5 Charts to Understand the Fed’s Liquidity Injection and Its Effect on Markets

2023.03.27 11:29

In this week’s newsletter, we’re going to run through several interesting market charts on our radar…

Let’s dive right in.

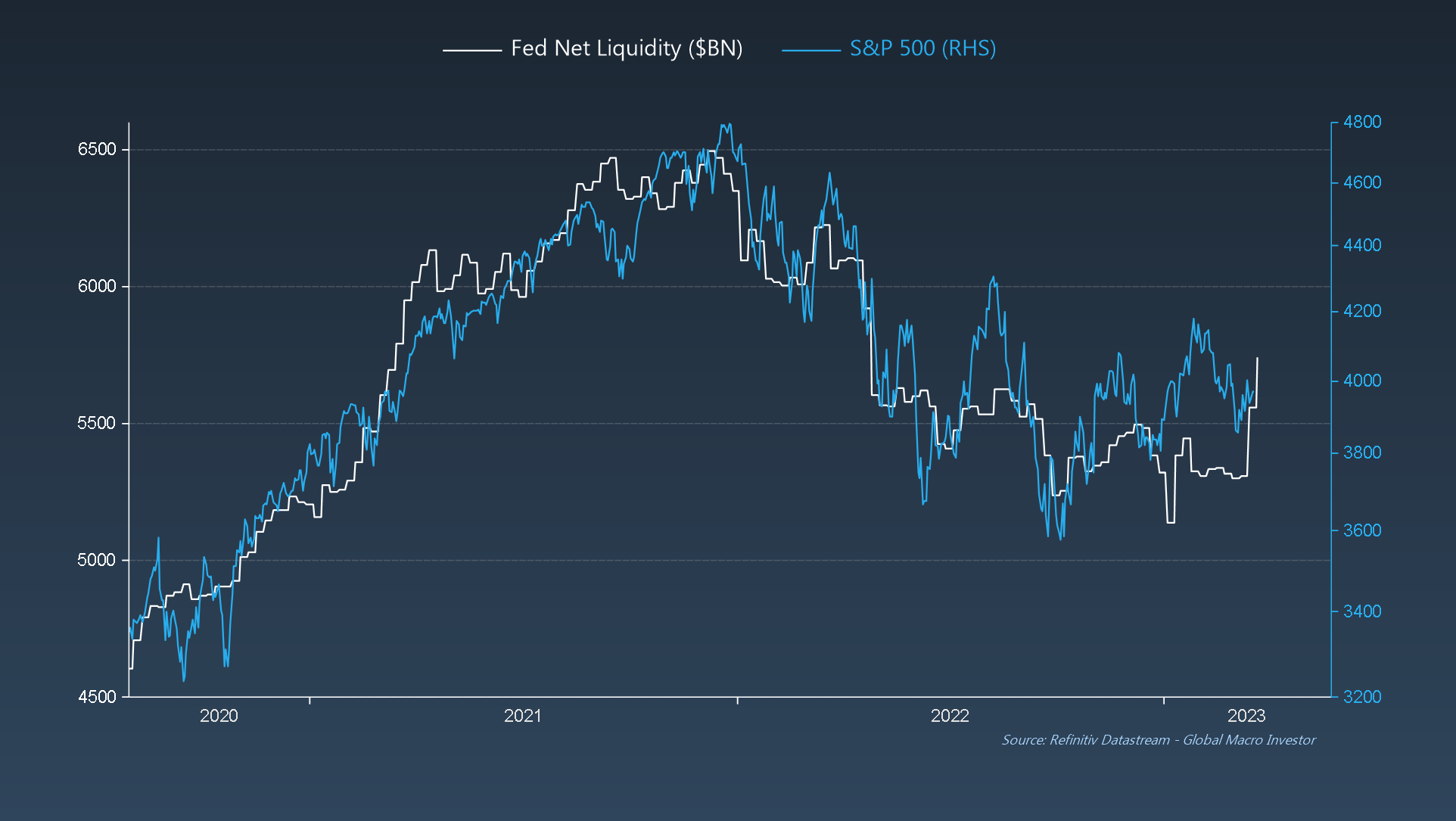

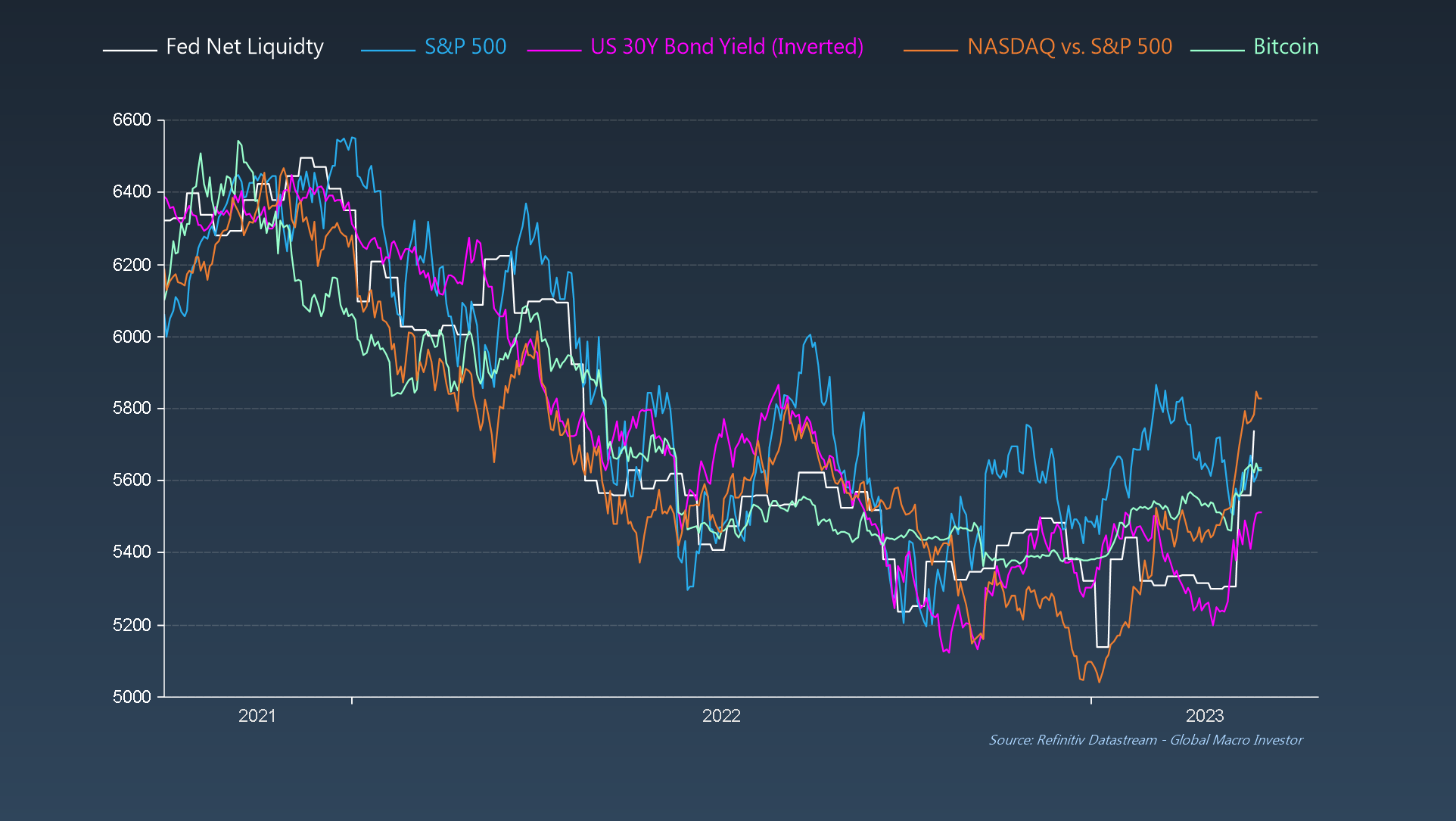

GMI Chart 1 – Fed Net Liquidity vs. S&P 500

Another week, another EXPLOSION in Fed liquidity as we have been expecting. We have now erased eleven