5 Incredibly Cheap China Tech Stocks Worth Buying as Shares Bounce Back

2024.05.08 06:10

Investors seeking opportunities in the Chinese market may find value in several underpriced stocks that have the potential to deliver substantial returns in the long run as the sector makes a comeback following its year-long selloff.

Indeed, the KraneShares CSI China Internet ETF (NYSE:), which is composed of securities of U.S.-listed Chinese software and information technology stocks, has surged 22% over the past three months to reach a fresh 2024 high.

Source: Investing.com

Amidst a backdrop of fading regulatory challenges and easing macroeconomic headwinds, companies like Alibaba (NYSE:), PDD Holdings (NASDAQ:), NetEase (NASDAQ:), JD (NASDAQ:).com, and Baidu (NASDAQ:) stand out as compelling investment options.

Despite recent volatility and uncertainty, these companies possess strong fundamentals, innovative business models, and growth prospects that could drive their stock prices higher in the coming months.

By the way, you too can harness the power of InvestingPro to pick out sold stocks poised for long-term growth.

Our predictive AI stock-picking tool can prove a game-changer in that respect. For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells, giving you a significant edge over the market.

Subscribe now and position your portfolio one step ahead of everyone else!

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Now, using the power of InvestingPro, let’s delve deeper into what makes these five bargain-priced Chinese tech giants stand out.

1. Alibaba

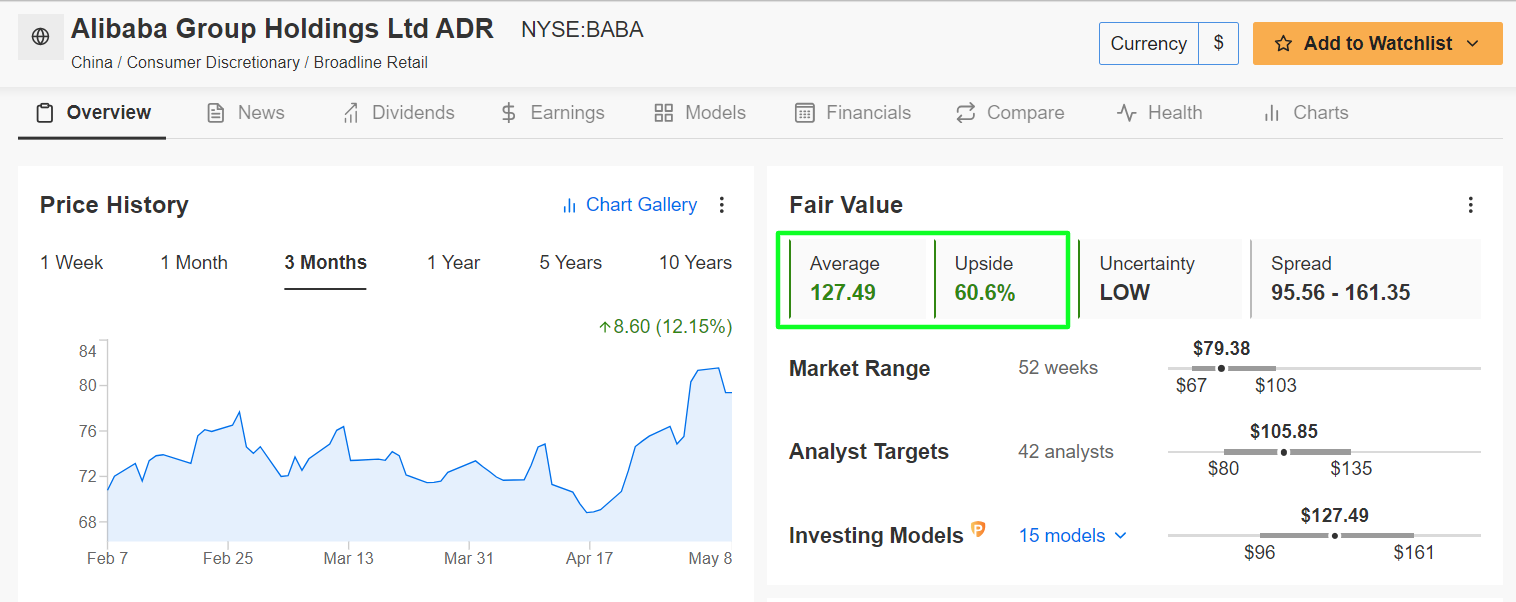

- Tuesday’s Closing Price: $79.38

- Fair Value Estimate: $127.49 (+60.6% Upside)

- Market Cap: $193.1 Billion

Alibaba, a global leader in e-commerce, cloud computing, and digital entertainment, continues to dominate China’s tech industry and online retail market.

