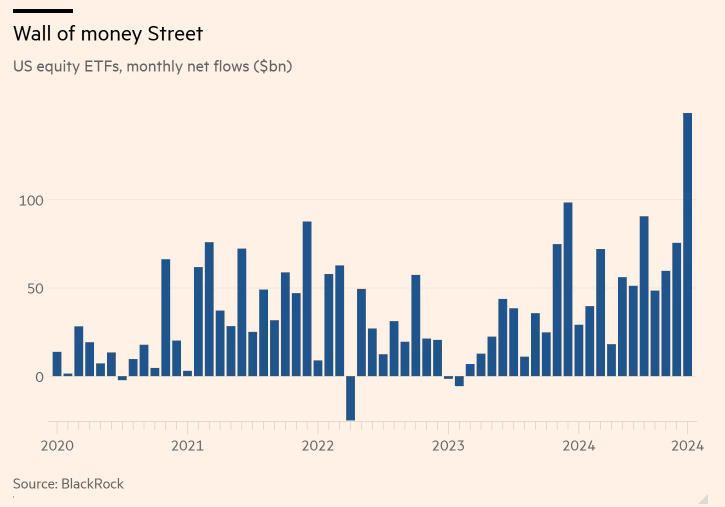

2. Fun Flows: Trumphoria saw record inflows into US equity ETFs during November. The crowd is voting with its feet in terms of the market outlook.

Source: @Barchart

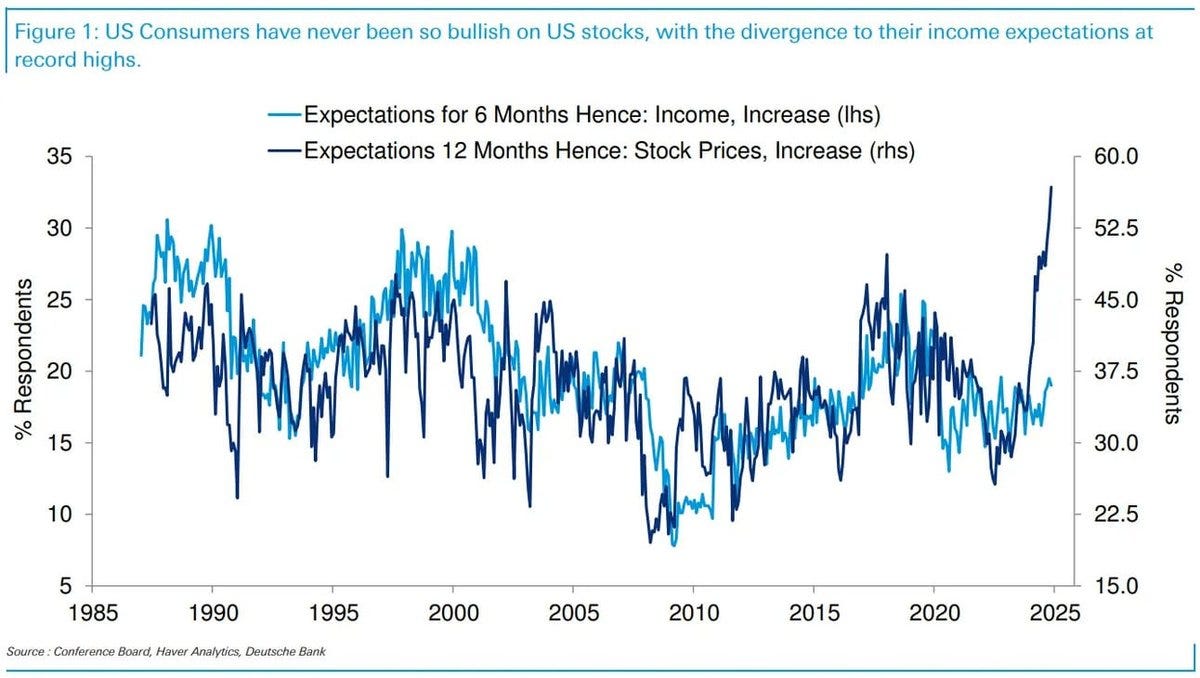

3. Expectations Gap: As I’ve previously documented, consumer expectations for the stock market are running at record highs. However, interestingly this stands at odds with consumer expectations for their own incomes. Makes you wonder how this expectations gap is going to close (are stock market expectations too frothy, or is the real economy about to surge?).