months of QT in less than two weeks with a $434 billion dollar injection. Boom!

Fed Net Liquidity vs. S&P 500

Fed Net Liquidity vs. S&P 500

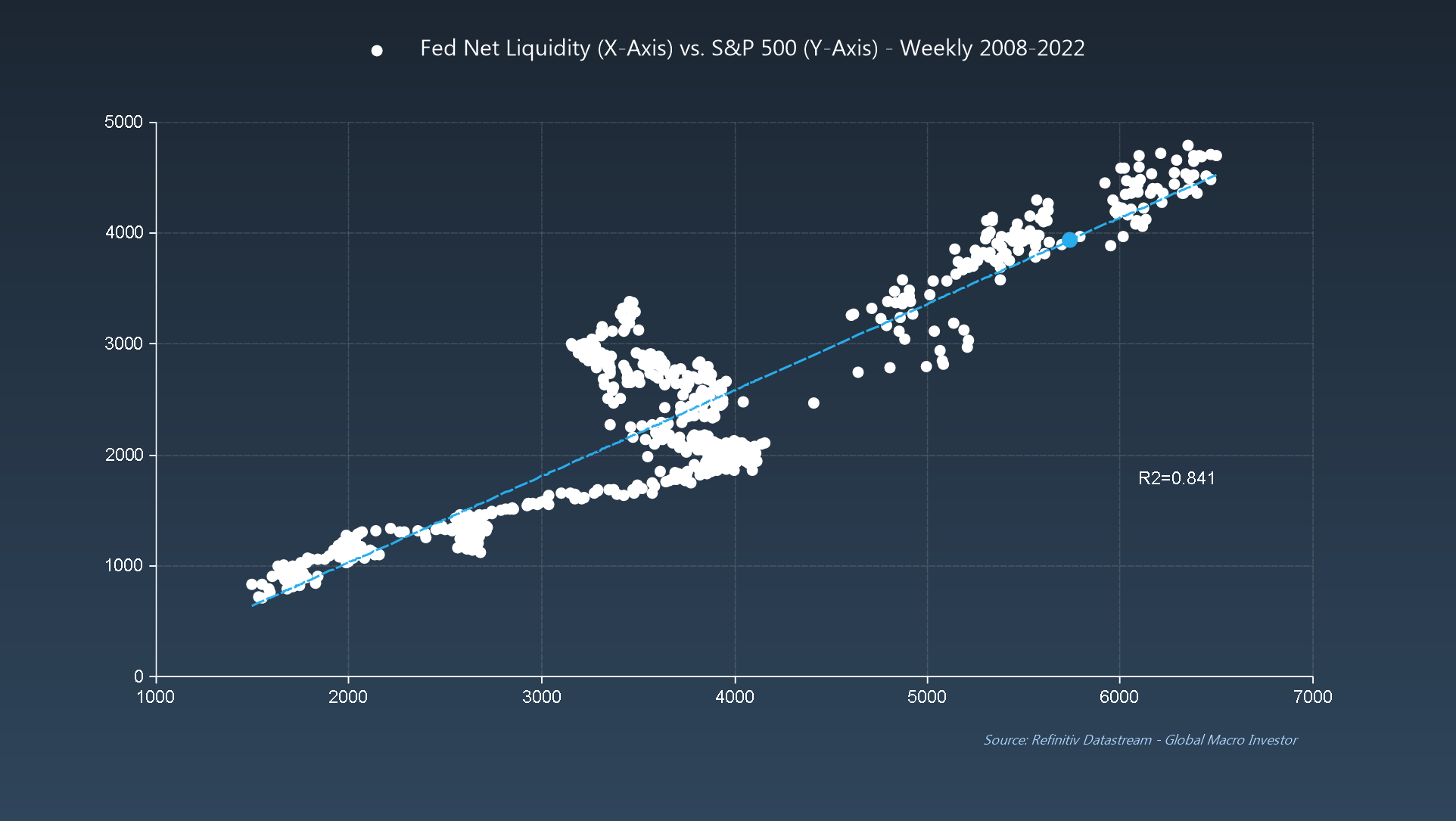

GMI Chart 2: Fed Net Liquidity vs. S&P 500 (Scatter Chart)

The surge in liquidity also means that the is back to trading bang on fair value versus domestic liquidity implied fair value conditions; liquidity is the only thing that matters for risk assets right now.