With a diverse ecosystem of platforms including Taobao and Tmall, Alibaba benefits from the increasing adoption of e-commerce and digital payments in China. In addition, the company’s cloud computing division, Alibaba Cloud, is a major player in the global cloud services market and contributes to its diversified revenue streams.

Despite recent regulatory scrutiny and macro challenges, Alibaba’s robust business model, ongoing restructuring efforts, and strong revenue growth potential make it an attractive long-term investment.

Tailwinds such as the ongoing digitalization of the Chinese economy and the company’s strategic investments in areas like cloud computing, artificial intelligence, and logistics further support its growth trajectory.

‘Fair Value’ Price Target: It is worth noting that current ‘Fair Value’ estimates indicate BABA stock is trading at an extremely cheap valuation. InvestingPro’s AI models predict a 60.6% potential upside from the current market value of $79.38.

Source: InvestingPro

That would bring shares closer to their ‘Fair Value’ price target of $127.49.

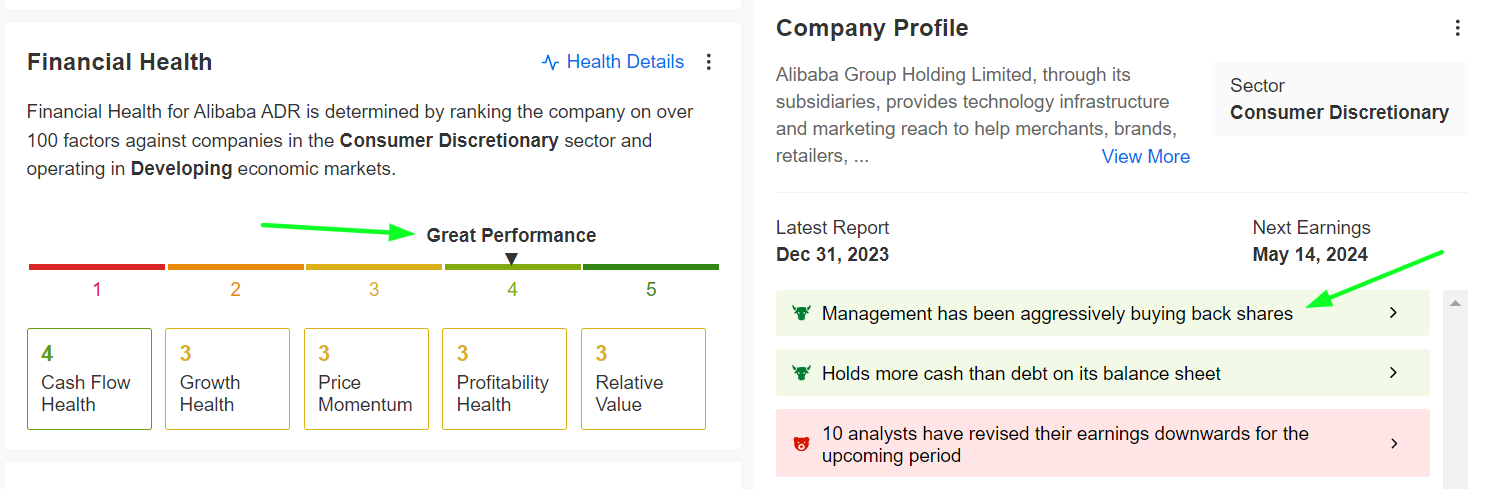

ProTips Headwinds: ProTips paints a bullish picture of Alibaba’s financial health, highlighting its strong balance sheet and robust profitability outlook.

Source: InvestingPro

ProTips also mentions that management has been aggressively buying back shares thanks to increasing free cash flow levels. The company announced a $25 billion share repurchase program in conjunction with its Q3 results in February.

