3 Ways to Bullet-Proof Your Portfolio From Rising Geopolitical Risks

2024.08.21 06:02

Military spending in the United States and Europe continues to rise, and this trend shows no signs of stopping.

Regardless of who wins the White House in 2025 – whether it’s Harris or Trump – defense budgets are set to increase, with Trump likely pushing for even more aggressive spending.

Recently, both the Senate and Congress approved a higher military budget for the next fiscal year.

Globally, defense spending has grown for nine consecutive years, reaching a record $2.5 trillion – a figure that’s expected to climb even higher in 2025.

Defense companies had a strong second quarter in 2024, reporting better-than-expected financial results and raising their profit forecasts. This positive momentum is likely to continue.

So, how can investors capitalize on this trend? Here are three ways:

- Through specialized funds and ETFs:

1. X Defense Tech ETF

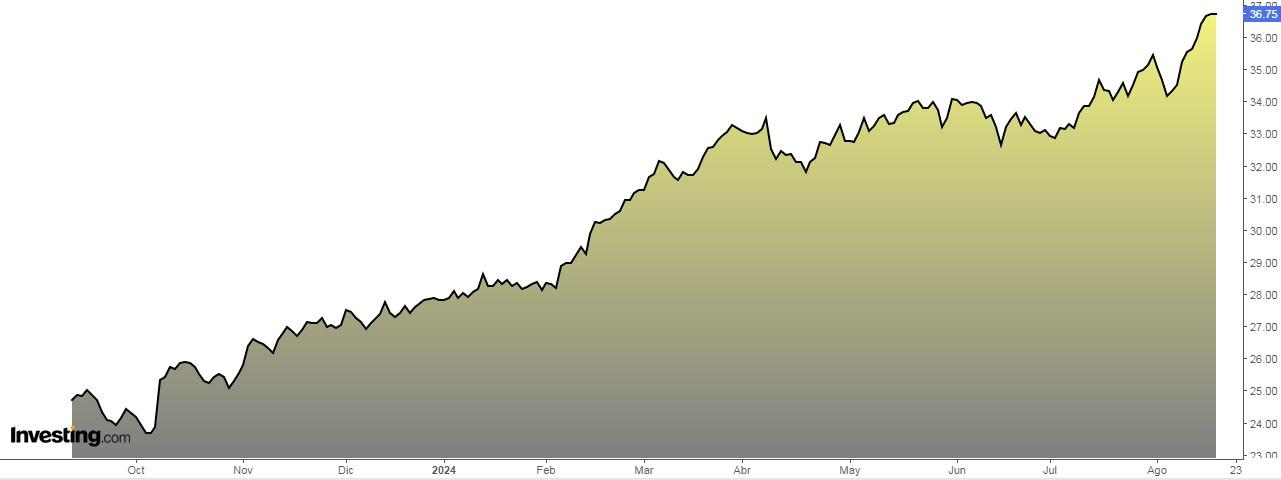

The Global X Defense Tech ETF (NYSE:) includes a mix of U.S. and European stocks, with about 35% of its holdings coming from non-U.S. companies.

Its top 10 positions include Lockheed Martin (NYSE:), RTX, Northrop Grumman (NYSE:), General Dynamics Corporation (NYSE:), BAE Systems (LON:) (OTC:), Palantir Technologies (NYSE:), L3Harris Technologies (NYSE:), Huntington Ingalls (NYSE:), Rheinmetall (OTC:) and Leidos (NYSE:).

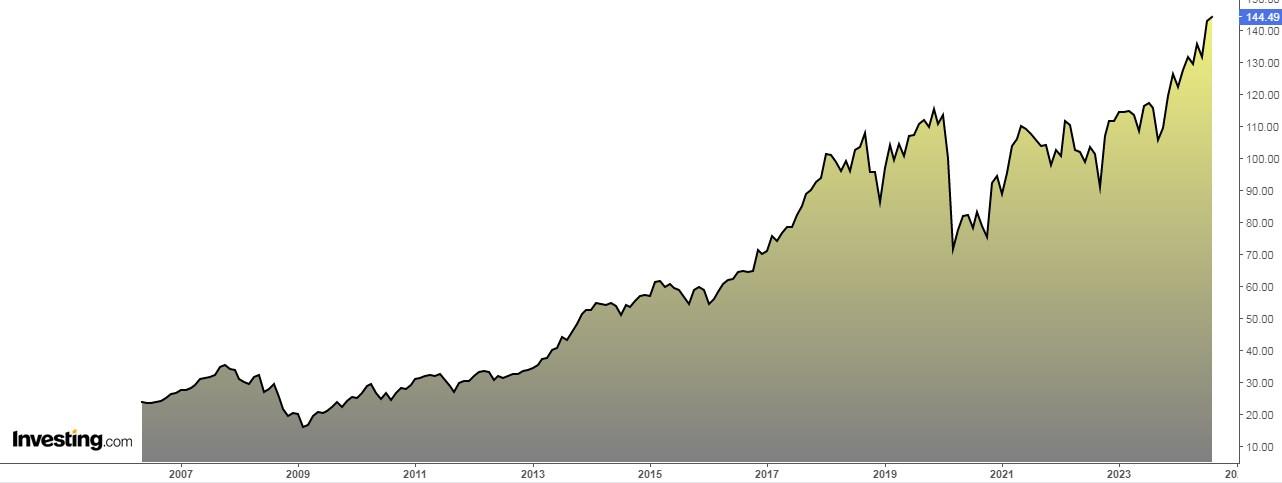

2. iShares U.S. Aerospace and Defense

iShares U.S. Aerospace & Defense ETF (NYSE:) invests in companies in the aerospace and defense sector too.

The top 10 holdings are GE Aerospace, RTX, Boeing (NYSE:), Lockheed Martin, Howmet Aerospace, Northrop Grumman, L3Harris Technologies, General Dynamics, Axon Enterprise (NASDAQ:) and TransDigm.

Their 10-year yield is 12.10%, 3-year yield is 10.90%, and 1-year yield is 22.50%.

- Investing Through Shares:

After ETFs, let’s see which stock could benefit from increased military defense spending. Defense stocks could make great alternatives to the ETFs above, especially for those looking to invest in individual stocks.

3. General Dynamics

General Dynamics is an American aerospace and defense company that offers products and services in aviation, shipbuilding and repair, ground combat vehicles, weapons systems, and munitions, as well as technology products and services.

It was founded in February 1899 and is headquartered in Virginia (USA).

The stock pays a dividend of $1.42 per share on November 15, and to receive it, shares must be held before October 11. Its annual dividend yield is 1.92%.

It has been increasing its dividend for 11 consecutive years and has distributed it for 46 years without ever failing to do so, underscoring its financial stability and reliability as an income-generating investment.

On October 23 it presents its results and is expected to increase revenues by 8.75%. Revenue growth over the last twelve months was 10%, with remarkable quarterly growth of 17.97%, pointing to solid financial results and continued expansion potential.

In addition, the G700 aircraft, which began delivery in the second quarter, is expected to contribute significantly to earnings expansion.

It trades at a relatively high P/E of 22.46, indicating a premium to near-term earnings growth, but this could reflect market confidence in its future prospects.

The market sees potential for it at $324.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.