3 Stocks Stocks Institutional Investors Can’t Get Enough of

2023.05.25 06:25

-

Warren Buffett increased his stake in Apple

- Likewise, institutional investors increased exposure to Microsoft

- Meanwhile, Lantheus Holdings has flown under the radar

Institutional investors’ portfolios often serve as the benchmark for determining which stocks are worthy additions to individual portfolios. Valuable insights can be gleaned from the periodically published 13F reports, which are mandatory for U.S. funds managing capital exceeding $100 million.

It should be noted that these reports are published with a delay, which means that on the day of presentation, the structure of a given portfolio may already be significantly different.

Companies that are particularly popular with institutional investors include technology giants Apple (NASDAQ:) and Microsoft Corporation (NASDAQ:).

But, Lantheus Holdings (NASDAQ:) has recently gained a lot of popularity as well. The stock is currently consolidating near all-time highs.

With the help of InvestingPro, we can delve into why these funds have such a strong preference for these three stocks.

You can do so for virtually any stock by clicking on the following link: Start picking stocks today!

1. Apple

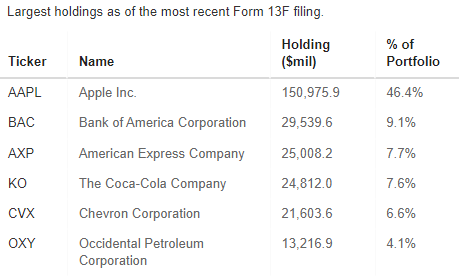

Warren Buffett, chairman, and CEO of Berkshire Hathaway (NYSE:), has raised his stake in Apple, as per the recent 13F report.

The report, released earlier this month, reveals that Buffett now holds 915,560,382 shares of the American tech giant, marking an increase of 20,424,207 shares.

Warren Buffett’s Portfolio Holdings

Source: InvestingPro

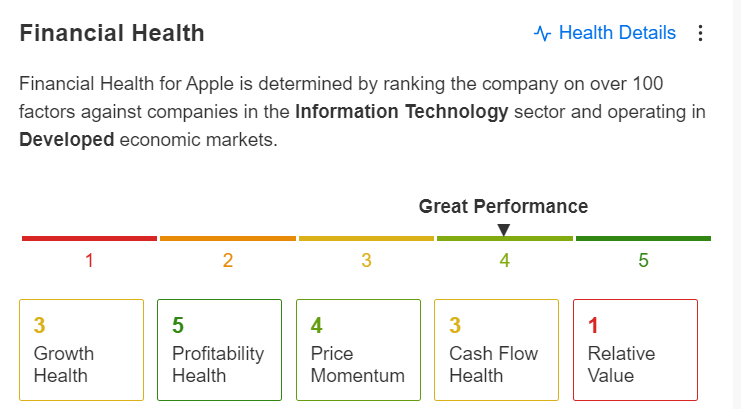

Looking at Apple’s fundamentals using InvestingPro, it’s hard to argue with Warren Buffett’s decision. Apple’s strong and consistent profitability, along with its continued revenue growth, contribute to its high score on the financial health index.

Source: InvestingPro

After a strong rebound over the past few months, the next target for the U.S. tech behemoth is its historic highs in the $182 region.

2. Microsoft

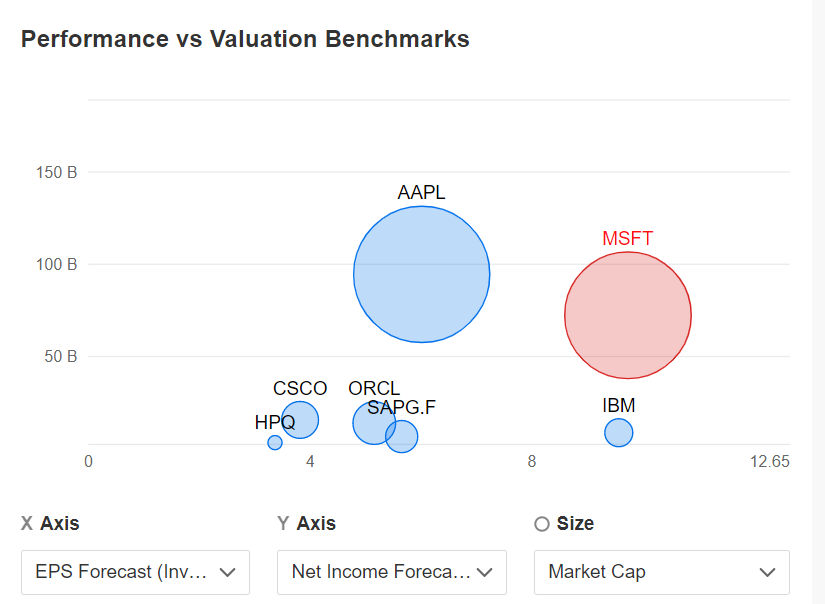

Microsoft’s popularity among institutional investors continues to grow. The latest 13F report, available on InvestingPro, reveals that investment funds have taken 224 long positions compared to 108 short positions, indicating that Microsoft remains an appealing choice for major market players.

Out of all its competitors, Microsoft has the highest earnings per share (EPS) of $9.73. Additionally, the company ranks second in net earnings, with $72.334 billion, surpassed only by Apple.

Microsoft Peer Comparison

Microsoft Peer Comparison

Source: InvestingPro

3. Lantheus Holdings

Lantheus Holdings, a U.S.-based healthcare company, sells medical equipment and supplies.

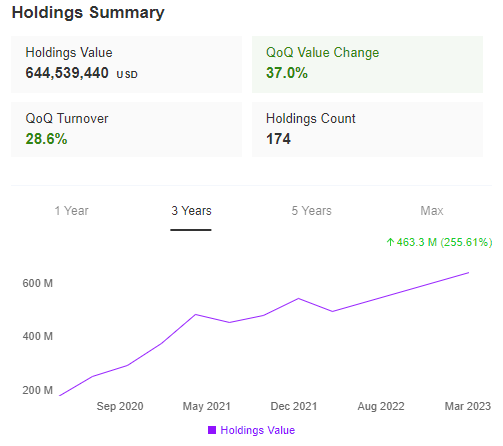

The company is held by several investment funds, including Nicholas Investment, Oberweis Asset, and Eagle Health. Eagle Health, in particular, focuses on the biotechnology sector and has delivered impressive returns over the past few years, as can be seen on InvestingPro.

rsquo;s Performance Over the Last 3 Years

Source: InvestingPro

After breaking out of all-time highs, the stock has formed a double peak below the $101 level. This indicates that a correction is likely before another uptrend ensues.

Lantheus Holdings Price Chart

Lantheus Holdings Price Chart

Key support levels to monitor for a possible recovery are at $92 and $84. If the stock breaks above the current consolidation phase, it could pave the way for another rally, targeting the $110 range.

InvestingPro tools assist savvy investors analyze stocks, like we did in this article. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.