3 Unconventional Stocks Millennials Can’t Resist

2023.06.08 06:30

- Tech-savvy millennials are very active stock market participants

- At times, they tend to double the trading volume of older generations

- Using InvestingPro, let’s take a look at some of the stocks that intrigue this generation

When it comes to investing, investors’ age often plays a significant role in shaping their investment style and philosophy.

Generally, as individuals grow older, it is common for them to adopt a more conservative approach to investing. Conversely, as younger investors enter the market, their risk aversion decreases.

A report by Apex Fintech Solutions has given insight into what millennials have been up to in the stock market lately.

This report analyzed a vast dataset of nearly 7 million broker accounts. We will leverage InvestingPro to analyze some of the stocks mentioned in the report.

You can do the same analysis for every topic of the market just by signing up at the following link: Start your free trial today!

Millennials Love Trading

This tech-savvy generation is fond of trading and investing, and that’s no secret.

Millennials often trade stocks more actively than other generations, both young and experienced investors, during certain periods. Interestingly, their trading volume can sometimes be twice that of Generation X.

Millennials are enthusiastic about buying stocks of popular companies such as:

- Tesla (NASDAQ:)

- Apple (NASDAQ:)

- Amazon (NASDAQ:)

- Microsoft Corporation (NASDAQ:)

- Meta Platforms (NASDAQ:)

- Nvidia (NASDAQ:)

- Alphabet (NASDAQ:)

Interestingly, Tesla is the top choice among young investors, with the highest number of purchases.

Other stocks include Mullen Automotive (NASDAQ:), Moderna (NASDAQ:), and Enphase Energy Inc (NASDAQ:).

In 2023, Marathon Digital Holdings emerged as the top performer among millennials’ favorite stocks, surging +190%, closely followed by Nvidia.

Additionally, when delving into less conventional stock choices, millennials favored the following purchases:

1. DraftKings

DraftKings (NASDAQ:), a Boston-based sports betting company, will report earnings on August 4 and is expected to do better than last time.

DraftKings Upcoming Earnings

Source: InvestingPro

The previous release was quite interesting.

DraftKings Previous Earnings

Source: InvestingPro

In the company’s news section on InvestingPro, DraftKings has 19 buy, 11 hold, and 2 sell ratings. Jefferies has given it a potential target price of $35.

Source: InvestingPro

However, InvestingPro models place the target price a bit lower, at almost $30.

DraftKings Target Price

Source: InvestingPro

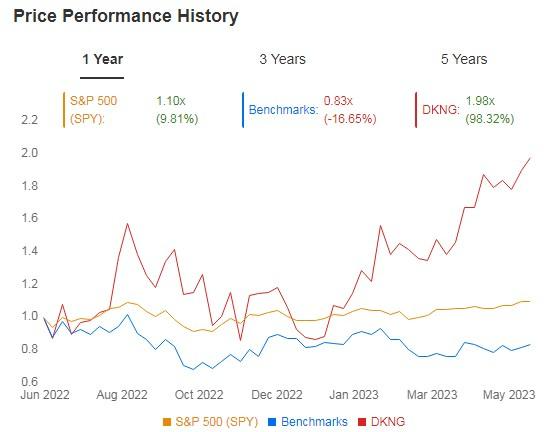

Here we can see the comparison with the :

DraftKings Price Performance History

Source: InvestingPro

Its shares are up +115% so far this year. A pullback to $22.77 would surely be a buying opportunity.

2. Royal Caribbean Cruises

Royal Caribbean Cruises (NYSE:), a Miami-based cruise company, is the second largest cruise operator in the world, after Carnival.

In 1997, Royal Caribbean Cruise Line and Celebrity Cruises merged to form this company.

It will report its quarterly results on August 3, and the market expects them to be positive.

Royal Caribbean Cruises Earnings

Source: InvestingPro

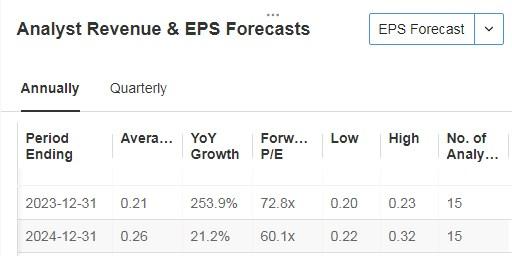

Here you can see the market forecasts for this year and next year:

Analyst Revenue and EPS Forecasts

Source: InvestingPro

The InvestingPro news section includes the market’s set targets for this stock. In addition, it has 15 buy calls, 7 hold, and 0 sell.

Royal Caribbean Cruises News

Royal Caribbean Cruises News

Source: InvestingPro

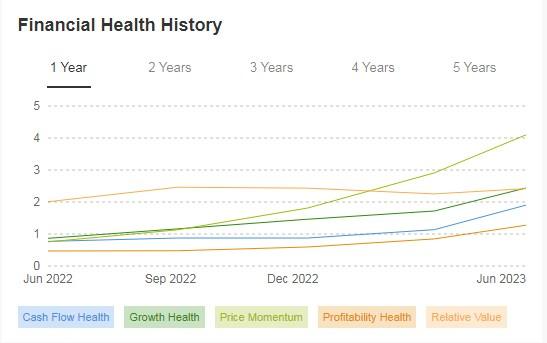

Its financial health has been optimal over the past 12 months.

src=

Source: InvestingPro

The stock has bullish momentum and is trying to break out of the ascending channel. But, a strong resistance lies ahead.

This resistance has proven challenging, with three unsuccessful attempts to breach it, and is currently at $98.

Royal Caribbean Cruises Daily Chart

Royal Caribbean Cruises Daily Chart

3. Palantir Technologies

Palantir Technologies (NYSE:) specializes in big data analytics. It was founded in 2004, and its original clients were federal agencies. It then offered its services to private companies in the financial industries.

It will report earnings on August 9. The previous were good as the earnings per share exceeded market forecasts by 25%.

Palantir Technologies Upcoming Earnings

Source: InvestingPro

You can view the projected results forecast for 2023 and 2024 here.

Analyst Revenue and EPS Forecasts

Source: InvestingPro

InvestingPro models have not projected a promising potential for the millennial-favorite stock, with a price target of approximately $11.70.

Palantir Technologies Target Price

Source: InvestingPro

So far this year, the stock has rallied +127%. It recently started to overcome its resistance level, but it needs to complete the consolidation of the breakout.

To do so, it must stay above $14.19. It is expected to continue consolidating as long as it remains above this price.

Palantir Technologies Daily Chart

Palantir Technologies Daily Chart

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any asset is highly risky and evaluated from multiple points of view; therefore, any investment decision and the associated risk remain with the investor.