2. PDD Holdings

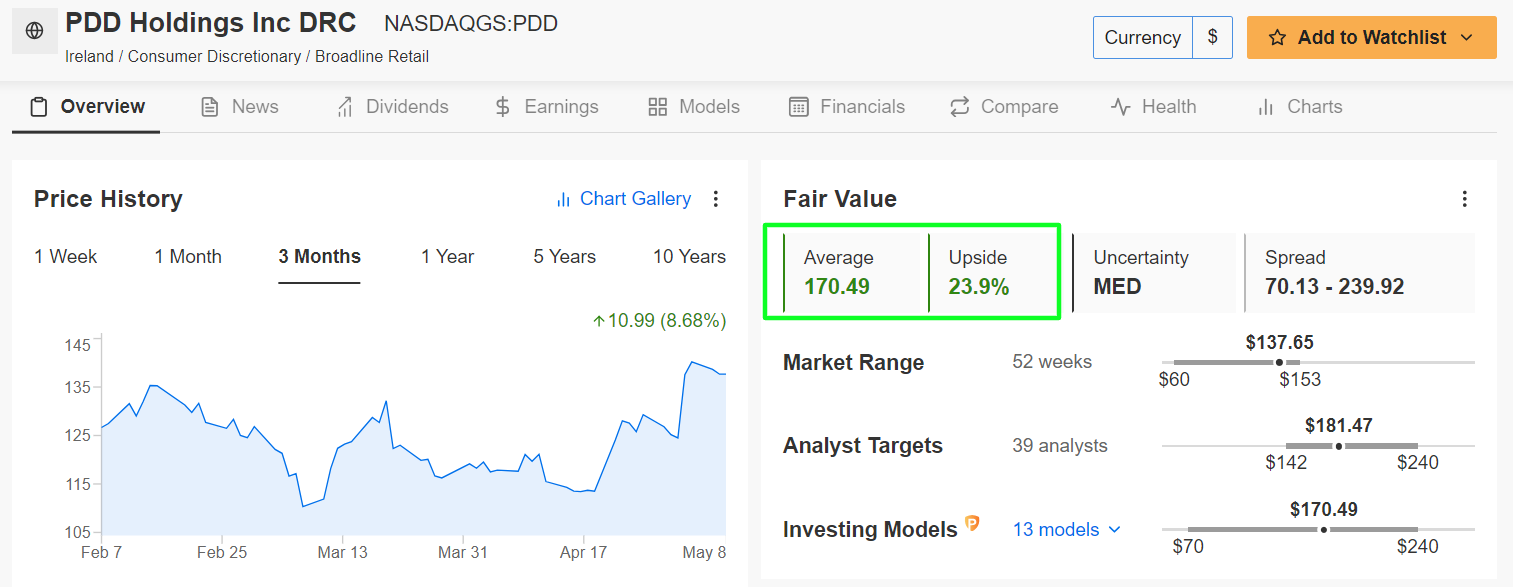

- Tuesday’s Closing Price: $137.65

- Fair Value Estimate: $170.49 (+23.9% Upside)

- Market Cap: $191.1 Billion

PDD Holdings, which operates the Pinduoduo (NASDAQ:) and Temu online marketplaces, has emerged as a disruptive force in China’s e-commerce landscape, leveraging social commerce and group buying to attract a large user base.

The e-commerce holding company, known for its innovative approach to online shopping, has carved a niche with its focus on value-conscious consumers and has been successful in grabbing market share from chief rivals Alibaba and JD.com.

Despite facing regulatory challenges, PDD’s innovative business model and robust supply chains position it favorably for long-term success.

As China’s middle-class population continues to expand and consumer preferences evolve, PDD stands to benefit from increased spending on online shopping and entertainment.

‘Fair Value’ Price Target: The AI-powered quantitative models in InvestingPro point to a gain of 23.9% in PDD stock from Tuesday’s closing price of $137.65, aligning it with its ‘Fair Value’ price target estimated at $170.49 per share.