Fed Net Liquidity vs. S&P 500 Weekly

Fed Net Liquidity vs. S&P 500 Weekly

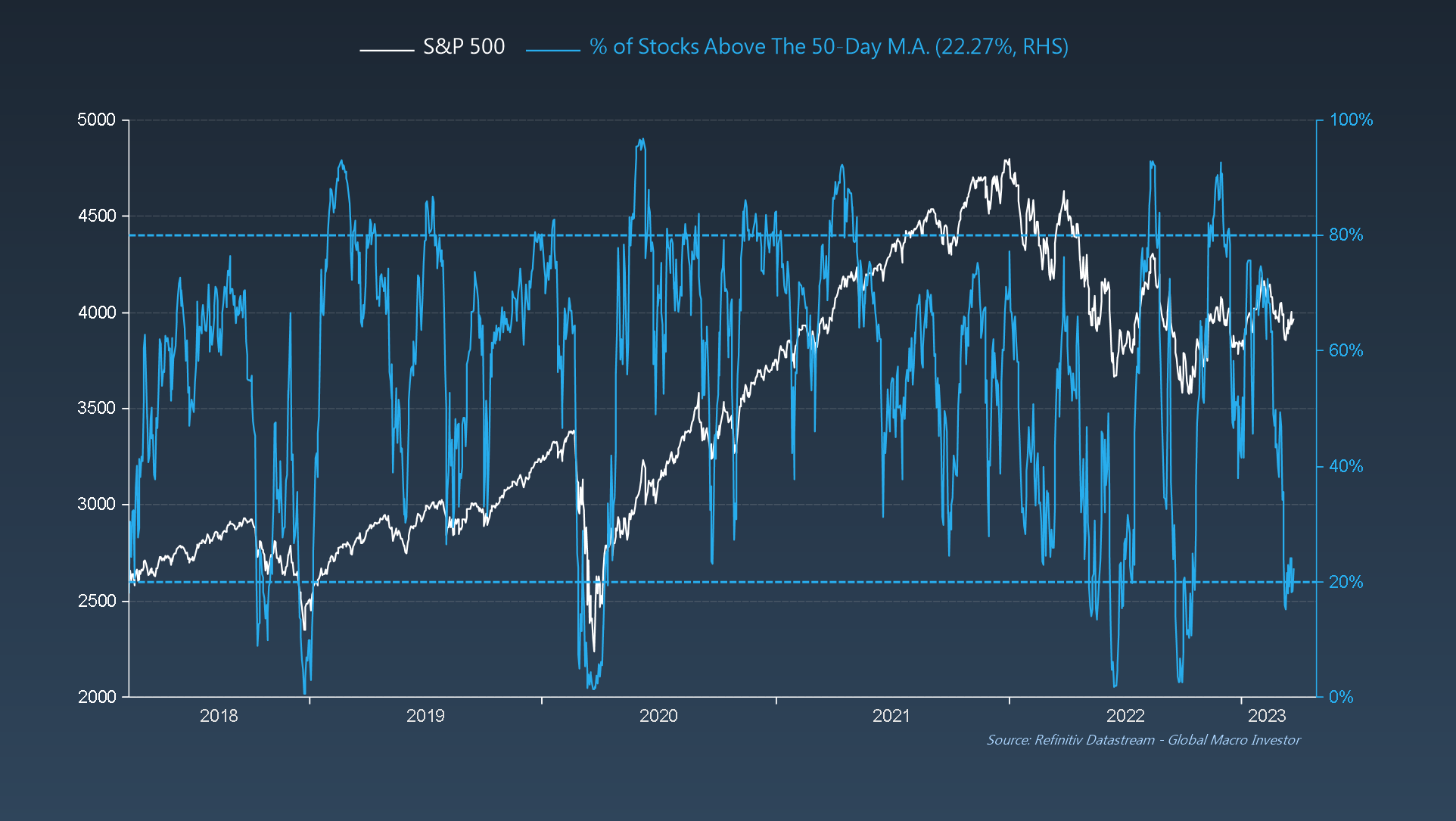

GMI Chart 3: S&P 500 with % of Stocks Above the 50-Day Moving Average

Additionally, the S&P 500 is also back to being oversold on a number of metrics:

- 1. The % of stocks trading above the 50-day moving average fell below the 20% threshold this week:

S&P 500 Vs. % of Stocks Above 50-Day Moving Average

S&P 500 Vs. % of Stocks Above 50-Day Moving Average

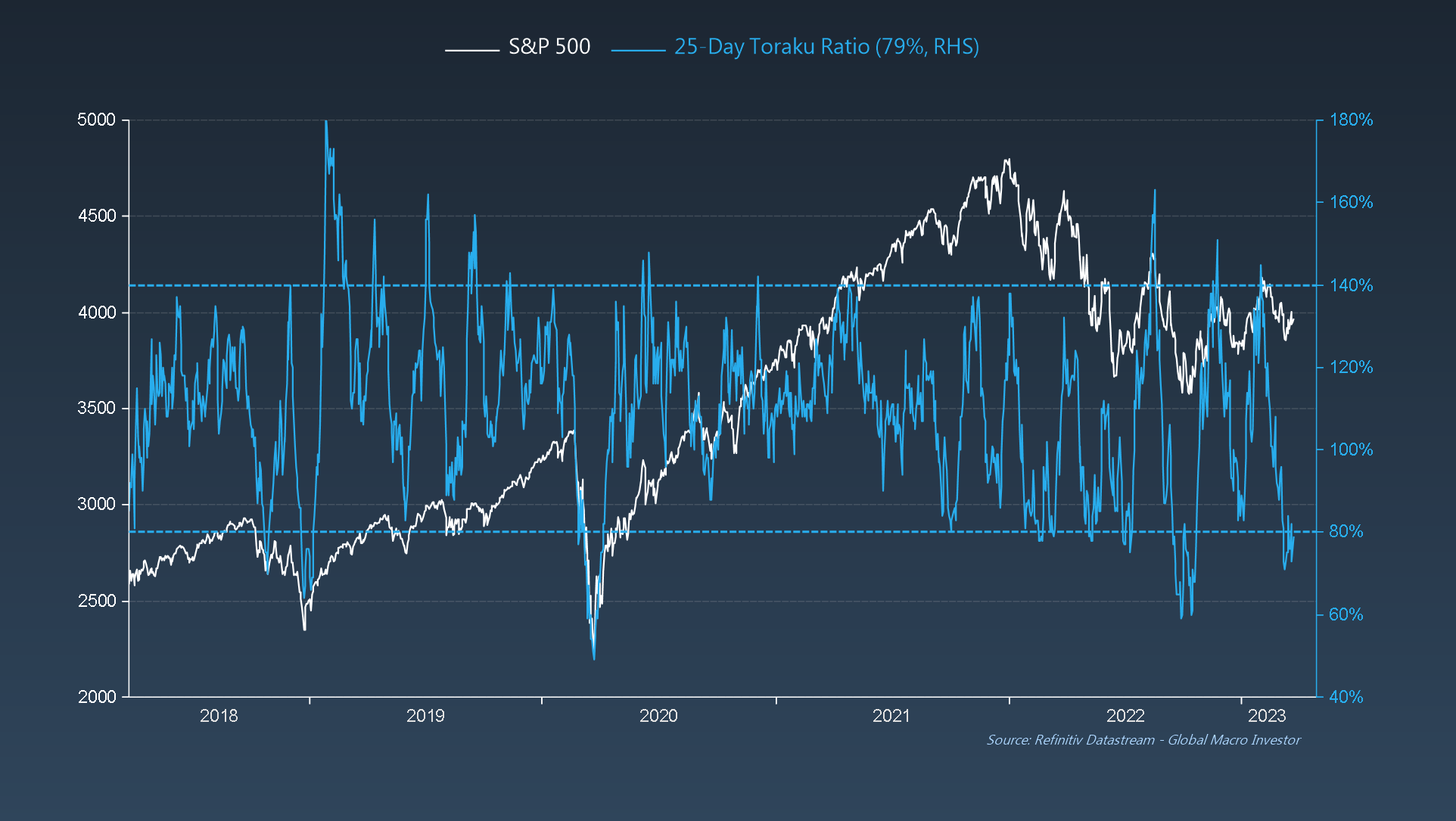

- 2. The 25-Day Toraku Ratio is also back in oversold territory after signaling overbought back at the beginning of February – currently the most oversold since October of last year.

