4 Sell Signals That Tell You When a CEF Is Headed for a Fall

2023.01.05 07:14

[ad_1]

Investors often ask me when it’s time to sell a closed-end fund (CEF)—or what to look for in a CEF they should avoid buying in the first place.

With 2023 now dawning, bringing a raft of challenges—and opportunities—for those of us who love high-yield CEFs, now is a good time to tackle this question. And it so happens that I’ve run across a good CEF to use as an example: the Guggenheim Strategic Opportunities Fund (GOF).

The big eye-catcher with this fund is its blockbuster 14.4% yield, which we’ll come back to in a second. First, let’s discuss the most important metric for telling whether your CEF is overvalued—and thus ripe for a drop in price.

CEF Sell Signal No. 1: A Big Premium

If you’ve been following CEFs for a while, you likely know about the discount to net asset value or NAV. It’s a CEF-specific metric that refers to the difference between a CEF’s market price, at which it trades on the stock market, and its NAV, or the per-share value of its portfolio. Many CEFs trade at discounts to NAV—and for new buys, we always favor CEFs that trade at a discount.

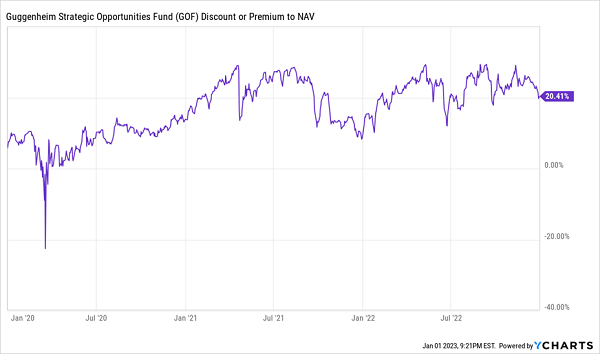

GOF? It trades at a premium to NAV—and a hefty one at that:

GOF Investors Pay $1.20 for Every Buck of Assets

GOF Premium To NAV Chart

GOF’s premium has soared in recent years, and as you can see above, it hovered around 20% for 2022. There’s simply no reason to overpay for this fund when there are so many discounted CEFs available right now. And by purchasing CEFs at unusually deep discounts, you can ride along as those discounts flip to premiums—maybe even to GOF-like 20% premiums. That would be the time to sell and take profits.

This closing-discount strategy is a proven way to build wealth in CEFs, and it’s key to all the funds I recommend in my CEF Insider service.

CEF Sell Signal No. 2: A Historical Return That Fails to Cover the Dividend

NAV isn’t only a good valuation measure. The fund’s total NAV return (or the return generated by its portfolio investments, including dividends) can tell you if it is generating the profits it needs to cover its dividend.

Once again, GOF provides an example: over the last three years, the fund has posted a total NAV return of 12.7%. That’s an alarm bell, because that 12.7%—over three years, remember—is below GOF’s 14.4% yield on price and well below its 17.3% yield on NAV (or the total annual payout divided by its per-share NAV).

This is particularly worrisome because any cut would likely surprise long-term GOF holders, as the fund has increased its payouts by 28.2% since inception and has never cut its dividend. That, along with the big premium, raises your downside risk.

CEF Sell Signal No. 3: Performance Decay

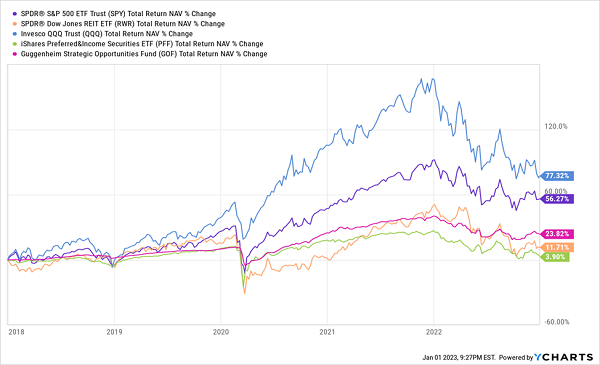

Of course, you’ll want to consider your fund’s historical return, especially in comparison to the indexes your CEF invests in. GOF, in pink below, has posted a 24% NAV return over the last five years.

GOF Lags Most Indices

GOF Performance Chart

While GOF is a little bit ahead of the preferred stock index fund (in green) and the REIT index fund (in orange), it’s well behind the others. In all honesty, we’d hope for better from GOF, in light of the fact that the fund has a broad mandate to invest in whatever assets management sees fit.

Consider also that when you stretch this performance out over the last decade, GOF posted a 7.9% annualized return, matching the broader market for a fund that combines stocks and bonds. GOF is also in the 85th percentile of top-performing CEFs over the last decade. But if you look at the last five years alone, that drops below the 50th percentile.

In other words, we’re seeing a decay in performance. And while this doesn’t mean GOF will remain a sell forever, it does give us another reason to avoid paying its premium.

CEF Sell Signal No. 4: Management That Isn’t Providing Much Value

Back in August, GOF pivoted toward owning index funds: the SPDR S&P 500 ETF Trust (SPY), iShares ETF (IWM), and the NASDAQ-tracking Invesco QQQ Trust (QQQ) were the fund’s top three holdings. To be sure, they only amounted to about 7% or so of the portfolio, but even so, that’s a fairly heavy weighting toward ETFs that simply track indices, especially for a fund with a broad mandate like GOF.

With the second half of 2022 providing little gain for the fund, GOF moved away from ETFs and back toward asset-backed securities and corporate bonds (which are its historical focus), including issues from banks like Morgan Stanley (NYSE:) and aerospace and airline firms, such as Delta Air Lines (NYSE:) and Boeing (NYSE:). These are great assets for the moment, but GOF isn’t the only fund to own them, and there are many discounted CEFs out there that hold similar assets.

The takeaway? At least until GOF’s premium vanishes, you’re best to avoid it or sell it now if you own it.

Available Now: Full No-Obligation Access to Our 10.2%-Yielding CEF Portfolio

The best way to make sure you’re making the most of your CEF buys is through a 60-day trial of my CEF Insider service.

I’m one of only a few analysts in the world who covers CEFs, which are incredible income generators fit for almost any investor’s portfolio. Our CEF Insider holdings, for example, generate a 10.2% average yield, and most of our holdings pay dividends monthly.

Speaking of monthly payouts, I’ve also combed through the entire CEF universe to dig up the 5 best monthly paying CEFs to buy now. These stout funds yield 8.9% and come from across the economy, including funds that hold bonds, blue chip US stocks, top international stocks, and more.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]