3 Stocks With Dividends Paid Out Every Month

2023.03.31 07:09

It doesn’t get any better than monthly dividends. Getting paid every 30 days aligns nicely with our monthly bill schedule.

Today we’ll discuss three monthly dividend stocks yielding 5.4% to 14.6% per year. Yes, that’s right, 14.6% per year!

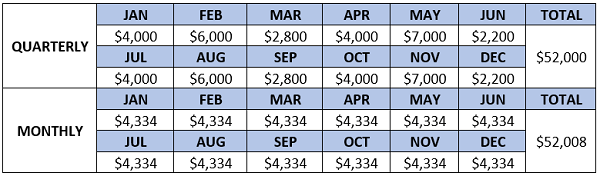

Worth it? We’ll discuss that shortly. First, an ode to the monthly payment. Below I’d like to invite you to choose your own retirement adventure. These are the same dividend payments except the top set is paid only quarterly.

The bottom, meanwhile, is paid monthly. Same total payments but a much smoother retirement ride with the monthlies.

Quarterly-Monthly Payouts

Where do we find monthly dividend payers? Generally they spring from the high-yielding “alphabet soup” industries: business development companies (BDCs), , and our focus today: real estate investment trusts (REITs).

You might remember: I recently talked about REITs that were in the doghouse, and the monthly paying variety is no different. These stocks are serving up yields of 5.4% to 14.6% as a result of their battered states.

But remember: A dividend stock has to offer more than a fat yield and a favorable schedule—it has to have a sturdy underlying business and dependable financials so we can keep collecting those dividends.

Let’s look at a few possible dividend traps so you know what to look out for, then talk about some monthly payers with real retirement potential.

1. Whitestone REIT

Dividend Yield: 5.4%

Let’s start with Whitestone REIT (NYSE:), a retail-focused real estate firm that operates almost exclusively in the Sun Belt.

Whitestone’s 52-property portfolio is primarily located within high-growth, high-income neighborhoods. Tenants tend to revolve more around grocery stores and service retail—restaurants, self-care, financial firms, education, and more—and stray away from apparel and other traditional product retailers.

The vast majority (93%) of its deals are triple-net leases, and they’re predominantly short-term, with an average lease term of under four years—“designed to do well in periods of high inflation,” Whitestone says. Fair enough. 2022, which was thick with inflation, saw …

- Revenues improve 11%

- Same-store net operating income (NOI) climb 8%

- Occupancy swell 240 basis points to 93.7%

- Funds per operation (FFO) per share jump 20%

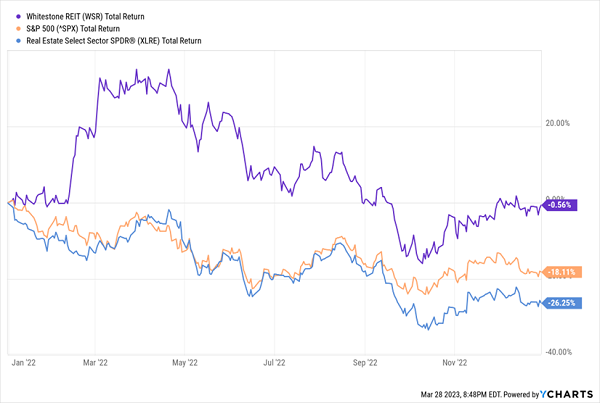

The result: a much better 12 months than many other shareholders enjoyed last year.

Flat WSR Shares Looked Fabulous in 2022

WSR-Total-Returns Chart

But I’m worried the momentum won’t continue.

Whitestone is a fairly highly levered REIT that has quite a bit of variable-rate debt. That, on top of extremely high retail exposure, makes it a prime candidate for pain should a much-expected come to fruition.

WSR might have given a small nod to this notion of late.

For years, Whitestone paid a shaky dividend that was typically higher than its FFO. That was until April 2020, when it finally slashed its payout—by 63% to 3.5 cents per share. A year later, it had slowly but surely started working on rebuilding the payout, with a small raise announced in March, and it did so again last February, to the current 4 cents per share. Unfortunately, Whitestone’s recent dividend announcement kept the payout flat, suggesting WSR is playing things conservatively given the macro environment.

None of this is to say that Whitestone is a poor operator. But the company is hardly a resilient dividend payer, and it’s a fairly cyclical investment that could give retirement investors fits.