Source: InvestingPro

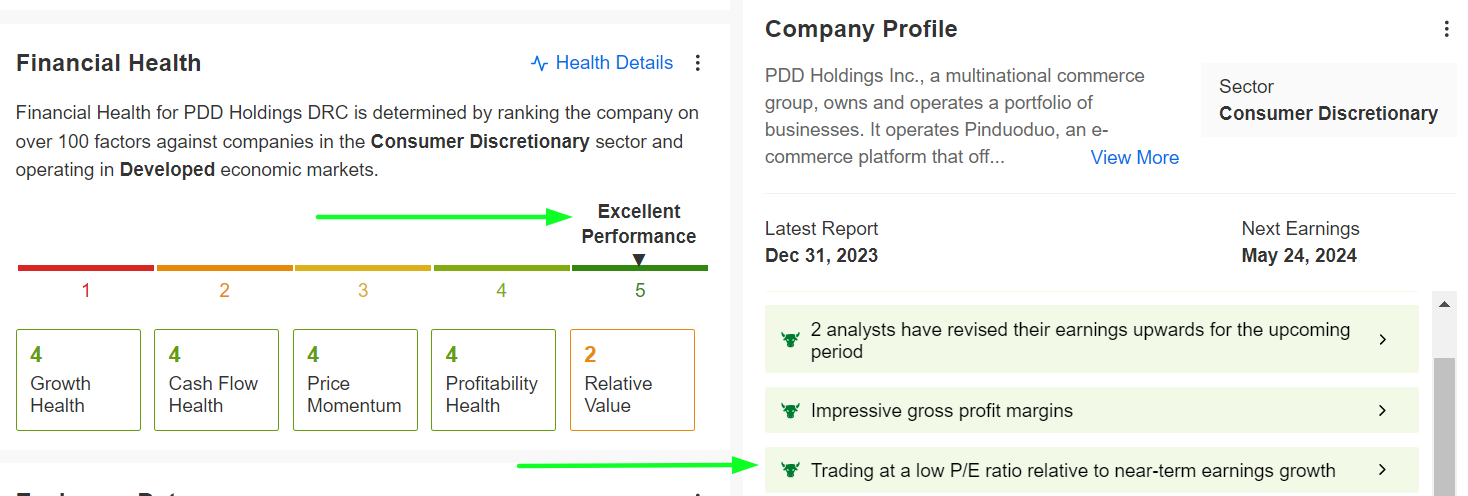

ProTips Headwinds: As InvestingPro points out, PDD Holdings trades at a low forward price-to-earnings (P/E) ratio relative to near-term earnings growth, implying an inexpensive valuation.

Source: InvestingPro

Additional factors that would help push the e-commerce giant forward include rising net income prospects, improved profitability trends, and a healthy sales growth outlook.

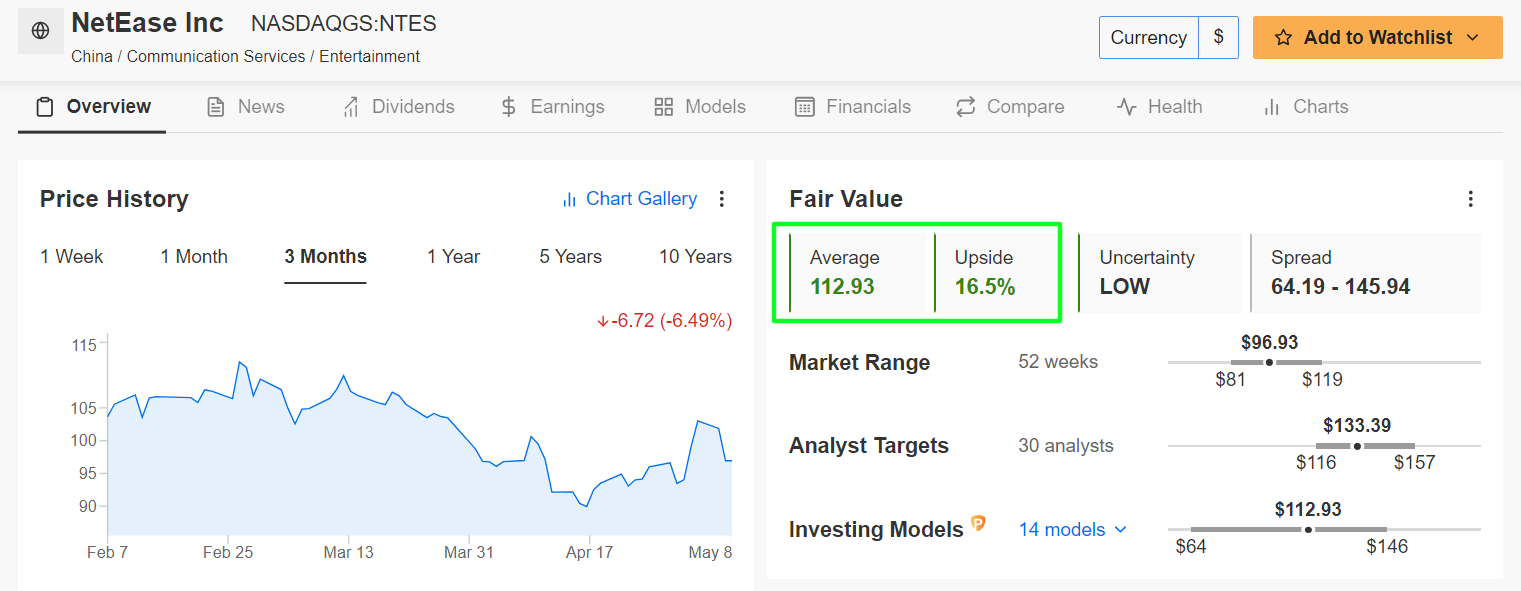

3. NetEase

- Tuesday’s Closing Price: $96.93

- Fair Value Estimate: $112.93 (+16.5% Upside)

- Market Cap: $62.5 Billion

NetEase, a leading provider of online gaming, e-commerce, and various internet-based services in China, boasts a diverse portfolio of products and a loyal customer base.