S&P 500 vs. 25-Day Toraku Ratio

S&P 500 vs. 25-Day Toraku Ratio

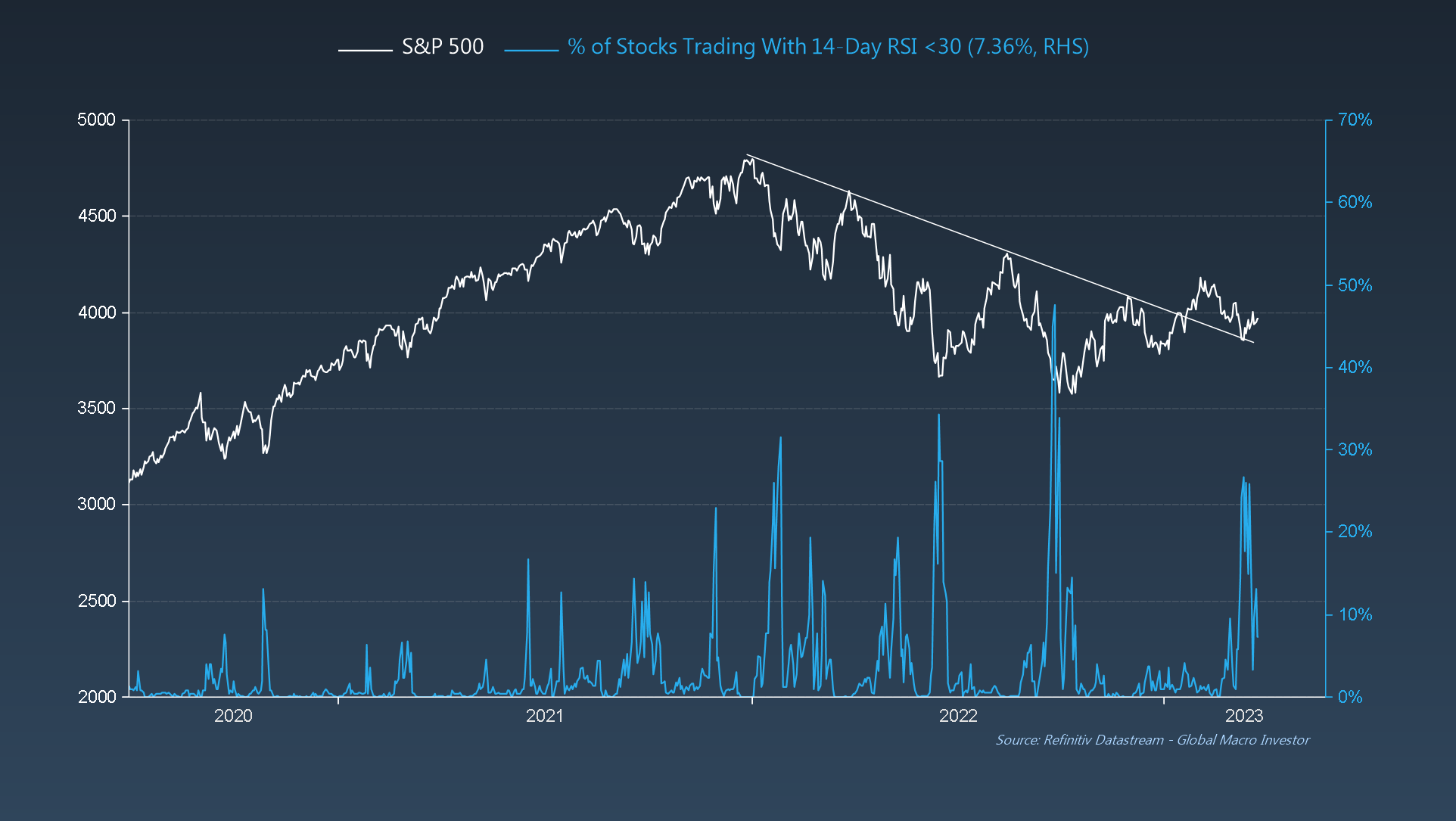

- 3. The % of stocks trading with a 14-day RSI less than 30 rose to 27% last week, which triggered right on key support for the S&P 500. We think it holds. Let’s see:

S&P 500 vs. % of Stocks With a 14-day RSI Below 30

S&P 500 vs. % of Stocks With a 14-day RSI Below 30

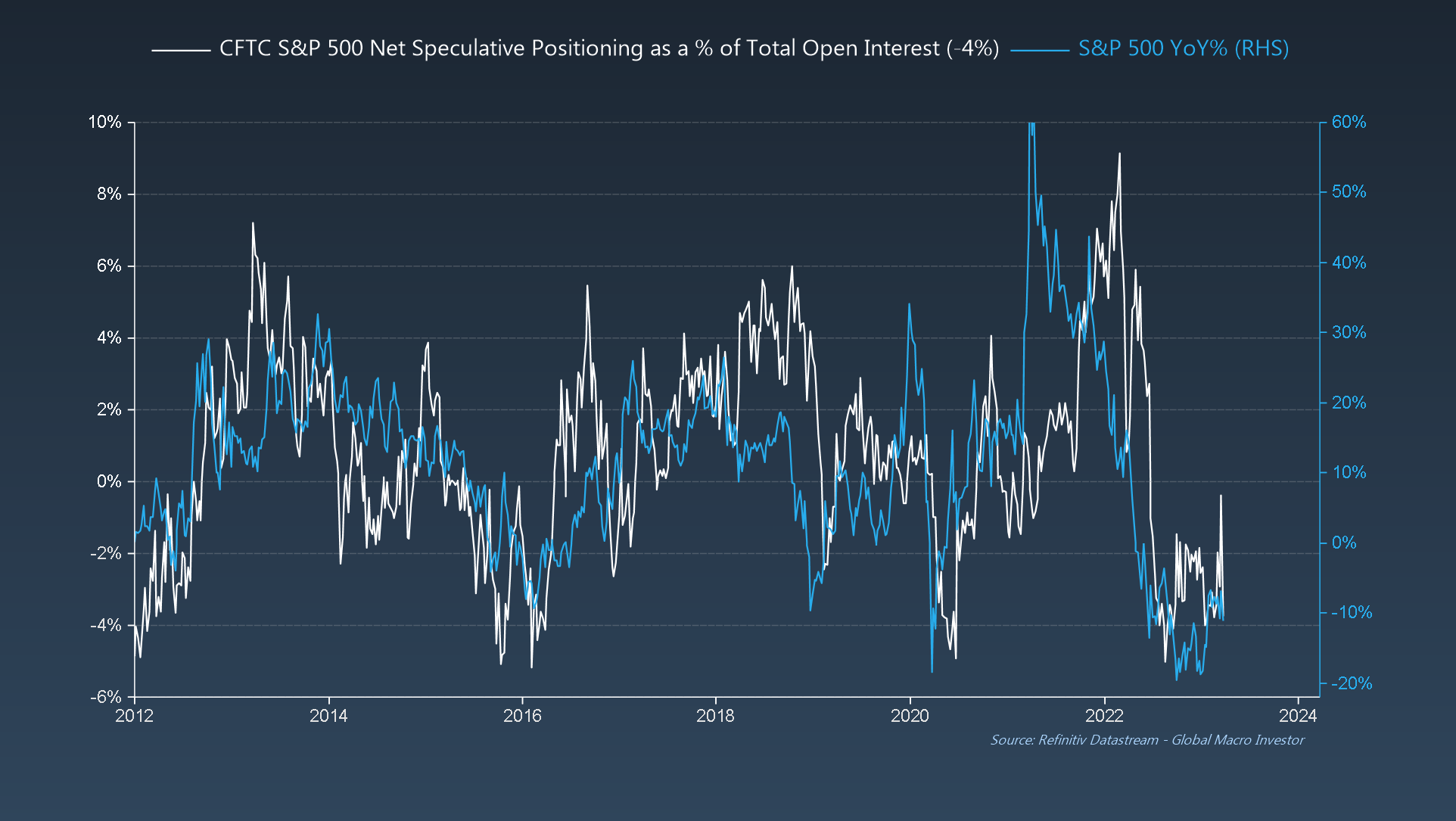

GMI Chart 4: CFTC S&P 500 Net Speculative Positioning as a % of Total OI vs. S&P 500 YoY%

Also, speculators remain very short the S&P 500 at -4% of total open interest.

CFTC S&P 500 Net Speculative Positioning vs. S&P 500 YoY%

CFTC S&P 500 Net Speculative Positioning vs. S&P 500 YoY%

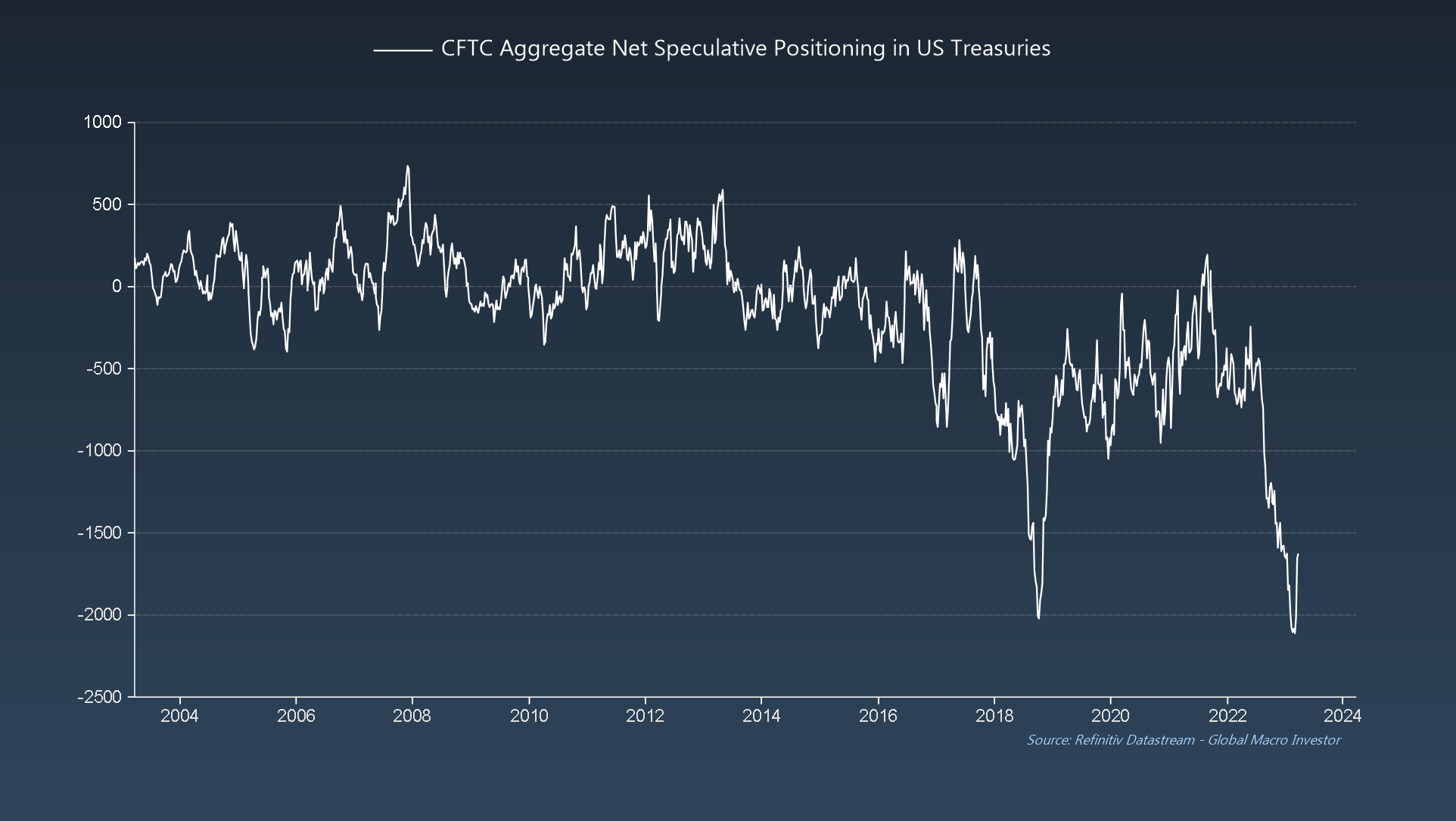

GMI Chart 5: CFTC Aggregate Net Speculative Positioning in US Treasuries

… and it’s the same when we look at bonds – still near record short. Fuel for the fire!