Source: @dailychartbook

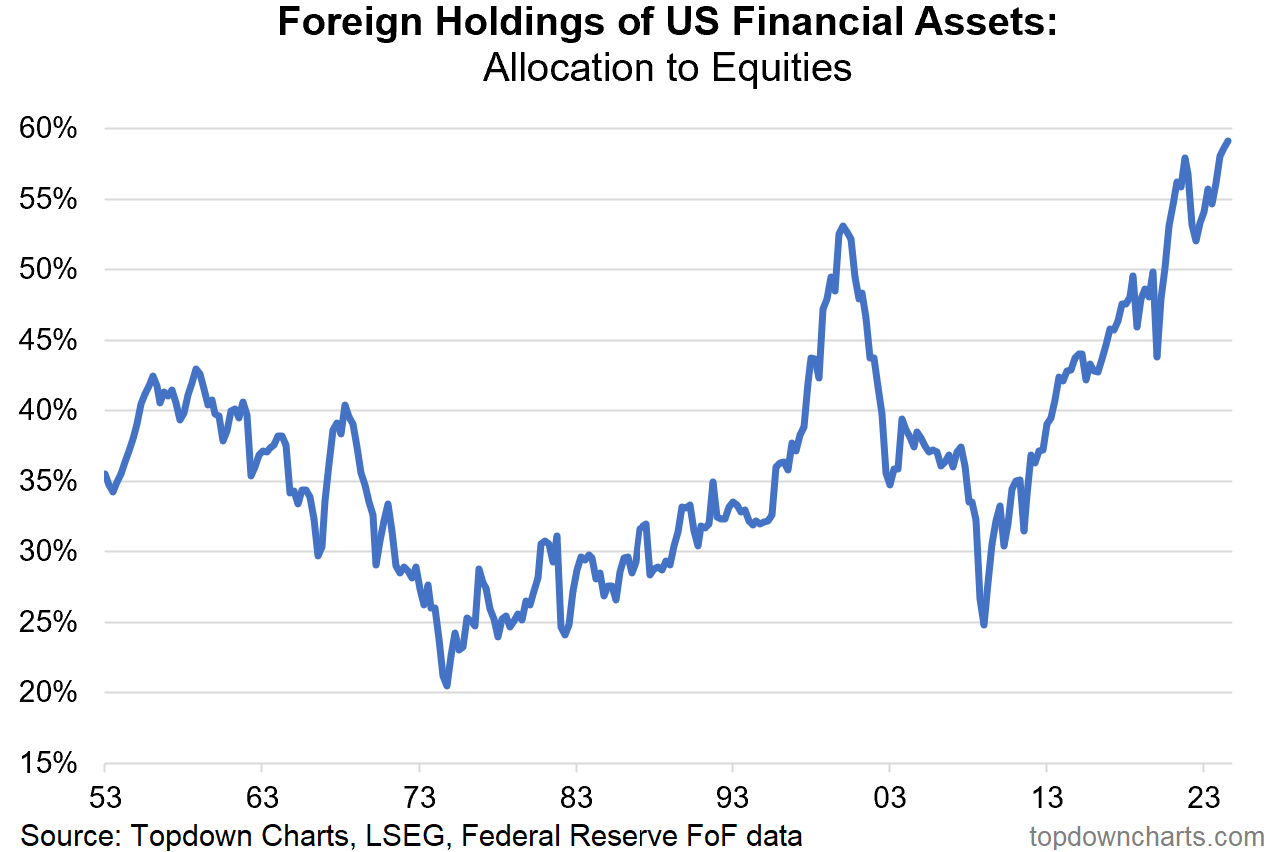

4. Foreign Fervor: Foreigners are rotating more and more into US equities. Another record high on this indicator in Q3. Compare and contrast the heights of the dot com bubble vs the depths of the financial crisis in terms of what this chart means.