The Chinese internet technology firm is renowned for its gaming division, which develops and publishes a wide range of popular titles for PC and mobile platforms.

In addition to gaming, NetEase provides a wide variety of internet services such as advertising, music streaming, and online education.

With the continued growth of China’s gaming market and the expansion of its e-commerce business, NetEase is well-positioned to capitalize on emerging opportunities.

The company’s strong track record of developing popular gaming titles and innovative online platforms has helped it maintain a competitive edge in the fast-paced tech industry.

‘Fair Value’ Price Target: The present valuation of NTES suggests it is a bargain, as indicated by the InvestingPro AI models.

Source: InvestingPro

There’s a possibility of a 16.5% increase from last night’s closing price of $96.93, moving it closer to its ‘Fair Value’ set at $112.93 per share.

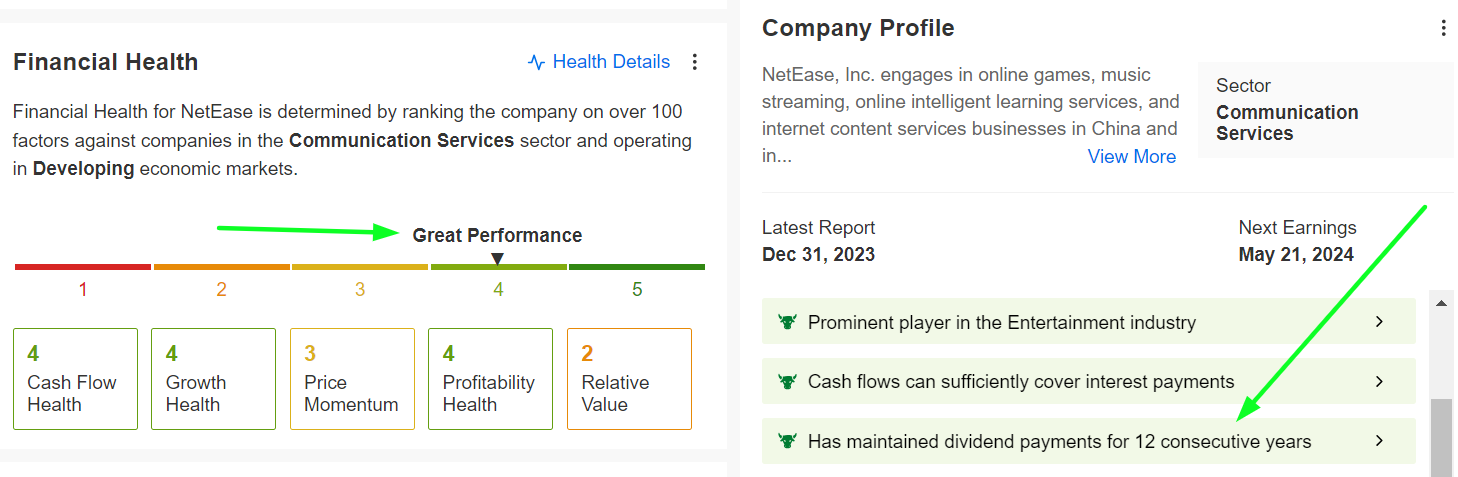

ProTips Headwinds: ProTips paints a fairly positive picture of NetEase’s financial health, highlighting its strong balance sheet and high free cash flow levels. It also boasts a relatively cheap valuation.

Source: InvestingPro

ProTips also mentions that the company has maintained its annual dividend payout for 12 consecutive years, a testament to its ongoing efforts to return capital to shareholders.