CFTC Aggregate Net Speculative Positioning in US Treasuries

CFTC Aggregate Net Speculative Positioning in US Treasuries

The GMI Big Picture

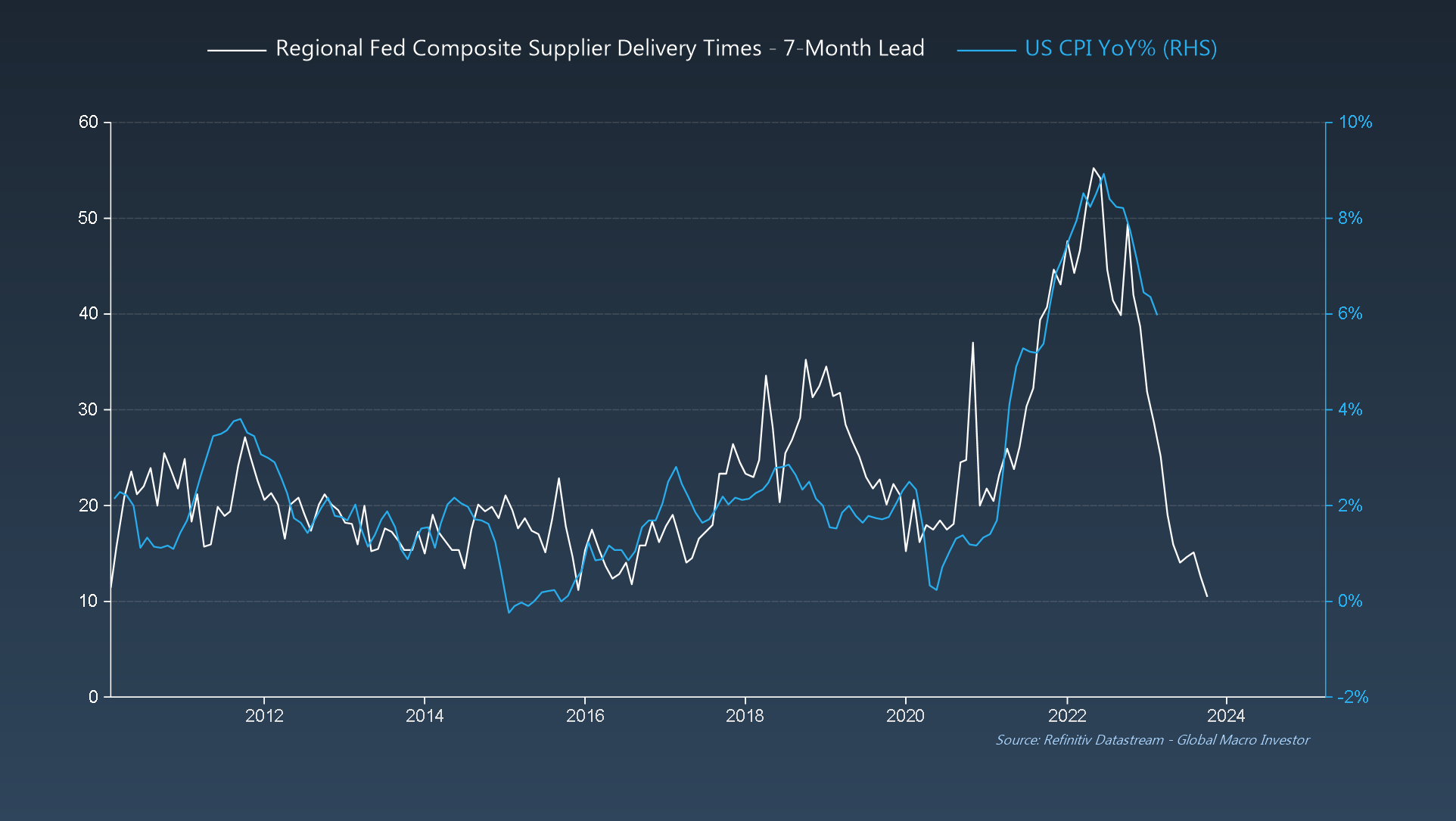

We continue to hold the view that is going to melt over the coming three to six months. Regional Fed Supplier Delivery Times continued to collapse in March and currently have CPI closer to 0%.

Regional Fed Supplier Delivery Times vs. US CPI

Regional Fed Supplier Delivery Times vs. US CPI

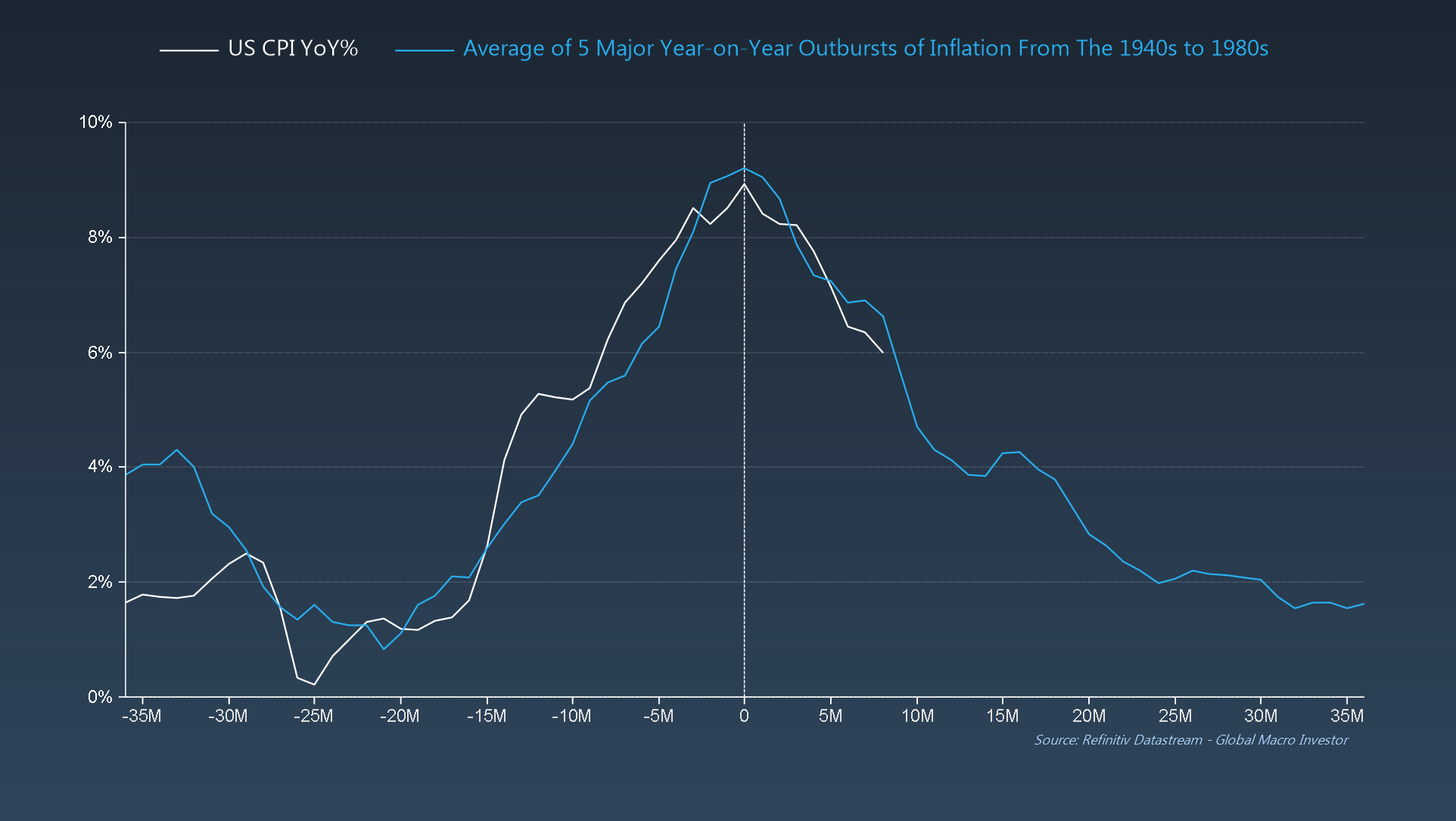

Also, don’t forget what we’ve been saying for some time: big spikes in inflation tend to be reflexive (symmetrical in rise and fall) due to the base effect: elevator up = elevator down!

