45 Stocks That Yielded Solid, Increasing Dividends Over the Past 50 Years

2023.01.11 08:42

[ad_1]

- Amid the current challenging market, dividend stocks are well-suited for investors looking for an incremental income stream

- Investors should consider the influence of dividend growth on their portfolio performance in the long run

- Here are 45 stocks that yielded consistent, growing dividends over the past 50 years

When we invest in the stock market, we need to remember the drivers of its growth over time. There are three elements:

- Earnings growth

- Dividend growth

- Speculative factor

But to invest well, we need to understand the percentage of influence these elements have on total returns (the famous 8-9%) in the long run.

- Earnings growth: 60-65%

- Dividend growth: 35-40%

- Speculative factor: 0%

The image below shows how steadily companies’ profits have grown, except for a few pauses along the way. Still, the trend is evident over time.

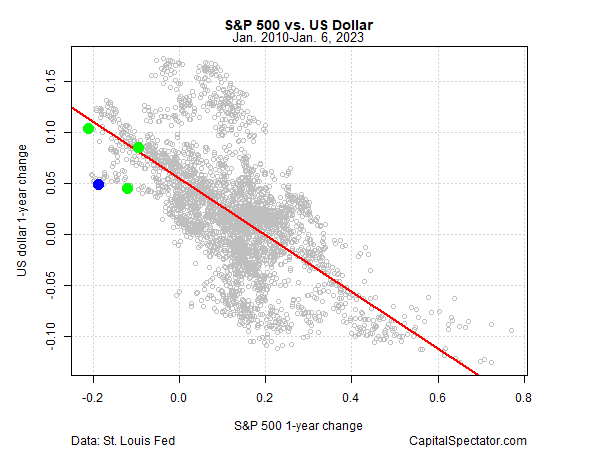

S&P 500 Vs. US Dollar

Human nature, progress, and evolution combine to drive companies and profits.

But as for dividends, again, some stocks pay them, and others that hold them and reinvest them in other things (instead of distributing them to shareholders).

However, if I wanted to invest with the intention of receiving periodic income, I would have to find companies that have two basic characteristics:

- They pay consistent dividends over time.

- The dividends paid record constant growth over time.

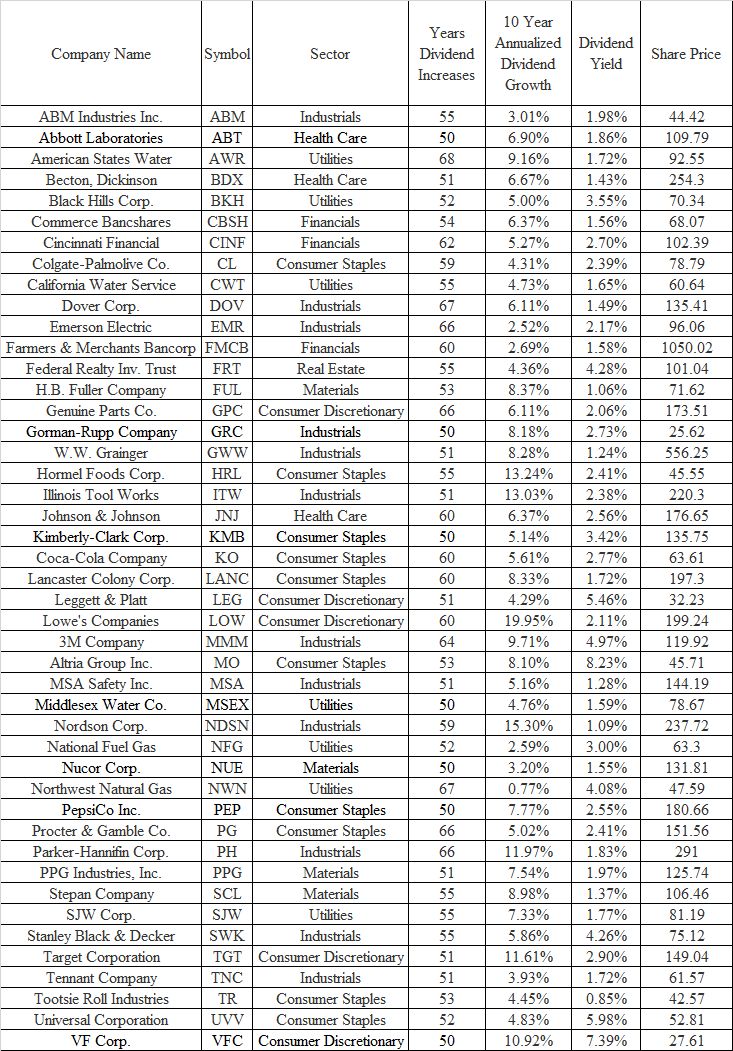

So, with this in mind, here is a list of 45 companies that have recorded consistent dividend returns and significant growth rates. These stocks are well-suited for investors looking for an incremental income stream.

The speculative element is mass psychology driving the market’s ups and downs. But, over time, this element’s influence is zero. So, the returns offered by the stock market are precisely the sum of only two out of three components, earnings, and dividends.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.

[ad_2]