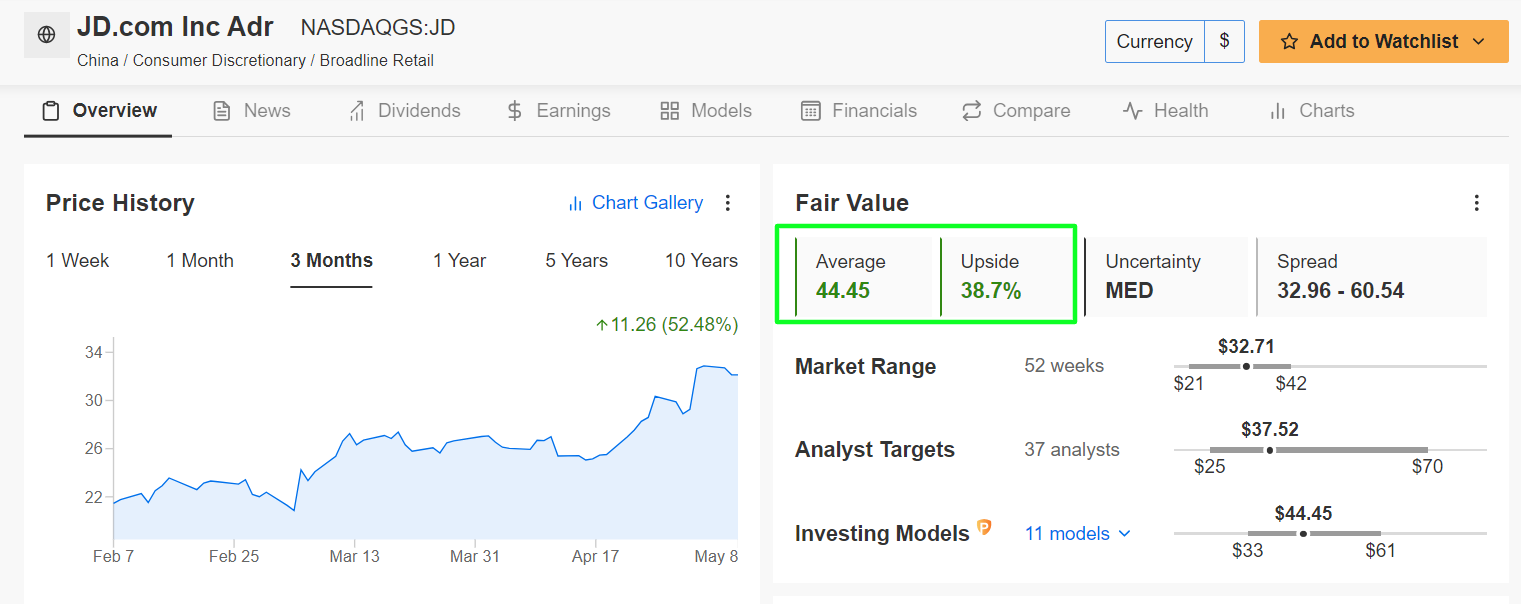

4. JD.com

- Tuesday’s Closing Price: $32.13

- Fair Value Estimate: $44.45 (+38.7% Upside)

- Market Cap: $49.2 Billion

JD.com, China’s largest online retailer by revenue, has established itself as a leader in the country’s e-commerce sector, offering a wide range of products across various categories, including electronics, apparel, home goods, and more.

The online retailer’s emphasis on quality control, authenticity, and customer service helps distinguish it from its rivals in the highly competitive e-commerce market. In addition to its core e-commerce business, JD.com has expanded into other areas such as cloud computing, finance, and AI.

Despite facing increased competition and regulatory scrutiny, JD.com continues to innovate and expand its market reach through strategic partnerships and investments. The tech company also operates its own logistics network, allowing for fast and reliable delivery to customers across China.

Looking ahead, JD.com’s focus on technology-driven solutions and customer satisfaction bodes well for its long-term growth prospects.

‘Fair Value’ Price Target: According to the AI-powered models in InvestingPro, JD stock is presently priced well below its ‘Fair Value’ estimate.

Source: InvestingPro

Anticipated growth of 38.7% from Tuesday’s closing price of $32.13 could bridge the gap to $44.45 per share.

