4 Stocks That Beat Earnings Expectations by Over 125%

2023.08.17 05:45

- Earnings season is about to wrap up and has fared a little better than expected

- But some companies have beaten market forecasts by wide margins

- Let’s take a look at the top 4 stocks to do so this season

Q2 earnings season ended up yielding better-than-anticipated results, albeit not by a hefty margin. On average, companies posted a modest +7% growth in earnings per share and a +2% in revenue quarter-on-quarter.

Still, the number of companies surpassing market projections has exceeded the 10-year average.

But despite the relatively positive picture, a year-over-year decline of over -8% remains, marking the third consecutive quarter of decline in comparison to the previous year. Nevertheless, a glimmer of hope shines through in the forecasts, suggesting a potential uptick in the next quarter.

Against this backdrop, what truly captures our attention is a distinctive group of stocks that share a common characteristic: they’ve beaten market forecasts by over 125%.

Without further delay, let’s delve deep and analyze whether these stocks are a buy right now.

1. Paramount Global

Paramount Global (NASDAQ:), formerly known as ViacomCBS, is a New York-based media conglomerate.

On October 2, it will distribute a dividend of $0.050 per share, requiring shareholders to possess shares by September 14 to qualify for the dividend.

The remarkable from August 7 underscore its performance. It achieved an EPS of 10 cents per share, a remarkable +671% improvement compared to market expectations.

This stands out as the most significant earnings beat among all stocks listed in the .

Looking ahead, Paramount Global is scheduled to reveal its upcoming results on November 2. The market’s outlook is less optimistic, anticipating a -68% decrease in earnings per share.

The support is $14.03.

2. Intel

Intel (NASDAQ:), the company renowned for creating the x86 series of computer processors, was founded on July 18, 1968.

Interestingly, during its inception, they initially considered the name ‘Moore Noyce,’ but it was dismissed because it sounded like “More Noise.”

After temporarily using NM Electronics, they eventually settled on Integrated Electronics, abbreviated as Intel.

In the latest unveiled on July 27, Intel reported earnings per share of $0.13, surpassing market forecasts by an impressive +546%. Additionally, its revenues outperformed expectations by +6.7%.

Mark your calendar for Intel’s upcoming results announcement on October 26. Although a decline in earnings per share is anticipated for 2023, there’s a positive outlook with projected increases from 2024 onward, including a noteworthy +184% surge in 2024.

Currently, the resistance at $36.87 is proving difficult to overcome.

3. Constellation Energy

Constellation Energy (NASDAQ:), headquartered in Baltimore, Maryland, is a prominent energy company specializing in providing electric energy and natural gas services.

In the recently disclosed results on August 3, Constellation Energy achieved an EPS of $3.67 per share, surpassing market expectations by a striking +370%. The positive streak continued, with revenues exceeding projections by +19.8%.

Looking ahead, mark November 7 on your calendar for Constellation Energy’s next results unveiling. The company is anticipated to maintain its growth trajectory, with expectations of continued earnings per share (EPS) growth not only in 2023 but also in the forthcoming years.

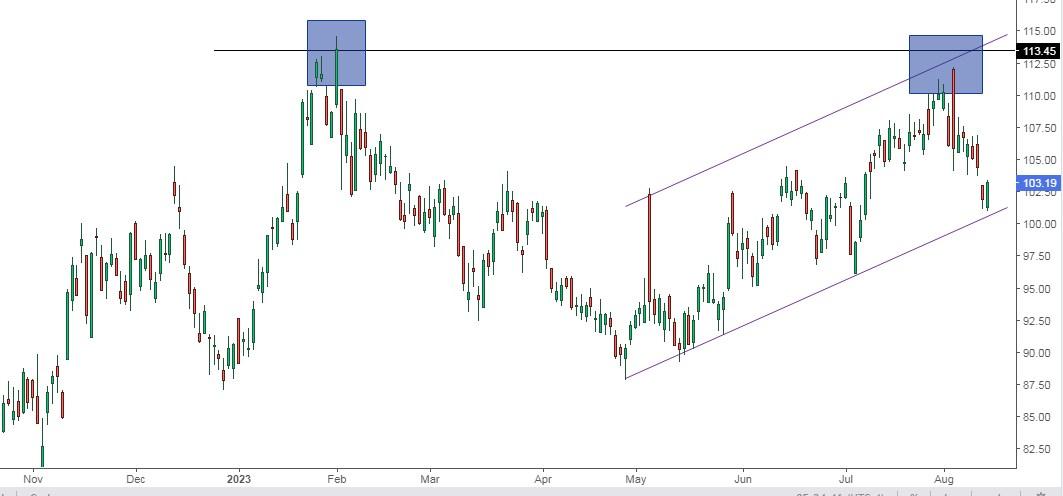

Constellation Daily Chart

Constellation Daily Chart

The stock’s current trend is clearly bullish, especially after breaking through resistance at the beginning of August.

4. Qorvo

Qorvo (NASDAQ:), headquartered in North Carolina, is a company specializing in wireless and energy market products.

The company’s establishment emerged from the merger of TriQuint Semiconductor and RF Micro Devices, a union that was announced in 2014 and finalized on January 1, 2015.

During the presentation on August 2, Qorvo demonstrated exceptional performance, revealing earnings per share of $0.34, exceeding market projections by an impressive +125.7%. Additionally, the company outperformed revenue forecasts by nearly +2%.

Stay tuned for November 1, when Qorvo will unveil its next results. The company’s growth trajectory appears promising, with expectations of continuous revenue expansion throughout 2023 and the subsequent years.

It could not break through its resistance at $113.53 when it tried on August 3.

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.