4 Potentially Undervalued Stocks to Buy Before They Catch Up to Broader Market

2024.09.03 07:12

Stocks have bounced back from their early August dip, with the hitting new all-time highs and other indexes attempting to follow. However, at the time of writing, US stock futures are pointing to a sluggish start for September.

Even with the market’s recent rally, several fundamentally strong stocks still trade below their intrinsic value. In this article, we’ll highlight these undervalued stocks that have yet to catch up to the broader market’s gains.

We’ll focus on stocks with two key characteristics:

- Their fundamental price targets are significantly higher than their current prices, signaling strong medium-term potential.

- They enjoy favor from market consensus.

1. Arcutis Biotherapeutics

Arcutis Biotherapeutics (NASDAQ:) develops and markets innovative dermatological treatments that address a variety of dermatological conditions, such as psoriasis, atopic dermatitis, and seborrheic dermatitis.

In the first quarter, net revenues were $21.6 million and it has a strong cash position of more than $404.5 million. This strong cash reserve will help the company with research and development (R&D) activities as well as marketing efforts.

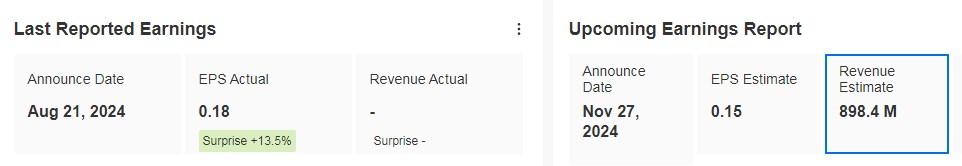

On November 6, we will know its income statements. Revenue is expected to increase by 59.97%.

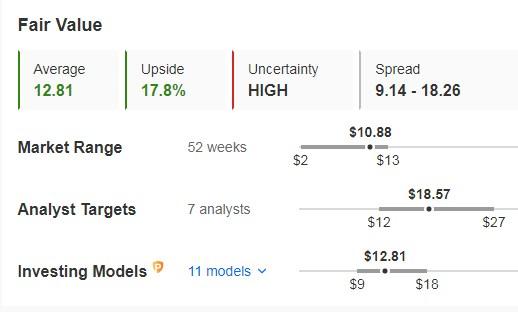

Source: InvestingPro

It has 6 ratings, of which 5 are buy, 1 is hold and none are sell.

Its fair value or fundamental price is at $12.81, which is 17.8% above the price at which it closed the week. The market sees tremendous potential for it at $18.57.

Source: InvestingPro

2. Snowflake

Artificial intelligence is transforming every industry. The major tech titans are market darlings, yet under-the-radar AI companies like Snowflake (NYSE:) have quickly risen to become major players in cloud computing and data warehousing.

It announced another solid quarter, with product revenue up. Total revenue increased 28.9% to $828.7 million. Product revenue increased 30% to $829.3 million.

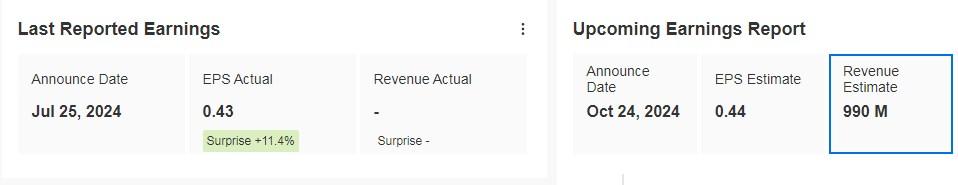

It will report its next quarterly results on November 27. The company’s management has increased its full-year product revenue forecast to 26% growth. This growth rate is considered one of the highest among public software companies.

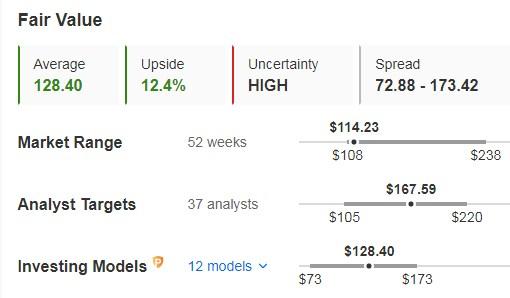

Source: InvestingPro

It has 44 ratings, of which 30 are buy, 12 are hold and 2 are sell.