2. Gladstone Commercial

Dividend Yield: 10.0%

Gladstone Commercial Corporation (NASDAQ:) is a member of the Gladstone Companies: a group of publicly traded investment vehicles that also includes:

- Gladstone Investment Corporation (NASDAQ:)

- Gladstone Capital Corporation (NASDAQ:)

- Gladstone Land Corporation (NASDAQ:)

Each of these funds invests in (and buys) lower middle market companies in the commercial and/or farmland real estate space.

And each one pays out a monthly dividend.

Gladstone Commercial is a REIT that invests in single-tenant and anchored multi-tenant net-leased industrial and office properties. Its portfolio currently consists of 137 properties in 27 states, leased out to 112 different tenants spanning 19 industries. Automotive tenants make up 14% of the portfolio (based on annualized straight-line rent), followed by telecommunications and diversified/conglomerate services at 12% each. Each of its 16 other industries make up 10% or less of the portfolio. And no single tenant makes up more than 4%.

Gladstone, to its credit, is an excellent operator. Since going public in 2003, the company has never allowed its occupancy to drop below 95%, and it currently stands at 96.8%.

Its problem, simply put, is its business.

While there’s nothing wrong with the industrial real estate space, which makes up 56% of its portfolio, the office portion (40%) has been struggling mightily, dragging on operational results and the stock alike.

WFH Has Been Weighing Like a Rock on Gladstone

GOOD-Total-Returns Chart

Gladstone finally capitulated in early January, announcing a 20% cut to its monthly dividend, to 10 cents per share. The company flat-out called it a “capital preservation” effort, which also included waiving its advisory incentive fee for the next couple of quarters.

The move brought GOOD down from a 96% FFO payout ratio prior to the cut down to a 77% payout ratio. That’s a far healthier place for Gladstone to be, and GOOD shares could enjoy a short-term snap-back if recent return-to-office efforts take hold in a big way. But the new norm will likely never look anything like the old norm, with some amount of WFH firmly in place, and that makes it difficult to depend on Gladstone long-term.

3. SL Green (SLG)

Dividend Yield: 14.6%

SL Green (SLG) owns or holds an interest in 61 buildings totaling 33.1 million square feet in New York City, including 28.9 million square feet of buildings in Manhattan. The REIT describes itself as New York City’s largest owner of office real estate.

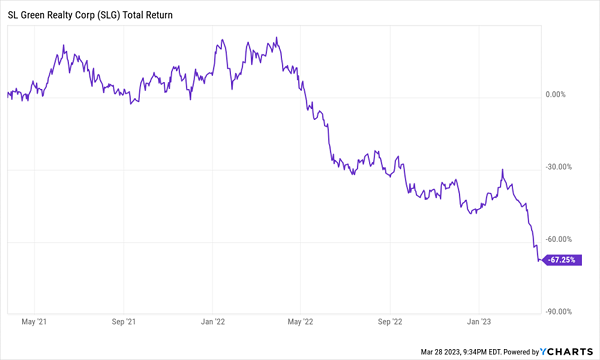

And It Shows

SLG-Total-Returns Chart

The move away from the office is taking a toll on SL Green, and rising rates aren’t helping either. Like with Gladstone, the financial weight around the company’s neck forced SLG to cut its payout in December by 13%, to 27.08 cents per share monthly.

Interestingly, this is one situation where payout ratios never told the whole story. Its trailing 12-month funds available for distribution (FAD) payout ratio had hovered around the mid-50% range over the prior few quarters. However, SL Green projected a considerable drop in FAD for 2023, and reduced its dividend to match—with the expectation that it will increase liquidity by $1.6 billion and reduce combined debt by almost $2.4 billion this year.

Let’s be clear: I wouldn’t bet against SL Green right now. It could enjoy not just a short pop, but a pretty aggressive one. Not only are shares extremely depressed, but 25% of SLG’s float is sold short: prime conditions for a classic short squeeze.

But I wouldn’t bet on SLG, either. It sniffs of a long-term yield trap—a lot of similarities to the stocks on my “Dirty Dozen” list of dividends that look primed for a cut.

Just like with quarterly payers, monthly payers need to be dependable. What good is a high, frequently paid-out dividend, if it tapers off or gets suspended in a few years?

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”