4 Stocks With Near-Perfect Buy Ratings Ready to Explode Higher

2024.06.25 09:11

- Finding stocks with a very high percentage of buy ratings and no sell ratings is like striking gold.

- Today, we’ll take a look at 4 such stocks that have a strong market backing.

- We will use insights from InvestingPro to analyze these stocks.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Investors constantly seek out stocks with strong market backing. Today, we explore a select group of companies boasting the ultimate endorsement: a minimum of 95% buy ratings and zero sell ratings from analysts.

These “market darlings” represent companies with exceptional growth prospects and a high degree of analyst confidence. Using InvestingPro, a comprehensive financial analysis tool, we’ll delve deeper into some of these highly favored stocks.

We’ll explore their key metrics, growth catalysts, and potential risks to help you determine if they deserve a place in your investment portfolio.

1. Amazon

Amazon (NASDAQ:) is a well-known company with the retail giant having a worldwide presence.

It reports results on July 25 and is expected to report EPS growth of 93.50%.

Source: InvestingPro

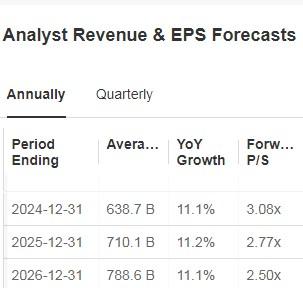

Advertising is expected to remain a strong tailwind for the company’s margins and the market is raising its revenue estimates for 2025 and 2026.

For example, for 2024 it expects an increase of 11.1%, for 2025 11.2%, and for 2026 11.1%. EPS is no slouch either, rising in 2024 by 56.5%, in 2025 by 26.3%, and in 2026 by 29.2%.

Source: InvestingPro

95% of all the ratings it presents are buy and it has no sell ratings. The average price target given by the market is $218.28.

Source: InvestingPro

2. Delta Air Lines

Delta Air Lines (NYSE:) is an airline company that has a fleet of approximately 1,273 aircraft. It was founded in 1924 and is headquartered in Atlanta, Georgia.

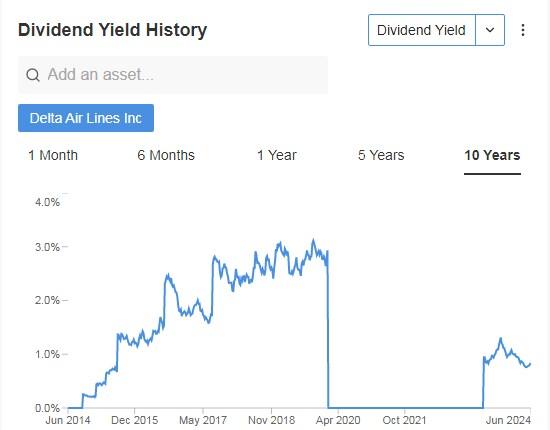

It announced a significant increase in its quarterly dividend, setting it at $0.15 per share, a 50% increase over previous distributions. The distribution will be on August 20, and shares must be held before July 30 to be eligible to receive it.

Source: InvestingPro

First-quarter earnings per share beat estimates. On July 11 it will present its accounts and EPS is expected to increase by 9.06% and revenue by 8.66%.

Source: InvestingPro

In its favor, it has solid operating performance and cost management. With a market cap of $32.03 billion and a very attractive P/E ratio of 6.3, it is trading at a low earnings multiple compared to its sector, suggesting its shares could be undervalued.

It has 95% buy ratings and no sell ratings.

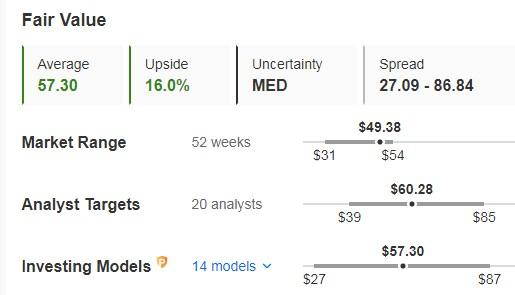

Its fair value is 16% above its share price at the close of the week, at $57.30. The target price given by the market would be $60.28.