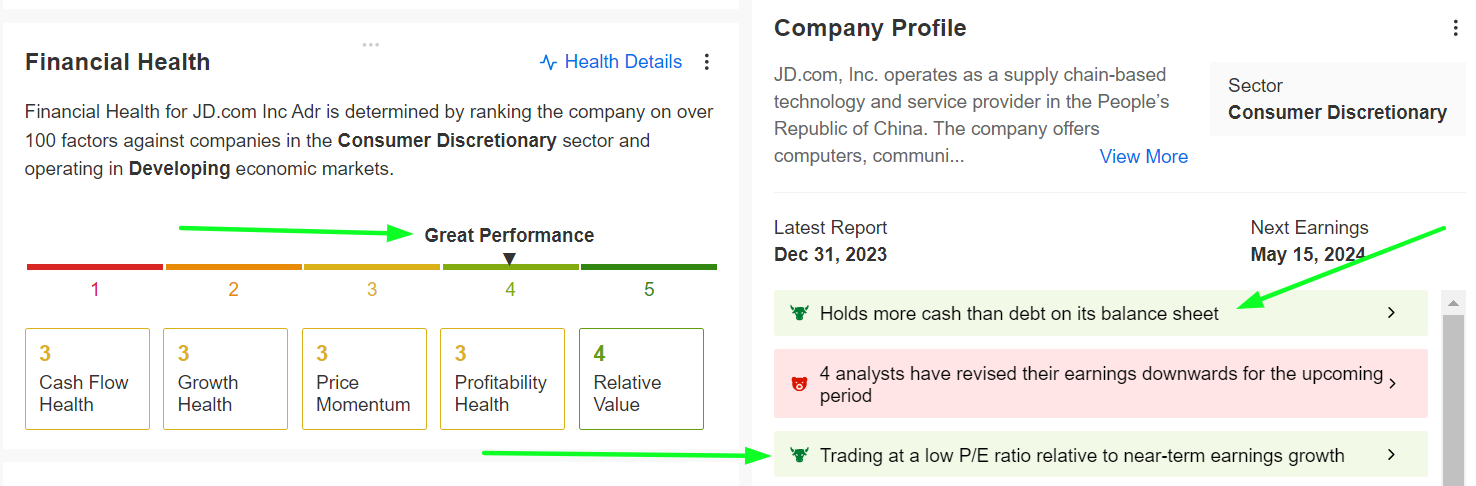

ProTips Headwinds: InvestingPro’s ProTips highlights several positive trends JD.com has working in its favor, including rising net income prospects, improved profitability trends, and a strong balance sheet. It also presents an attractive valuation proposition.

Source: InvestingPro

Furthermore, ProTips also mentions that the company has been boosting efforts to return capital to stockholders by using share buybacks. Management announced recently that it had repurchased $1.2 billion worth of stock in the first quarter of 2024.

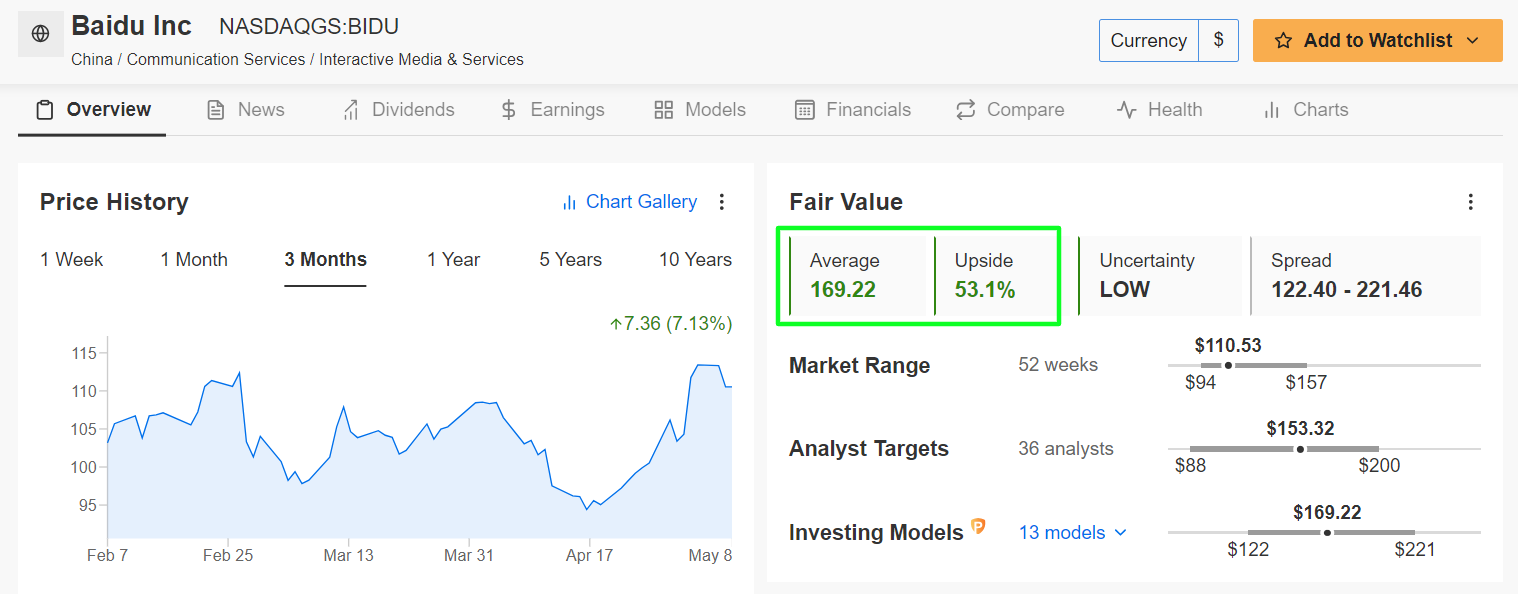

5. Baidu

- Tuesday’s Closing Price: $110.53

- Fair Value Estimate: $169.22 (+53.1% Upside)