Its fair value is at $128.40, or 12.4% above the price at which it closed the week. The market sees tremendous potential for it at $167.59.

Source: InvestingPro

3. DexCom

Based in California and valued at $44.6 billion, DexCom (NASDAQ:) is a pioneer in continuous glucose monitoring that has revolutionized diabetes monitoring since 1999.

The company has a substantial $2.9 billion in cash and its revolving credit facility is untouched. This strong cash cushion provides DexCom with significant financial and strategic flexibility as it ramps up production and ventures into new markets.

We will learn about its accounts on October 24. The company updated its full fiscal year forecast and expects revenues of $4.0 billion and $4.05 billion.

Profit is expected to reach $1.78 per share in fiscal 2024, up 17.1% from the previous fiscal year, and up another 24.7% to $2.22 per share in fiscal 2025.

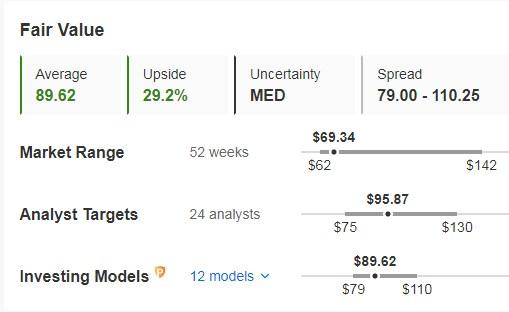

Source: InvestingPro

DexCom’s management has been actively engaged in share buybacks, a sign that it is confident in the company’s valuation and future prospects.

Announced the U.S. launch of Stelo, a sensor aimed at non-insulin-dependent diabetes patients. The launch of Stelo marks a strategic move to expand its product offering and provide more affordable diabetes management solutions.

With the product now available for purchase, the company is positioned for continued growth in the coming years.

Its financial health is optimal it has a score of 4, with 5 being the highest score.

Source: InvestingPro

It has 22 ratings, of which 19 are buy, 3 are hold and none are sell.

Its fundamental price is at $89.62, or 29.2% above the price at which it closed the week. The market sees tremendous potential for it at $95.87 (it trades at $69.34).

Source: InvestingPro

4. PayPal

PayPal (NASDAQ:) is an electronic alternative to traditional payment methods. Founded in 1998, it debuted on the stock market in 2002 and is headquartered in San Jose (California).

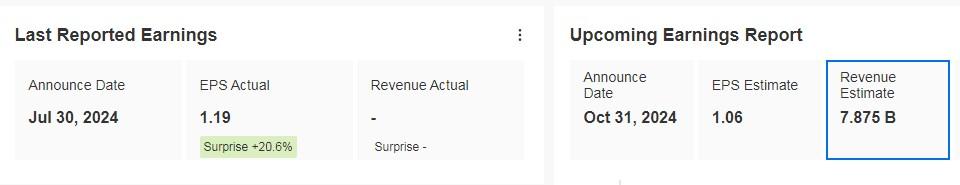

On October 31 it presents its numbers for the quarter.

Source: InvestingPro

The net margin trend is already bullish and, in fact, since the floor in June 2022, the company has managed to turn around net margins, consolidating its recovery.

It is only a matter of time before the company manages to reverse the negative gross margin trend and with it, the share price.

Its Beta of 1.42 reflects that the stock is moving in the same direction as the market and with greater volatility.

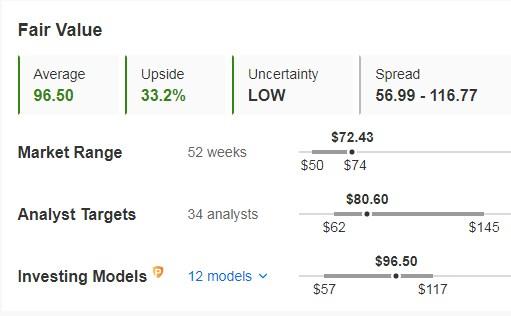

Source: InvestingPro

Its fundamental price is at $96.50, which is 33.2% above the price at which it closed the week. The market sees tremendous potential for it at $80.60.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.