Source: InvestingPro

3. Zoetis

Zoetis (NYSE:) is engaged in the development, manufacture, and marketing of medicines and vaccines for animal health. It was founded in 1952 and is headquartered in Parsippany, New Jersey.

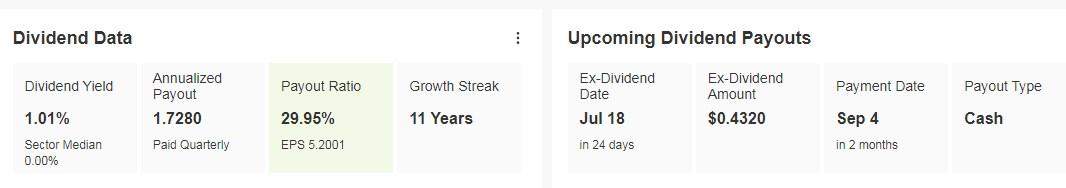

It distributes a dividend of $0.4320 per share on Sept. 4, and to be eligible to receive it you must own shares before July 18.

Source: InvestingPro

On August 1, it will publish its results. Looking ahead to 2024 the expectation is for an EPS increase of 8.4% and revenue of 7.1%.

Source: InvestingPro

95% of its ratings are buy and it has no sells.

Its beta is 0.88, so the stock has low volatility and therefore its up and down movements are generally less intense than those of the market where it trades.

Source: InvestingPro

The average price target the market sees for it stands at $210.15.

Source: InvestingPro

4. Schlumberger

Schlumberger NV (NYSE:) is engaged in the supply of technology for the energy industry worldwide. The company was formerly known as Societe de Prospection Electrique. It was founded in 1926 and is headquartered in Houston, Texas.

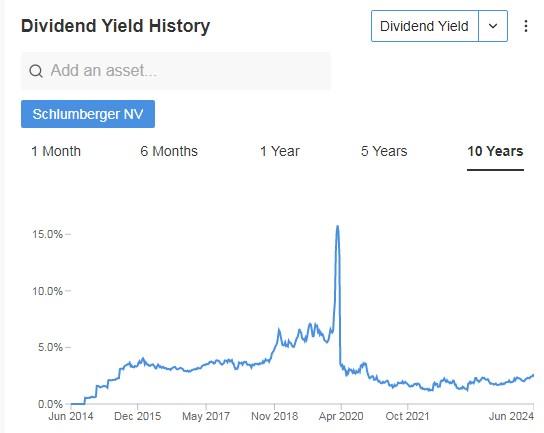

Its dividend yield is 2.41%, a far cry from the 15% yield of four years ago.

Source: InvestingPro

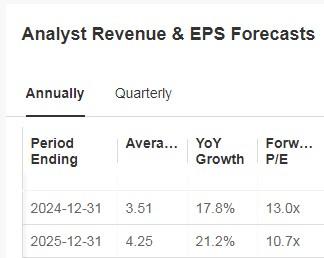

We will have its accounts on July 19 and for the current fiscal year, it expects EPS growth of 17.8% and revenues of 12.2%.

Source: InvestingPro

Its recent acquisition of CHX was a strategic move that will strengthen its portfolio and improve its exposure to future growth markets.

Of note is revenue growth, margin expansion driven by its international positioning and artificial intelligence solutions, and that it trades at a discount to historical valuations.

In addition, the company’s commitment to distribute more than 50% of its free cash flow to shareholders reinforces its attractiveness to investors.

It has 95% buy ratings and no sell ratings.

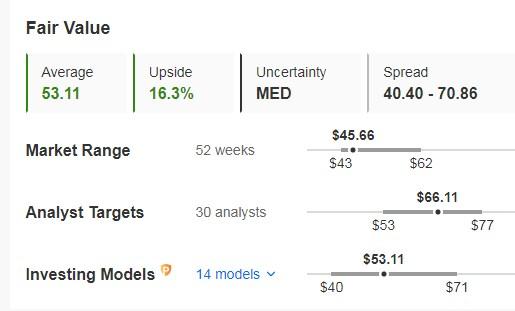

Its fair value is 16.3% higher than its share price at the end of the week, at $53.11. The company’s market price target is $53.11. The target price given by the market would be $66.11.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.