US CPI vs. Average of 5 Major YoY Outbursts of Inflation

US CPI vs. Average of 5 Major YoY Outbursts of Inflation

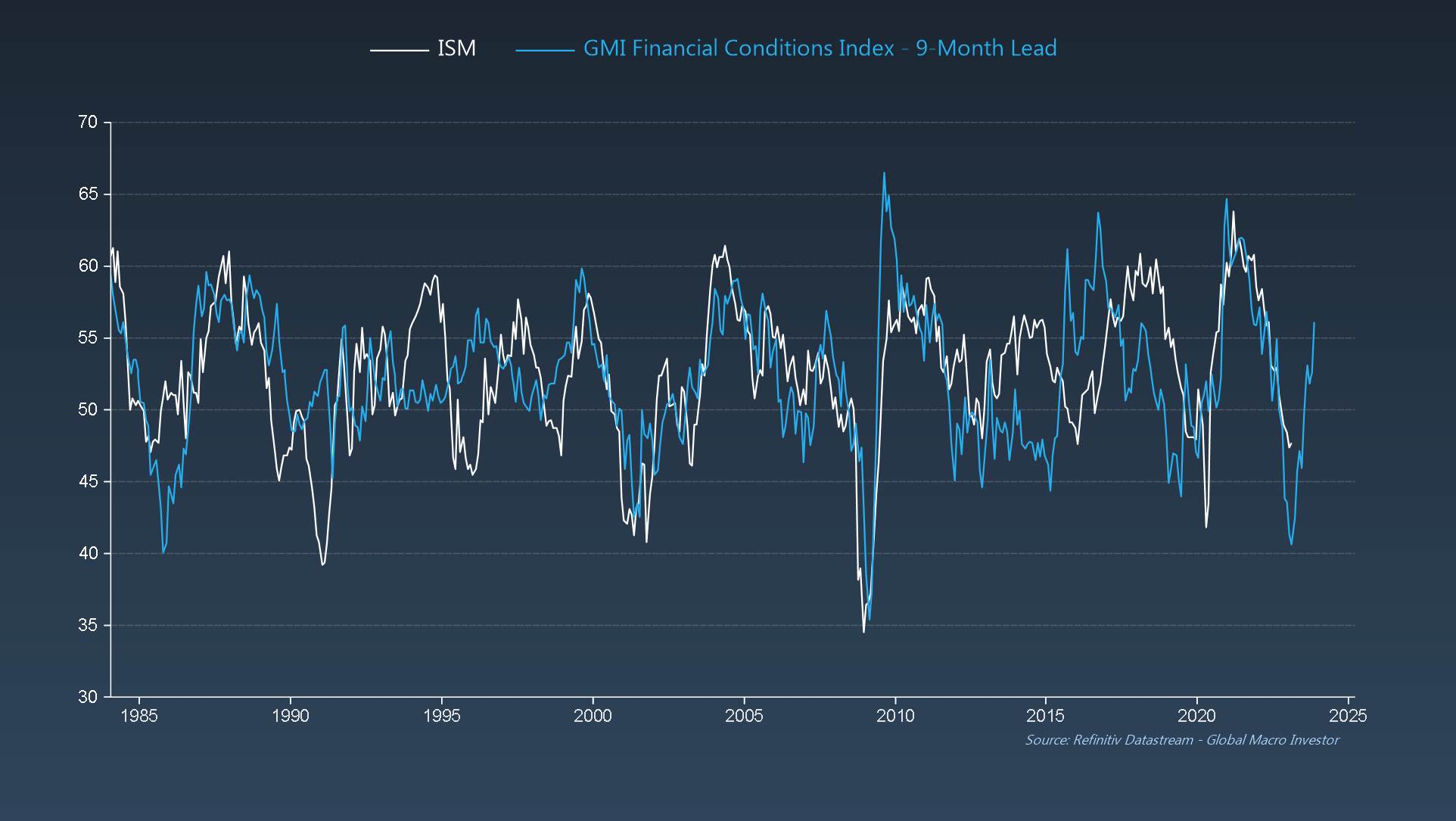

Additionally, our GMI Financial Conditions Index continues to skyrocket higher on the back of recent dollar weakness, plunging commodity prices and lower bond yields, which will be a tailwind for the in a couple of months.