Source: Topdown Charts+ Topdown Charts Professional

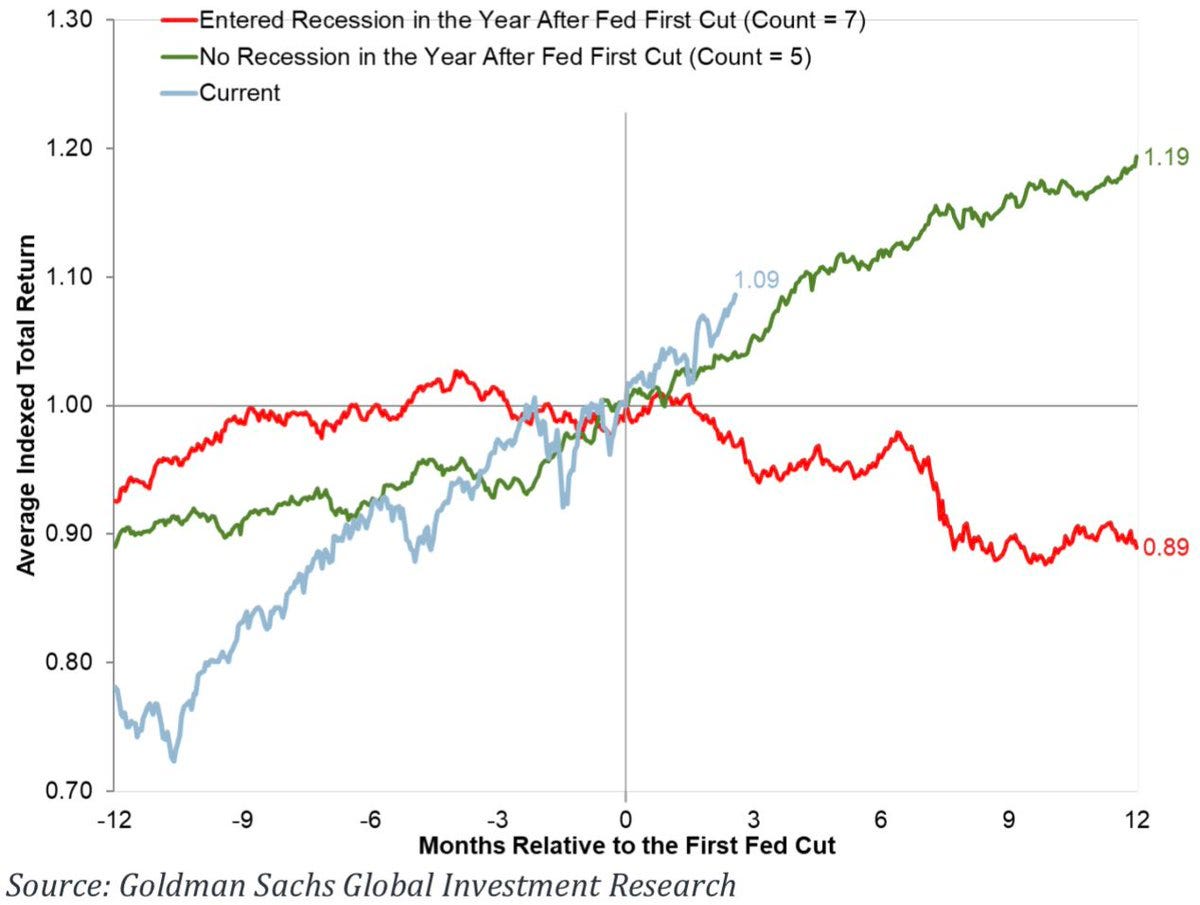

5. Rate Cut Trading: This chart shows the average path of markets before and after the first Fed rate cut when a recession happened (red line) and when one did not happen directly after the Fed began rate cuts (green line). For now the current path of markets is consistent with the “no recession” line. In other words, the market is trading as if this is a non-recessionary rate cut. And if true, that’s bullish, it would mean more upside to come.

Source: @Marlin_Capital

Original Post