- Market Cap: $38.7 Billion

Baidu, often referred to as China’s Google (NASDAQ:), provides a wide range of products and services, including internet search, online advertising, cloud computing, and autonomous driving. Its flagship product, the Baidu search engine, is one of the most widely used search platforms in China, providing users with access to a vast array of online information.

Baidu is also a major player in the field of artificial intelligence, with initiatives ranging from AI-powered voice assistants to autonomous driving technology. Additionally, the tech juggernaut operates various online platforms and services, including digital maps, cloud storage, and online video streaming.

Despite facing several challenges in the advertising market and increased competition from rivals as well as regulatory and macro headwinds, Baidu remains a key player in China’s digital ecosystem.

With its increasing focus on AI-driven innovation and strategic investments in emerging technologies, Baidu is well-positioned to capitalize on the growing demand for digital solutions in China.

‘Fair Value’ Price Target: As per the InvestingPro AI-backed model, BIDU stock is currently priced at a substantial discount.

Source: InvestingPro

There’s potential for a 53.1% climb from Tuesday’s closing price of $110.53, bringing it towards its ‘Fair Value’ estimate of $169.22 per share.

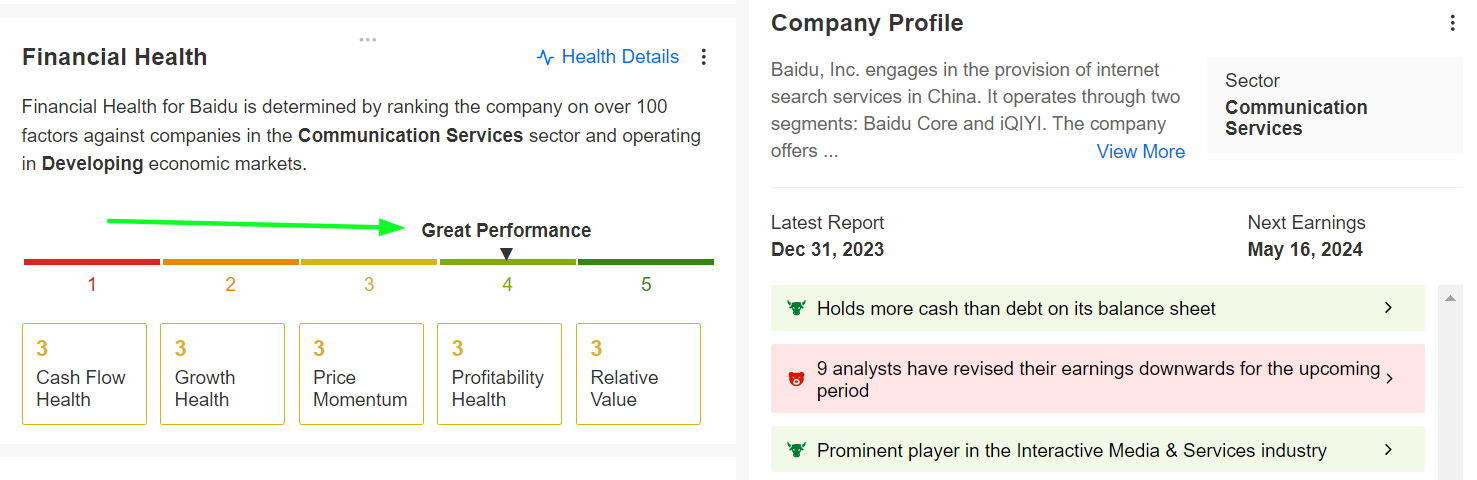

ProTips Headwinds: InvestingPro’s ProTips underscore Baidu’s promising outlook, emphasizing its favorable positioning in the Interactive Media & Services industry, which has allowed it to leverage a resilient business model and strong sales growth. Source: InvestingPro

Source: InvestingPro

In addition, shares of the internet search engine and AI technology company are bargain-priced at less than ten times this year’s projected earnings, making it an ideal long-term investment.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation and high interest rates.

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See the stocks Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.