ISM vs. GMI Financial Conditions Index

ISM vs. GMI Financial Conditions Index

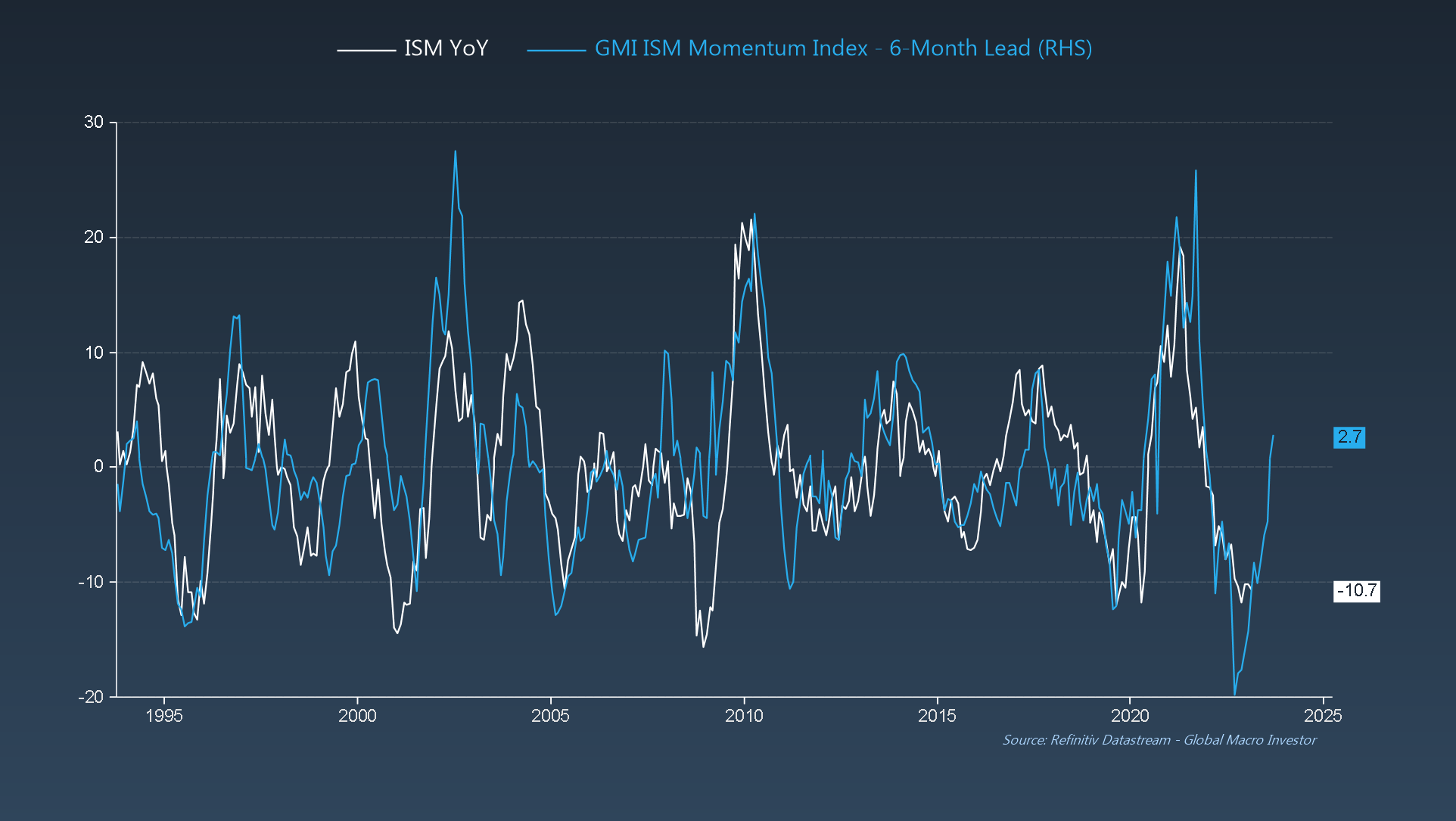

… with our GMI ISM Momentum Index currently suggesting that the ISM could be up as much as 2.7 points year-on-year by September, targeting an ISM of around 54…

ISM YoY vs. GMI ISM Momentum Index

ISM YoY vs. GMI ISM Momentum Index

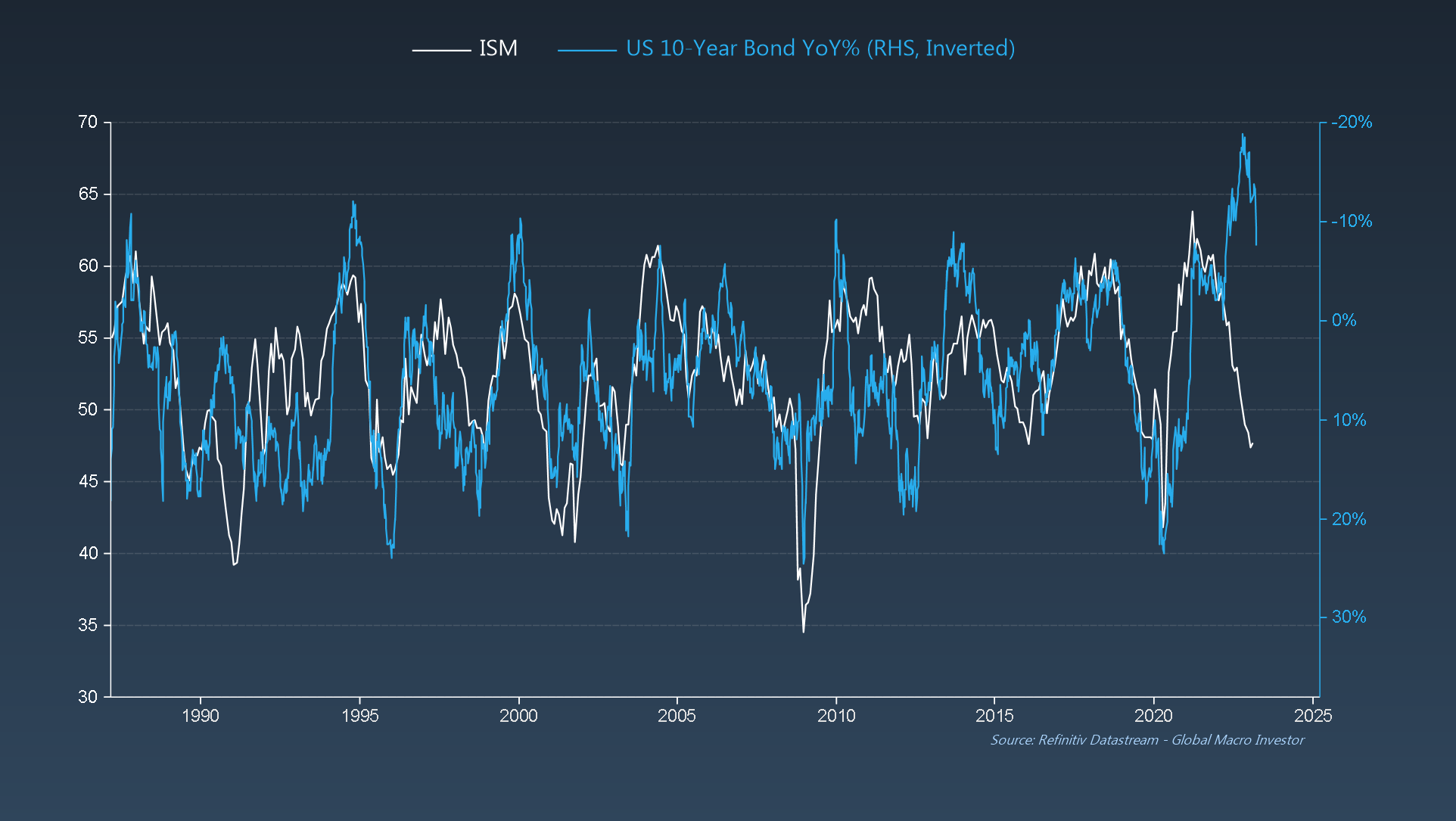

In the meantime, the record short in Treasuries coupled with a near-record dislocation of bonds with the business cycle, needs to close. Bond yields are heading MUCH lower from here.

The last chart we’ll leave with you to mull over is below. Remember, liquidity is the tide that lifts all ships and, as we’ve been saying now since September 2022 when we wrote our September GMI Monthly titled “The Turn is Near”, more cowbell (liquidity) is coming. MOAR!

Fed Net Liquidity/S&P 500/US 30-Year Bond Yield

Fed Net Liquidity/S&P 500/US 30-Year Bond Yield

Next week, as we are writing the April GMI Monthly, we will not release a weekly update but, as ever, we will share something special with you from one of our recent GMI Monthly publications. Stay tuned!

***

Want to read these the moment they come out? Sign up entirely free for my newsletter, Short Excerpts From Global Macro Investor here. New articles published every single Sunday.