3 Stocks That Benefit From A Strong U.S. Dollar

2022.10.17 07:08

[ad_1]

- The is up 18% for 2022

- Importers benefit from a strong U.S. dollar as their purchasing power improves.

- Exporters get hurt by a strong U.S. dollar as they get paid less for their products.

- Walmart (NYSE:), Dollar Tree (NASDAQ:), and Darden Restaurants (NYSE:) are three benefactors of a strong U.S. dollar

A strong U.S. dollar results in more buying power for U.S. importers and U.S. tourists buying products overseas. However, it’s terrible news for U.S. companies that export U.S. products overseas as they receive less. We’ve seen the warnings from significant players as their earnings and forecasts get lowered from the impacts of continued strength in the U.S. dollar.

The stock market didn’t punish companies too harshly for currency impacts as they also reported in constant currency to smooth out the volatility. However, the substantial U.S. dollar impacts are a disorder that adds to the existing headwinds of inflationary pressures, supply chain constraints, eroding consumer spending, and rising interest rates.

This pain is felt by major U.S. conglomerates and technology companies as the U.S. dollar index has climbed 18% for the year. These Companies can see the extra damage to their underlying stock price compared to the benchmark S&P 500 index.

The Domino Effect

The strong U.S. dollar has been driven by a number of factors, like a domino effect. Before the pandemic, inflation stood at an average of just 1.9% in 2019. The COVID pandemic triggered government-mandated lockdowns forcing economies and businesses to come to a screeching halt. This caused inflation to drop to an average of 1.2% in 2020 as factories and plants were taken offline, and companies dropped production and cut inventories to handle the demand shock.

When the reopening took effect, producers were caught off guard as pent-up demand triggered a massive supply shock driving up prices in everything from food and energy to cars and collectibles. The supply chain disruptions only made matters worse as container ships stalled at ports for weeks while the supply of shipping containers ran out.

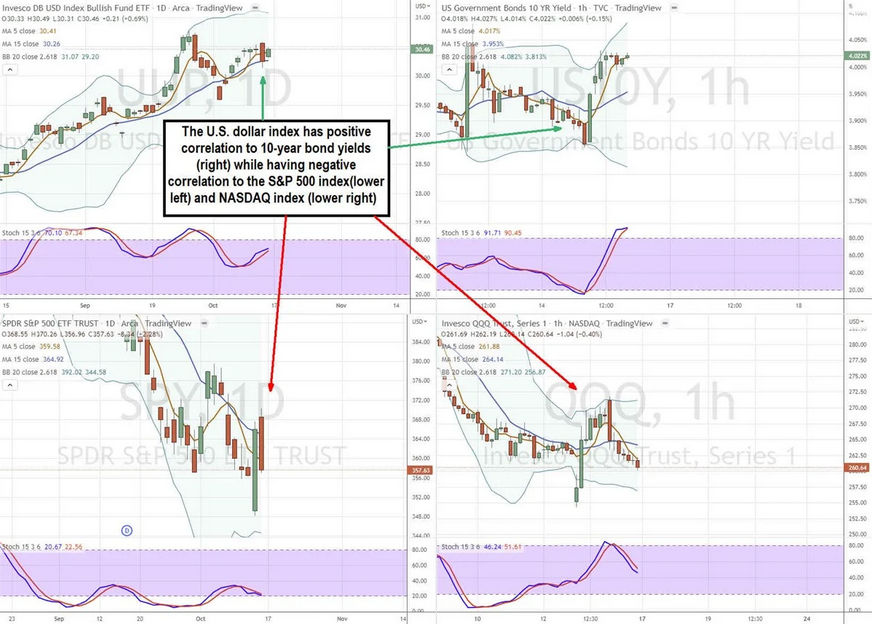

This caused to surge to 9.1% in June 2022. This prompted the U.S. Federal Reserve to accelerate its rate hikes as it realized that inflation was not “transient” and the economy was too strong. They raised interest rates by 3% in six months, which caused the U.S. dollar to surge through 17-year highs.

This caused bonds to collapse and yields to spike. It also triggered an inverted yield curve stoking recession fears. The collapse of the sterling has accelerated the strength in the U.S. dollar and rise in bond yields, causing equity markets to fall to lows.

The Losers

Globalization has been punishing U.S. companies that receive a large chunk of their revenues from overseas. Technology companies get paid less by overseas clients and see their stocks deflate from rising inflation. This can be seen in shares of Salesforce (NYSE:) down (-44%), Nike (NYSE:) (-46%), and Netflix (NASDAQ:) (-61%) versus the SPY falling (-25%) for the year. With the third-quarter earnings season, more companies can be expected to report on the material impacts to their business from a strong U.S. dollar.

The Insulated

U.S. companies that do most of their business in the U.S., like healthcare companies like Humana (NYSE:) which receives over 90% of their revenues from government health programs, and UnitedHealth Group (NYSE:). These shares are up 7.4% and 2.1% for the year.

The Winners

However, there’s always to flipside to any situation. Here are three U.S. stocks benefit from a strong and rising U.S. dollar. Companies that buy goods from overseas have more purchasing power. These companies benefit, especially if the rate of increase in the U.S. dollar is greater than the inflation rate (IE: 18% vs. 8.1%). Importers are the winners. The largest importer in the U.S. is Walmart Inc (NYSE:) whose shares are only down (-9.8%) versus the SPY. High inflation is pushing consumers to find ways to stretch their wallets.

This is driving growth to discount retailers. Dollar Tree (NASDAQ: DLTR) benefits during economic slowdowns as budget-conscious consumers fill their stores. It’s also the seventh largest U.S. importer, enabling it to bolster its margins from the strong U.S. dollar. Shares are down only (-3.6%) on the year. Darden Restaurants (NYSE: DRI) shares are down (-12%) for the year. They operate over 1,800 full-service restaurants throughout the U.S. and Canada, including premium brands like The Capital Grille and Eddie V’s to popular, affordable brands like the Olive Garden and Longhorn Steakhouse.

The nation’s largest full-service restaurant chain imports food from pork to seafood and beef from over 1,575 suppliers throughout 38 different countries. According to Bank of America (NYSE:), it has the “highest positive correlation to the U.S. dollar of any stock Bank of America covers”.

Original Post

[ad_2]

Source link